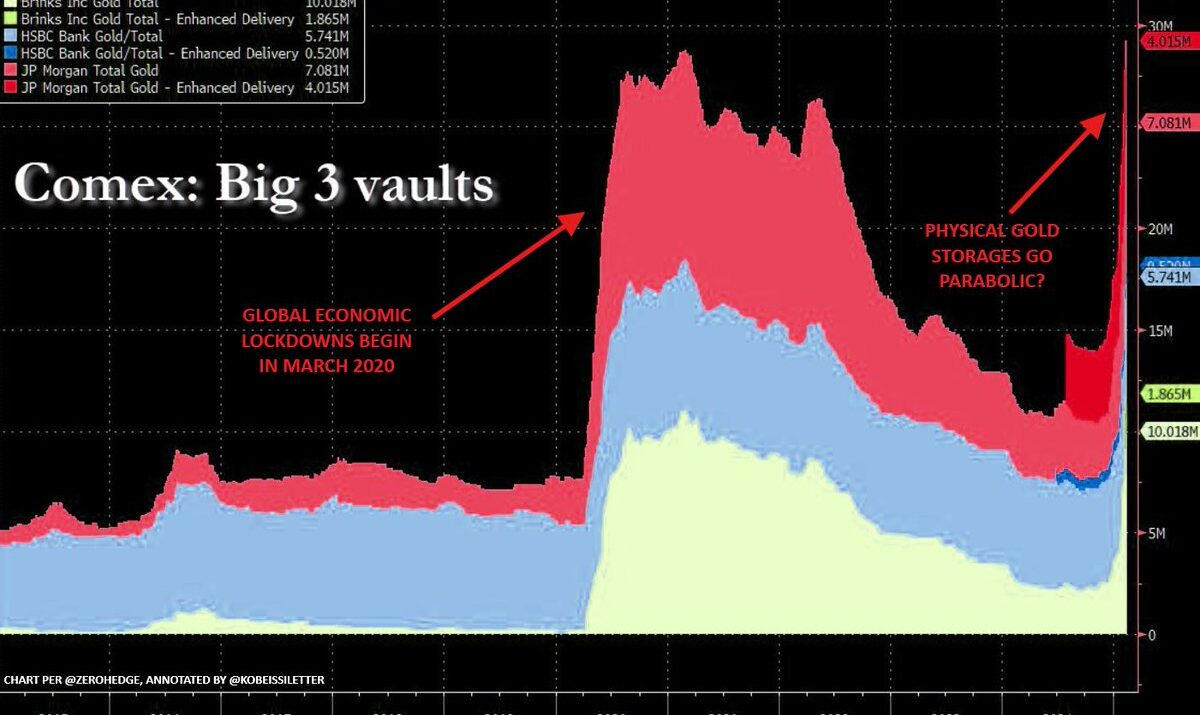

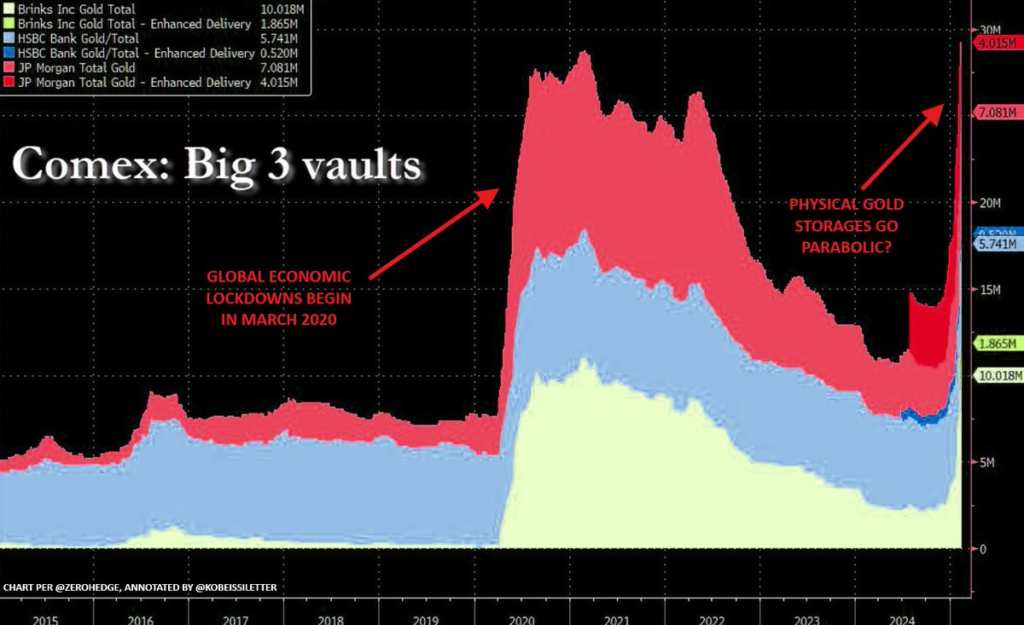

Gold inventories in the 3 largest COMEX gold vaults just surged by 15 MILLION ounces in 2 months. That’s a +115% increase, putting physical gold holdings ABOVE 2020 pandemic levels.

What is happening? Let TKL explain.

For some background:

These are secure gold storage facilities approved by the Commodity Exchange (COMEX). They are literally located under and around Manhattan, NY. January ALONE saw 19+ THOUSAND contracts delivered.

Never in HISTORY have we seen buying like this.

COMEX is a subsidiary of CME Group which publishes daily data on these vaults. They outline total registered, pledged and eligible inventories by the ounce. As seen in the below excel sheet, combined total just hit ~35.5 MILLION troy ounces.

And it gets even more strange. As COMEX inventories surge, London vault inventories are being depleted. Withdrawal times in London are rising toward 8 WEEKS. Meanwhile, the US has switched from being a net gold exporter to a net gold importer in November 2024.

Clearly, US gold markets and physical gold demand is signaling a major pivot from the norm. Gold prices are now up +40% in 12 months as the US Dollar and interest rates are up sharply. Not even a 10% pullback seems to be attainable.

This has never happened in history.

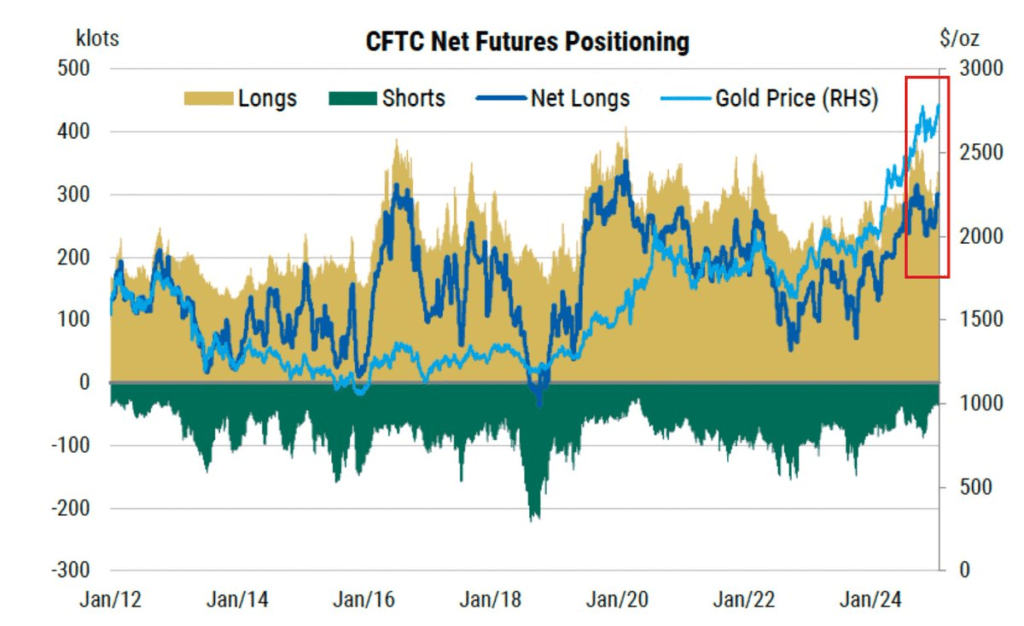

Here is a chart showing CFTC Net Futures positioning:

Net long positioning is set to break above it s2024 high and the long gold trade has SURGED. Short positioning is at its lowest level since the pandemic in 2020.

Again, this doesn’t happen in “normal” environments.

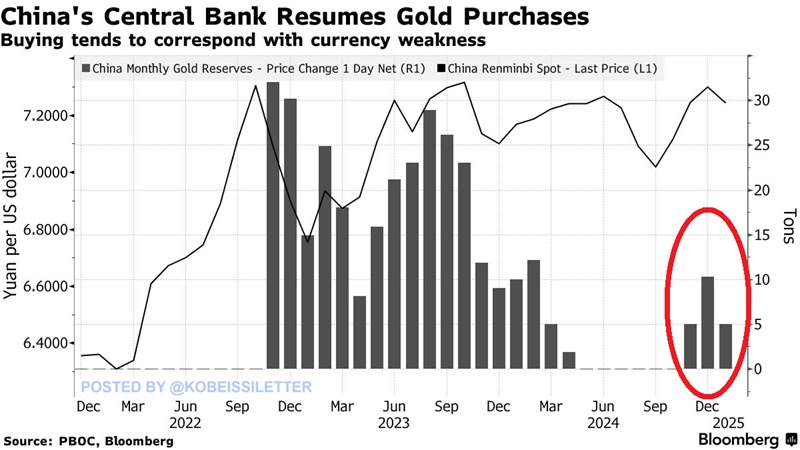

China has also joined the gold buying party. China’s central bank bought 5 tonnes of gold in January, its 3rd consecutive monthly purchase. Assets in Chinese Gold ETFs have TRIPLED in just 18 months. There are now $9.5 BILLION of assets in Chinese gold ETFs alone.

What’s even more unusual is gold has DOUBLED the S&P 500’s +22% return over the last 12 months. Usually gold prices are a hedge against equity market volatility. As stocks have posted a historic rally, gold has posted an even more historic rally.

Even after the DeepSeek drop, the S&P 500 and Gold have traded +4% off of their recent lows.

The beginning of President Trump’s trade war has only accelerated this trend. While precious metals are not currently a part of these tariffs, they are serving as the GLOBAL hedge. We expect gold to continue to serve as the global hedge against inflation AND uncertainty.

And this is particularly the case as US Deficit spending is out of control. The US has borrowed $838 BILLION in the first 4 months of FY 2025. This is crushing bond prices as treasury yields are driven higher.

Gold’s position as the global hedge has only grown as a result. To top it off, the US Money Supply grew 3.9% YoY, its biggest increase since 2022. After reaching its deepest contraction in 65 years, money printing is back.

Gold is painting a picture worth a thousand words.

Related: After quietly hit a record high, Gold is telling us something