Palantir Technologies (NASDAQ: PLTR), a data analytics and artificial intelligence (AI) giant with roots in US defence, will report Q1 2025 earnings on Monday, May 5, after the close. With its stock surging ~140% over the past year, investor expectations are sky-high, and the upcoming report could be one of the company’s most pivotal moments since going public.

We’ve analysed all the top research, analyst forecasts, and market commentary across 20+ sources to bring you the most comprehensive preview of what to expect.

Consensus Expectations: What the Street Expects

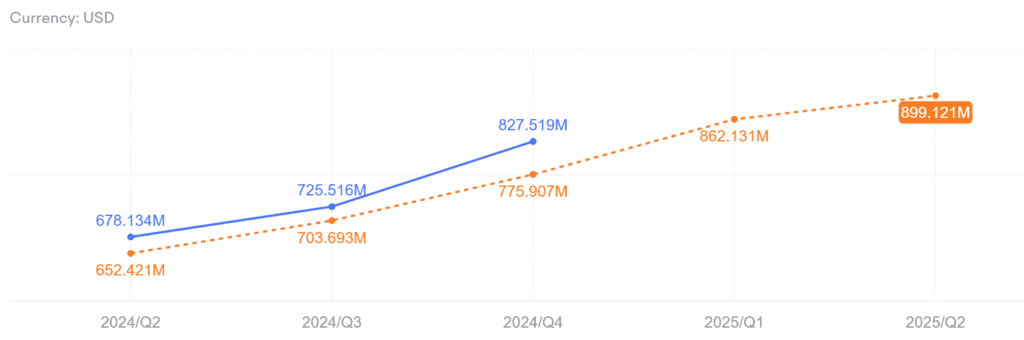

- Revenue: $645–650 million (up ~25% YoY), compared to $525 million last year

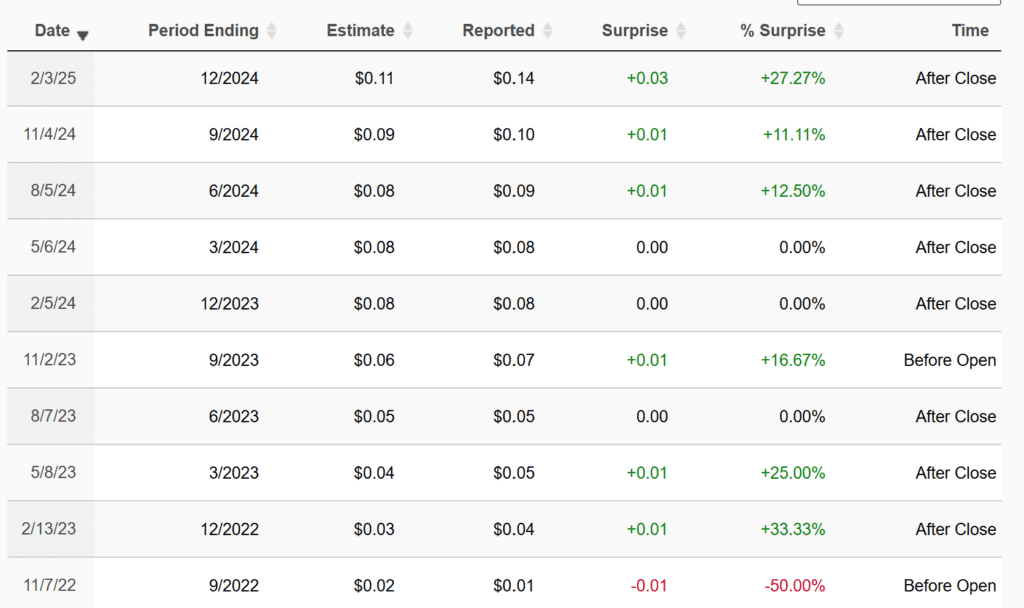

- EPS (adjusted): $0.08–$0.09, up from $0.05 YoY

- Adjusted operating margin: ~25–26%

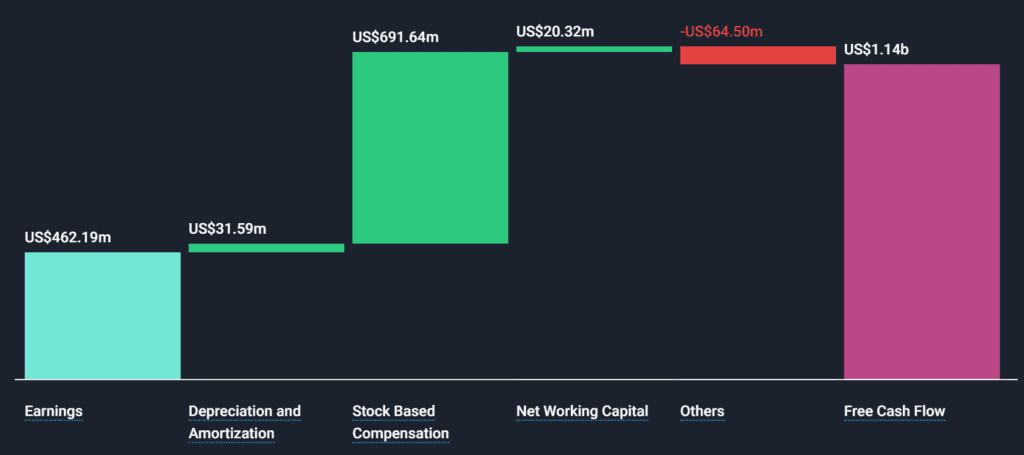

- Free cash flow: expected positive, reflecting operational leverage

Critically, Palantir has beaten earnings estimates for five consecutive quarters, often by 5–10% on both revenue and EPS.

Core Drivers and Themes

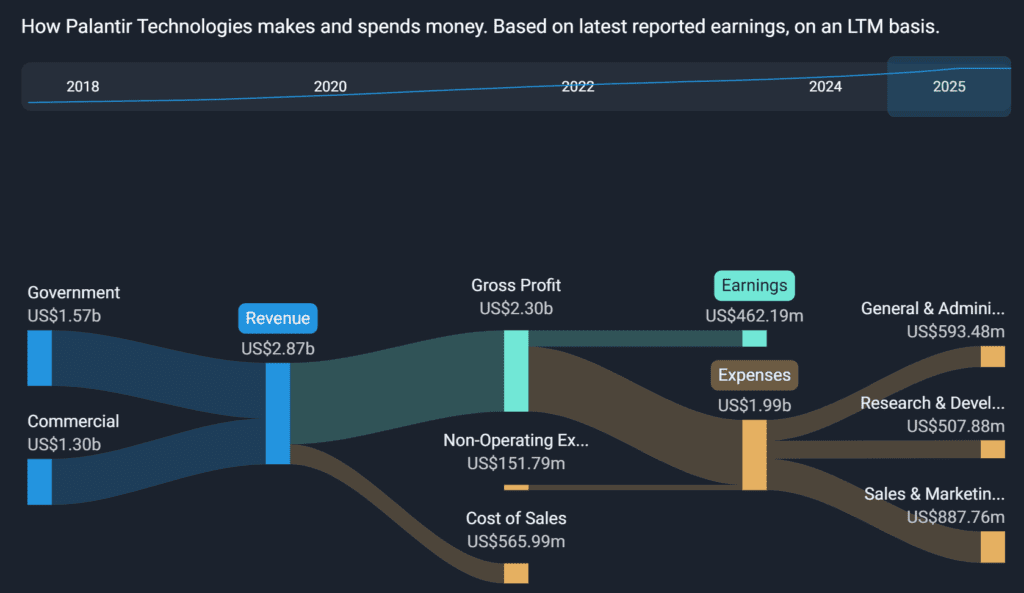

Government Business: Still the Anchor: Palantir’s government segment, contributing ~55–60% of revenues, is fueled by long-term U.S. defense, intelligence, and homeland security contracts.

- Major programs include the U.S. Army TITAN system, Defense Department AI integration, and counterterrorism modeling.

- Saxo Bank notes that ongoing global tensions, especially in Eastern Europe and the Middle East, are accelerating military demand for predictive analytics, potentially driving upside surprise.

- Commercial Growth: Fastest-Growing Segment

Palantir’s commercial revenue is growing at ~35% YoY, led by energy, healthcare, and financial services.

- Companies like BP, Merck, and Airbus use Palantir’s Foundry platform to improve supply chains, drug discovery, and manufacturing efficiency.

- Nasdaq reports that the commercial customer count has surged to ~450 from ~300 last year — an inflection point many software firms struggle to reach.

AI Platform (AIP): The Next Big Engine: Palantir’s newly launched Artificial Intelligence Platform (AIP) is the star of this earnings cycle.

- Analysts at Investors.com and Morningstar emphasize AIP’s potential to monetize the generative AI wave by helping enterprises deploy large language models safely, an area where competitors like Microsoft and Google focus mainly on tools.

- CEO Alex Karp has stated AIP is Palantir’s “largest addressable market expansion in a decade,” with over 200 pilots under evaluation.

Profitability Milestone: Palantir turned GAAP-profitable in early 2024 — a huge credibility win for a company long criticized for burning cash.

- Management has guided for 25–26% adjusted operating margins, a jump from ~21% last year.

- Yahoo Finance notes the company has also generated positive free cash flow for three consecutive quarters, a rarity in the high-growth SaaS space.

International Expansion: Palantir’s Europe and Asia strategy is gathering steam.

- The Globe and Mail reports government wins in the UK, Germany, and Australia, while commercial traction is building in Japan and South Korea.

- International revenue is now ~22% of total sales, with a goal to push past 30% by 2026.

Bullish Case: Why Optimists Are Betting Big

1️⃣ AI Platform (AIP) Momentum

With over 200 enterprise pilots underway, AIP has become a major pipeline driver. Analysts at Nasdaq suggest that even modest conversion rates could unlock $200–300 million in incremental revenue over the next year.

2️⃣ Government Tailwinds from Global Tensions

Saxo Bank and Zacks highlight rising NATO and U.S. defense budgets, where Palantir plays a central role, especially in Ukraine support, intelligence analysis, and battlefield logistics.

3️⃣ Commercial Expansion Is Real, Not Hype

Palantir’s commercial customer count has surged ~50% YoY, a sign that Foundry is no longer a niche product. IG.com notes its top-line improvement is tied to real-world deployments, not just pilot deals.

4️⃣ Path to Sustained Profitability

Morningstar points to GAAP profitability, expanding margins, and three straight quarters of free cash flow as evidence that Palantir has graduated from “story stock” to cash-generating business.

5️⃣ Strong Balance Sheet, No Debt

With ~$3 billion in cash and zero debt, Palantir has flexibility to reinvest aggressively or return capital, a rarity among fast-growth software peers.

Bearish Case: Where Sceptics See Risks

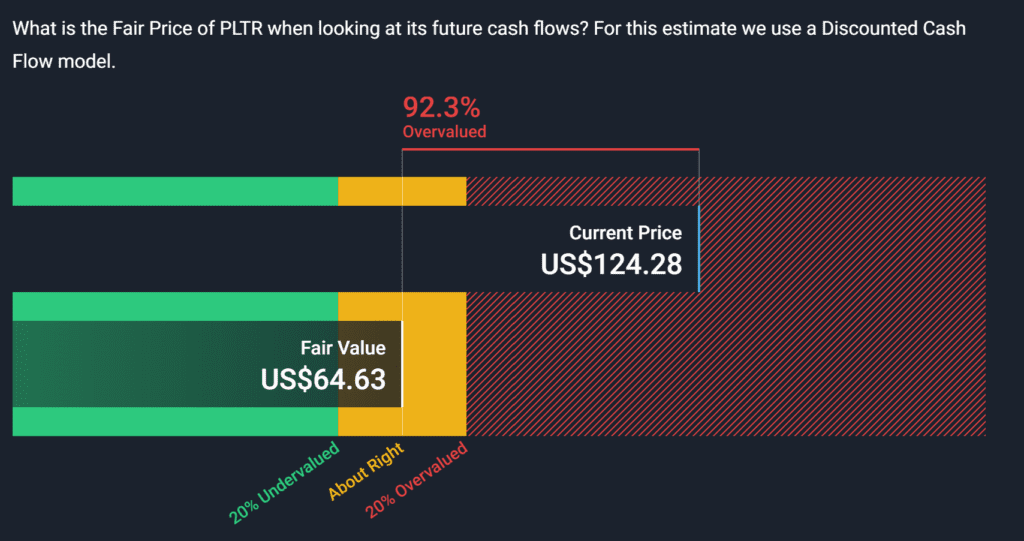

1️⃣ Rich Valuation and Hype Premium

Palantir trades at ~21x forward sales and ~70x forward EPS — multiples that leave zero margin for error. Even a slight revenue miss could trigger a correction.

2️⃣ Overdependence on Government Spending

While government contracts are a strength, ~60% of revenue comes from this lumpy, slow-moving channel. The Globe and Mail warns that a single delayed Pentagon renewal could derail quarterly momentum.

3️⃣ AI Monetization Uncertainty

Investopedia and Yahoo Finance caution that while AIP has buzz, actual monetization is still unproven. Converting pilots into large contracts takes time and execution.

4️⃣ Increasing Competitive Pressure

Palantir is no longer the only AI-in-enterprise player. Microsoft (Azure AI), Snowflake, and even defense integrators like Booz Allen are attacking Palantir’s sweet spots.

5️⃣ Stock Volatility and Retail Heavy Ownership

With ~15% of float held by retail traders, Palantir shares are prone to wild swings on earnings — sometimes +20% or -15% moves in a single day, according to MarketBeat.

Prediction and Market Sentiment

Wall Street expects:

- Revenue beat: High probability given strong commercial growth and government tailwinds.

- EPS beat: Street modeling ~$0.08–$0.09; Palantir likely prints ~$0.10 if margin execution holds.

- Positive guidance: Investors want FY2025 revenue guide above $2.8 billion, signaling >25% growth.

However, the real test is AIP monetization updates. If management gives concrete numbers (vs. vague excitement), the stock could break out toward $30. If not, expect “sell-the-news” profit-taking.

Valuation, Ratings, and Sentiment Check

- YTD performance: +45%

- Market cap: ~$60B

- Forward P/E: ~70x

- Forward sales multiple: ~21x

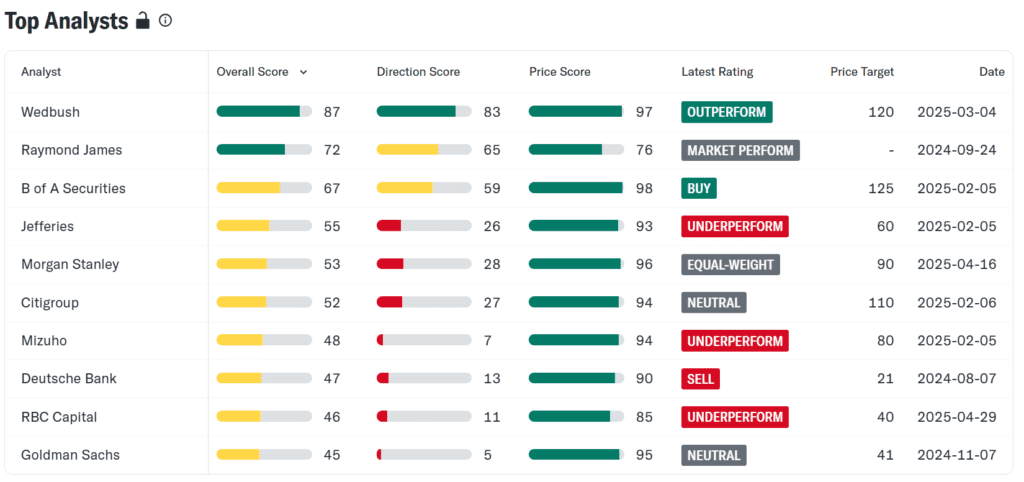

- Wall Street analyst ratings: 6 Buy, 8 Hold, 3 Sell

- Average price target: ~$26–28 vs. ~$24.50 current (Investopedia, Morningstar, Nasdaq)

Overall, sentiment is cautiously bullish — but this is a “show-me” quarter.

Final Takeaways for Investors and Traders

For investors: Palantir is transitioning from a defence-heavy contractor to an AI-powered software giant — but execution on AIP will make or break its next phase.

For traders:

- Expect high volatility on earnings, with potential +20% or -15% swings.

- Watch for guidance, AIP numbers, and commercial deal pipeline as key catalysts.

For beginners:

- Understand that while Palantir has a promising long-term vision, its valuation embeds high expectations.

- Focus on fundamentals and don’t chase short-term moves blindly.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Warren Buffett Warns About Trump Tariffs: ‘Trade Should Not Be A Weapon’

Trump downplays recession fears, saying the US would be ‘OK’ in the long term

China quietly exempts tariffs on $40 billion worth of US goods

Temu halts shipping direct from China as de minimis tariff loophole is cut off

US lawmakers urge SEC to delist Alibaba and Chinese companies

China Weighs Fentanyl Offer to US to Start Trade Talks

Nvidia is working on China-tailored chips again after US export ban

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World