Nvidia struck a major deal this summer, agreeing to rent 10,000 of its own AI chips from cloud provider Lambda over four years in a deal worth $1.3 billion. A second agreement reportedly added 8,000 more chips in a deal valued at $200 million.

Why Lambda? – Lambda is a fast-growing cloud infrastructure firm specializing in AI GPU rentals. Offering plug-and-play access to powerful AI hardware, it serves researchers, startups, and companies needing scalable compute. Previously, Lambda secured ~$320 million in funding to expand its infrastructure and achieved a valuation of $4–5 billion ahead of a potential IPO.

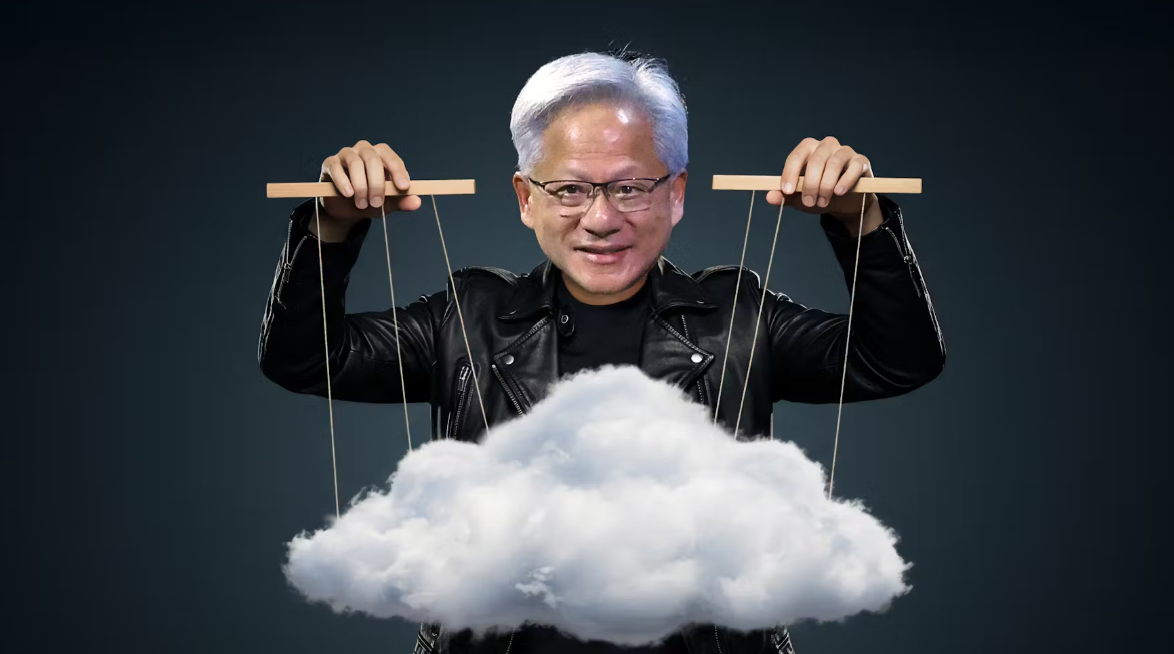

Nvidia’s Logic: By renting chips to a channel partner rather than selling them directly, Nvidia ensures revenue and utilization while boosting Lambda’s inventory and cloud strength—without requiring a full sale. It also deepens the partnership as Lambda gears up for an IPO. Nvidia effectively becomes Lambda’s largest customer.

Strategic Timing: This move aligns with Nvidia’s broader “AI Cloud” strategy—expanding beyond chip sales into building compute ecosystems, including leasing data center space and supporting “neoclouds” like CoreWeave and Lambda. Analysts project AI neocloud revenues rising from $4B in 2024 to $32B by 2027.

Why It’s a Smart Play (…but Not Risk-Free)

The Upside

- Revenue consistency & demand pull-through: Nvidia locks in long-term income while ensuring Lambda uses its chips at scale.

- Ecosystem leverage: Strengthens Lambda’s infrastructure, raising its IPO value and anchoring Nvidia into the future AI stack.

- Footprint expansion: Enhances Nvidia’s indirect reach in the AI cloud market, competing with AWS, Azure, and Google Cloud in their friendly terrain.

The Caveats

- Capital tie-up vs. direct sale: Rental income may miss the upfront margin of chip sales.

- Execution risk: Lambda must deliver uptime, manage scaling, and meet expectations—especially under IPO scrutiny.

- Cloud competition heating up: Hyperscalers and other neocloud players might outpace Lambda if Nvidia leans equally into others (like CoreWeave).

Nvidia’s chip rental deal with Lambda is smart strategic positioning—tying revenue to ecosystem growth and securing compute demand via one of the most dynamic AI cloud partners.

If Lambda delivers and scales well, Nvidia benefits from long-term visibility, brand expansion, and access to burgeoning neocloud demand. But success hinges on Lambda’s execution and Nvidia’s ability to balance rental and core chip sales. Overall? A calculated win with manageable risk—a quiet but telling move in Nvidia’s march toward AI infrastructure dominance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility