With a potential US-China trade agreement on the horizon, Nvidia Corp. CEO Jensen Huang is making a high-profile pitch in the heart of the US capital. This week, Nvidia is hosting one of its largest AI conferences just blocks from the White House, signalling the company’s growing presence in Washington—and its escalating efforts to regain access to the Chinese market.

The event, part of Nvidia’s GPU Technology Conference (GTC), arrives as President Donald Trump prepares to meet Chinese President Xi Jinping on Thursday to finalize a long-anticipated trade agreement. Though the draft deal includes China’s pledge to delay rare earth export limits, it does not ease U.S. restrictions on the export of advanced AI chips to China—a critical sticking point for Nvidia.

“We went from 95% market share to zero market share in about 40% of the world’s AI market,” Huang said recently on Fox News. “If our goal is to have 90% of the world build on the American tech stack someday, we’re off to a relatively poor start.”

More: Jensen Huang Says Nvidia Went From 95% Market Share to 0% in China

Nvidia’s AI Playbook Meets Washington Politics

Huang will deliver his keynote Tuesday at noon, focusing on Nvidia’s AI product vision, but offstage, lobbying and policy influence are at the heart of the company’s Washington strategy.

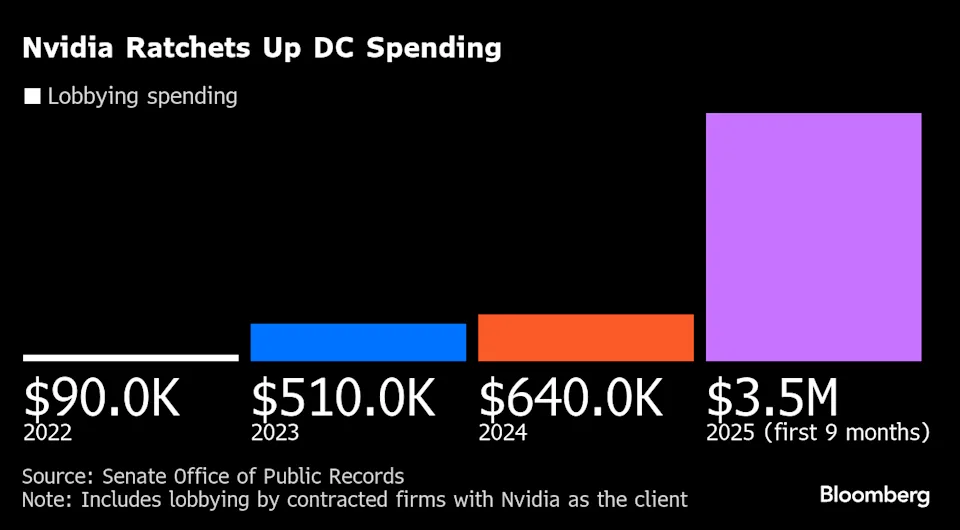

- Nvidia has spent $3.5 million on lobbying so far in 2025—up from just $640,000 in all of 2024.

- The company donated $1 million to Trump’s inauguration and has expanded its DC staff.

- Huang has formed close ties with top U.S. officials including Commerce Secretary Howard Lutnick and White House AI Policy Czar David Sacks.

The company has aligned itself closely with the Biden-Trump administration’s AI Action Plan, aiming to promote U.S.-built AI infrastructure globally, while urging looser export controls for key trading partners.

China Market: Still Off-Limits—for Now

While Trump recently allowed limited H20 chip exports to China—with Nvidia surrendering 15% of the revenue to the U.S. government—China has shown little interest. Beijing reportedly discouraged domestic firms from buying the downgraded chips, calling into question their commercial viability.

Though not factored into Nvidia’s revenue guidance, CFO Colette Kress suggested the company could generate $5 billion in H20 revenue in just three months—if geopolitical tensions subside.

Political Pushback

Nvidia’s push to reenter the Chinese market is facing resistance from national security hawks:

- Senator Jim Banks has proposed a bipartisan amendment to restrict advanced chip sales to foreign nations.

- House Representative John Moolenaar, chair of the China Select Committee, warned against any backsliding on export restrictions, urging the U.S. to “hold the line.”

What’s Next?

While Trump won’t attend the GTC, which also features appearances from Senator Todd Young and Rep. Sam Liccardo, Huang is expected to join the president later this week at a business roundtable in South Korea, coinciding with the APEC summit.

“I’m confident President Trump will reach a good deal with China,” Huang said. “But we still assume China is a zero market. Anything else would be a huge bonus.”

With AI reshaping everything from defense to the global economy, Nvidia is betting big—not just on technology, but on policy. The message from Huang in Washington is clear: leadership in AI starts with access—and America must lead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.