Microsoft (MSFT) is set to report Q4 fiscal 2025 earnings after the market closes today, wrapping up a critical season for the megacaps. With shares up nearly 30% year to date and investor enthusiasm running high around AI monetization, the bar is high — especially for cloud and productivity segments.

As Wall Street anticipates signs of continued AI-driven growth, analysts are closely watching whether Microsoft’s Azure, Copilot, and Office 365 ecosystem can keep delivering top-line acceleration despite mounting competition and shifting enterprise IT budgets.

Street Forecast

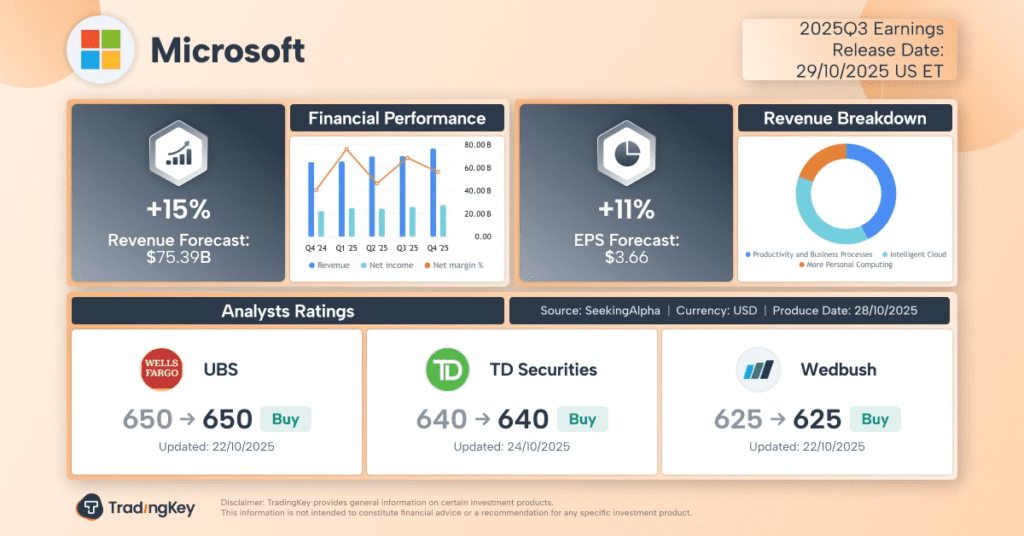

Wall Street expects another strong showing. According to consensus estimates (LSEG, FactSet), Microsoft is expected to post:

| Metric | Consensus Estimate | YoY Growth |

|---|---|---|

| Revenue | $70–$75.39 billion | +13–14% |

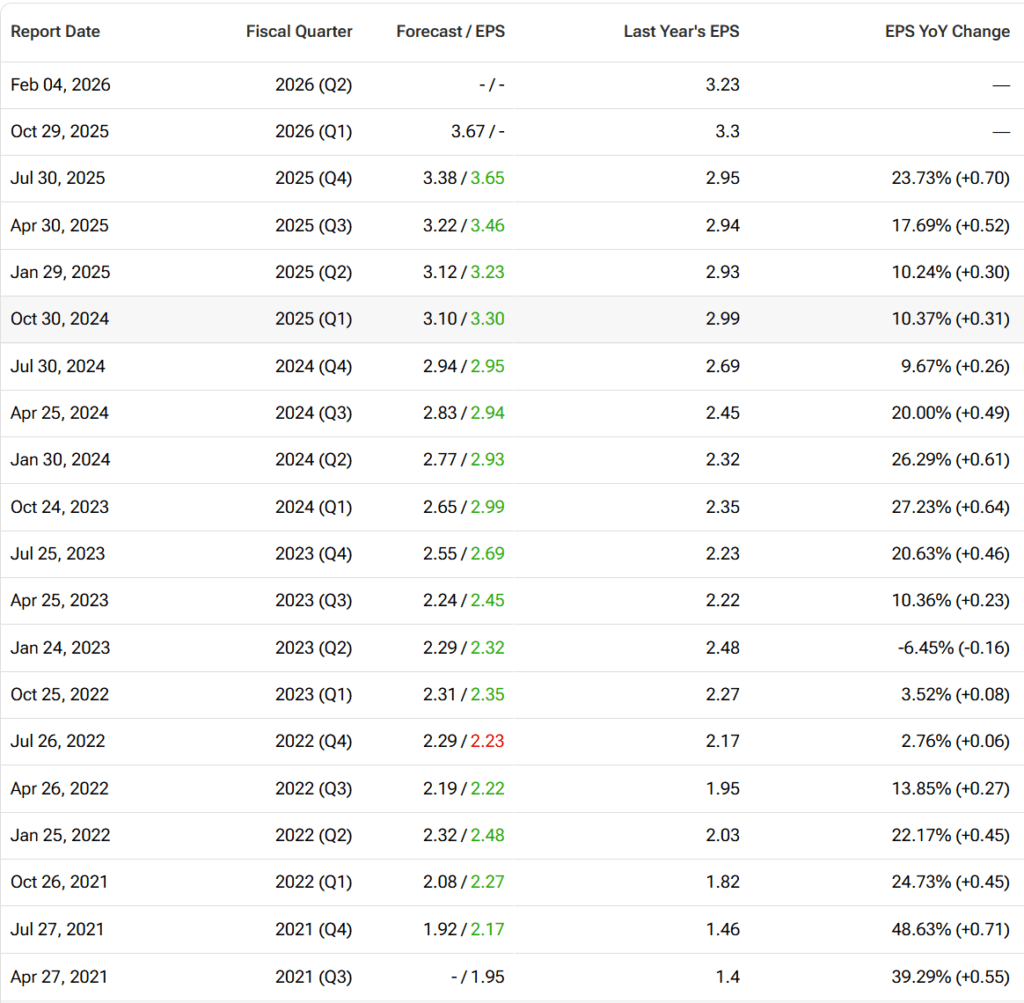

| EPS (GAAP diluted) | $2.96–$3.66 | +18–20% |

| Operating Margin | ~44.8% | +2 pts YoY |

Microsoft previously guided for Q4 revenue between $67.8B and $69.2B, reflecting consistent strength across cloud services, enterprise software, and gaming. Analysts are now expecting results near the high end of that range.

Prediction: Microsoft beats slightly on EPS, but guidance tone will be critical in determining how markets respond.

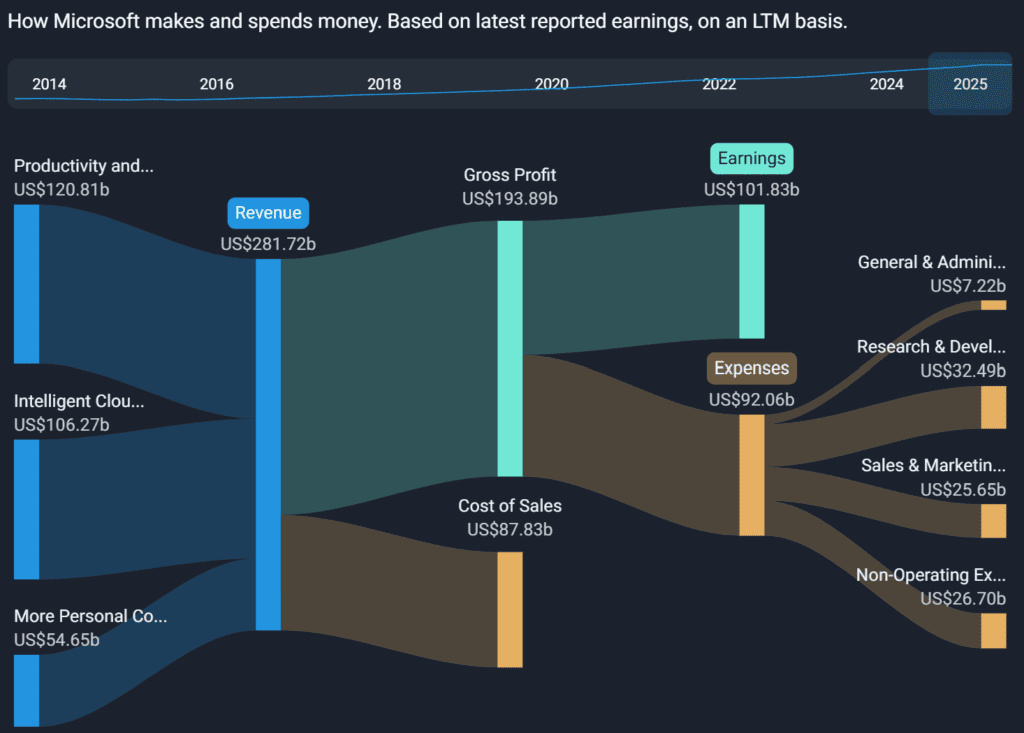

Azure: The Heart of AI Spend

Azure remains Microsoft’s flagship growth engine, and AI infrastructure demand has been a major tailwind. Wall Street expects Azure revenue to grow 26–28% YoY in constant currency, aided by customer adoption of OpenAI APIs, Copilot services, and GPU-rich AI clusters for model training and inference.

Azure’s share gains vs. AWS have continued in key verticals. However, Microsoft will need to show that its AI workloads are translating to margin-accretive revenue, especially as cloud pricing continues to evolve.

Prediction: Azure growth hits 27% YoY (CC), with Microsoft reaffirming AI as a top driver of long-term cloud bookings.

Office and Productivity: Copilot in the Spotlight

Microsoft’s second-largest revenue pillar is its Office and Productivity division, where the company has been rolling out Microsoft 365 Copilot to enterprise users since late 2024. Analysts expect meaningful contribution to growth from paid Copilot seats this quarter — though exact revenue attribution remains fuzzy.

Q3 saw Office commercial revenue up 12% YoY, and that pace is expected to accelerate slightly in Q4. Uptake from large enterprise customers has been positive, but adoption in SMB and education remains a work in progress.

Prediction: Productivity segment shows modest acceleration (13–14% YoY growth), with commentary highlighting early Copilot traction in enterprise renewals.

Windows and Devices: Stabilization Phase

After several quarters of contraction, the Windows OEM segment is expected to be flat to slightly positive this quarter as PC demand stabilizes post-pandemic. While consumer Windows licenses remain under pressure, commercial volume licensing is holding steady.

Hardware (Surface and accessories) likely declined YoY again, but cost discipline has improved margin resilience. Microsoft has de-emphasized hardware profitability in favor of cloud and software leverage.

Prediction: Modest Windows revenue growth (+2% YoY), with gross margin commentary more positive than expected.

LinkedIn and Ads: Soft Landing in B2B

Microsoft’s LinkedIn and advertising units are under the microscope as business-to-business (B2B) spending faces macro uncertainty. Hiring activity has softened, which could affect LinkedIn’s Talent Solutions revenue. However, marketing budgets in sectors like tech and finance have stabilized.

Search and news advertising tied to Bing has seen moderate growth. Overall, analysts expect LinkedIn revenue to rise 6–7% YoY, and ad revenue to increase about 4–5%.

Prediction: Inline performance from B2B units, with LinkedIn showing signs of monetizing AI-enhanced content and creator tools.

Gaming and Activision Blizzard: Integration Watch

This is Microsoft’s first full fiscal year since closing the Activision Blizzard acquisition, and gaming is expected to post a significant YoY boost. Consensus forecasts

for Xbox content and services to grow ~15–18% YoY, driven by titles like Call of Duty and Game Pass subscriptions.

While hardware sales have been underwhelming, software and in-game revenue is strong. Microsoft has also highlighted early synergy wins in content integration and back-end infrastructure.

Prediction: Gaming beats modestly, but investors will be listening for commentary on post-merger operating costs and profitability trajectory.

AI Monetization and Ecosystem: Copilot Everywhere

Microsoft has bet heavily on embedding AI copilots across its product suite — from GitHub to Excel to Teams. While AI-related capex has soared (estimated $50B+ for FY2025), the company insists monetization is ramping.

Notably, Microsoft recently expanded GitHub Copilot Enterprise, priced at $39/user/month, and is seeing strong traction among developers. Azure OpenAI usage continues to climb, though costs (especially GPU procurement and model tuning) remain high.

Prediction: Microsoft reiterates that FY2026 will see accelerating AI monetization, with enterprise AI penetration still in early innings.

Competitive Landscape: Arms Race Intensifies

Microsoft’s rivals are also pressing forward. Google’s Gemini AI and Amazon’s Bedrock services threaten cloud share, while Meta is pushing open-source AI models and enterprise solutions. In Office productivity, startups like Notion, Zoom, and Miro are adding lightweight AI features.

But Microsoft’s full-stack integration remains its biggest edge. The deep linkage between Azure compute, Copilot interfaces, and enterprise data access (via Microsoft Graph) gives it a unique defensible position, according to analysts.

Consensus: Microsoft leads the enterprise AI pack — but will need to fend off faster-moving competitors in SMB and cloud-native verticals.

Macroeconomics and FX: Tailwinds and Caution

Enterprise tech spending has improved slightly from 2024 lows. CIO surveys show stable budgets for cloud and security, but cautious investment in areas like digital transformation and device refresh.

Foreign exchange remains a slight tailwind this quarter due to euro and yen strength vs. the dollar. But pricing pressure in cloud and productivity services remains a watchpoint.

Prediction: No major macro surprises in the quarter, but tone of forward guidance will matter more than historical results.

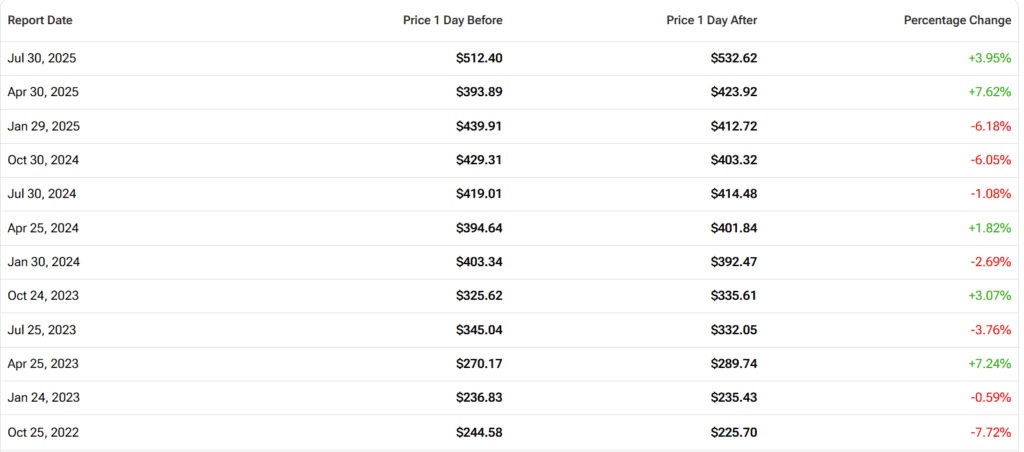

Investor Sentiment: Cautiously Optimistic

Microsoft stock is up ~29% year to date and trading near all-time highs. The valuation premium (~35x forward earnings) assumes smooth execution on AI and cloud strategy. Last quarter, Microsoft beat on both revenue and EPS but issued slightly conservative guidance, which capped upside.

Options markets imply a post-earnings move of ~3.5%, with traders leaning bullish but wary of a miss on AI momentum or margin outlook.

Will Microsoft Deliver on the AI Flywheel?

Microsoft is arguably the best-positioned Big Tech firm to capitalize on enterprise AI — but its massive capital investments must translate into sustained revenue growth, higher ARPU, and longer-term operating leverage.

Prediction: Microsoft delivers a clean beat on EPS, slightly above-consensus revenue, and emphasizes AI monetization traction. Commentary on FY2026 capex and commercial Copilot adoption will shape post-earnings sentiment. Unless guidance softens or Azure misses expectations, the stock is likely to trade modestly higher in after-hours.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.

Related: Meta Q3 2025 Earnings Preview and Prediction: What to Expect