Microsoft Corporation (NASDAQ: MSFT) is set to report its fiscal Q1 2025 earnings after the market closes on Wednesday, April 30, 2025. Analysts anticipate strong year-over-year growth, driven by advancements in AI and robust cloud services. However, challenges such as trade tensions and regulatory scrutiny may impact the company’s performance.

Expected Q1 2025 Results

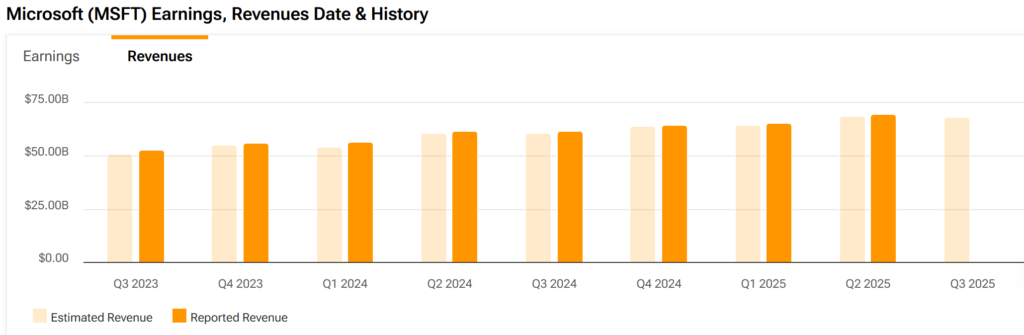

- Revenue: $68.44 billion (up 11% YoY)

- Earnings Per Share (EPS): $3.22 (up 10% YoY)

- Net Income: $23.94 billion

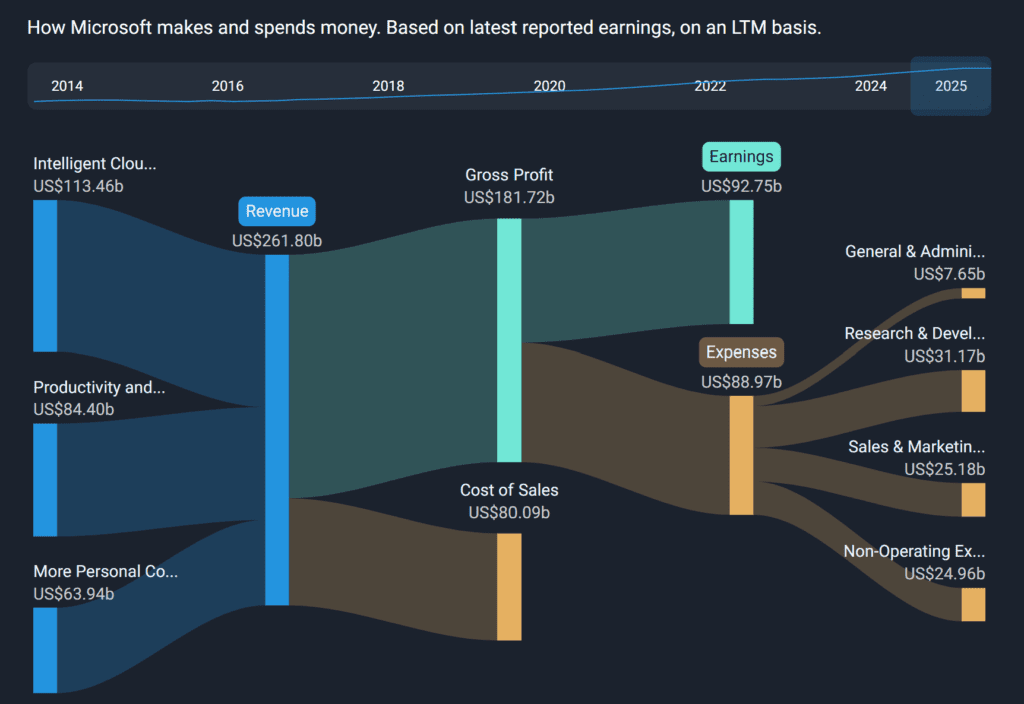

- Intelligent Cloud Revenue: $26.13 billion (up 18% YoY)

Key Factors to Watch

1. Azure Cloud Growth

Azure’s performance remains a critical metric. Analysts expect Azure and other cloud services to grow by approximately 31% year-over-year. However, some caution that businesses are becoming more conservative in their cloud spending, which could impact growth rates.

2. AI Integration and Copilot Adoption

Microsoft’s investment in AI, particularly through its Copilot AI assistant, is a significant growth driver. While interest in Copilot remains high, many customers are seeking clear business justifications before committing, potentially affecting adoption rates.

3. Capital Expenditures

The company plans to spend over $80 billion this year on cloud and AI infrastructure. Analysts will be watching for updates on capital expenditure trends, especially amid reports of paused or canceled data center projects

Analyst Sentiment and Stock Performance

Analysts maintain a bullish outlook on Microsoft:

Average Price Target: $486.14 (approx. 24% upside)

Consensus Rating: Strong Buy

Bullish Case for Microsoft

- Microsoft Cloud Revenue Surpasses $40 Billion: Microsoft Cloud revenue reached over $40 billion, growing 21% year-over-year, marking continued strength and growth in cloud services.

- AI Business Annual Revenue Run Rate Hits $13 Billion: Microsoft’s AI business surpassed an annual revenue run rate of $13 billion, growing 175% year-over-year, driven by enterprise-wide deployments of AI solutions.

- Record Commercial Bookings: Commercial bookings increased 67%, or 75% in constant currency, significantly ahead of expectations, driven by large Azure commitments from OpenAI.

- Growth in Microsoft 365 Copilot Adoption: Microsoft 365 Copilot saw accelerated customer adoption with a significant increase in seats and usage intensity, expanding seats by more than 10x over 18 months.

- LinkedIn Premium Revenue Surpasses $2 Billion: LinkedIn Premium achieved over $2 billion in annual revenue, with subscriber growth increasing nearly 50% over the past two years.

Bearish Case for Microsoft

- Azure Non-AI Services Underperformance: Azure non-AI services growth was slightly lower than expected due to go-to-market execution challenges, particularly with scale motions reaching customers through partners.

- Gaming Revenue Decline: Gaming revenue decreased by 7%, affected by hardware declines, although Xbox content and services revenue increased by 2%.

- On-Premises Server Revenue Decline: On-premises server revenue decreased by 3%, slightly below expectations, driven by slower than expected purchasing around Windows Server 2025 launch.

- Enterprise and Partner Services Revenue Decline: Enterprise and Partner Services revenue decreased by 1%, below expectations, with lower performance across Enterprise Support Services and Industry Solutions.

Microsoft’s Historical Post-Earnings Stock Behavior:

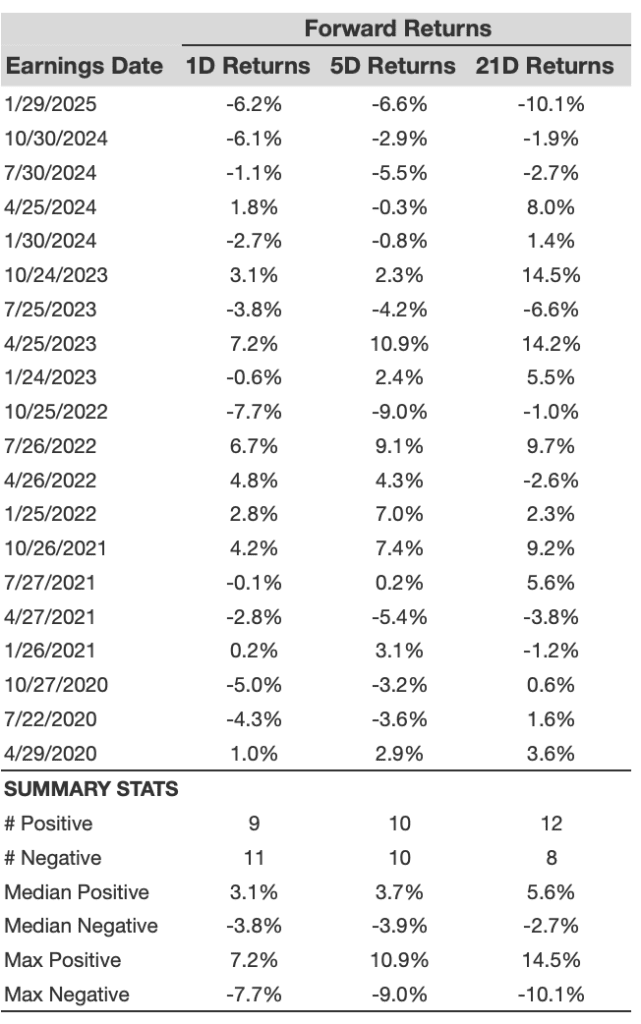

- Over the past 5 years, MSFT shares fell the day after earnings in 55% of cases

- Median negative 1D return: -3.8% | Largest drop: -7.7%

- Over the last 3 years, 1D positive reactions dropped to just 36%

- EPS estimate: $3.21 | Revenue: $68.43B vs. $2.94 on $61.86B a year ago

- Margins may slightly compress YoY despite topline growth from Microsoft 365 and Azure

Trader Insight: Short-term (1D) earnings reactions tend to correlate best with 5-day (5D) movements, suggesting a 5D momentum strategy may be viable post-earnings

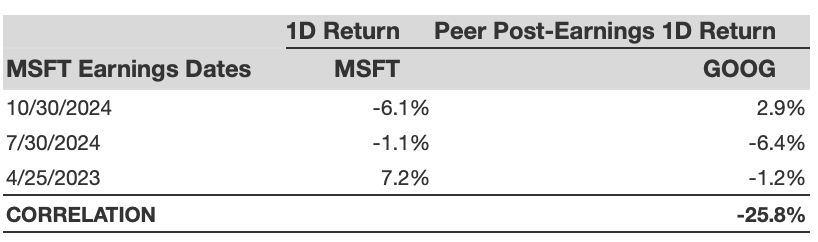

MSFT stock has also shown some correlation with peer earnings reactions, meaning sentiment can be influenced before results are even released.

Conclusion

Microsoft’s Q1 2025 earnings are poised to reflect its strengths in cloud computing and AI integration. While growth prospects remain robust, external factors such as trade tensions and regulatory challenges warrant close attention. Investors will be keenly observing Azure’s performance, AI adoption rates, and capital expenditure trends for insights into the company’s future trajectory.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Meta Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion

Shein and Temu Hike Prices as Trump’s 120% Tariff Takes Effect Next Week