McDonald’s is set to report its Q1 2025 earnings on Thursday, May 2, before market open. As one of the most iconic consumer brands in the world, McDonald’s earnings will be closely watched as a key gauge of global consumer health, fast-food sector resilience, and pricing power amid cost pressures and a cautious spending environment.

Here’s a deep dive into what to expect, what’s driving results, where the risks lie, and how Wall Street is positioned.

Expected Q1 2025 Results

What’s at stake:

Wall Street will be laser-focused on whether McDonald’s can maintain momentum despite softer consumer spending and international challenges.

- Revenue: ~$6.16B (consensus; MarketBeat, Nasdaq, Yahoo Finance)

- EPS: $2.72 (consensus; Nasdaq, Yahoo Finance)

- Previous Year Revenue: $5.9B

- Previous Year EPS: $2.63

- 2025 EPS trend: Mostly stable, with moderate upward revisions in the past 30 days (MarketBeat)

Why it matters:

McDonald’s has been a defensive giant in past downturns, but investors want to see whether value meals and store traffic can offset rising costs and weak discretionary spending.

Key Focus Areas

Let’s break down the business drivers shaping Q1 results.

✅ U.S. Same-Store Sales

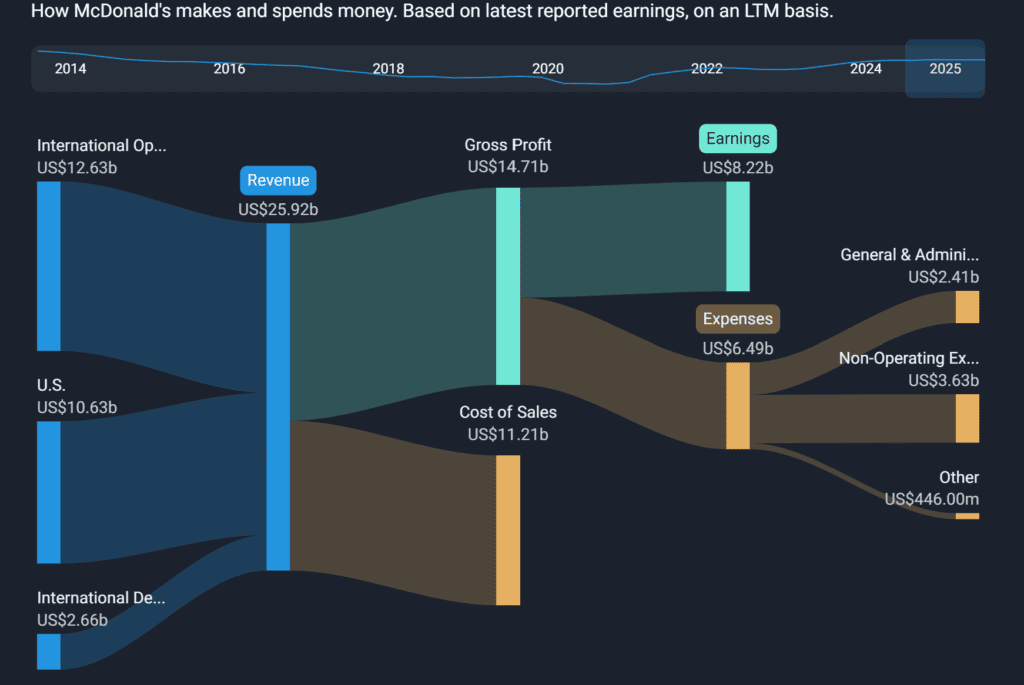

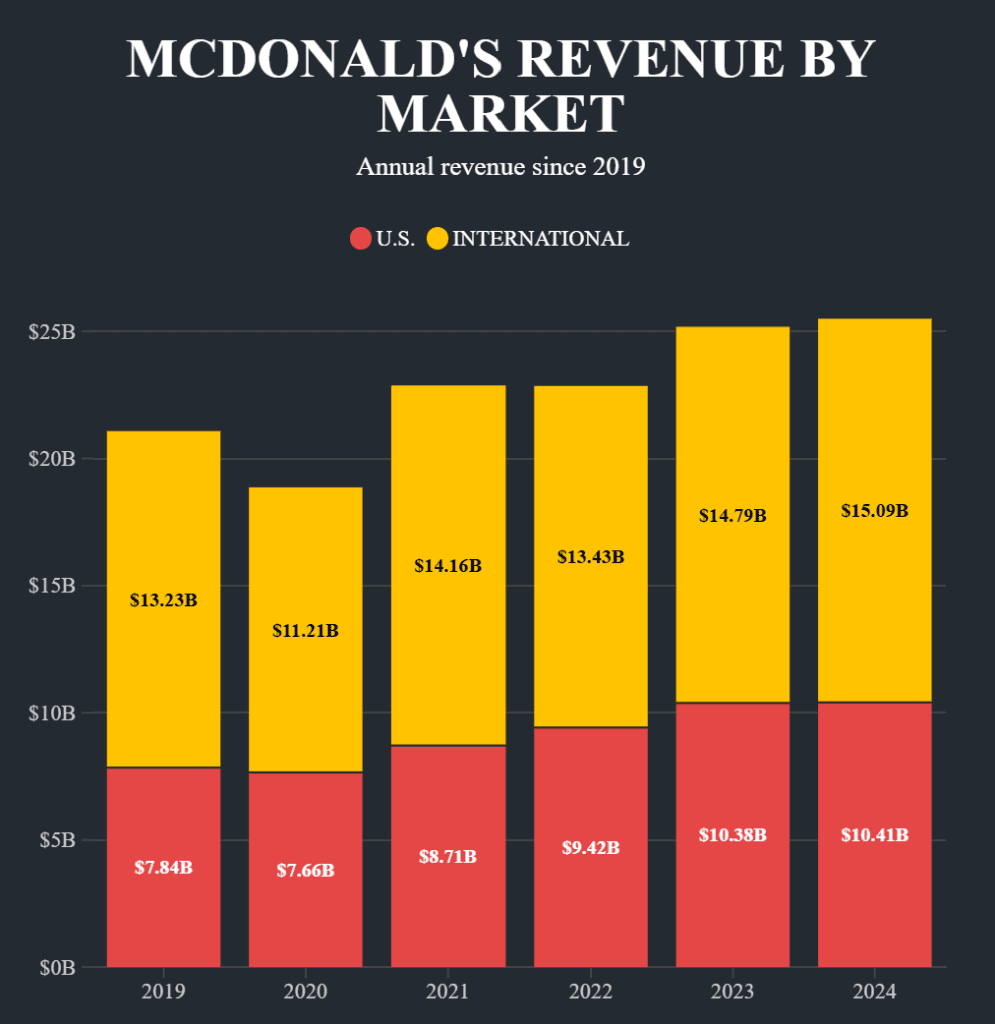

McDonald’s U.S. segment — its most profitable region — is under the microscope.

- Analysts expect high-single-digit same-store sales (SSS) growth

- Key drivers: Price increases, menu innovation (McCrispy, Spicy Nuggets), digital orders, delivery partnerships (DoorDash, Uber Eats)

Why it matters:

The U.S. accounts for ~40% of revenue and ~50% of operating income. Sustained SSS growth here is critical for maintaining margins.

✅ International Operated Markets

This segment covers major markets like the UK, Canada, Australia, Germany, and France.

- SSS likely up mid-to-high single digits, though Western Europe faces consumer softness

- Analysts highlight strength in digital sales and loyalty app usage

Why it matters:

International strength helps diversify the U.S. dependence and offers protection against domestic slowdowns.

✅ International Developmental Licensed Markets

This segment, which includes China, Japan, and Latin America, is mixed.

- China remains a major concern due to uneven recovery and competitive pricing

- Latin America is showing relative strength, but foreign exchange headwinds are a watch item

Why it matters:

China is McDonald’s second-largest market, and any meaningful pickup or slowdown will move the stock.

✅ Margins and Input Costs

Investors want updates on:

- Commodity inflation (especially beef, chicken, potatoes)

- Labor costs, particularly in the U.S.

- Supply chain improvements

Why it matters:

McDonald’s has so far used pricing power to protect margins, but elasticity will be tested as lower-income consumers tighten wallets.

✅ Digital and Delivery Growth

Digital orders + delivery now account for ~40% of systemwide sales (QuiverQuant, IndexBox).

Why it matters:

Digital channels have higher ticket sizes and better customer data — both critical for long-term growth.

Challenges and Headwinds

- U.S. consumer softness at lower income tiers

- China recovery slower than expected

- Competition from value-focused rivals like Wendy’s, Burger King

- Foreign exchange pressures on international earnings

- Labor and input cost inflation

Bullish Drivers

Why bulls are optimistic.

- Menu innovation driving ticket size

- Positive Global Comp Sales Growth in Q4: Global comp sales increased 0.4% in the fourth quarter, showing positive comps across IDL and IOM segments despite challenges.

- Incremental Benefits from Strategic Technology Platforms: Deployment of new solutions from strategic technology platforms in Consumer, Restaurant, and Company segments is expected to yield benefits.

- Strong Performance in Canada and Germany: Canada saw positive guest count performance driven by value propositions and cultural campaigns. Germany achieved market share gains with innovative menu offerings.

- Positive Developments in France: France showed improvement with positive comp sales and guest count gaps to competitors, driven by successful marketing campaigns.

- Growth in Middle East and Japan: IDL segment comp sales increased by over 4%, driven by positive results in the Middle East and Japan.

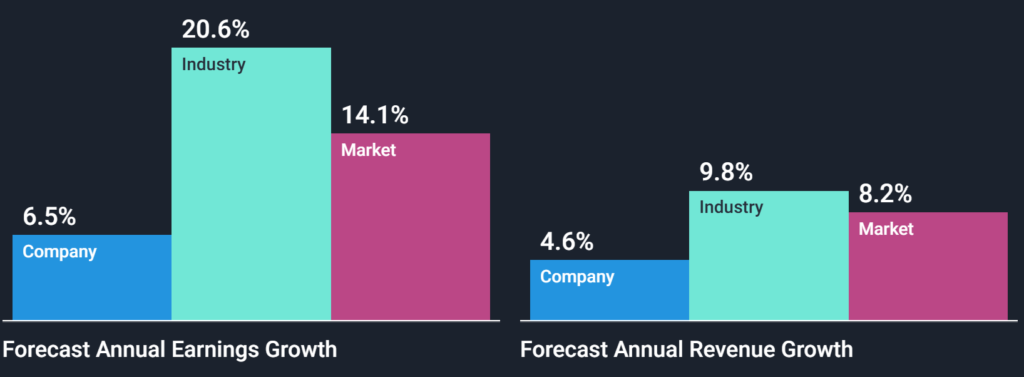

- Continued Expansion Plans: McDonald’s plans to open approximately 2,200 restaurants in 2025, contributing to over 4% unit growth.

Bearish Risks

Why bears are cautious.

- Global Comp Sales Decrease for Full Year: Global comp sales decreased by 0.1% for the full year 2024.

- US Comp Sales Decline Due to E. coli Outbreak: US comp sales were down 1.4% in Q4, attributed to the impact of an E. coli outbreak.

- Challenges in UK and Australia Markets: UK and Australia faced market challenges with underperformance in value offerings and marketing execution.

- Pressure on Low-Income Consumers: Persistent spending pressure on low-income and family cohorts, particularly in Europe.

- Decrease in Adjusted Earnings Per Share: Adjusted earnings per share decreased by 4% for the quarter compared to the prior year.

- Lower Free Cash Flow Conversion: Free cash flow conversion was 81%, below the expected 90% range due to pressures on top-line performance.

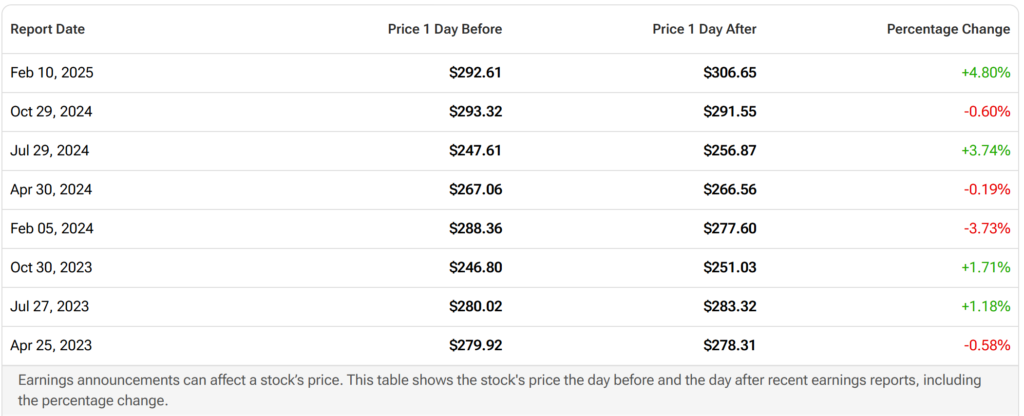

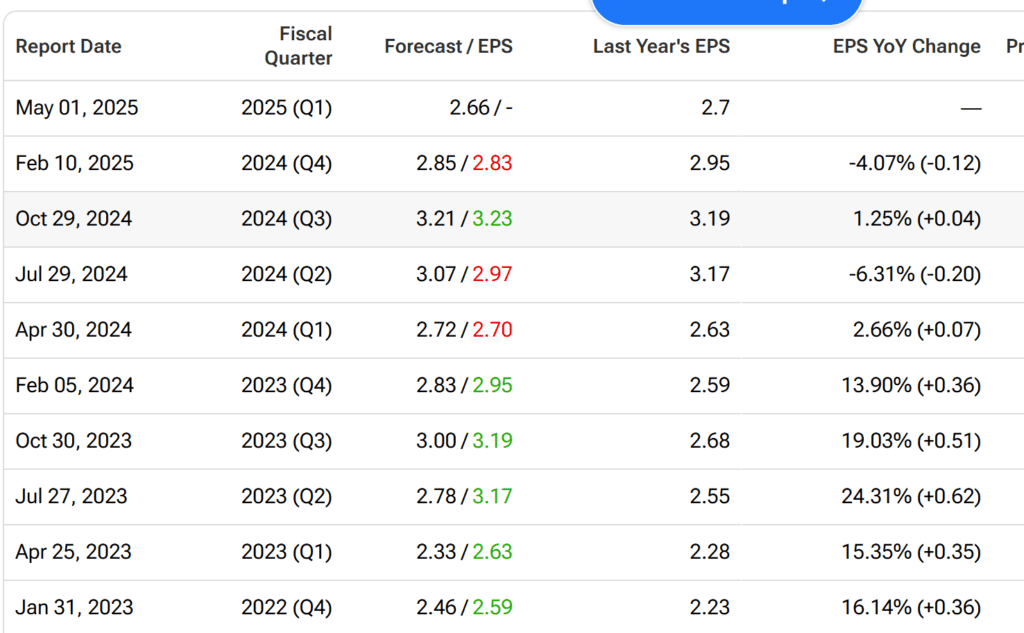

Earnings Surprise History

- Beat EPS in 13 of last 16 quarters (MarketBeat, Nasdaq)

- Average surprise: ~3%

- Current setup: Analysts expect a beat, but sentiment is cautious due to macro challenges

Why it matters: McDonald’s has a strong beat record, but investors will focus just as much on guidance and tone.

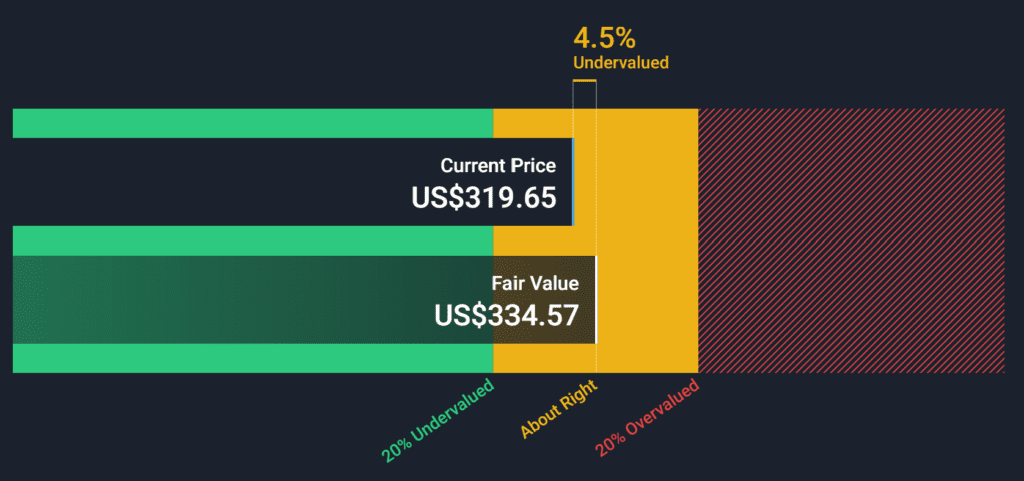

Stock and Valuation Snapshot

- YTD performance: ~+9% (Barron’s, TradingView)

- Market cap: ~$220B

- P/E ratio: ~25x forward earnings

- Wall Street sentiment:

- 24 Buy

- 8 Hold

- 2 Sell (MarketBeat, Yahoo Finance)

- Average target price: ~$320 (vs. ~$292 current) — ~10% upside

Why it matters:

McDonald’s is considered a “safe haven” consumer stock, but valuation reflects high expectations.

Conclusion

McDonald’s Q1 2025 earnings come at a critical moment.

Investors will watch whether price hikes, menu innovation, and digital expansion can offset pressure from a squeezed global consumer. China’s recovery, margin resilience, and U.S. store traffic will be key swing factors.

Long-term bulls argue McDonald’s unmatched scale and brand will power it through; bears warn the golden arches may not be as immune to consumer headwinds as before.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Apple Q2 2025 Earnings Preview and Prediction: What to Expect

Eli Lilly Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion

Shein and Temu Hike Prices as Trump’s 120% Tariff Takes Effect Next Week