Wall Street finished Tuesday higher, with investors balancing politics, Fed turmoil, and the countdown to Nvidia’s earnings that could set the tone for global markets.

Tuesday’s Close – Calm but Cautious

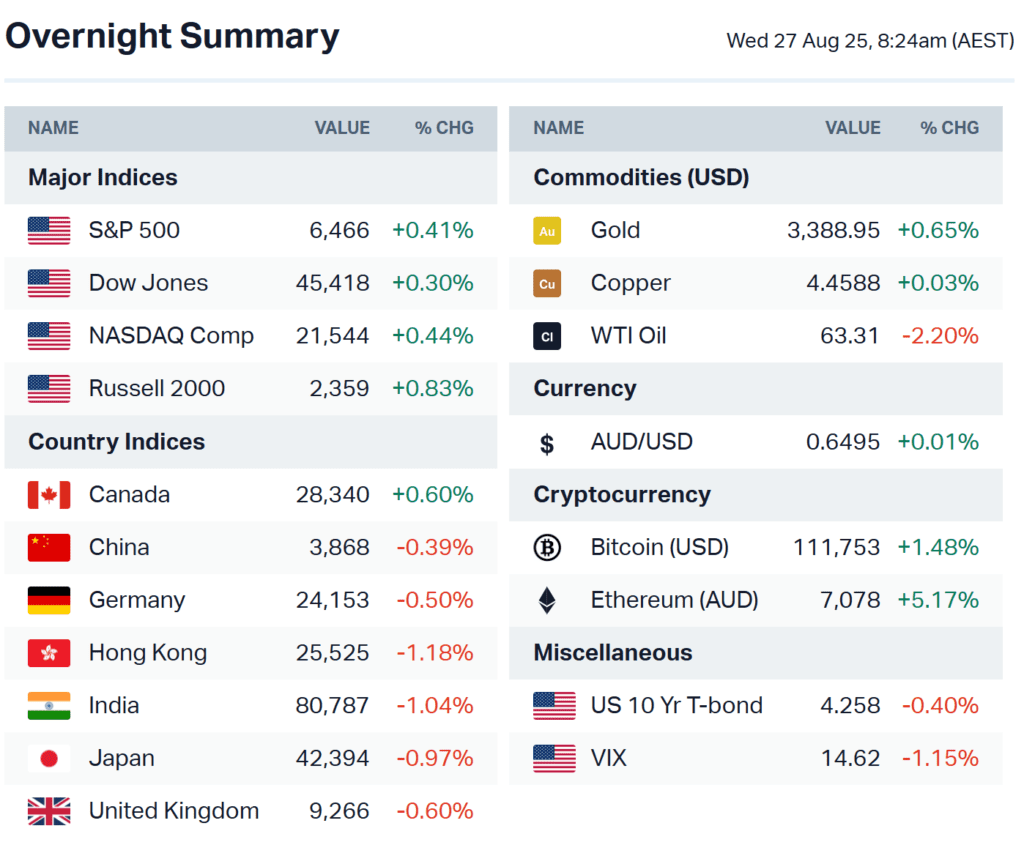

The S&P 500 rose 0.4%, the Nasdaq gained 0.4%, and the Dow added 0.3%. Defense and pharma stocks lifted the tape, while oil weakness capped energy. Yields eased to 4.26% on the 10-year, and the VIX dipped to 14.6. It was a quiet, steady climb, with most traders already looking to Wednesday’s Nvidia test.

Trump vs. the Fed – Cook Firing Attempt Sparks Lawsuit

Markets continue to digest Trump’s move to oust Fed Governor Lisa Cook, accused of mortgage improprieties. Cook has vowed to sue, saying Trump has no authority. The standoff raises fresh questions about Fed independence, with some strategists warning of a steeper curve and weaker dollar if confidence erodes.

Trade Tensions – India, Korea, and Now the EU/UK

- On Wednesday Trump followed through on his threat to slap 50% tariffs on Indian imports, punishing New Delhi for buying https://www.nytimes.com/2025/08/27/business/india-tariffs-trump-russia-oil.htmlRussian oil. The levy threatens exporters in textiles, chemicals, and jewelry, and risks cooling decades of US–India economic ties.

- At the same time, Trump announced a $150B South Korea investment pledge, plus a record $50B Boeing aircraft order and shipbuilding deals, while opening cooperation on Alaska gas reserves.

- On Tuesday, Trump also warned he will impose tariffs and export restrictions on the UK and EU unless they scrap their digital services taxes targeting US Big Tech. He called the measures “designed to harm or discriminate against American technology” while sparing Chinese firms. The UK’s DST alone brings in about £800M a year. Full story here.

Europe in Focus – France’s Political Mess

The CAC 40 is down more than 3% this week, hit by PM Francois Bayrou’s failed debt plan. The French–German 10-year yield spread widened to 79 bps, its highest since April, as investors brace for deeper instability.

All Eyes on Nvidia Tonight – A $260B Swing?

Wednesday is the moment all semiconductor fans have been waiting for: Nvidia is set to report after the market closes. It has been a blizzard of events since the last time the AI tech giant reported, so here are some points to watch: Chief Jensen Huang and company will talk on the call about the new 15% charge to sell to China imposed by the Trump Admin, and the $8B+ Nvidia will pull in now that their chip ban is gone again.

Speaking of Trump news, the prez has said 100% tariffs on Semiconductors are on the way, unless companies build in the U.S., but Nvidia should pass that loyalty test. The giant announced plans for $500B in new chip manufacturing in the U.S., shortly after Liberation Day scared the market in April.

In earnings, the Street expects adjusted EPS of $1 and revenue of $46.2B, according to Bloomberg estimates. If the company meets or beats, it would be nearly 50% growth in both EPS and revenue from last year. It’s a bit of a slower pace than the 12% revenue growth in Q2 2024, but still.

Look for $41B in data center rev, more than doubled from last year. The hope for Nvidia is that other tech giants are only increasing CapEx spending on datacenters, and Nvidia is going to be a prime recipient as a market leader. Alphabet estimates its spending will grow to a total $85B for 2025, Meta is looking at $66-72B. Microsoft’s CapEx last fiscal year was $80B, and analysts see it climbing to $120B.

Nvidia is not the only report coming; Kohl’s saw a 783% spike in retail chatter ahead of its Q2 earnings, with sentiment split between meme-fueled optimism and bearish warnings over real estate valuations and tariff-driven demand risks.

Global Markets Steady

Global markets opened today on a cautious note. In Asia, Japan’s Nikkei edged higher on chip strength, while Shanghai gained modestly and Hong Kong slipped. Europe opened softer, with France’s CAC under pressure from ongoing political turmoil and banks leading losses. US futures are flat to slightly higher after Wall Street closed firmer on Tuesday, led by defense and tech stocks.

Bond markets remain calm, with the US 10-year yield holding near 4.26%. Oil is weaker around $67 a barrel, gold is steady above $3,380, and Bitcoin hovers near $111K after heavy volatility earlier this week. Sentiment is still leaning optimistic—the Fear & Greed Index sits at 60, in “Greed” territory—though traders are clearly waiting for Nvidia’s earnings later today to set the next big move.

Other Movers

- UnitedHealth (-1.45%) fell after reports the DOJ is probing Medicare overbilling through Optum.

- Google hit a fresh all-time high, now the world’s 4th-largest company.

- AMD confirmed CAO Philip Carter will step down Sept. 5 to take a CFO role elsewhere.

Crypto & Commodities Snapshot

- Bitcoin $111,753 (+1.5%) – rebounded after a whale dump drove a flash crash.

- Gold $3,389 (+0.8%) – climbing on Fed uncertainty.

- Oil – still soft, Brent at $67.30, WTI at $63.31.

Today’s Key Events (US & UK time)

- 08:30 / 13:30 — US Trade Balance

- 09:45 / 14:45 — US S&P Global PMI

- 10:00 / 15:00 — US ISM Non-Manufacturing PMI

- 13:00 / 18:00 — US 3-Year Note Auction & Atlanta Fed GDPNow (Q3)

- 16:30 / 21:30 — API Weekly Crude Oil Stock

Earnings on Deck

- Pre-market: UP Fintech ($TIGR), Abercrombie & Fitch ($ANF)

- After hours: Nvidia ($NVDA), CrowdStrike ($CRWD), Snowflake ($SNOW), Nutanix ($NTNX), HP ($HPQ), Pure Storage ($PSTG)

Markets are steady, but Trump’s escalating tariff front—from India to the EU and UK—shows trade risks aren’t going away. Nvidia’s earnings tonight will decide if the AI trade keeps powering the market higher or finally runs into resistance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana