US stock futures fell sharply Monday morning following reports that a highly anticipated U.S.-Japan trade deal, once viewed as the market’s top bullish catalyst, is not expected to be finalised imminently.

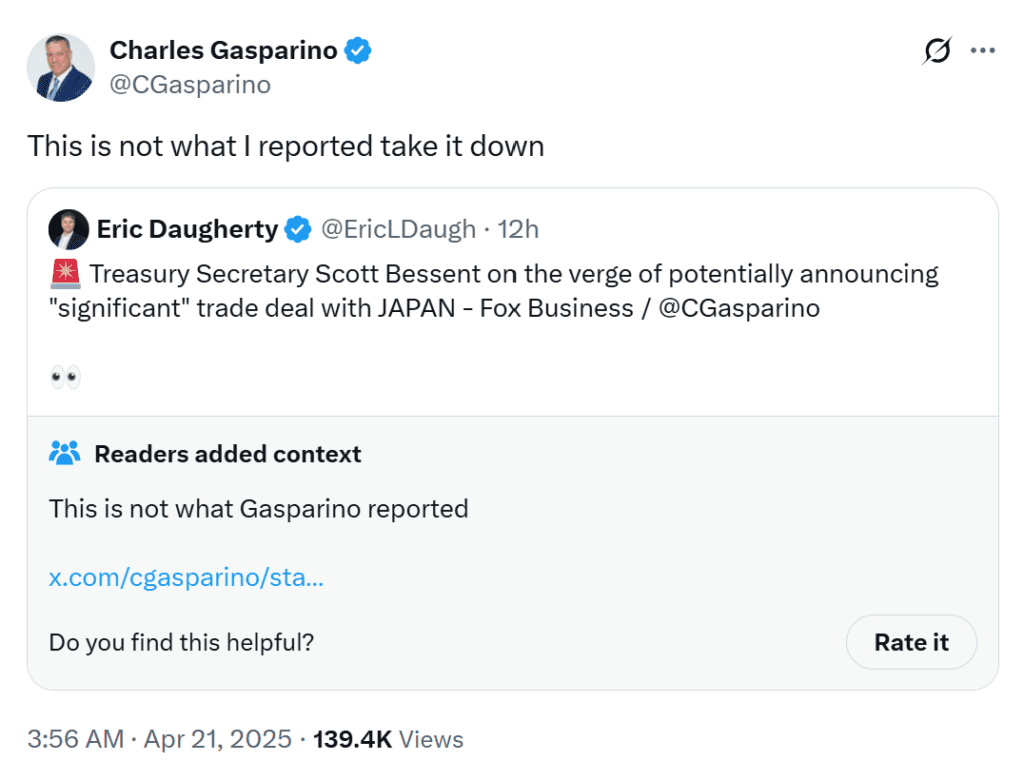

According to Fox Business senior correspondent Charles Gasparino, while there is “progress” in ongoing negotiations, a formal agreement is not yet in sight. The update has triggered immediate market reaction, particularly among tech-heavy indices.

Nasdaq 100 futures are down nearly -1%, reversing last week’s optimism that a breakthrough deal with Japan could ease global trade tensions.

Last week, speculation about a U.S.-Japan trade agreement helped drive equities higher, with the potential deal seen as a key counterweight to deteriorating relations with China. Markets were betting that Japan — the world’s third-largest economy — could serve as a stabilizing trade partner in a landscape dominated by tariff battles and geopolitical uncertainty.

However, Monday’s report suggests that any final deal may still be weeks away, if not longer, deflating the momentum that had propped up risk assets.

Market Implications:

- U.S. exporters and multinationals that rely on stable Pacific trade routes may face renewed uncertainty.

- Tech and semiconductor stocks, many of which are tied to Japanese suppliers or customers, could see increased volatility.

- Investors may rotate back to defensive sectors if the trade outlook darkens further.

While negotiations continue, the latest headlines underscore just how sensitive markets remain to any shifts in global trade sentiment — especially in a week already loaded with earnings reports and geopolitical risks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

China Warns of Retaliation Against US Allies as Trade Tensions Escalate

Bear Market Survival Guide: How to Stay Smart, Calm, and Positioned for the Rebound

OpenAI spends ‘tens of millions of dollars’ on people saying ‘please’ and ‘thank you’

The Role of Fiscal Dominance in Monetary Policy

Authorities use high tech, called “Overwatch” to enhance border security

Why are more rich Americans opening Swiss bank accounts recently?

Gold Is at a Record High. Why It Could Climb Even Higher?

Nvidia’s CEO makes surprise visit to Beijing after US restricts chip sales to China

The Rule of 40: Your Ultimate Guide to Evaluating Software Stocks