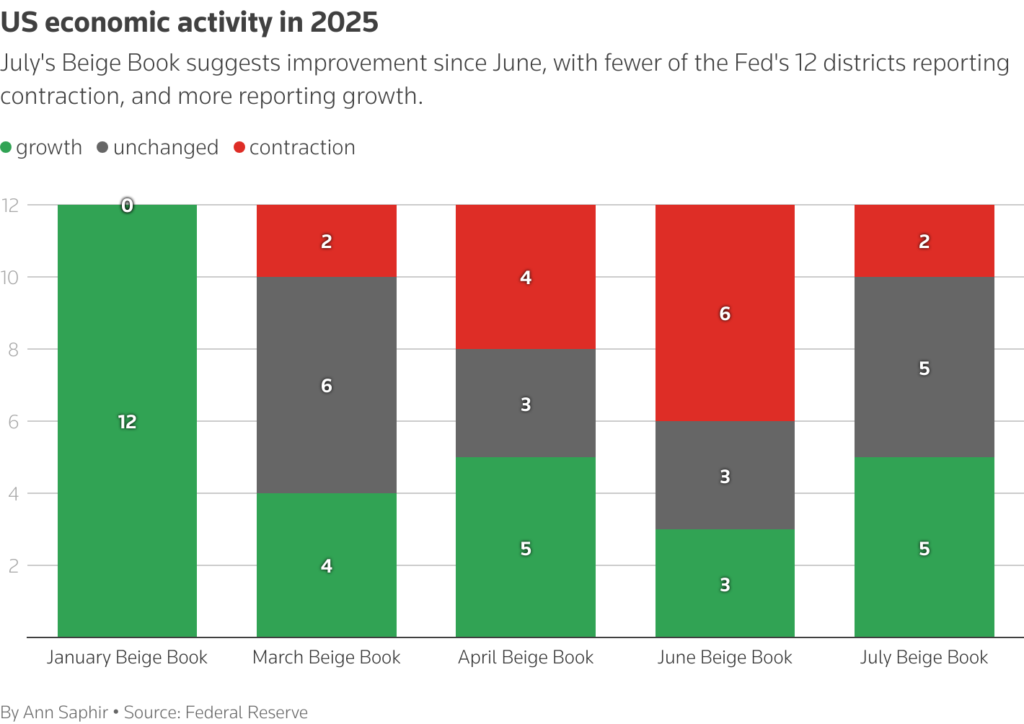

Markets steadied on Thursday with traders increasingly confident the Federal Reserve will deliver a September rate cut, as the Beige Book revealed sluggish consumer spending and tariff-driven cost pressures. Alphabet and Apple’s rally gave Wall Street a lift, while Asia and Europe traded cautiously.

More about: Message for Big Tech in the Google Ruling: Play Nice, but Play On

Beige Book: Economy Flat, Tariffs in Focus

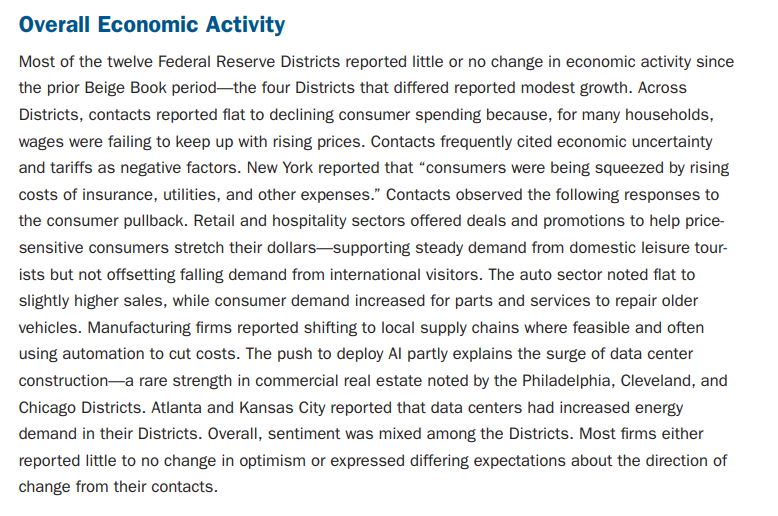

The Fed’s latest Beige Book showed most districts reporting little to no growth, with consumer spending flat as wages lagged rising costs. Mentions of tariffs surged to 69, up sharply from 40 in the prior report, highlighting concerns about inflationary pressures.

- Retailers and hospitality used discounts to support demand, but foreign tourism fell.

- Auto demand held steady, mostly for repairs on older vehicles.

- Manufacturers leaned on local supply chains and automation.

- Data centers tied to AI were a rare bright spot, lifting energy demand in Atlanta and Kansas City.

Overall, sentiment was mixed: most firms reported no change in optimism, while some grew cautious on hiring.

Kashkari: No Recession, Gentle Cooling

Minneapolis Fed President Neel Kashkari sought to reassure markets:

- “I am not forecasting a recession,” he said, adding that rates have “some room to come down gently.”

- He stressed the Fed sees “every reason to believe there will be a gentle cooling in the economy.”

- Kashkari noted the breakeven hiring rate is now ~75,000 jobs per month, and warned that goods inflation driven by tariffs must be watched closely.

His remarks echoed the Beige Book’s cautious tone — steady labor markets, but companies slowing hiring and investment.

Market Action: Tech Boosts Wall Street

US stocks bounced back, led by big tech after a favorable antitrust ruling.

- Alphabet ($GOOGL) +9.0% after avoiding a forced Chrome sale; must share search data but keeps lucrative Apple deal.

- Apple ($AAPL) +3.8% on relief it can still preload Google Search on iPhones.

- S&P 500 +0.1% snapped a two-day losing streak.

- Nasdaq +0.7%, powered by tech.

- Dow –0.6%, dragged by banks and energy.

HSBC lifted its S&P 500 target again, citing strong earnings momentum and only modest tariff fallout.

Market Moves: Bonds, Gold, and Crypto Shine

- Treasuries: Yields eased as investors priced in a near-95% chance of a September cut.

- Gold: Climbed 1.1% to fresh highs, reflecting safe-haven demand amid tariff-driven inflation fears and US debt concerns.

- Oil: Brent crude slid 2.2% to $67.63, weighed down by OPEC+ production expectations.

- Currencies: The US dollar held steady; the Australian dollar rose 0.5% on global risk sentiment.

- Crypto: Bitcoin gained 1.4% to $112,429, supported by optimism around ETFs and the Nasdaq debut of American Bitcoin, which surged 34.5%.

- FX: The Australian dollar gained 0.5% to US¢65.51, helped by Fed cut bets. Euro flat at $1.1662, yen steady at 148.09, yuan unchanged at 7.1388.

Asia & Europe: Mixed Sentiment

Markets abroad traded cautiously:

- Japan’s 30-year JGB auction eased nerves, stabilizing bonds after yields hit records.

- MSCI Asia ex-Japan slipped 0.2% as China fell hard: CSI 300 –2.5%, STAR 50 –5.4%, with regulators preparing market-cooling measures.

- India’s Sensex gained 1.1% after tax cuts aimed at boosting demand against US tariffs.

- In Europe, DAX futures –0.1%, FTSE +0.1%, Euro Stoxx flat.

Global Policy Backdrop

Reports surfaced that Washington urged countries to reject a proposed UN shipping fuel emissions deal, warning it might impose tariffs on those who back it. The stance reinforced how tariffs remain a central pillar of US trade policy, and a major uncertainty for global markets.

What to Watch Today

| Time (EST) | Event | Detail |

|---|---|---|

| 07:30 | Challenger Layoffs | Aug job cuts |

| 08:15 | ADP Employment Change | Aug labor market |

| 08:30 | Trade Balance | Jul |

| 08:30 | Initial Jobless Claims | Weekly |

| 09:45 | S&P Services PMI | Aug |

| 10:00 | ISM Services PMI | Aug |

| 12:05 | Fed’s Williams | Speech |

| 19:00 | Fed’s Goolsbee | Speech |

| Time (EST) Earnings | Companies | Tickers |

|---|---|---|

| 05:45 | Duluth Holdings | $DLTH |

| 06:10 | Shoe Carnival | $SCVL |

| 06:30 | Dollar Tree | $DLTR |

| 06:45 | Caleres | $CAL |

| 06:55 | SAIC | $SAIC |

| 07:00 | Ciena, G-III Apparel, Brady, VersaBank | $CIEN, $GIII, $BRC, $VBNK |

| 07:15 | Endava | $DAVA |

| 07:30 | CarMart, Wiley | $CRMT, $WLY |

| 08:30 | Toro | $TTC |

| — | 1-800-Flowers | $FLWS |

| Time (EST) Earnings | Companies | Tickers |

|---|---|---|

| 16:00 | Phreesia | $PHR |

| 16:05 | Lululemon, DocuSign, Braze, Argan, ServiceTitan, Zumiez, Sportsman’s Warehouse, Concrete Pumping, Torrid, LifeVantage, eGain, American Outdoor Brands | $LULU, $DOCU, $BRZE, $AGX, $TTAN, $ZUMZ, $SPWH, $BBCP, $CURV, $LFVN, $EGAN, $AOUT |

| 16:10 | UiPath, Samsara | $PATH, $IOT |

| 16:15 | Broadcom, Copart, Guidewire, Quanex | $AVGO, $CPRT, $GWRE, $NX |

| 19:00 | Ambiq Micro | $AMBQ |

| — | Smith & Wesson, Cango | $SWBI, $CANG |

The Beige Book shows an economy treading water, caught between resilient labor markets and consumer strain from tariffs and high costs. With Kashkari and futures markets pointing to a September cut, investors are betting the Fed can deliver a soft landing. But with tariffs still in play and inflation risks tied to global trade, volatility is unlikely to ease soon.

Also, tech strength is keeping Wall Street afloat, while gold’s rally shows investors are still hedging for turbulence.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)