Global markets eased into Tuesday after Monday’s post-Powell hangover, with traders digesting Trump’s latest tariff and trade maneuvers, South Korea’s record $150 billion investment pledge, and the last fireworks of the second-quarter earnings season.

How We Closed Monday

Markets stumbled after the weekend’s Fed euphoria. The S&P 500 slipped 0.1%, the Dow shed 242 points (-0.5%), while the Nasdaq eked out a 0.3% gain thanks to support from $INTC and $NVDA. Most sectors ended in the red, with energy and communications being the rare pockets of green. Tech broadly sold off, Bloomberg TV dubbing the screens “angry red.”

Bond markets saw 10-year yields climb back toward 4.28% as traders reassessed Powell’s dovish tone and prepped for this week’s Treasury auctions. Oil added modestly, with Brent hovering near $68.16, while gold steadied at $3,368 after last week’s jump.

Trump–Korea Pact: Big Ships, Big Planes, Big Money

After Monday’s Oval Office meeting, President Trump and South Korean President Lee Jae Myung unveiled a sweeping package of deals:

- $150 billion in investment pledges by Korean firms.

- Korean Air’s record $50 billion order of 103 Boeing aircraft plus $13.7 billion in GE Aerospace engines.

- New shipbuilding partnership and purchases of South Korean vessels.

- Agreement to expand U.S.–Korea arms cooperation and reaffirm commitment to denuclearization.

- Trump also teased a trilateral partnership with Seoul and Tokyo to tap Alaska’s natural gas reserves.

“We really sort of need each other… we love their ships, their products, and they love what we have,” Trump said.

The announcement follows July’s tariff cut deal that lowered U.S. levies on South Korean autos to 15% from 25%. Whether the new $150 billion overlaps with July’s $350 billion pledge remains unclear, but Reuters suggested it’s separate.

Earnings Season Ends With a Bang

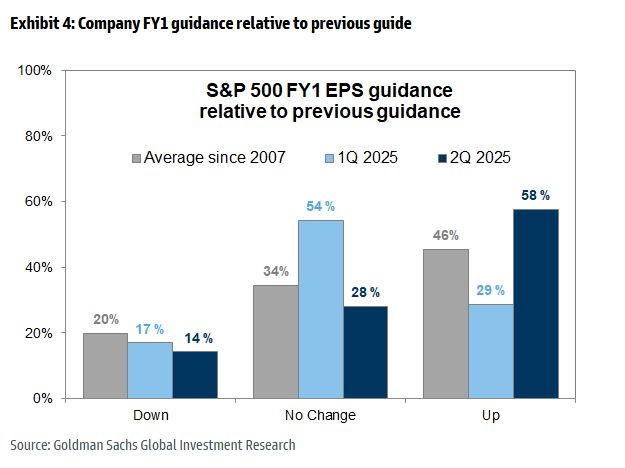

Goldman Sachs chief strategist David Kostin summed it up: Q2 was “better than feared.” S&P 500 EPS grew 11% YoY, nearly triple consensus estimates.

- 60% of companies beat by more than one standard deviation after estimates had been slashed post-tariff shock in spring.

- 58% of firms raised guidance, twice the pace of Q1. Analysts are now hiking 2H 2025 and 2026 forecasts, though consensus still expects growth to slow to 7% in 2H.

- Margins held steady despite tariff headwinds; 2026 projections assume expansion that some strategists call “ambitious.”

- FX tailwinds boosted large-cap nominal sales, but real growth slowed, especially in mid- and small-caps.

- Mega-Cap Tech carried the load, with EPS up 26% YoY. $NVDA hasn’t reported yet — earnings Wednesday after the bell are forecast at $46B revenue and $1 EPS.

Kostin’s bottom line: “The bar was set low, and U.S. corporates vaulted it.”

This Morning’s Global Snapshot

Global markets are starting Tuesday on a cautious note as investors await Nvidia’s blockbuster earnings midweek. The Federal Reserve’s pivot has kept sentiment buoyant, but Trump’s trade maneuvers and rate-cut uncertainty linger in the background. The Fear & Greed Index sits at “Greed,” showing investors remain optimistic despite recent volatility.

- Asia: Japan’s Nikkei +0.4% on optimism around South Korea–US investment deals; China’s CSI 300 +2% at a three-year high.

- Europe: STOXX 600 -0.2%, dragged by renewable energy stocks after the U.S. blocked Orsted’s Rhode Island wind project.

- U.S. Futures: S&P 500 -0.2%, Nasdaq -0.3% ahead of Nvidia results; Dow futures lower after Monday’s slip.

- Bonds: U.S. 10-year yield ~4.28% after Treasury selloff; European yields also higher.

- Currencies: Dollar firmer at ¥147.3, euro softer at $1.17.

- Commodities: Brent ~$68.2, WTI ~$64.1. Gold steady at $3,360.

- Crypto: Bitcoin $110,255 (-1.85% 24h, -4.1% 7d, -6.8% 30d).

TLDR: BTC fell after a whale sold 24,000 BTC (~$2.7B), triggering a flash crash to $109,700. Volatility also came from Fed rate-cut uncertainty post-Jackson Hole, and a technical breakdown accelerated automated selling.

Today’s U.S. Calendar (ET):

- 8:30 — Trade Balance

- 9:45 — S&P Global PMI

- 10:00 — ISM Non-Manufacturing PMI

- 1:00 — 3-Year Note Auction & Atlanta Fed GDPNow (Q3) update

- 4:30 — API Weekly Crude Oil Stock

Earnings on Deck:

- Pre-market: $EH, $GOTU, $DQ, $BMO, $BNS

- Post-market: $OKTA, $APDN, $MDB, $BOX

So, Markets are entering Tuesday in a cautious but still optimistic mood. The Powell-driven rally has cooled, with investors digesting Trump’s latest tariff manoeuvres, South Korea’s $150 billion investment pledge, and the end of earnings season. Nvidia’s results on Wednesday now stand as the pivotal test for the AI trade and broader market sentiment. Meanwhile, Bitcoin’s slide to $110K underlines the fragility of risk assets when liquidity shifts suddenly. The key question for traders this week: will Nvidia’s report and fresh economic data reignite risk appetite, or does the market finally take a breather after record highs?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana