THE ‘BIG STAY’ COULD BOOST PRODUCTIVITY

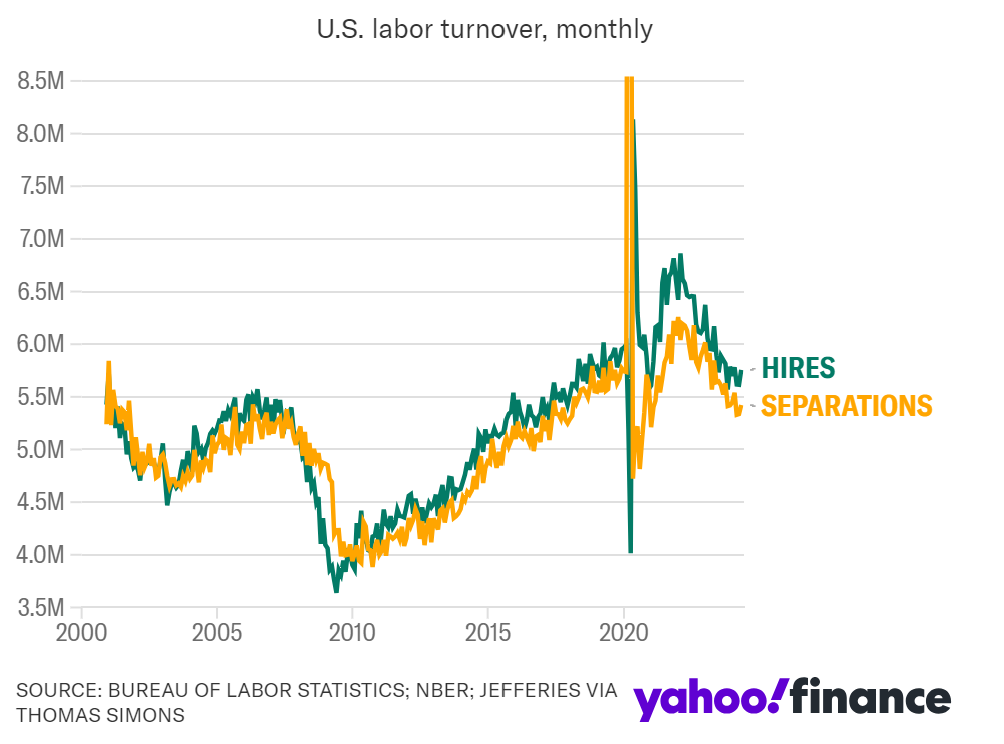

Recent JOLTS data reveals:

- 47.7 million people quit their jobs in 2021.

- 50.6 million quit in 2022.

- This compares with an average of 37.9 million annually from 2015-2019.

This high turnover during the “Great Resignation” was a drag on productivity. However, with turnover now slowing and workers staying longer, productivity is expected to improve, reducing wage pressures and helping to cool inflation.

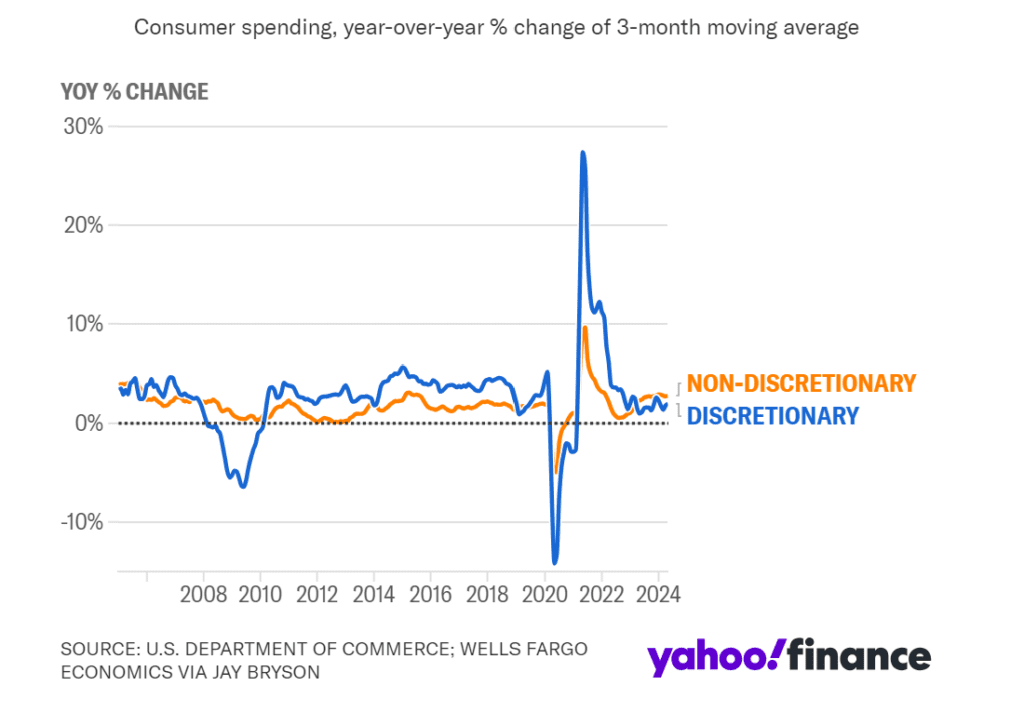

CONSUMERS PULL BACK ON SPENDING

Wells Fargo economics team analysis:

In over 60 years, there has never been a recession without real discretionary spending falling year-over-year. Real discretionary spending growth has been close to breaking through zero this year, indicating cautious consumer behaviour amid fading purchasing power.

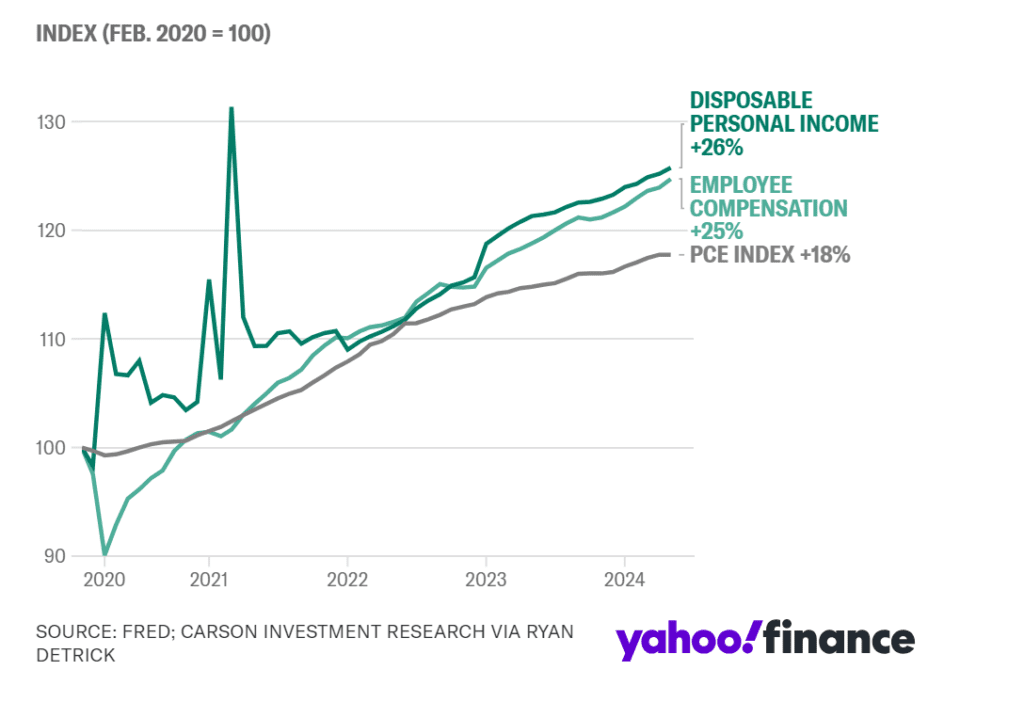

DISPOSABLE INCOME OUTPACING INFLATION SINCE PANDEMIC

Despite inflation, disposable incomes and employee compensation have increased more than overall inflation since the pandemic. This has helped avoid a recession, with expectations for inflation to improve in the second half of the year, keeping consumers in good shape.

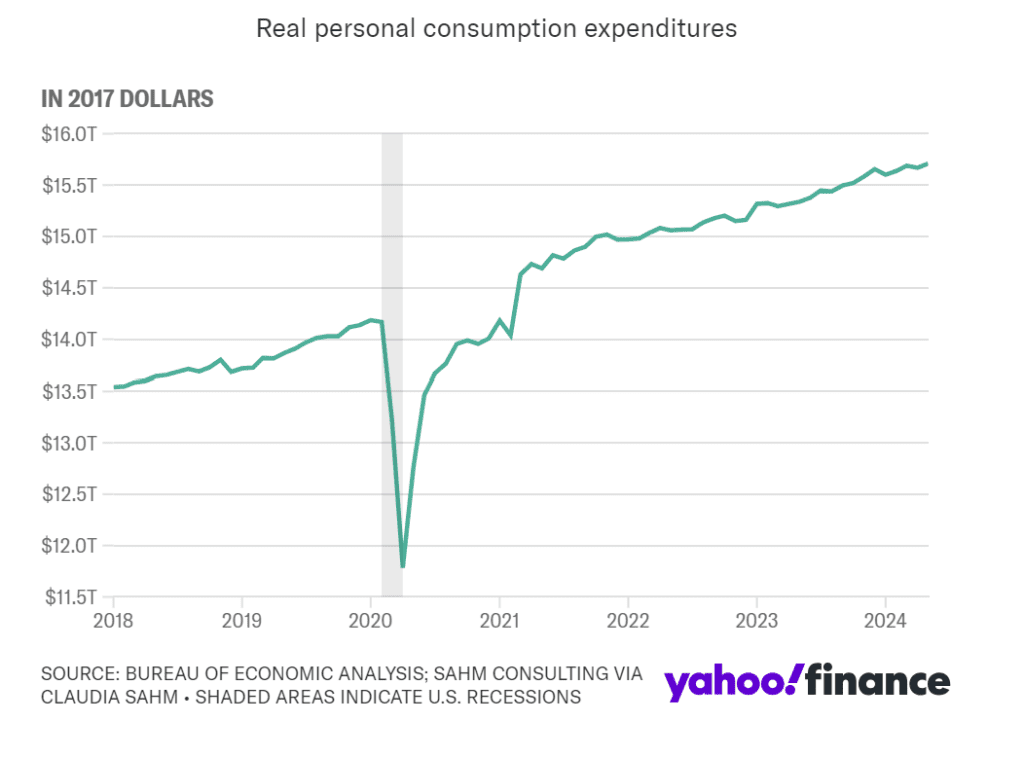

CONSUMER SPENDING REMAINS KEY TO AVOIDING RECESSION

Real consumer spending has risen solidly post-COVID and is near its pre-pandemic trend. Growth in real consumer spending slowed in the first half of 2024, but this is not unusual. Consumers will remain central to monitoring recession risks.

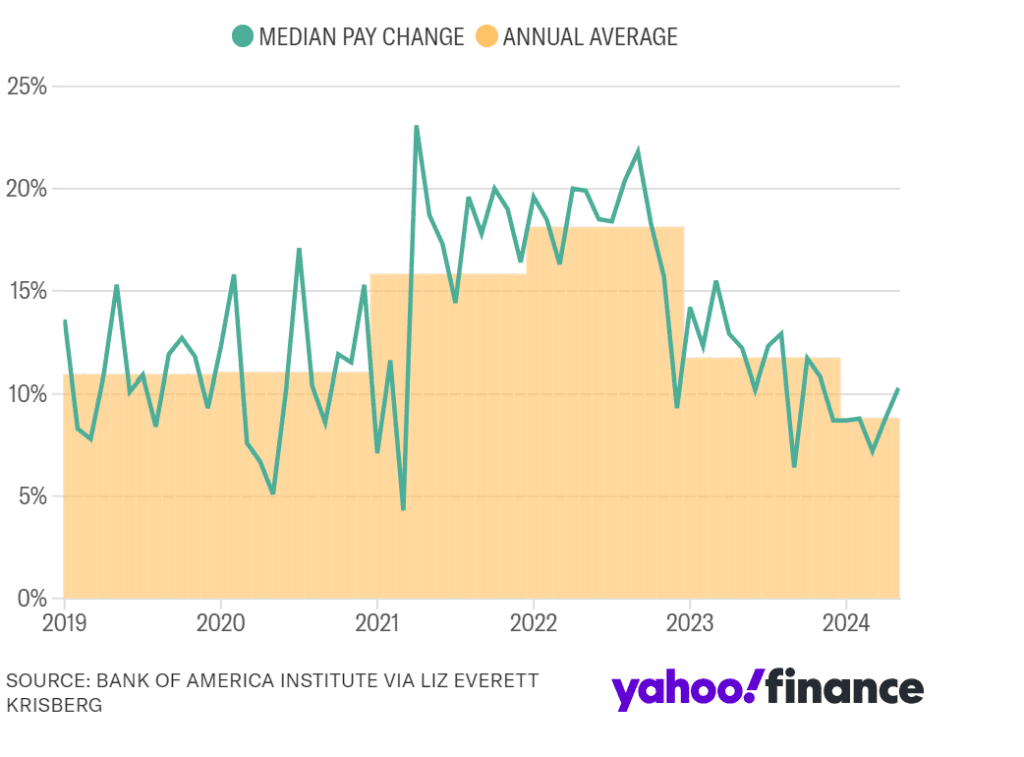

PAY BUMPS FOR JOB HOPPERS DECLINE

The rate of job switching has declined compared to 2023. Median pay raises for job hoppers fell to around 10% YoY in May 2024, below the 2019 and 2020 average annual levels, and less than half the level seen during the “Great Resignation.”

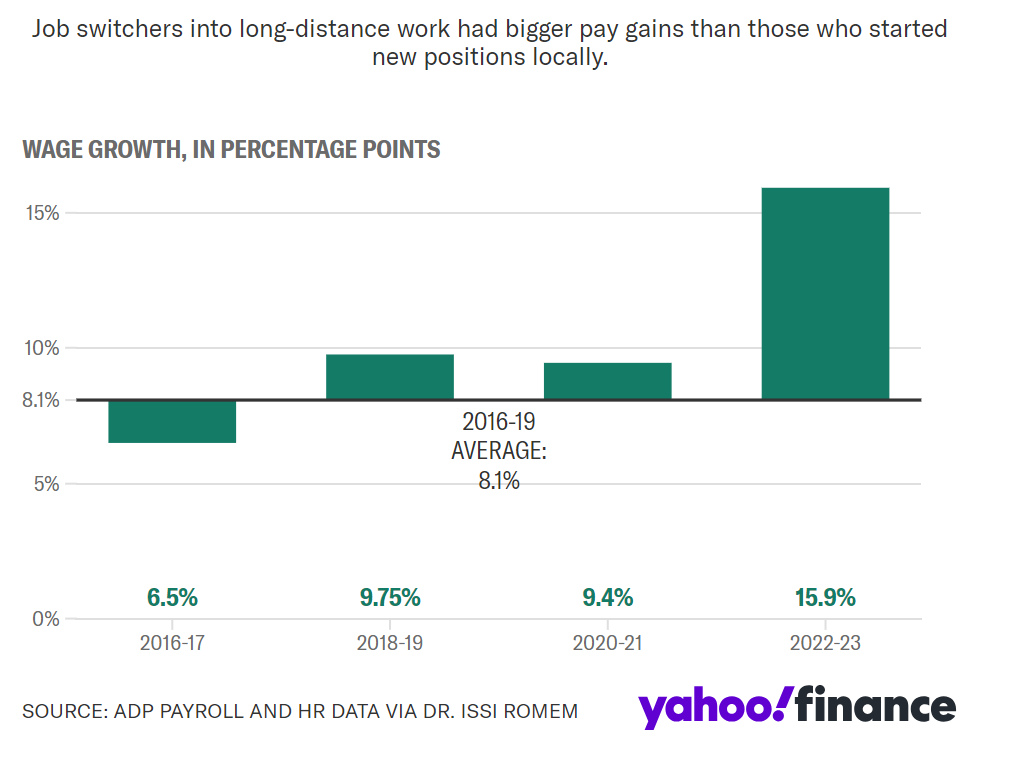

REMOTE JOB SWITCHERS COME OUT AHEAD

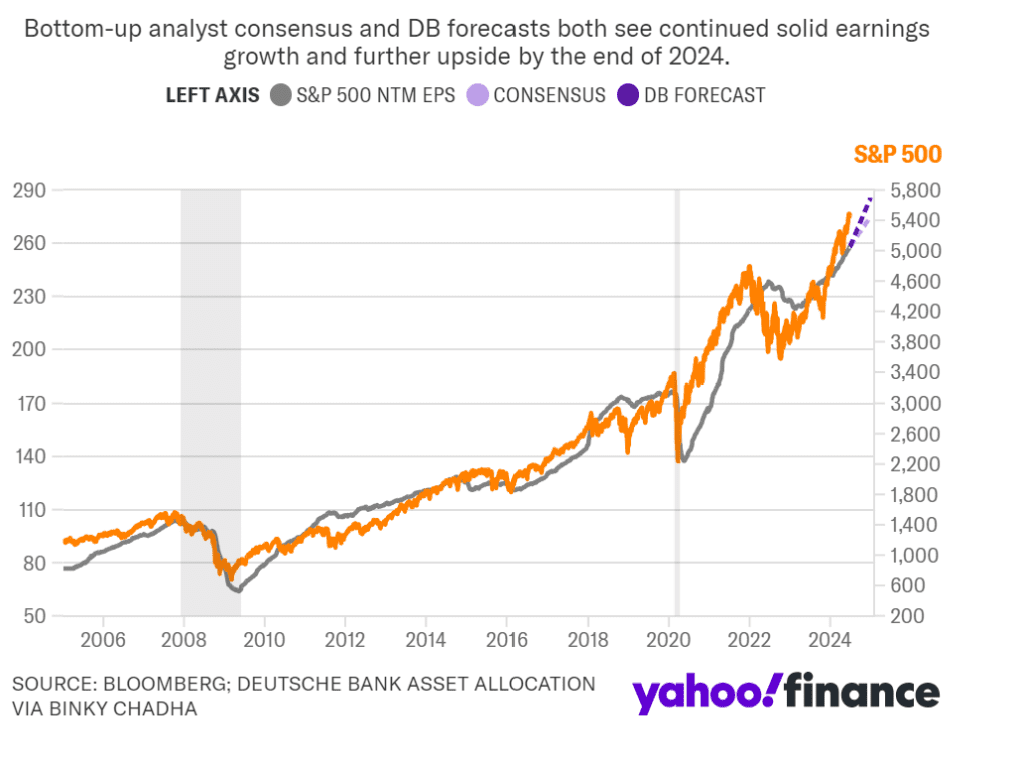

EXPECTED EARNINGS GROWTH REMAINS STRONG

Both bottom-up analyst consensus and Deutsche Bank’s earnings forecasts see continued solid earnings growth. Projections suggest the S&P 500 could reach 5,500 to 5,800 by year-end, depending on the speed and durability of the earnings cycle.

RATE CUTS DON’T ALWAYS UPEND THE STOCK MARKET

Rate cuts are expected soon, and while typically a response to economic trouble, this cut is seen as celebratory, indicating control over inflation.

FALLING RATES ARE THE BULL CASE FOR STOCKS

The “soft locks” scenario of softening macro activity and moderating inflation supports a bullish outlook for equities and the economy. Brian Belski and Keith Lerner highlight historical trends suggesting significant room for stock market growth through year-end despite potential near-term pullbacks

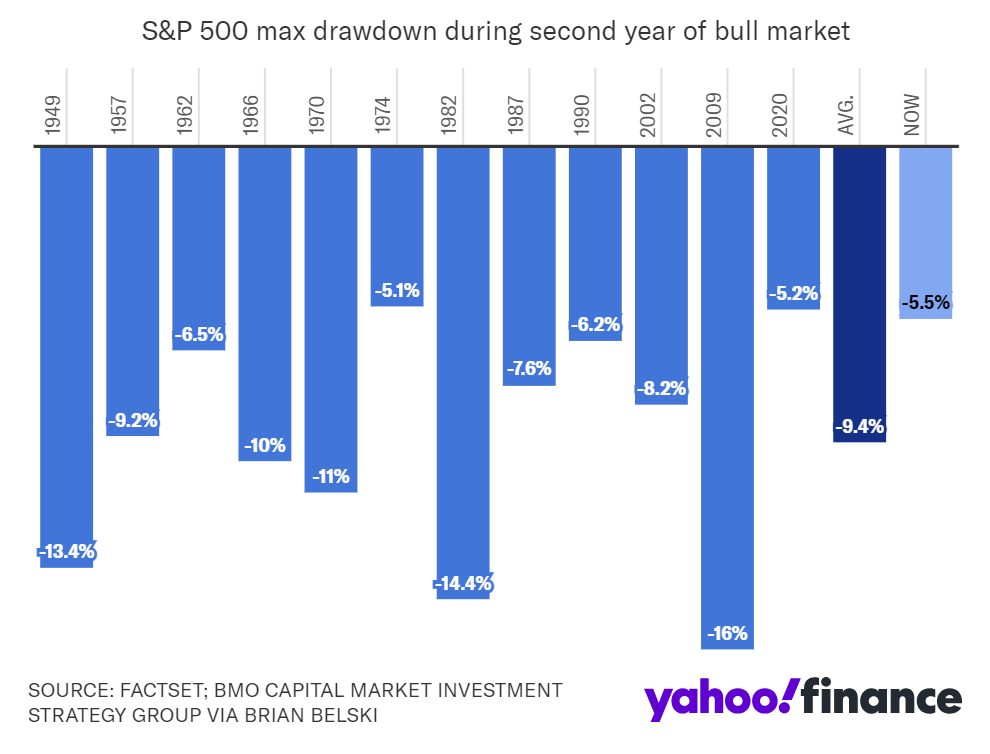

MAX DRAWDOWN LOW RELATIVE TO HISTORY

We are still sceptical that the 5.5% drawdown that occurred during March-April will be the worst for the S&P 500 this year given historical data that shows an average drawdown of 9.4% for the second year of bull markets historically. However, we are now convinced that should a more severe pullback happen over the near term, it will likely occur at higher index levels than we previously anticipated. Therefore, the eventual rebound, which has averaged roughly 14.5% historically, will begin at a higher base, suggesting to us that stocks have plenty of room to run through year-end

Click Part 1

Click Part 2