Wall Street’s winning streak continues, but so do the signs of overheating. With valuations near historic peaks, AI hype fueling speculation, and the media now echoing bubble warnings, investor sentiment may be approaching dangerous levels.

Record Highs, Relentless Momentum — and a Rally Nobody Can Fully Explain

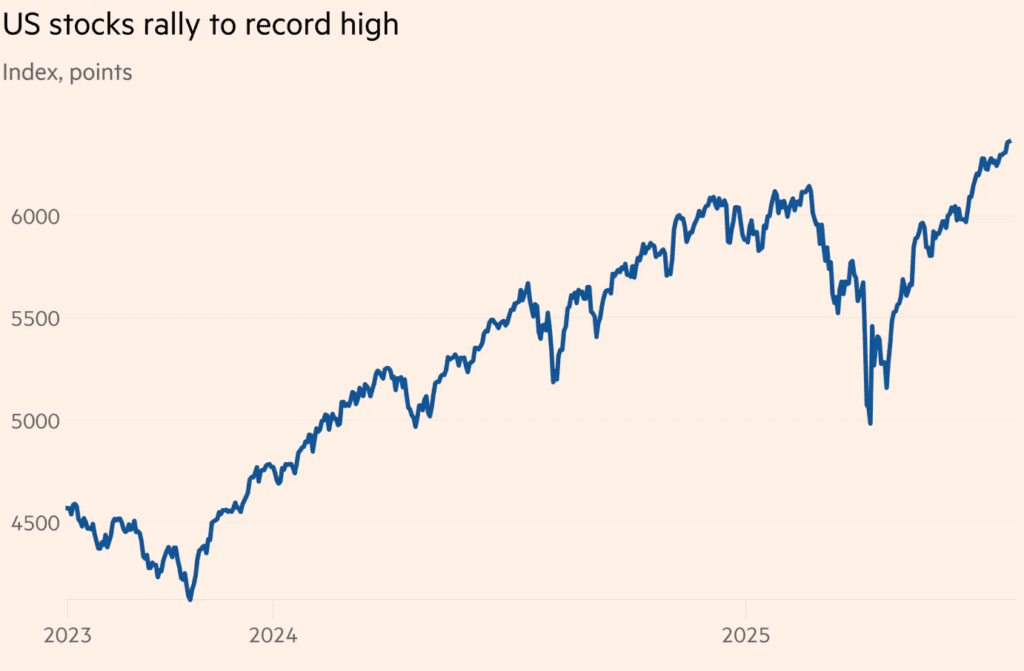

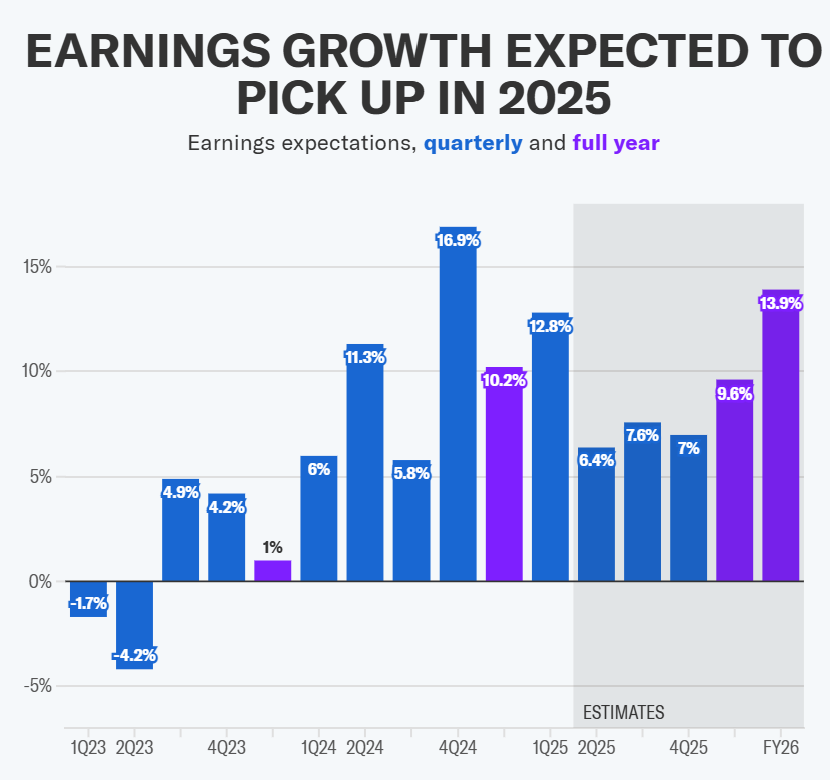

The S&P 500 closed last week at a record 6,388.64, extending a powerful 28% rebound from April lows and marking one of the longest weekly winning streaks in recent memory. On the surface, the rally appears justified: earnings are strong, inflation is cooling, and liquidity remains ample. But dig deeper, and the picture grows more fragile.

What’s Driving the Surge:

- 87% of companies have beaten earnings expectations so far, especially in tech, healthcare, financials, and industrials.

- AI momentum remains relentless, with Nvidia, Meta, and Palantir surging on product announcements, government contracts, and investor exuberance.

- Speculative mania is back: Meme stocks like Kohl’s and GoPro are spiking, Coinbase is up 180%, and crypto trades are surging.

- Bitcoin hit $120,000, helping lift the entire risk-on asset complex.

- 0DTE options volume remains historically elevated, showing the market is being driven increasingly by retail sentiment and ultra-short-term trades.

As Citi’s Drew Pettit put it:

“Every incremental uptick in sentiment just increases the downside risk if the positive story breaks.”

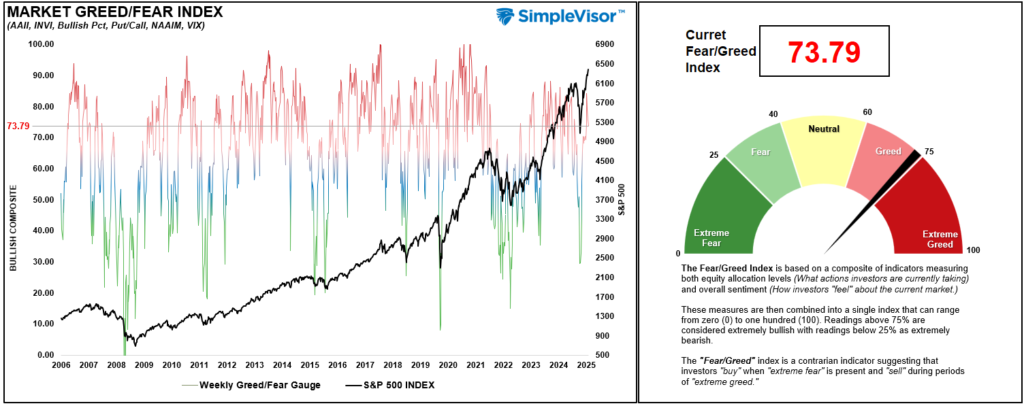

Valuation and Sentiment Are Entering Bubble Territory — Fast

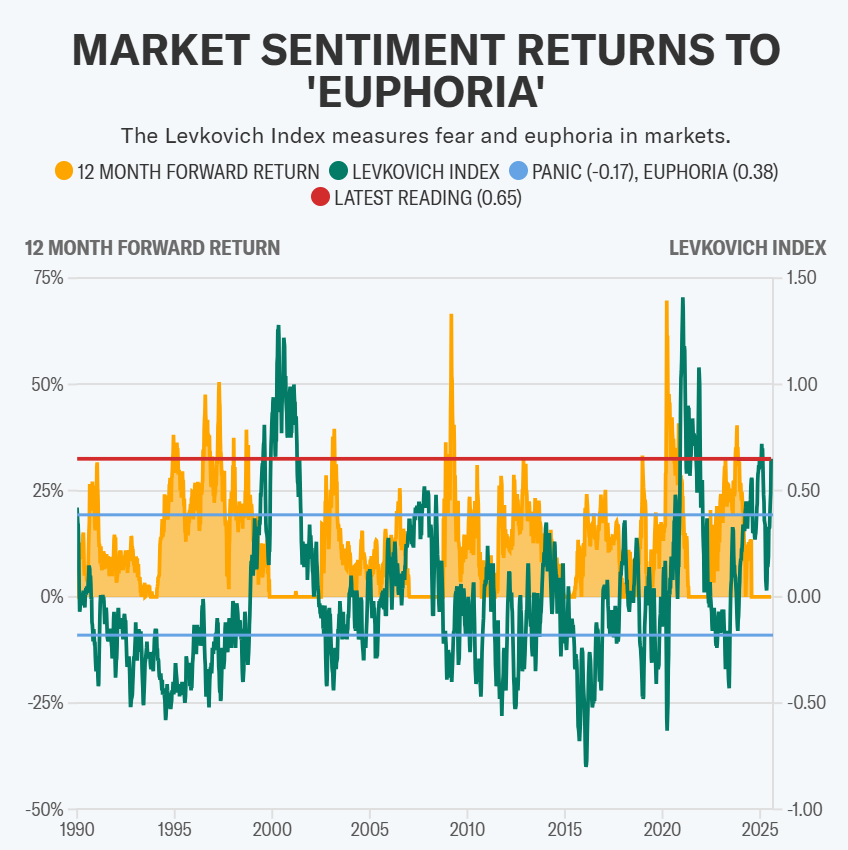

Beneath the bullish surface lies data pointing to one of the most euphoric market environments since the dot-com boom. Equity risk indicators, positioning metrics, and valuation multiples are flashing red — and analysts are starting to acknowledge it publicly.

Evidence of Euphoria:

- S&P 500 trades at over 3.3x price-to-sales, an all-time high (Bloomberg data via FT).

- Barclays’ Equity Euphoria Index is at 2x its historical average, a level historically associated with asset bubbles.

- Citi’s Levkovich Index rose to 0.65 last Friday — well above the euphoria line (0.38).

- Goldman Sachs reports that 34% of the S&P 500’s market cap is now in tech, matching 1999/2000 peaks.

- Retail investors are crowding into high-beta trades at the fastest rate in 30 years (JP Morgan).

- Meme stock volume is rising just as hedging activity declines — a recipe for overconfidence.

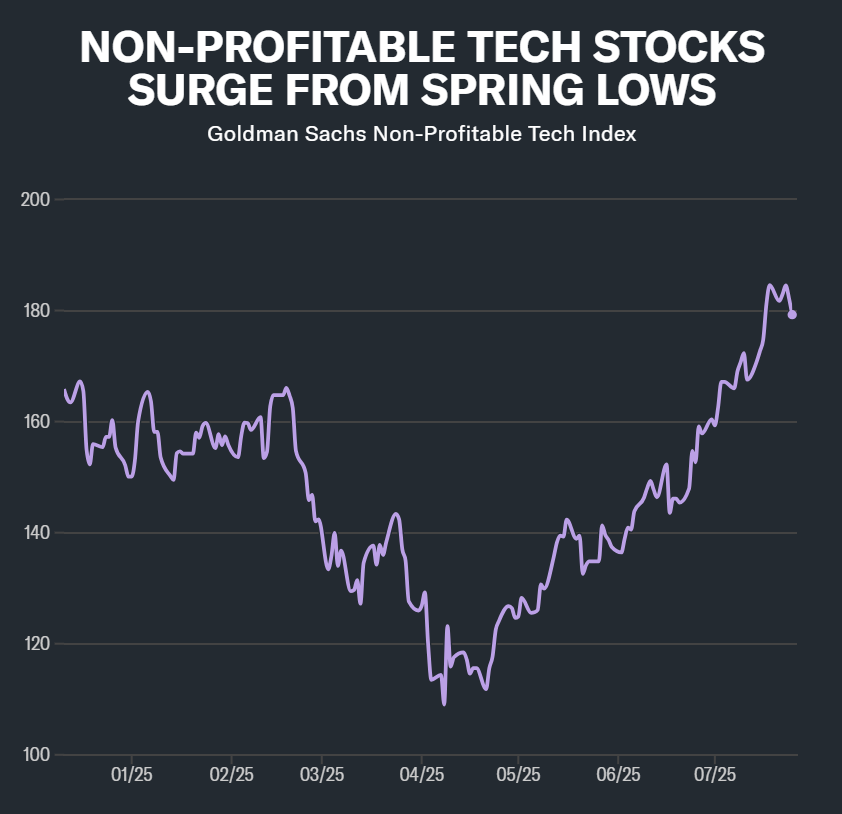

- Goldman’s Non-Profitable Tech Index is up 65% since April, despite no earnings improvement.

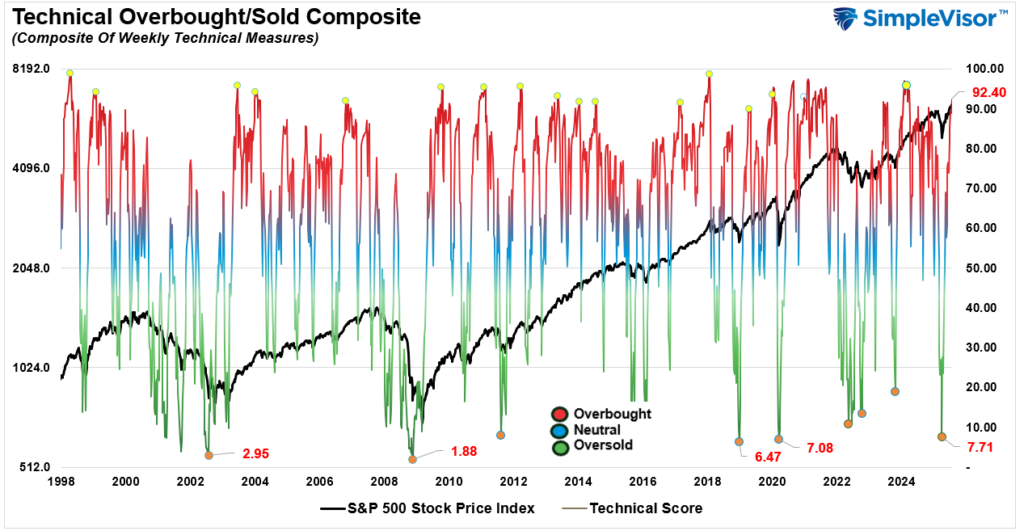

Technical Overheating: Momentum Is Extreme, and That’s a Risk

The index gains look smooth, but technical indicators suggest the rally is running out of breath. RSI, MACD, moving averages, and breadth data now show classic signs of exhaustion. That doesn’t mean a crash is imminent — but it does mean upside is increasingly vulnerable to shock.

Technical Flashpoints:

- RSI (Relative Strength Index) on the S&P 500 has hit 71.5, overbought but not yet extreme. In past cycles (2018, 2021), RSI above 75 marked reversal zones.

- MACD is still bullish but flattening — a sign momentum is fading.

- Nasdaq 100 has traded 60 days above its 20DMA, the second-longest stretch since 1985.

- S&P hasn’t moved ±1% in 18 trading sessions, the longest calm stretch since late 2024.

- Sector momentum: Technology, Industrials, and Transports are all deeply overbought on the technical composite index (above 90/100).

- The S&P, midcaps, and gold miners are well above monthly risk ranges — suggesting short-term pullbacks are increasingly likely.

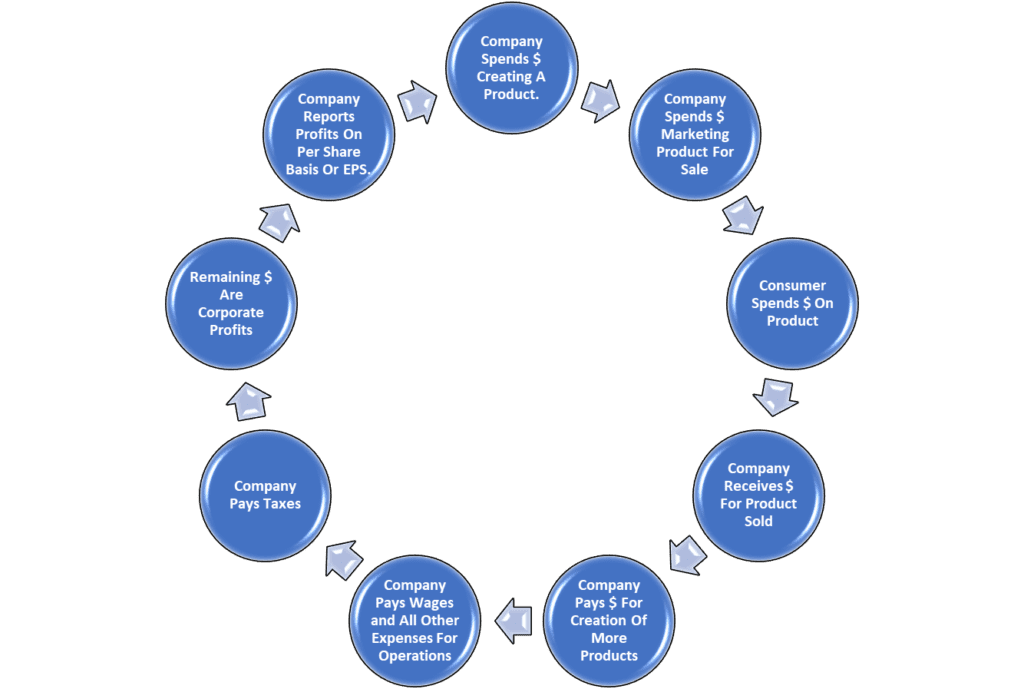

Consumer May Be Cracking — and That’s a Problem for Earnings

Strong corporate earnings have supported the rally — but they rely on consumer spending. And beneath the headlines, retail and discretionary data show signs of fatigue. Analysts are warning that lower-income households are already pulling back.

Cracks in Consumer Demand:

- Real (inflation-adjusted) retail sales have been flat since 2021, suggesting no true growth despite nominal increases.

- June’s nominal retail sales rose 0.6%, but adjusted for inflation, that strength disappears.

- Consumer Discretionary sector (XLY) is up only +0.3% YTD, the second-worst performing S&P sector.

- Chipotle, Hasbro, Hilton, and American Airlines all cited weaker demand or slashed forecasts.

- Airlines like Southwest and American Airlines pointed to softer domestic demand from lower-income consumers.

- Luxury spending remains strong — but that only reinforces the K-shaped divergence between high and low-income households.

“You have to be out with deals,” said US Bank’s Eric Freedman. “It’s a hyper-promotional environment to get lower-income consumers to spend.”

Oxford Economics summed it up well:

“Consumer spending is down, but not out. There’s a bit more pain to come before improvement.”

Future Risk Catalysts: What Could Break the Rally?

Right now, sentiment is so strong that even bad news is being ignored. But when expectations are priced for perfection, it doesn’t take a recession to trigger a reversal. It just takes a disappointment.

Watch These Triggers Closely:

- Fed Decision – Wednesday: Powell’s tone on rate cuts will be dissected.

- Core PCE Inflation – Thursday: A hot print could push back pivot expectations.

- Apple, Amazon, and Google Earnings: Guidance will matter more than Q2 numbers.

- Portfolio Rebalancing: Institutional funds may lock in July gains, adding pressure.

- A geopolitical surprise, trade war escalation, or AI stock miss could all derail sentiment fast.

“Bull markets don’t die of old age,” Citi’s Pettit reminds. “There has to be a catalyst.”

Risk of Crowded Trades and AI Over-Exuberance

At the center of the market rally is belief in AI’s future. But the assumption that current winners will dominate forever is being called out by seasoned investors as dangerous groupthink. If momentum turns, the damage to passive indexers could be swift.

Over-Concentration Dangers:

- 5–7 mega-cap tech names now dominate S&P 500 returns.

- Nvidia just hit $4 trillion market cap, even as its competitors ramp up.

- Rob Arnott calls it:

“Picking the popular names today is like picking up pennies in front of a steamroller.”

Portfolio Positioning: Stay in the Game — But Know Where the Exit Is

With sentiment this extreme, the best play isn’t fear — it’s discipline. Investors don’t need to run for the door. But they should know where it is.

Tactical Recommendations:

- Hold core quality: Stick to strong balance sheets, recurring cash flow.

- Limit speculation to 5–10%: Don’t let AI or meme mania become your portfolio.

- Use protective options: Covered calls and put spreads on SPY/QQQ can limit downside.

- Trim and rebalance: Especially in overextended AI names or high-beta stocks.

- Raise tactical cash: A 10–20% reserve gives room to buy dips — not panic sell.

- Watch sentiment: When Fear & Greed Index is high (now at 76), be contrarian.

Final Thought: This Is What the Top Feels Like — Until It’s Not

The 2025 rally is not built on fraud or fantasy. But it is being stretched by momentum, extrapolation, and the belief that there’s no alternative. That’s what makes this market fragile: not a lack of growth, but an excess of confidence.

History says euphoric markets don’t end on headlines — they end when nobody’s prepared to sell. And that’s exactly when the first drop turns into a rush for the exits.

“Trees don’t grow to the sky. If everyone’s buying, eventually there’s no one left to buy.” – Lance Roberts

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources:

Investing.com – S&P 500 Can Bulls Keep the Winning Streak Alive

Yahoo Finance – Signs of Euphoria Rise with Market Highs

Financial Times – Wall Street Euphoria Sparks Bubble Warnings

Related:

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion