KULR Technology Group (NYSE: KULR) is set to report its Q1 2025 financial results on Thursday, May 15, after the close. Specialising in battery safety, thermal management, and space-grade technologies, KULR has garnered attention for its contracts with NASA, the U.S. military, and EV battery developers — but its financial performance has yet to reflect its technological promise.

Here’s a deep dive into what to expect from this earnings report, what analysts are watching, and how traders, investors, and beginners should interpret the results.

Wall Street Forecasts & Financial Expectations

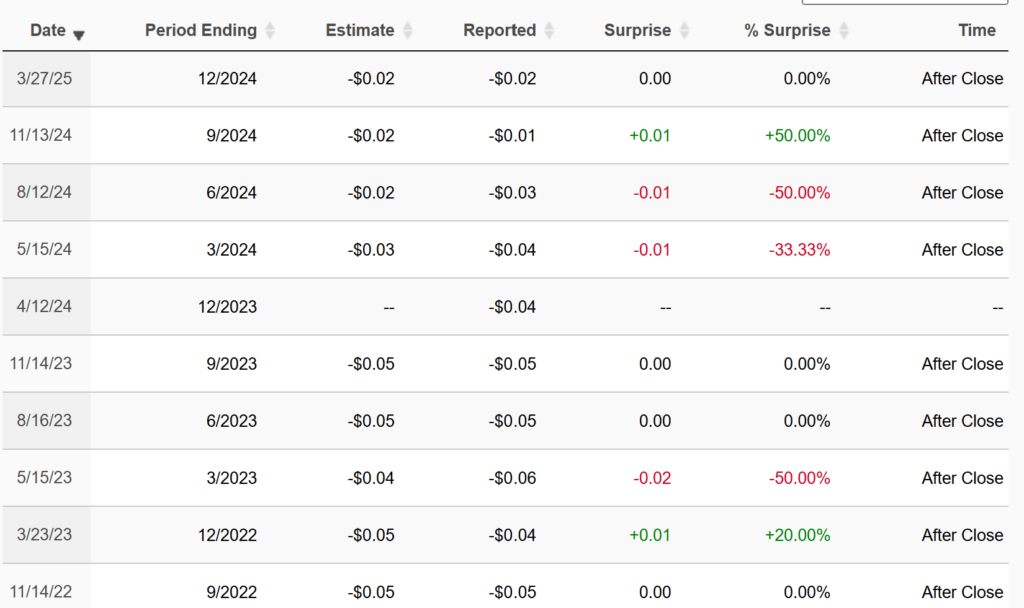

According to TipRanks, MarketBeat, and Zacks, consensus expectations for Q1 2025 are:

- Revenue: $2.7M to $3.0M (vs. $1.8M in Q1 2024)

→ ~50–60% YoY growth expected - EPS: -$0.04 to -$0.06 per share

→ Consistent with past losses, but narrower than previous quarters - Gross Margin: Expected between 28–35% based on last quarter trends

Note: KULR has no history of profitability, and analysts expect continued cash burn in 2025.

KULR’s Business Segments: What They Actually Do

KULR develops and commercializes thermal management and battery safety solutions designed for:

- Defense & Aerospace:

- Long-standing partnerships with NASA and the U.S. Department of Defense

- Supplied battery safety tech for the Mars Rover and ISS missions

- Secured a $1.13M U.S. military contract in 2024 for secure energy storage development (per GuruFocus)

- Commercial Battery Markets:

- Offers thermal runaway shields, battery testing, and fire mitigation solutions

- Targeting EV, e-mobility, energy storage, and drone manufacturers

- Launched KULR ONE platform, integrating battery telemetry with thermal data — a growing area of B2B interest

- Licensing and Certification Services: KULR helps battery suppliers meet UN 38.3 safety testing and DoT transport standards, creating a regulatory moat.

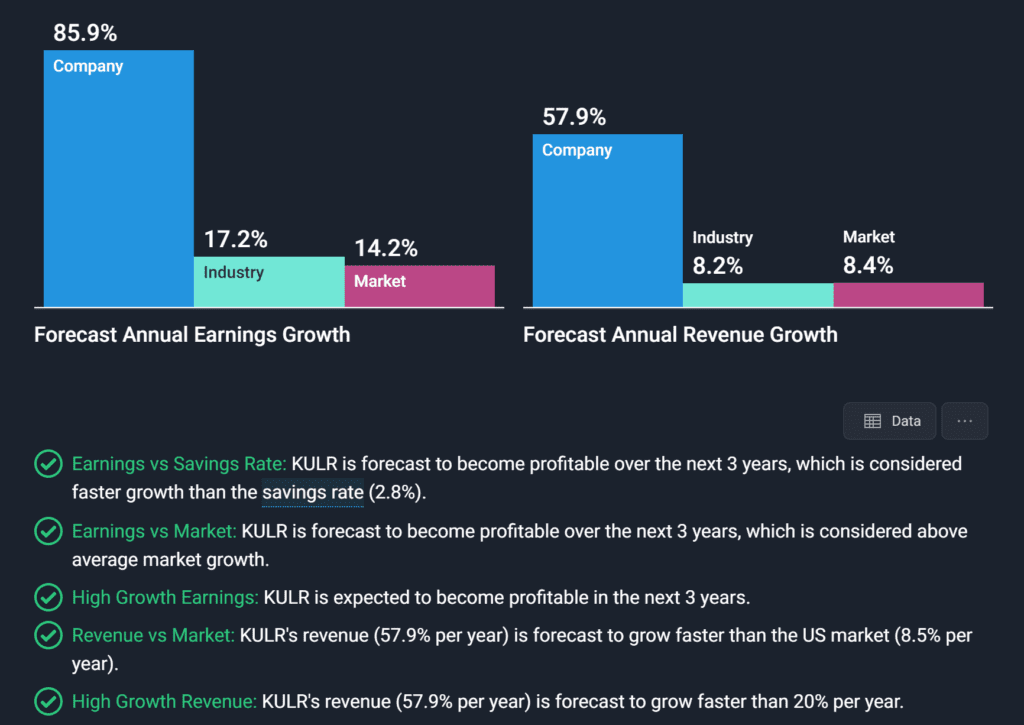

Growth Narrative: Revenue Expansion but No Profits Yet

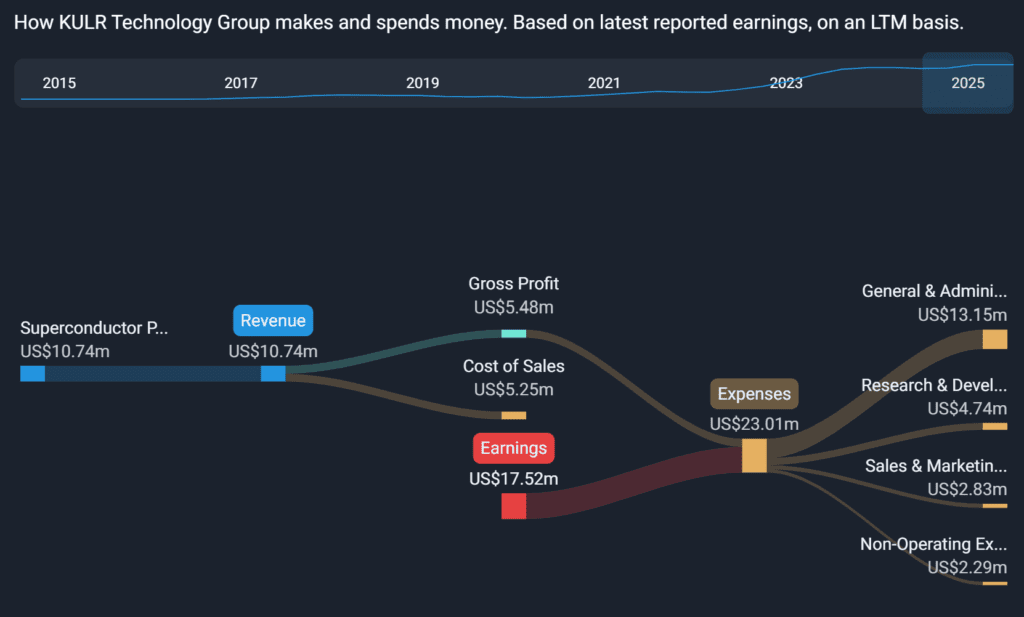

Revenue Trends:

- 2024 revenue was $10.3M, up 72% YoY — Q1 2025 is expected to maintain this growth pace

- Management targets $20M+ annual revenue by 2026, driven by commercial adoption

Cash Burn & Dilution Risks:

- KULR reported $3.2M net loss last quarter and has regularly raised capital through stock offerings

- Per Nasdaq, the company had ~$6.5M in cash as of Q4 — enough for 2–3 quarters at current burn rate

- Investors are closely watching for future dilution risk in 2H 2025

Technology & Partnerships: Are They Paying Off?

- NASA Jet Propulsion Lab collaboration remains active, but revenue from this partnership is small

- DoD contract wins continue, but none have been transformative in size yet

- The company is still in a pre-commercialization phase — with “technology ahead of financials”

Newer developments:

- KULR ONE system trials with commercial drone firms and e-mobility startups

- Expansion of battery safety testing-as-a-service, including in Europe (via new labs)

Volatility & Market Sentiment

- Short interest: ~11–13% of float — traders expect high volatility post-earnings

- Stock price YTD: -22% as of May 2025

Retail-driven momentum in 2021–2022 has faded. KULR now trades like a deep-speculative clean tech microcap, with day traders monitoring volume surges.

Bullish Case: Where Optimists See Potential

Revenue Growth Acceleration: Expected 50–60% YoY growth for Q1 shows demand is materializing in both defense and battery safety verticals.

First-Mover Advantage in Battery Thermal Safety: KULR owns NASA-developed IP and provides solutions most battery OEMs cannot internally replicate. This creates licensing potential as EV and storage markets scale.

Growing Government and Defense Footprint: Steady small DoD contracts could grow into larger multi-year awards. Government backing also provides credibility with commercial buyers.

Gross Margin Expansion: KULR reported >30% gross margin in Q4 2024 — up from ~18% in 2023 — driven by higher-value service contracts.

High-Leverage Upside: With a market cap under $60M and float under 100M shares, even small contract wins can lead to outsized stock moves.

Bearish Case: Where Caution Is Warranted

Consistent Losses & Cash Burn: KULR has never been profitable. Without a capital infusion or profitability, more dilution is likely in 2025.

Contracts Are Small and Fragmented: Most government and commercial deals are under $2M, limiting near-term financial impact.

Uncertain Commercial Adoption Timeline: Smartkarma warns that customer trials are taking longer than expected, and the e-mobility market remains fragmented.

High Valuation Relative to Revenue: Even with projected $12–15M revenue for 2025, the company trades at ~4–5x forward sales — high for a firm without profits.

Penny Stock Risks: Trading under $0.50 with microcap liquidity and low analyst coverage, KULR is subject to delisting, manipulation, or extreme volatility.

Earnings Prediction & Market Setup

- Likely outcome: Revenue beat, EPS in line, with optimistic tone but cautious guidance

- Investors want clarity on:

- Backlog and recurring contract revenue

- Burn rate and cash runway

- Customer pipeline conversion timelines

If Q1 revenue >$3M or new contracts are announced, expect +20–30% stock spike. Otherwise, muted or negative reaction is likely due to dilution concerns.

Final Takeaway: What Investors, Beginners, and Traders Should Know

For investors: KULR is a long-duration bet on battery safety and aerospace-grade tech commercialization. If you’re betting on electrification and regulatory pressure for safer batteries, KULR is a niche but risky player.

For traders: Volatility will be high post-earnings. Watch volume, float rotation, and headline flow (DoD, NASA contracts). Ideal for short-term setups, but risk of dilution or sell-offs remains.

For beginners: Understand this is a microcap company with promising tech, but no profits. Never invest what you can’t afford to lose. Use this as a learning opportunity in how emerging tech scales — slowly and with volatility.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump & US Executives Lock In Over $1 Trillion in Middle East Deals

Qatar Buys 160 Boeing Jets as Trump Accepts $400M Gift Jet

Elon Musk, Robotaxis, and Starlink: Inside Multi-Billion Dollar US–Saudi Tech Power Play

Nvidia’s Partnership With Saudi Arabia Opens a New Frontier in Global AI

Trump Secures $600 Billion Saudi Investment in US Tech, Energy, and AI

US Drug Price Revolution Begins: Trump Targets 30–80% Cuts

US and China announce deal to cut reciprocal tariffs for 90 days