According to App Economy Insights, recent earnings reports have revealed major trends across AI, e-commerce, fintech, and cloud computing. Companies like Walmart ($WMT), Alibaba ($BABA), and Arista Networks ($ANET) are showing strong digital expansion, while Live Nation ($LYV) and Tripadvisor ($TRIP) benefit from booming travel and entertainment demand. However, macro headwinds and competitive pressures remain challenges for sectors like oil and retail.

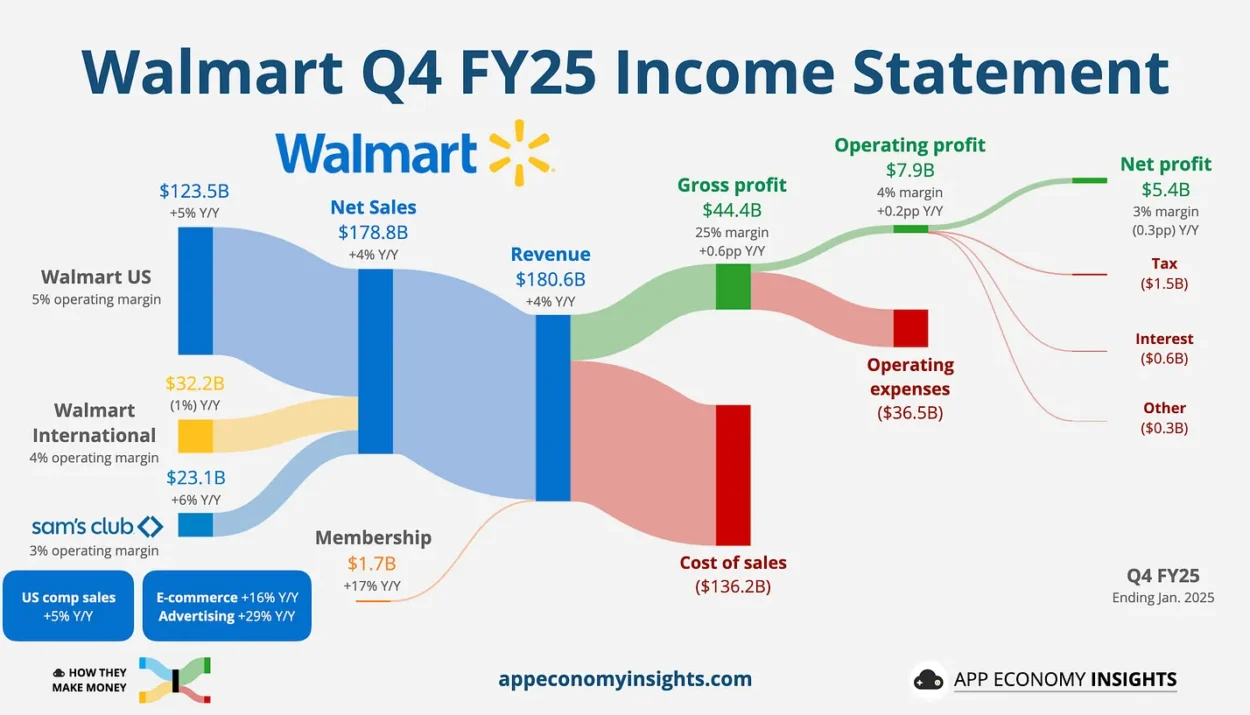

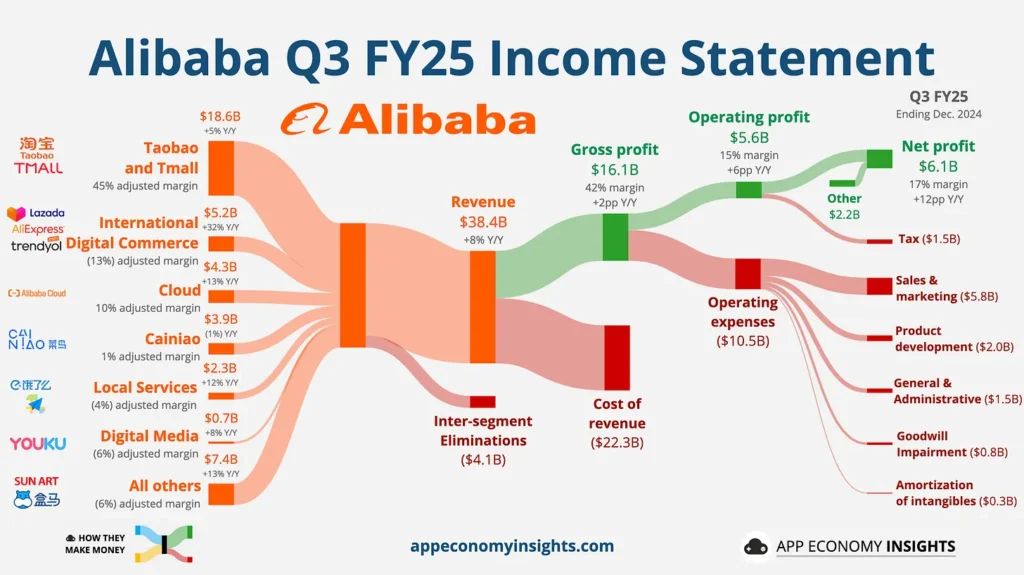

🛒 Walmart ($WMT): Digital Strength – Walmart’s revenue grew 4% Y/Y to $180.6 billion ($1.6 billion beat) in its Q4 FY25 (ending in January 2025), with US comparable sales up 5%. E-commerce remained a standout, rising 16% Y/Y and now comprising 18% of total sales. Higher-income households continued driving growth, and global advertising revenue jumped 29%.

However, FY26 guidance disappointed, with projected sales growth of 3%-4% and EPS of $2.50-$2.60 ($2.76 expected). Management cited economic uncertainty and potential tariff impacts, though it expects to outperform initial targets, as seen in prior years.

Walmart’s focus on digital expansion, automation, and new revenue streams like advertising (including the recent VIZIO acquisition) and membership growth positions it well, even as consumer spending remains cautious. Despite near-term headwinds, market share gains and e-commerce profitability continue to drive long-term momentum.

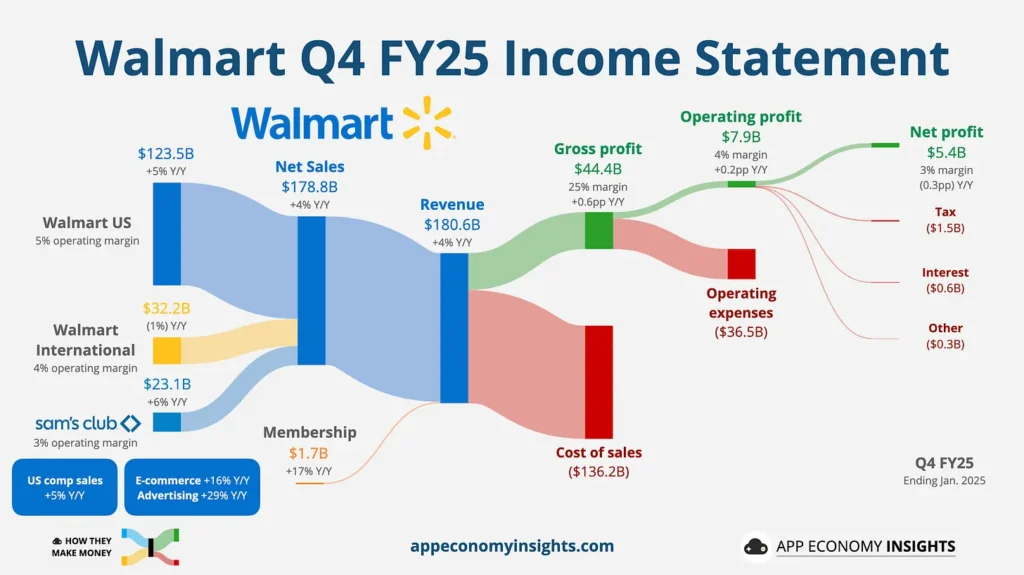

📦 Alibaba ($BABA): AI Powers Growth – Alibaba’s revenue grew 8% Y/Y to $38.4 billion ($130 million beat), its fastest pace since 2023. Cloud revenue growth accelerated to 13% Y/Y (from 7% Y/Y in the previous quarter), fueled by six consecutive quarters of triple-digit AI growth. The company is doubling down on AI investments, with CEO Eddie Wu calling Artificial General Intelligence (AGI) Alibaba’s “primary objective.”

E-commerce also rebounded, with Taobao and Tmall revenue up 5%, including a 9% rise in customer management revenue, signaling improving monetization. International commerce soared 32%, led by AliExpress and Trendyol.

Alibaba’s renewed focus on AI and infrastructure investments, coupled with a partnership with Apple to integrate its AI into iPhones in China, has fueled a $100 billion market cap surge in 2025. Despite fierce competition from PDD and ByteDance, Alibaba’s strategy is showing results.

🏝️ Booking Holdings ($BKNG): Travel Demand Still Strong – Booking Holdings saw gross bookings rise 15% year-over-year, reflecting sustained consumer demand for travel. Its alternative accommodation sector remains a strong revenue driver, positioning the company for further growth as travel continues to rebound.

🌐 Arista Networks ($ANET): AI-Driven Growth – Arista Networks reported 25% year-over-year revenue growth, fueled by strong demand for AI-driven networking infrastructure. The company’s partnerships with major cloud providers reinforce its leadership in high-performance networking.

🤝 MercadoLibre ($MELI): Expanding Ecosystem – MercadoLibre’s 30% revenue growth reflects the continued expansion of its e-commerce and fintech ecosystem in Latin America. Investments in logistics, payments, and digital services are increasing user engagement and boosting transaction volume.

⚙️ Analog Devices ($ADI): Gradual Recovery – Analog Devices reported a 10% year-over-year revenue increase, signaling a slow but steady recovery in the semiconductor market. Diversification across industrial, automotive, and communications sectors has helped offset supply chain pressures.

💡 Cadence ($CDNS): AI Momentum – Cadence Design Systems posted 12% revenue growth, driven by increased demand for AI-powered electronic design automation (EDA) tools. Its cutting-edge AI-driven chip design solutions continue to attract semiconductor clients.

🎮 NetEase ($NTES): Marvel Rivals Boost – NetEase’s gaming revenue jumped 20% year-over-year, fueled by the success of Marvel Rivals and strong demand in global markets. The company’s expanding portfolio of international games is positioning it as a rising leader in gaming.

🏦 Nu Holdings ($NU): FX Headwinds – Despite a 5% revenue decline due to foreign exchange volatility, Nu Holdings saw its customer base grow by 10%, indicating continued demand for its digital banking services in Latin America.

☁️ Cloudflare ($NET): Acceleration Ahead – Cloudflare reported 20% revenue growth, with projections indicating further acceleration due to increasing demand for security and performance solutions amid growing cyber threats.

🔲 Block ($SQ): Weak Quarter – Block’s revenue declined 3% year-over-year, affected by lower transaction volumes in its payment processing business. The company is working on new growth initiatives to regain momentum.

🛢️ Occidental Petroleum ($OXY): Weak Pricing – Occidental Petroleum’s revenue fell 8% year-over-year, primarily due to declining oil prices. The company is focusing on cost-cutting and asset optimization to manage pricing challenges.

🐶 Datadog ($DDOG): Cautious Outlook – Datadog reported a 15% revenue increase but issued a cautious forecast, citing concerns over macroeconomic headwinds impacting IT spending.

🎤 Live Nation ($LYV): Record Concert Demand – Live Nation’s revenue surged 25% year-over-year, driven by record-breaking attendance at concerts and strong demand for live events post-pandemic.

🍞 Toast ($TOST): Profitable Growth – Toast reported 22% revenue growth and reached profitability for the first time, as demand for restaurant management solutions continued to expand.

💻 Lenovo ($LNVGY): AI Servers Fuel Growth – Lenovo’s revenue rose 18% year-over-year, with AI-powered server sales emerging as a major growth driver. The company’s enterprise AI expansion strategy is solidifying its market position.

🛵 Grab ($GRAB): Rising Competition – Grab faced a 4% revenue decline, as competition in ride-hailing and food delivery intensified in Southeast Asia. The company is diversifying its services to counteract competitive pressures.

🏴 Klaviyo ($KVYO): Scaling Upmarket – Klaviyo’s 15% revenue growth was driven by its expansion into enterprise marketing automation, positioning it to capture a larger share of the market.

🛍️ Global-E ($GLBE): Record Growth & Profitable – Global-E reported a 35% revenue increase, achieving record profitability, as its cross-border e-commerce solutions gain traction with global retailers.

📦 Etsy ($ETSY): GMS Decline Continues – Etsy’s Gross Merchandise Sales (GMS) fell 5% year-over-year, as consumer shopping patterns shifted. The company is focusing on enhancing platform features to retain and attract buyers.

🚘 Lyft ($LYFT): Record Growth – Lyft saw its fastest growth rate on record, with strong demand for ride-hailing services. Strategic pricing adjustments and improved rider retention helped boost revenue.

🍽️ Tripadvisor ($TRIP): Experiences Drive Growth – Tripadvisor’s revenue increased, with strong demand for travel experiences driving growth. The company is leveraging its content and booking ecosystem to expand its market share.

Related:

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4

Will Elon Musk Enter Quantum Computing? Here’s Why It Might Happen in 2025

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Nvidia CEO Jensen Huang directly addresses DeepSeek stock sell-off, saying investors got it wrong

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China

Trump plans to impose 25% tariffs on autos, chips and pharmaceuticals – Stock Market Impact

Congressional Stock Trading Scandal: Lawmakers Profit Big on Palantir Stock Surge