Liquid Piston is starting an industrial revolution with its efficient engines and making us rethink the whole “bigger is better” mantra.

But is Liquid Piston a good investment?

Let’s see whether the startup’s rotary engine technology is the missing piece in your investment portfolio.

What Is Liquid Piston?

LiquidPiston is an MIT startup founded by the father-son team of physicist Nikolay Shkolnik and CEO Alec Shkolnik.

This pioneering company designs bleeding-edge rotary engines — compact, scalable, and capable of efficiently burning fossil or renewable fuels.

Why Should You Invest in Liquid Piston?

Let’s break down why LiquidPiston could be an exciting investment opportunity for you:

1. One-in-a-Century Innovation

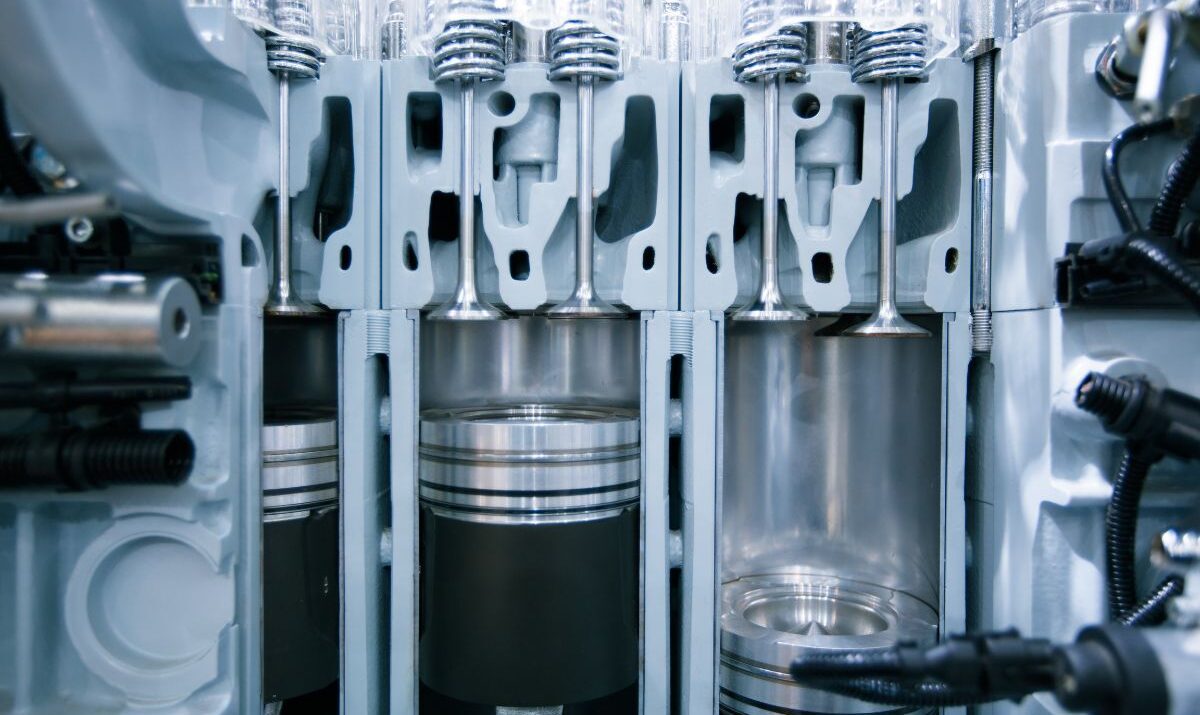

LiquidPiston developed an enhanced rotary engine based on its patented thermodynamic cycle. In essence, the engine design gives you more power using less fuel and more efficiency with fewer moving parts.

Imagine an engine ten times smaller but with a power rating comparable to traditional engines. But that’s not even the best part. This engine isn’t picky; it can run on a wide variety of fuels, including:

- Diesel

- Gasoline

- Jet fuel

- Low-carbon fuels (bio-fuels and Sustainable Aviation Fuel)

- Hydrogen

2. Military Contracts

It’s no surprise that DARPA is investing heavily in LiquidPiston’s hyper-efficient rotary engine architecture. Their technology is the ultimate game-changer — lighter, smaller, quieter, and more fuel-efficient.

Essentially, LiquidPiston is redefining what’s possible in military applications. For instance, the U.S. Army sees immense potential in this technology, which fits their need for compact engines and versatile power solutions in heavy fuel applications.

In fact, its X-Engine propulsion system for small Unmanned Aerial Systems won an innovation award from the U.S. Army. Not only that, but LiquidPiston also snagged an $8.3 million contract to develop compact 10-kilowatt generators for the Army.

3. Limitless Commercial Applications

Liquid Piston isn’t just limited to military applications. It has its sights on the $400-billion internal combustion engine market, including mobile power generation and Supplemental Power Units (SPU).

Think drones, electric scooters, mopeds, robots, and portable power tools like lawnmowers and chainsaws.

And it’s not sticking to one lane. The company is exploring opportunities in land vehicles, electric propulsion systems, and aerospace applications for larger manned fixed-wing aircraft.

However, keep in mind that LiquidPiston’s rotary engine technology is still in the works and undergoing testing. In other words, it hasn’t hit mass production yet.

4. Market Potential

LiquidPiston has reached profitability in 2022, with a whopping 156% revenue growth. If that’s not impressive enough, the firm bagged a hefty $9 million Army contract to develop a prototype engine for unmanned aircraft.

And there’s more in the pipeline—LiquidPiston awaits an Air Force contract worth $15 million for the production of a hybrid power unit.

Not to mention, the multi-awarded company has 82 pending and approved patents on a variety of subjects and applications.

Right now, LiquidPiston is worth over $69 million. Its latest equity crowdfunding campaign raised more than $3 million in Reg A and Reg CF offerings.

5. Exit Opportunities and Future Prospects

Recent updates reveal Liquid Piston has been busy—opening a new machine shop, hiring more manpower, and securing additional funding. They’re currently knee-deep in developing their 5th generation engine architecture and X-Engine prototypes.

With all hands on deck, LiquidPiston looks all set to make huge moves in commercial applications. The company is also eyeing the vertical take-off and landing aircraft (VTOL) as a target market.

Plus, LiquidPiston is considering potential revenue streams through the following:

- Offering conceptual design and engine development for clients

- Licensing their intellectual property to Original Equipment Manufacturers (OEM) for engine production

- Manufacturing and selling core engines

Looking ahead, its exit plan includes getting acquired and a potential public offering (IPO).

Important Risks to Keep in Mind when investing in Liquid Piston

Before you jump in, here are a few speed bumps to consider:

1. Electrification Challenge

The green energy movement is well underway, but LiquidPiston has taken the road less traveled: improving the thermal efficiency of a traditional rotary engine. Now, we know what you’re thinking—with all eyes on electrification, why combustion engines?

The good news is that LiquidPiston is tackling the EV market segment through its hybrid power systems and Auxiliary Power Units (APU). Its tech could be the missing link to make hybrids truly accessible.

The idea is to use its rotary engine technology to power the battery pack in an EV. The result? No bulky setups and no exorbitant price tags.

After all, EVs might still be out of reach for many. With recent improvements in battery efficiency, an EV could still set you back $25,000.

2. Automotive Adoption Hurdle

Thanks to the national security power requirements, LiquidPiston has its foot in the door of the military sector.

The automotive market is a different ball game. Since LiquidPiston engines represent new technologies (no pistons and cylinders), the company has to deal with some serious hoops. We’re talking about meeting strict safety and performance standards set by the big regulators.

In particular, the emissions certification cycle stands out as a significant roadblock. This process involves testing vehicles under various conditions to measure the amount of pollutants they emit.

And let’s not forget the competition. Car giants like Toyota, Tesla, BMW, and others are driving innovations in clean energy at full speed.

For instance, Mazda is working to use a Wankel rotary engine as a range extension for its EV—a concept similar to LiquidPiston’s.

How to Invest in Liquid Piston

Investing in LiquidPiston is a breeze. You can buy shares at $11.50 each for a minimum investment size of $1,000.50.

No need to be an accredited investor; you can invest directly on their website with just a few clicks. Head to the investment page, hit ‘Invest Now,’ and let the website guide you through the process.

Just a quick heads-up: The company uses Regulation A, which means it can tweak its share price by 20% without needing to re-register with the SEC.

So, before making a decision, take a moment to reflect. Only put in what you can afford to part with. Given it’s pretty high risk, there’s a possibility you could lose your entire investment.

Final Thoughts

So, is Liquid Piston a good investment?

With its advanced engine architecture and efficient fuel consumption, LiquidPiston is shaking up the power system industry. With over two decades of experience, slow and steady seems to be its winning formula.

If you’re considering green options and want to dive into a startup that’s making innovative moves, LiquidPiston is definitely one to keep an eye on. You can check out their StartEngine profile for more details.