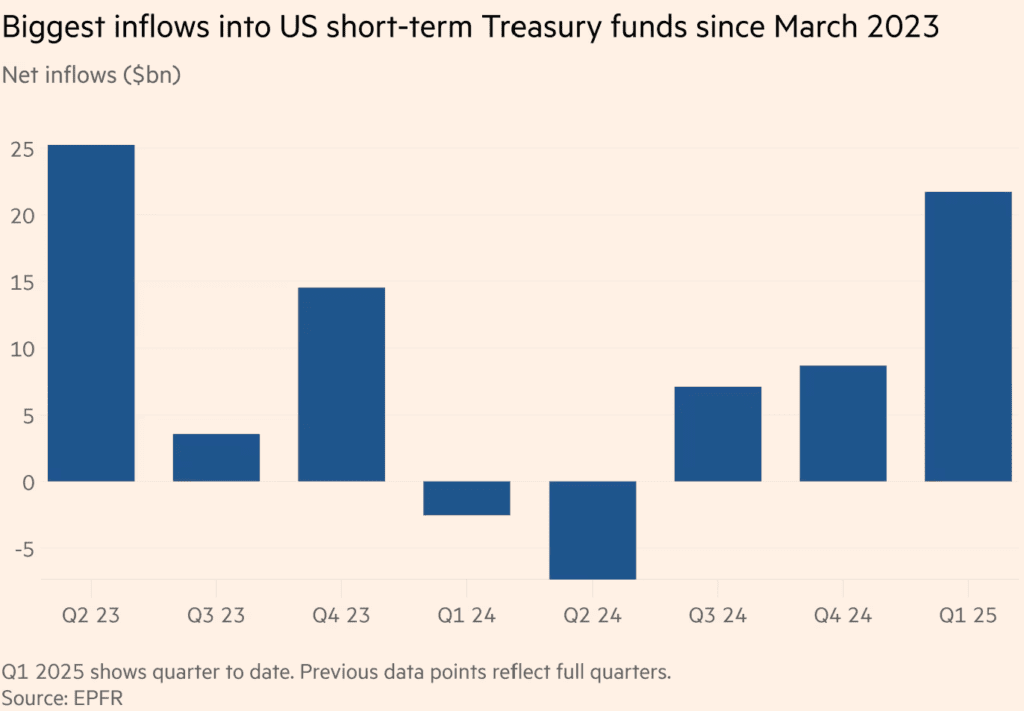

Amid escalating concerns over Donald Trump’s aggressive trade policies and the rising risk of a U.S. economic slowdown, investors have piled into short-term U.S. government debt at record levels. According to EPFR data, nearly $22 billion has flowed into short-term Treasury funds between early January and March 14—the largest quarterly surge into these vehicles in two years.

The Great Shift to Safety

Money managers are de-risking portfolios as volatility shakes equities and corporate bonds. Bob Michele, JPMorgan’s Head of Global Fixed Income, described U.S. bonds as “the anchor in the storm,” noting they offer a safe haven in a market fraught with uncertainty.

A Bank of America survey this week showed that investors made the largest-ever cuts to U.S. equity allocations in March. Junk bond spreads have also widened significantly, reflecting mounting concerns over economic growth and rising inflation.

“If you’re worried about risk assets and the possibility of an economic slowdown, it makes sense to move out of equities and into safer alternatives,” said Mark Cabana, Head of U.S. Rates Strategy at Bank of America.

Attractive Yields Drive Demand

Short-term debt isn’t just safer; it’s offering yields that are hard to ignore. One-month Treasuries are yielding 4.3% annualized, while two-year notes yield around 4%. Analysts suggest that if the Federal Reserve cuts interest rates later this year, yields on these instruments will drop, but their prices will rise—giving bondholders potential capital gains.

“There’s no doubt money market fund assets have risen,” Michele noted, highlighting the appeal of ultra-short dated Treasury bills and other cash-equivalent investments.

Fed Decision Looms

The Fed’s next move is critical. Markets are pricing in two to three interest rate cuts this year. If the Fed shifts from this expectation, it could ripple through bond markets and reshape the current safe-haven narrative.

Broader Economic Concerns

Uncertainty over Trump’s policy path, including trade aggressions and potential isolationist measures, has amplified fears of slowed growth. Andy Brenner of NatAlliance Securities suggested that long-term Treasuries may offer bigger returns if the economy slows dramatically, but “if you lack that conviction, then front-end funds are liquid, safe, and easy to move in and out of.”

With nearly $22 billion pouring into short-term Treasuries and $2.6 billion into long-term government bonds, the message is clear: Investors are bracing for a storm. Whether that storm brings a hard landing or just prolonged turbulence remains to be seen.

Related:

How often do market corrections lead to a recession in the US? – Research

Google Bought Wiz for $32 Billion: What to expect

The Most Undervalued Stocks In The Market

BYD Launches Megawatt Super Charging System to Rival Tesla and NIO in China’s EV Race

Amazon Undercuts Nvidia With Aggressive AI Chip Discounts

Warren Buffett’s Berkshire Has Been Selling US Stocks. Where It’s Buying Now

Will Trump Use the Federal Reserve as Leverage in Global Finance?

Key Events and Earning Calendar to Watch This Week (17-21 March)

Facebook’s secrets, by the insider Zuckerberg tried to silence