Newly surfaced internal emails from Ripple Labs, dating back to 2018, have reignited controversy over the company’s anti-Bitcoin messaging strategy. The documents, revealed as part of the ongoing U.S. Securities and Exchange Commission (SEC) lawsuit against Ripple over alleged unregistered securities sales, show top Ripple executives and staff discussing efforts to frame Bitcoin as being “controlled by China.”

Ripple’s Internal “China FUD” Playbook

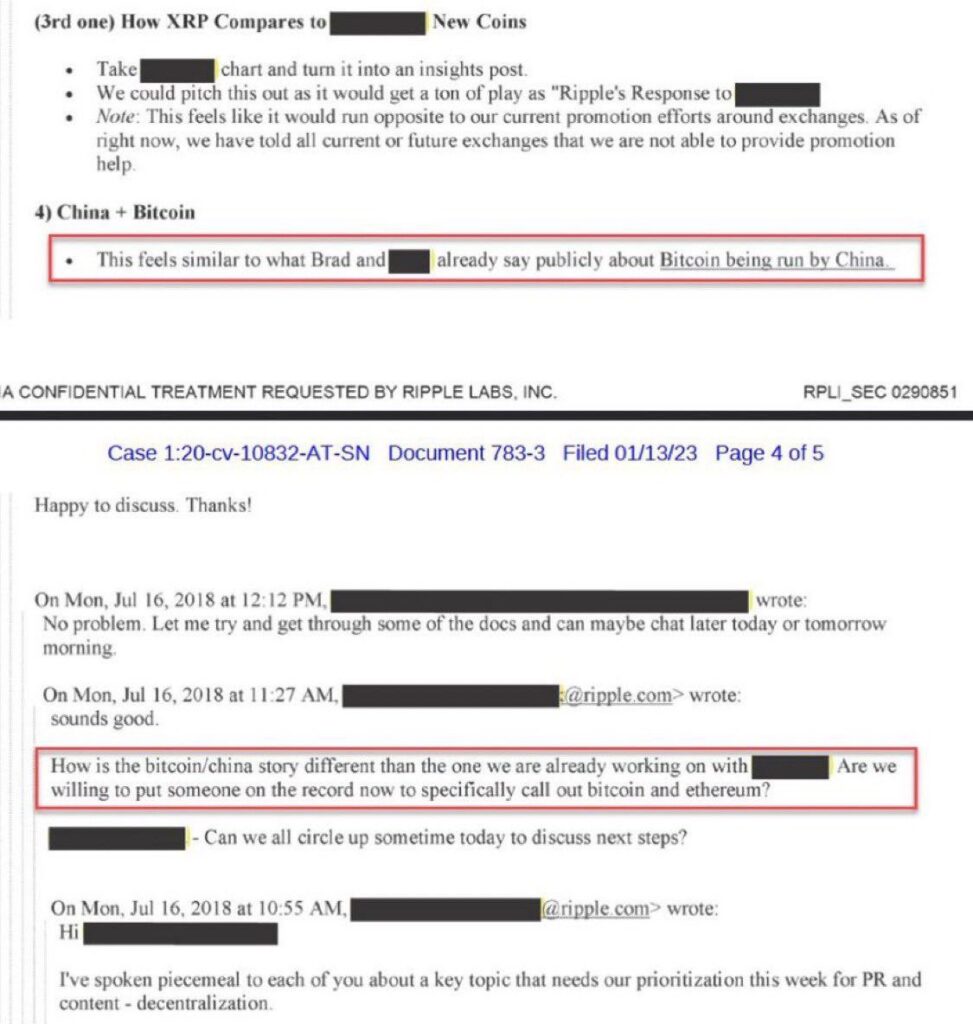

Among the emails submitted in the case, one labeled “4) China + Bitcoin” explicitly outlines Ripple’s internal narrative. The email states:

“This feels similar to what Brad and [Redacted] already say publicly about Bitcoin being run by China.”

Ripple executives reportedly planned a public “insights post” contrasting XRP with other cryptocurrencies, pushing the idea that Bitcoin’s decentralization is compromised due to its reliance on Chinese mining pools. Another email, dated July 16, 2018, raised the question of whether Ripple was ready to publicly call out both Bitcoin and Ethereum on centralization concerns.

The conversations show Ripple was actively crafting talking points and PR strategies designed to elevate XRP as a superior, decentralized alternative.

Ripple’s Lobbying Against Bitcoin-Only Strategies

These revelations come shortly after President Donald Trump announced the U.S. Strategic Bitcoin Reserve, a move that Ripple reportedly opposed. Leaks indicate Ripple executives lobbied the administration for a diversified approach to digital assets, pushing for the inclusion of XRP, Solana (SOL), and Cardano (ADA) alongside Bitcoin.

Ripple CEO Brad Garlinghouse is said to have met with the Trump administration directly to advocate for broad-based crypto policies, positioning Ripple as a key player in shaping crypto regulation. However, critics argue that Ripple’s behind-the-scenes efforts reveal a more aggressive campaign against Bitcoin.

Ripple’s History of Anti-Bitcoin Campaigning

The resurfaced emails align with public statements made by Ripple leadership. On October 9, 2018, Ripple CTO David Schwartz tweeted:

“A new study shows China controls 74% of bitcoin. Does that sound decentralized to you?”

Critics say this tweet reflects the internal narrative discussed in the leaked emails. Prominent Bitcoin advocate Pierre Rochard, VP of Research at Riot Platforms, accused Ripple of spreading misinformation:

“Brad Garlinghouse did his best to smear Bitcoin as bad for the environment and controlled by China. Disinformation. The truth won, he lost.”

Ripple co-founder Chris Larsen has also been a vocal critic of Bitcoin’s energy use. In March 2022, Larsen personally funded the controversial “Change the Code” campaign with $5 million, calling for Bitcoin to switch from Proof of Work (PoW) to Proof of Stake (PoS).

Despite high-profile ads and an art installation dubbed the “Skull of Satoshi”, the campaign backfired. The Bitcoin community embraced the skull as a symbol of defiance, while artist Benjamin Von Wong later admitted he misunderstood Bitcoin’s energy use. Von Wong shifted from advocating for code changes to supporting efforts to green Bitcoin mining through renewable energy adoption.

Ripple’s Reputation at Stake

These latest revelations further complicate Ripple’s public image. While the company has long claimed to promote innovation and crypto adoption, critics argue its anti-Bitcoin lobbying and PR strategies were designed to undermine competitors rather than support the broader crypto ecosystem.

With the SEC lawsuit ongoing and Ripple’s role in shaping crypto policy under renewed scrutiny, these internal discussions may fuel concerns about the company’s true motives.

Related:

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app

Crypto Capital Of The World? Trump’s Bitcoin Reserve Plan Sparks Debate

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions

Congress Trading: A Spotlight on Ecolab (ECL)

Trump’s Bitcoin Reserve: A Game-Changer or a Market Shock?

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?