Intel Corp. just delivered its strongest stock rally in a quarter century. Shares jumped 23.6% last week, their best performance since January 2000, as reports surfaced that President Donald Trump is considering an unprecedented move: a U.S. government stake in the struggling chip giant. Yet analysts warn that while a cash injection might ease Intel’s immediate woes, it won’t fix the technological roadblocks that have left America’s last big semiconductor manufacturer trailing far behind global rivals.

A Historic Rally

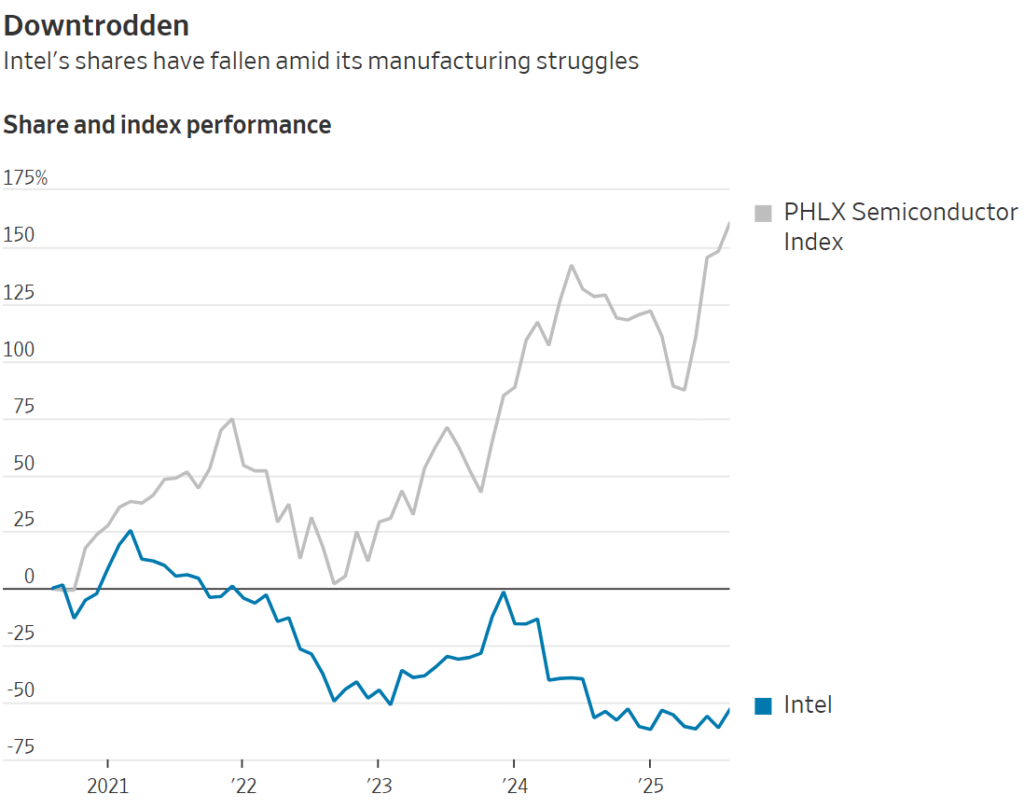

Intel’s stock surge comes amid feverish speculation over government intervention. The Bloomberg report that Trump and Intel are in talks about federal investment sent shares soaring 7% on Thursday alone. The gains offered a rare reprieve for investors battered by years of missteps: Intel’s market value remains down about 70% from its 2000 peak, and the stock is still roughly 7% below its 52-week high.

For Trump, the move aligns with a central campaign promise—to bring semiconductor supremacy back to U.S. soil. Intel is the only major American company still attempting to manufacture advanced chips domestically, while competitors such as Nvidia and AMD rely heavily on Taiwan Semiconductor Manufacturing Co. (TSMC).

Cash Burn vs. Technology Gaps

Intel’s challenge is twofold: financial strain and technological stagnation.

- The company has burned nearly $40 billion in cash over the past three years trying to regain its manufacturing lead.

- Its most advanced process, 18A, was expected to close the gap with TSMC but has failed to attract outside customers, leaving Intel reliant on internal products.

- Successive roadmaps—from 7nm to Meteor Lake (4nm) to Granite Rapids (3nm)—have been plagued by weak demand, product delays, or outright cancellations.

- The next big bet, 14A, won’t move forward without strong commitments from external clients, according to CEO Lip-Bu Tan.

Bernstein’s Stacy Rasgon issued a stark warning: without a viable process roadmap, government support risks becoming “economically equivalent to setting tens of billions of dollars on fire.”

Washington’s Potential Role

Analysts agree that Trump can provide money, but not the technology Intel desperately needs. Options on the table include:

- Direct federal investment to recapitalize Intel’s fabs, offsetting heavy losses during years of ramp-up.

- Tariff or regulatory pressure to force or strongly encourage U.S. companies to use Intel’s foundry services.

- Accelerating delayed projects such as the long-planned Ohio mega-fab, though Intel has resisted moving ahead given excess capacity and weak external demand.

While financial backing could keep Intel afloat, analysts stress it won’t guarantee competitiveness. Seaport Research Partners’ Jay Goldberg questioned whether any deal would be “purely political” or whether it would help Intel reclaim its position as a serious advanced-node manufacturer.

Strings Attached: Nationalization Risks

A stake by Washington would mark a dramatic step toward quasi-nationalization of Intel, a prospect some warn could backfire.

- Federal funding through the Chips Act has already provided about $8 billion, but that hasn’t closed the gap with Asia.

- A direct stake could introduce political pressures—such as rushing the Ohio factory or mandating domestic sourcing—that may harm Intel’s long-term economics.

- Critics argue U.S. taxpayers risk underwriting losses without solving Intel’s core technological issues.

As Wall Street Journal analysts Dan Gallagher and Asa Fitch noted, government support “always comes with strings attached,” and in Intel’s case those strings could end up “tripping up not only Intel but the broader U.S. chip industry.”

Investor Sentiment: Hope Meets Caution

For now, investors are cheering. After years of decline, last week’s rally reflects optimism that government backing might buy Intel the time it needs to stabilize. But analysts remain split.

- Bernstein maintains a market-perform rating, citing unresolved technical problems.

- Seaport keeps a sell rating, doubting that government purchases or incentives could fill Intel’s vast fab capacity.

- Some see echoes of past bailouts: a politically driven move that could provide temporary relief but leave the underlying issues unaddressed.

The Bigger Picture

Intel’s struggle underscores the geopolitical stakes of the global semiconductor race. Washington wants to ensure a domestic supply of cutting-edge chips, not only to reduce reliance on Asia but also to secure military and national-security needs. Yet without a breakthrough in Intel’s manufacturing roadmap, Trump’s aid could amount to a politically symbolic lifeline rather than a sustainable turnaround strategy.

Key Takeaways

- Intel posted its best weekly stock rally in 25 years (+23.6%) on reports of possible U.S. government investment.

- Trump aims to resurrect U.S. chipmaking, but analysts warn money won’t solve Intel’s lagging technology.

- Intel’s cash burn—nearly $40 billion in three years—and repeated process delays highlight deep execution challenges.

- Risks of nationalization loom, with political mandates potentially harming long-term competitiveness.

- Investors are encouraged, but leading analysts remain cautious, seeing limited near-term solutions.

Sources:

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Secret White House Spreadsheet Ranks US Companies by Loyalty to Trump

Why Stock Market Keeps Climbing Despite Tariffs and Tensions

Billionaire Investors Reveal Q2 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?