Intel’s chief executive Lip-Bu Tan has rejected calls to step down after President Donald Trump accused him of being “highly CONFLICTED” over alleged links to Chinese companies.

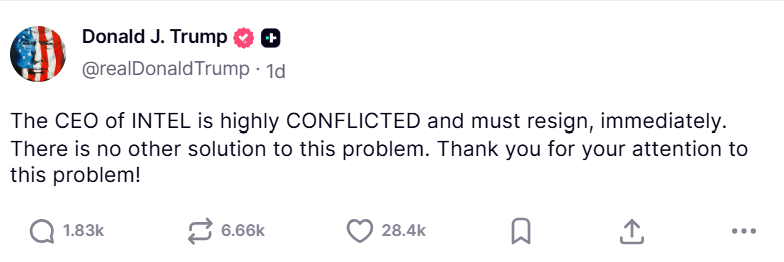

In an early Thursday post on Truth Social, Trump said Tan “must resign, immediately”, adding there was “no other solution” to the problem. The comments mark one of the rare instances where Trump has directly urged the removal of a corporate leader.

The attack came a day after Trump threatened 100% tariffs on many foreign-made semiconductors to push manufacturing back to the US.

Tan’s Response: ‘Misinformation’ and Full Board Support

Hours later, Tan issued a letter to Intel employees, also posted publicly, defending his record:

“There has been a lot of misinformation circulating about my past roles… I have always operated within the highest legal and ethical standards.”

Tan, a US citizen born in Malaysia and raised in Singapore, stressed his 40+ years in the industry and said Intel’s board is “fully supportive” of his leadership. He also confirmed that the company is engaging with the Trump administration “to ensure they have the facts.”

The China Connection Controversy

The dispute stems from Tan’s past investments through his venture capital firm Walden International, which Reuters reported remains tied to 20 funds and companies alongside Chinese state-backed entities.

He has also faced scrutiny for his tenure at Cadence Design Systems, which in July pleaded guilty to illegally selling technology to a Chinese military-linked university — though Tan was not named in the case.

Adding to the political pressure, Republican Senator Tom Cotton sent a letter to Intel’s board questioning Tan’s ability to oversee the company while meeting US national security obligations, citing Intel’s $8 billion CHIPS Act grant.

Market & Industry Reaction

- Intel shares fell over 3% Thursday after Trump’s post but recovered some ground Friday.

- Analysts are split: Bernstein’s Stacy Rasgon said Tan is a “legend” in the semiconductor world but acknowledged his China ties create “a bad look” under the current administration.

- Other chip stocks — AMD, Nvidia, Broadcom — have outperformed Intel this year, with Intel’s shares up just 1.8% YTD.

Intel’s Bigger Struggles

Tan took over in March following a troubled period under Pat Gelsinger. His mandate: revive Intel’s fading chip leadership.

The company is:

- Cutting its workforce by 15% to reduce costs

- Scaling back plans to offer its 18A manufacturing process to external customers

- Facing internal board tensions, including reported clashes with chairman Frank Yeary over whether to keep Intel’s manufacturing business

Despite the political storm, Intel reiterated its commitment to “advancing US national and economic security” and aligning with Trump’s America First push by boosting domestic chip production.

Trump’s public demand has turned Intel’s turnaround story into a political flashpoint. Whether Tan survives the pressure may now depend as much on Washington as on Wall Street.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years