The S&P 500 climbed 2.5% last week, the Nasdaq Composite surged nearly 4% to a fresh record close, and the Dow Jones added 1.4%. Gains were powered by tech, led by Apple’s $100 billion US investment plan and continued AI enthusiasm.

Now, attention turns to July’s inflation data and whether the Federal Reserve will accelerate rate cuts as markets are pricing in multiple reductions before year-end.

CPI Report Could Shape the September Fed Meeting

The Consumer Price Index (CPI) for July will be released Tuesday and is expected to be the week’s defining economic event.

- Headline CPI: +2.8% YoY expected (June: +2.7%)

- Core CPI (ex-food & energy): +3.0% YoY expected (June: +2.9%)

- Monthly core CPI: +0.3% forecast (June: +0.2%)

Economists point to Trump’s recent tariffs as a key driver of renewed price pressures. UBS’s Alan Detmeister projects core CPI will climb to 3.5% by year-end as tariff effects feed through supply chains.

Wholesale inflation (PPI) is due Thursday, and Friday’s University of Michigan consumer sentiment survey will show how households view inflationary pressures.

Rate Cut Bets Intensify Amid Fed Shake-Up

The Fed’s September decision is in sharp focus. Weak July jobs data and Trump’s nomination of Stephen Miran — a proponent of easier policy — to the Fed Board have fueled speculation that Powell could deliver a 25 bp cut sooner than planned.

JPMorgan’s Michael Feroli notes that if Miran is confirmed before September, dissent within the Fed could rise to at least three votes in favor of immediate easing.

This week’s scheduled Fed speakers — Richmond’s Thomas Barkin, Chicago’s Austan Goolsbee, and Atlanta’s Raphael Bostic — could offer fresh clues on timing.

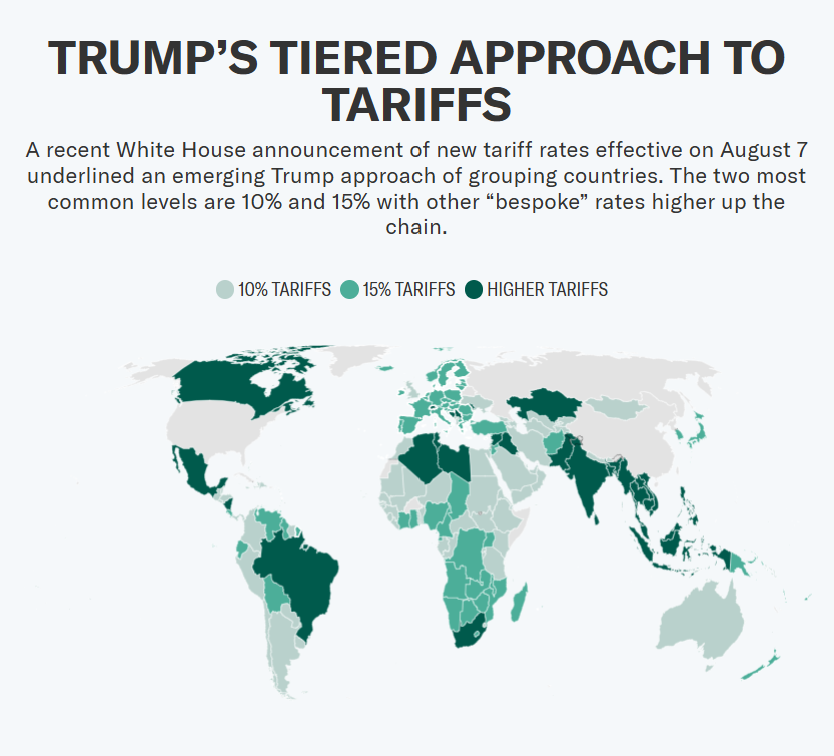

Trade Policy Uncertainty: Trump’s Deals Still in Limbo

Alongside domestic data, global markets are watching Trump’s evolving trade regime, which last week saw announcements of 10–20% tariffs for nations that reached preliminary agreements — including the EU, Japan, South Korea, the Philippines, and Vietnam.

The problem: Most deals remain in handshake phase, lacking joint statements or legal texts. Key sticking points:

- Sectoral tariffs: Trump has floated 100% tariffs on semiconductors and triple-digit rates on pharmaceuticals. The EU and South Korea claim exemptions, but the US has yet to confirm.

- Auto tariffs: Current 232 tariffs are 25%; verbal agreements suggest lowering to 15% for the EU, Japan, and South Korea — but no action yet. Japan’s top trade negotiator Ryosei Akazawa visited Washington last week seeking implementation assurances.

- Foreign investment pledges: Trump touts “signing bonuses” — $600B from Europe, $550B from Japan, $350B from South Korea — as US-controlled funds. But European officials say their figure is just “expressed interest,” while Japan frames its commitment as mutually beneficial investments, not blank checks.

Trump has signaled he will enforce compliance with constant tariff threats, keeping importers and trade partners on edge.

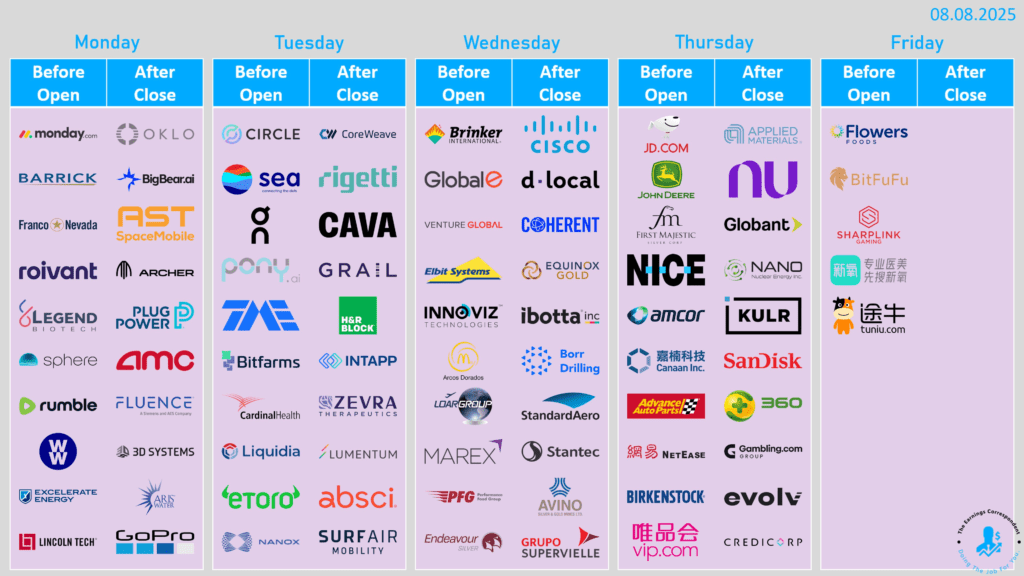

This Week Calendar

| Day | Economic Data | Earnings Highlights |

|---|---|---|

| Monday, Aug 11 | — | BigBear.AI (BBAI), Monday.com (MNDY), Oklo (OKLO), Plug Power (PLUG) |

| Tuesday, Aug 12 | NFIB Small Business Optimism (Jul) – 98.6 exp (98.6 prev) CPI MoM (Jul) – +0.2% exp (+0.3% prev) Core CPI MoM (Jul) – +0.3% exp (+0.2% prev) CPI YoY (Jul) – +2.8% exp (+2.7% prev) Core CPI YoY (Jul) – +3.0% exp (+2.9% prev) Real Avg Hourly Earnings YoY (Jul) – (+1.1% prev) | Circle Internet Group (CRCL) – Stablecoin issuer, +400% since June IPO, first report under GENIUS Act Pony AI (PONY) On Holding (ONON) CoreWeave (CRWV) – Nvidia-backed, $6B PA data center project Rigetti (RGTI) Cava Group (CAVA) – Strong recent comps |

| Wednesday, Aug 13 | MBA Mortgage Applications (week ending Aug 8) – (+3.1% prev) | Brinker International (EAT) Cisco Systems (CSCO) – AI-driven demand boosted prior quarter Red Robin (RRGB) |

| Thursday, Aug 14 | Initial Jobless Claims (week ending Aug 9) – (226k prev) Retail Sales MoM (Jul) – +0.5% exp (+0.6% prev) PPI MoM (Jul) – +0.2% exp (+0.0% prev) PPI YoY (Jul) – +2.5% exp (+2.3% prev) | JD.com (JD) – Key China e-commerce read Deere & Company (DE) – Industrial spending outlook Advanced Auto Parts (AAP) Birkenstock (BIRK) Applied Materials (AMAT) – Semiconductor equipment barometer Nucor (NUE) |

| Friday, Aug 15 | Retail Sales ex Auto & Gas (Jul) – +0.3% exp (+0.6% prev) Import Prices MoM (Jul) – 0% exp (+0.1% prev) Export Prices MoM (Jul) – 0% exp (+0.5% prev) Industrial Production MoM (Jul) – 0% exp (+0.3% prev) University of Michigan Consumer Sentiment (Aug prelim) – 62.1 exp (61.7 prev) | — |

Why It Matters for Markets

The week could answer the market’s biggest question:

Can the Fed cut rates to support growth without triggering recession fears that pull money from risk assets into necessities?

As Richard Bernstein notes, when rate cuts come amid solid growth, speculation can thrive. But if cuts are forced by a sharp slowdown, “people stop speculating on bitcoin — they buy bread.”

CPI will be the pivot point. A softer reading could cement September rate-cut bets and extend the rally, while a hotter print might rattle stocks and push yields higher — just as tech earnings test the AI trade’s staying power.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years