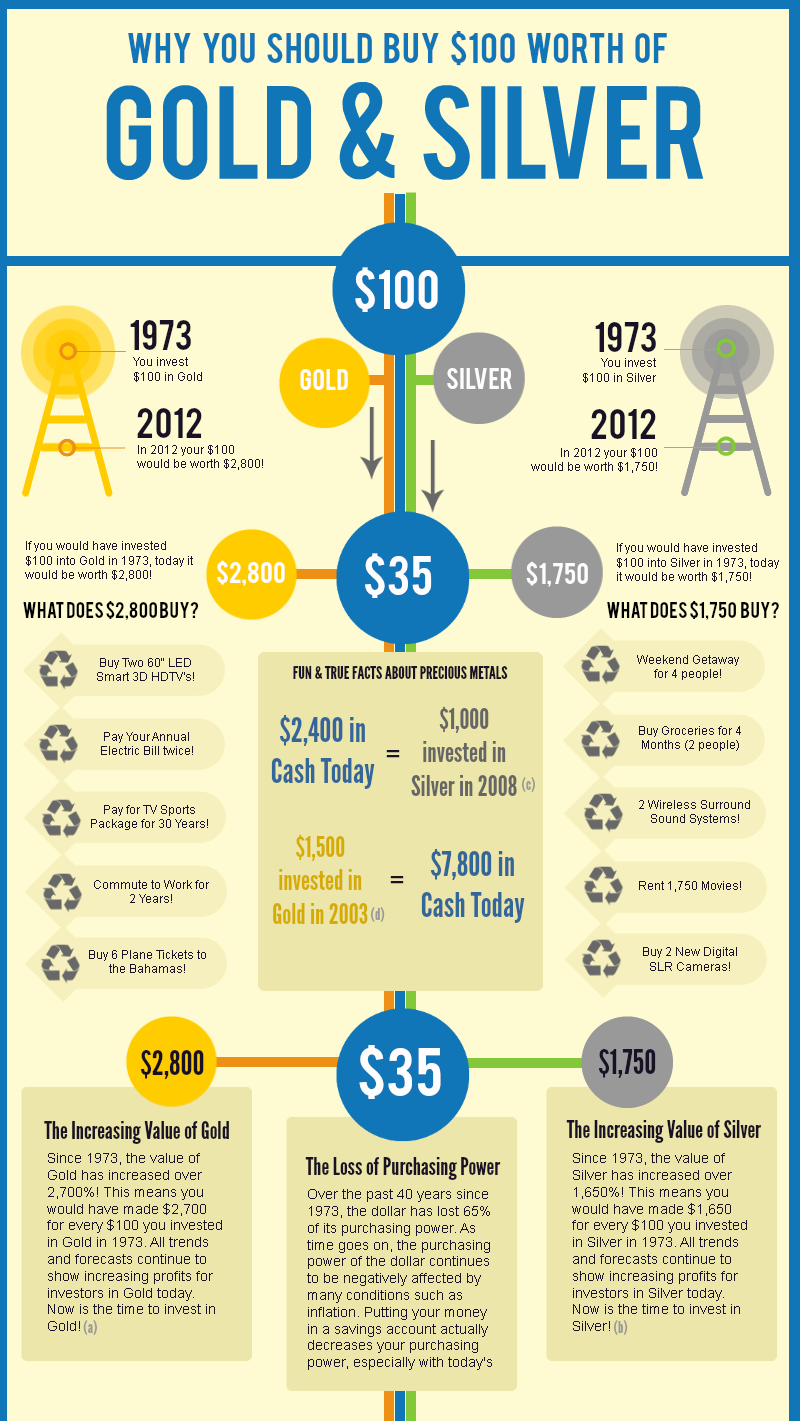

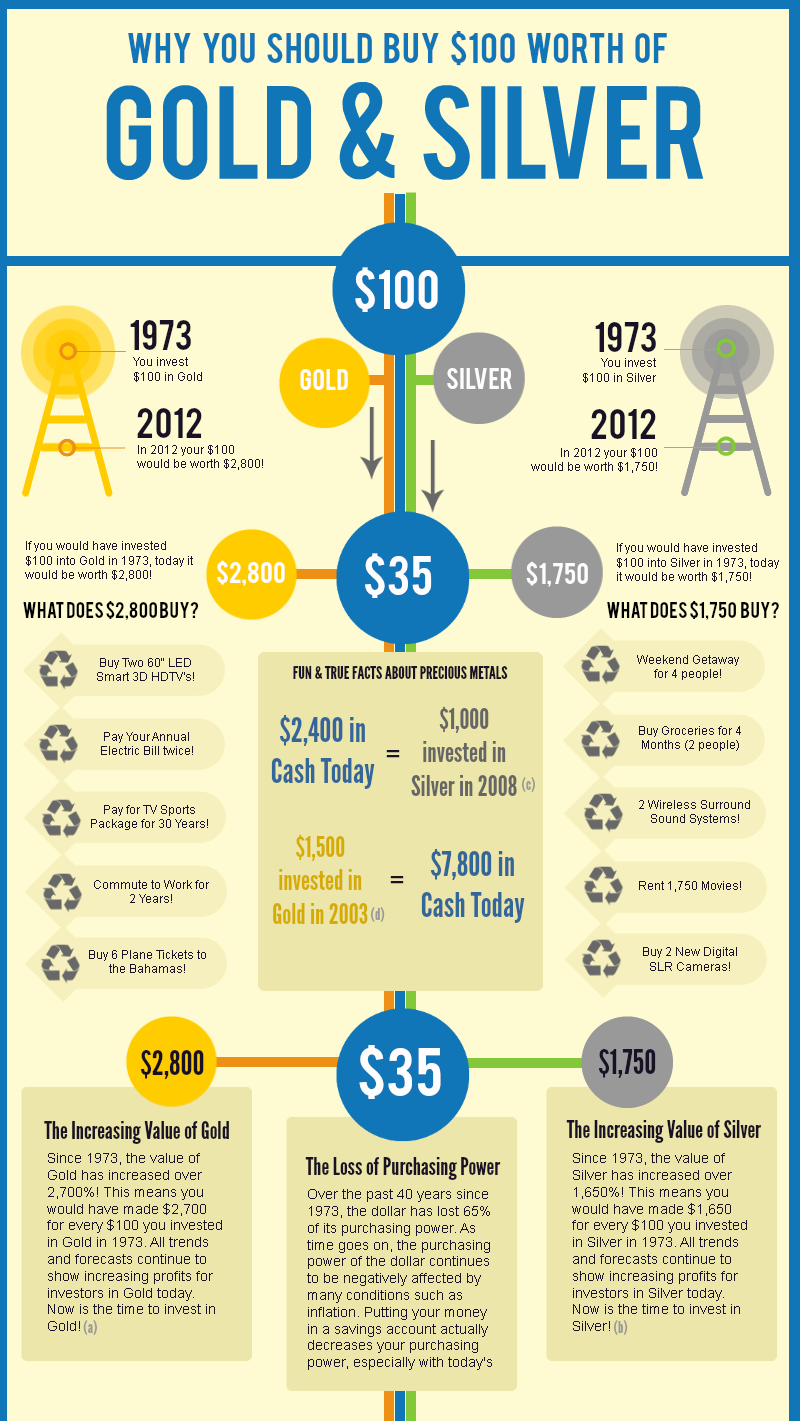

Investing in gold and silver has long been a popular strategy for diversifying portfolios and protecting against inflation. Precious metals like gold and silver are considered safe-haven assets, providing stability during economic uncertainty. This guide explores various ways to invest in these metals and how to get started.

Why Invest in Gold and Silver?

Investors turn to gold and silver for several reasons:

- Hedge Against Inflation: Precious metals often retain value better than fiat currencies, making them ideal during inflationary periods.

- Diversification: Adding gold and silver to your portfolio can reduce overall risk by balancing out the volatility of stocks and bonds.

- Safe-Haven Asset: Historically, gold has been a reliable store of value during market downturns or economic crises.

How to Invest in Physical Gold and Silver

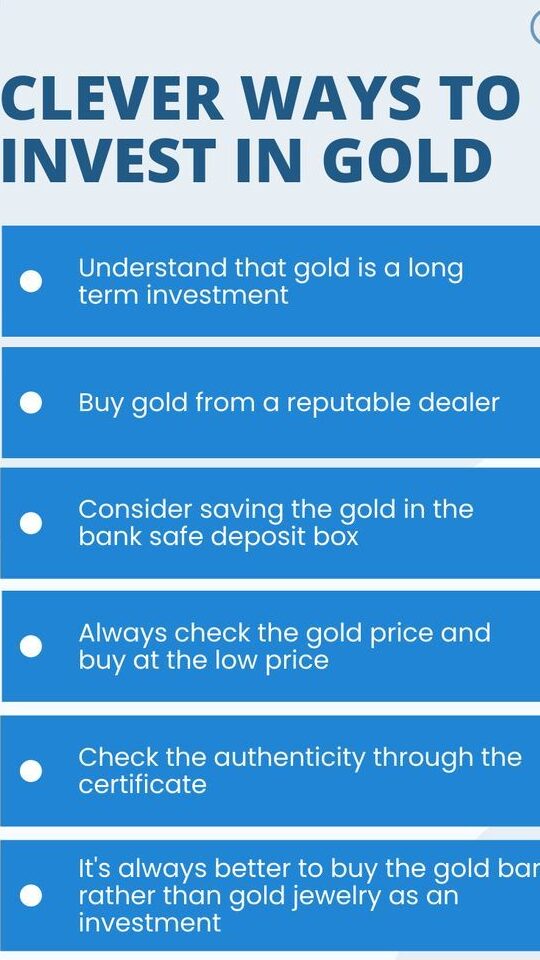

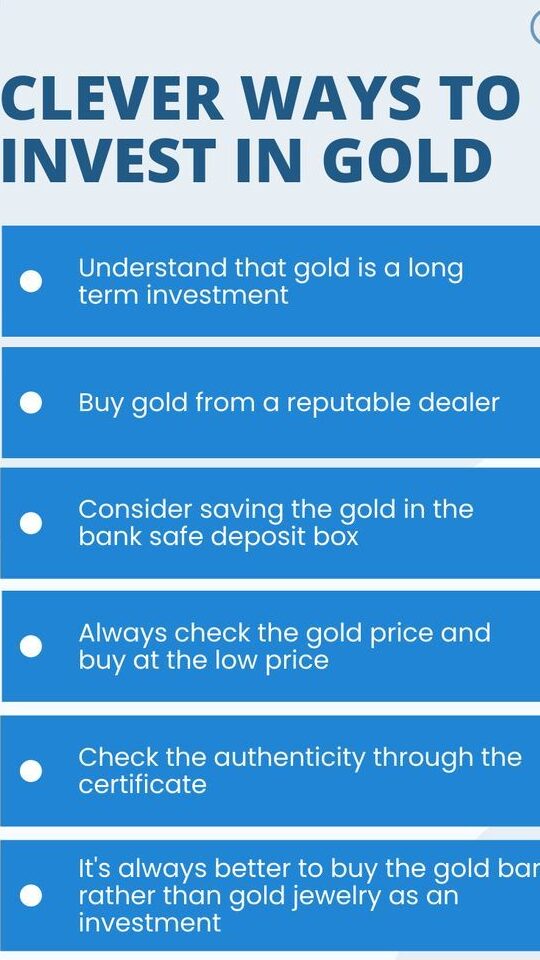

Investing directly in physical gold and silver can be a straightforward way to hold tangible assets. Here are the most common options:

1. Gold and Silver Bullion

Bullion bars and coins are popular forms of investing in physical gold and silver. Bullion is usually sold by weight and can be purchased from reputable dealers like APMEX, JM Bullion, or Kitco.

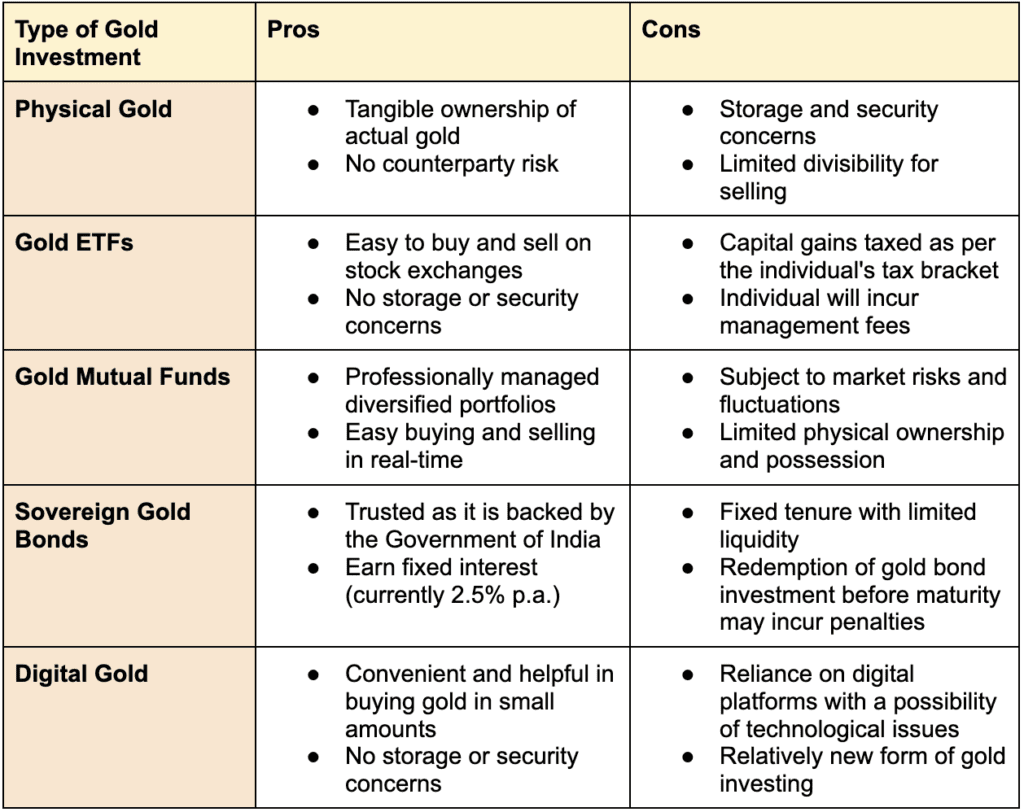

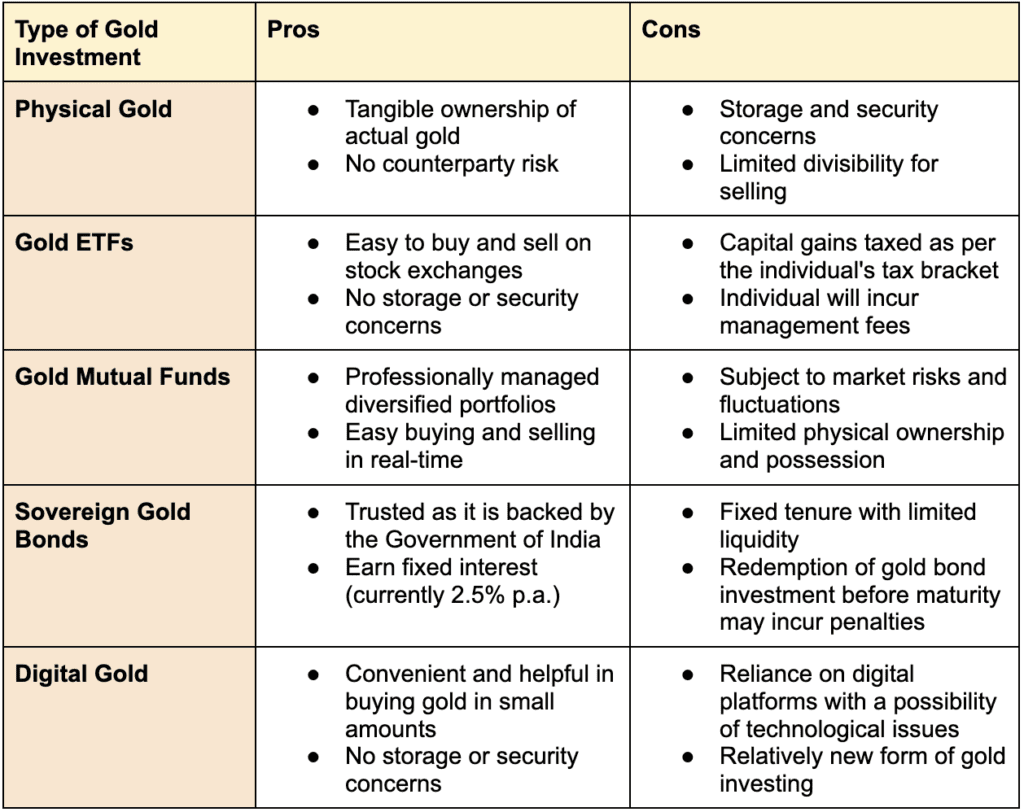

- Pros: Tangible asset, no counterparty risk.

- Cons: Requires secure storage and may involve additional costs like insurance.

2. Numismatic Coins

Numismatic coins have a collectable value beyond their metal content. These coins are usually older and rare, like pre-1933 U.S. gold coins.

- Pros: Potential for higher appreciation due to rarity.

- Cons: Can be expensive and require expertise to evaluate authenticity.

3. Storage Options

Storing physical metals requires consideration of safety and accessibility. Options include a home safe, bank safety deposit boxes, or professional vault storage.

Investing in Gold and Silver ETFs

Exchange-Traded Funds (ETFs) are a popular way to invest in gold and silver without the hassle of physical ownership. These funds track the price of the metal and are traded on stock exchanges.

- Pros: Easy to buy and sell through brokerage accounts, lower costs compared to physical ownership.

- Cons: No physical possession, potential management fees.

Gold ETFs hold physical gold, allowing investors to gain exposure to gold prices.

- SPDR Gold Trust (GLD), Expense Ratio: 0.40%

- iShares Gold Trust (IAU), Expense Ratio: 0.25%

- SPDR Gold MiniShares Trust (GLDM), Expense Ratio: 0.18%

- Aberdeen Physical Gold Shares ETF (SGOL), expense Ratio 0.17%

- Sprott Physical Gold Trust (PHYS), Expense Ratio 0.46%

- Perth Mint Physical Gold ETF (AAAU), Expense Ratio 0.18%

Silver:

- iShares Silver Trust (SLV), Expense Ratio: 0.50%

- Aberdeen Physical Silver Shares ETF (SIVR), Expense Ratio: 0.30%

- Sprott Physical Silver Trust (PSLV), Expense Ratio 0.67%

Invest in Gold and Silver Mining Stocks

Mining stocks offer exposure to the precious metals market through companies involved in the extraction of gold and silver.

- Gold Mining Companies: Leading companies like Barrick Gold (GOLD) and Newmont Corporation (NEM) have historically performed well during periods of rising gold prices.

- Silver Mining Stocks: Companies like First Majestic Silver (AG) and Pan American Silver (PAAS) provide exposure to silver.

- Pros: Potential for dividends, leverage on metal prices.

- Cons: Subject to operational risks, such as mining accidents or regulatory changes.

Other Ways to Invest in Gold and Silver

In addition to physical metals, ETFs, and mining stocks, there are other investment options to consider:

1. Precious Metals Mutual Funds

These funds invest in a mix of physical metals, mining stocks, and futures contracts. Examples include the Fidelity Select Gold Portfolio (FSAGX) and the VanEck International Investors Gold Fund (INIVX).

- Pros: Diversification within the precious metals sector.

- Cons: Higher management fees than ETFs.

2. Futures and Options

Futures and options contracts allow you to speculate on the price movement of gold and silver without owning the physical metals.

- Pros: Potential for high returns with leverage.

- Cons: High risk due to market volatility and leverage requirements.

3. Digital Gold

Digital gold platforms like Vaulted and Goldmoney allow you to buy fractional ownership of physical gold stored in secure vaults.

- Pros: Easy access and liquidity.

- Cons: Lack of physical possession and potential platform fees.

Factors to Consider Before Investing

Before investing in gold and silver, consider these factors:

- Market Conditions: Precious metals often perform well during times of economic uncertainty or rising inflation. Assess current economic trends before investing.

- Costs and Fees: Whether you’re buying physical metals or investing in ETFs, consider costs like management fees, storage, and insurance.

- Investment Goals: Determine whether you are investing for long-term wealth preservation, short-term trading, or diversification.

Risks of Investing in Gold and Silver

While gold and silver can be excellent investments, they come with risks:

- Volatility: Prices can fluctuate based on market demand, geopolitical events, and macroeconomic factors.

- Lack of Income: Unlike stocks or bonds, gold and silver do not generate passive income like dividends or interest.

- Liquidity Issues: Selling physical metals may take time and incur transaction fees, especially for larger bars.

Investors should be aware of these risks and consider their risk tolerance before investing in precious metals.

Gold and silver are timeless assets that can provide stability and diversification to any investment portfolio. By understanding the different ways to invest and considering your financial goals, you can effectively incorporate these metals into your investment strategy.

Related articles:

- Which savings account will earn you the least money?

- Which Savings Account Will Earn You the Most Money?

Sources:

- https://www.apmex.com/

- https://guardian-gold.com.au/market-updates/getting-started-with-gold-and-silver-investing-a-beginners-guide/

- https://www.investopedia.com/how-to-invest-in-gold-and-silver-7369625

- https://www.lynalden.com/precious-metals-investing/