NVIDIA delivered another blockbuster quarter, with $39 billion in revenue—a 78% year-over-year surge fueled by insatiable AI demand.

After a hiccup, its latest platform, Blackwell, is off to the fastest product ramp in company history, generating $11 billion in its first quarter.

But CEO Jensen Huang sees this as just the beginning. As AI accelerates, he framed NVIDIA’s role in defining the future. This isn’t just about faster chips—it’s about a fundamental transformation in computing. Huang pointed to the rise of AI reasoning models, requiring 100x more compute power than today’s AI models. Demand isn’t slowing—it’s accelerating into a new phase.

“The next wave is coming, agentic AI for enterprise, physical AI for robotics, and sovereign AI as different regions build out their AI for their own ecosystems.”

Investors shrugged at another record-setting quarter. Why? Expectations are now sky-high. Even a $1.2 billion revenue beat was NVIDIA’s smallest since early 2023.

With AI reshaping entire industries, hyperscalers spending tens of billions, and NVIDIA still at the center of it all, one question looms:

How long can NVIDIA stay untouchable?

1. NVIDIA Q4 FY25

NVIDIA’s fiscal year ends in January, so the latest quarter is Q4 FY25. I’m focusing on sequential growth (quarter-over-quarter), which better represents the momentum.

Income statement:

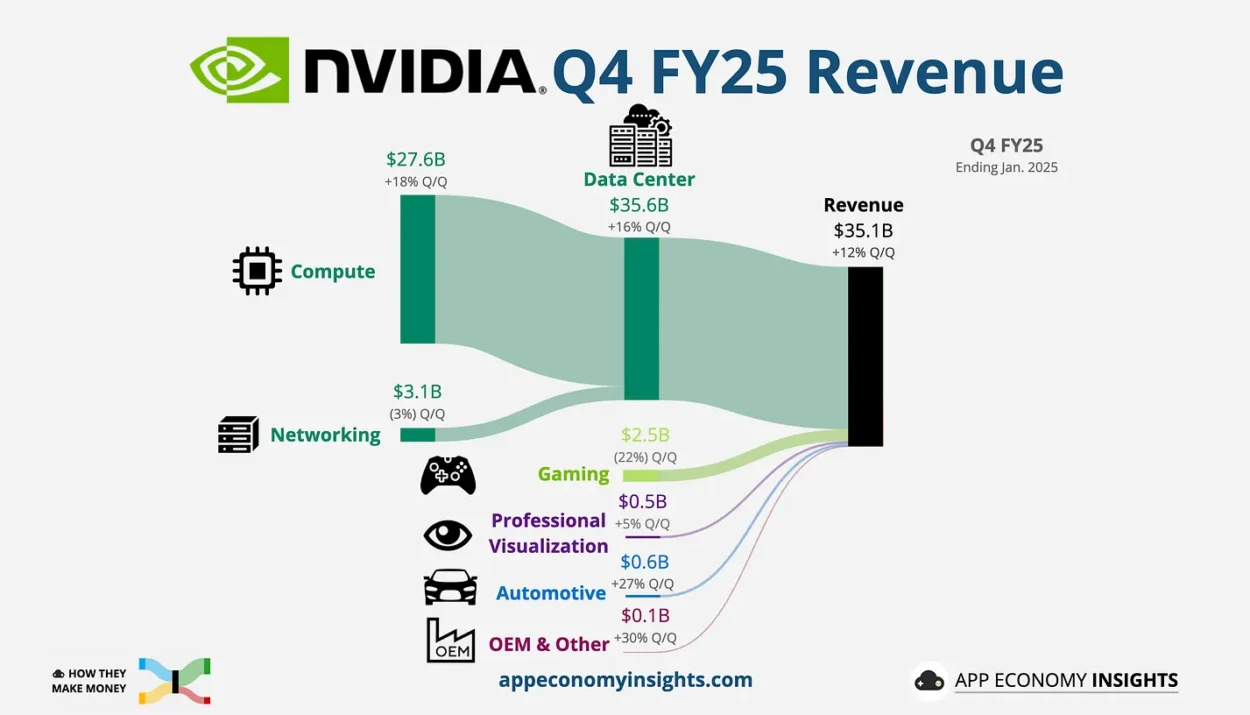

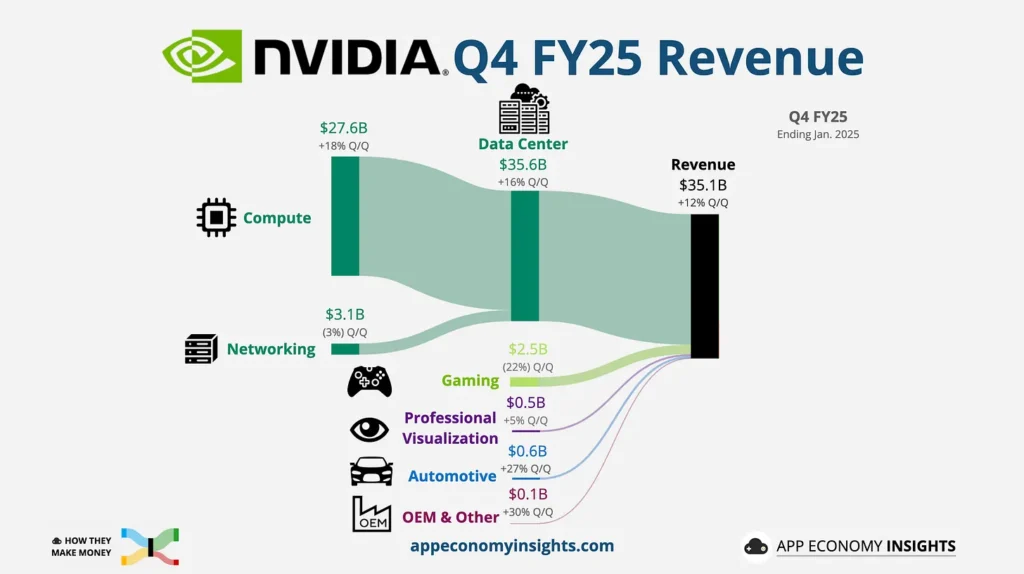

- Revenue jumped +12% Q/Q to $39.3 billion ($1.2 billion beat).

- Data Center grew +16% Q/Q to $35.6 billion.

- Gaming declined by 22% Q/Q to $2.5 billion.

- Professional Visualization grew +5% Q/Q to $0.5 billion.

- Automotive grew +27% Q/Q to $0.6 billion.

- OEM & Other grew +30% Q/Q to $0.1 billion.

- Gross margin was 73% (-2pp Q/Q), in line with guidance.

- Operating margin was 61% (-1pp Q/Q).

- Non-GAAP operating margin was 65% (-1pp Q/Q).

- Non-GAAP EPS $0.89 ($0.04 beat).

Cash flow:

- Operating cash flow was $16.6 billion (42% margin).

- Free cash flow was $15.5 billion (39% margin).

Balance sheet:

- Cash and cash equivalents: $43.2 billion.

- Debt: $8.5 billion.

Q1 FY26 Guidance:

- Revenue +9% Q/Q to $43.0 billion ($1.0 billion beat).

- Gross margin 71% (-2pp Q/Q).

So what to make of all this?

- NVIDIA’s AI dominance continues, but expectations are higher than ever. The company delivered another strong quarter, beating revenue estimates by $1.2 billion. However, this was the smallest beat since early 2023, reinforcing that the law of large numbers is setting in.

- Data Center remains the growth engine, contributing 90% of total revenue. However, margin pressure intensified due to the high cost of scaling production and a shift to next-gen architectures.

- Compute: Demand for Hopper GPUs remained strong, but Blackwell’s rollout stole the spotlight, contributing $11 billion in first-quarter sales.

- Networking: Revenue remained lumpy, with another sequential decline. However, Spectrum-X Ethernet solutions for AI continued to gain traction. Management expects a return to growth in Q1 FY26. The first Stargate data center will notably use Spectrum-X.

- Gaming: Revenue declined 22% sequentially to $2.5 billion, reflecting supply constraints following a strong Q3 FY25. The segment is expected to rebound next quarter.

- Professional Visualization: Revenue grew 5% sequentially to $511 million, with AI-driven workflows and Omniverse adoption driving demand, notably in automotive and healthcare.

- Automotive: Revenue jumped 27% sequentially to $570 million, fueled by increasing adoption of autonomous vehicles and digital cockpit solutions. Toyota, the world’s largest automaker, will build its next-gen vehicles on NVIDIA Orin.

- The AI demand narrative is evolving. CEO Jensen Huang emphasized a shift toward AI reasoning models, which require far more computing power. Despite concerns over DeepSeek’s efficient AI model, Huang argues this trend actually expands NVIDIA’s long-term opportunity—reasoning models could require up to 100x more compute.

- Margins took a hit. Gross margin dipped 2 percentage points sequentially to 73% as Blackwell production ramped up. Management expects further compression to 71% in Q1 FY26 before stabilizing in the mid-70s later in the year.

- The outlook remains strong but no longer shocking. NVIDIA guided for 9% sequential revenue growth next quarter, slightly above expectations. While impressive, it’s a slowdown from previous quarters, reflecting tougher comparisons. Data Center and Gaming will drive sequential growth in Q1.

- Risks are emerging. Beyond slowing beats, NVIDIA faces growing competition from AMD and custom AI chips built by hyperscalers like Amazon, Microsoft, and Google. Tariff uncertainties could also impact future sales, with potential new US trade restrictions on AI chip exports.

Big picture: NVIDIA is still at the heart of the AI boom, but the days of effortless upside surprises may be fading. Blackwell’s rapid adoption and AI’s shift to reasoning models remain tailwinds, but margin pressure, competition, and geopolitical risks are worth watching.

2. Recent developments

The DeepSeek Shock

NVIDIA faced its biggest AI scare yet when Chinese startup DeepSeek unveiled an AI model trained with far fewer GPUs, triggering a ~17% sell-off in one day for NVDA. Investors worried that AI development might shift away from NVIDIA’s power-hungry chips. But Jensen Huang flipped the narrative, arguing that DeepSeek’s approach could actually increase long-term demand.

Huang’s take:

“We’ve really only tapped consumer AI and search and some amount of consumer generative AI, advertising, recommenders, kind of the early days of software. […] Future reasoning models can consume much more compute.”

DeepSeek-R1, he said, has “ignited global enthusiasm” and will push reasoning AI into even more compute-intensive applications. In short, NVIDIA’s chips aren’t getting sidelined—they’re becoming even more critical.

The 3 Scaling Laws of AI compute

Huang laid out a new framework for understanding AI’s growing compute needs, highlighting three distinct scaling laws:

- Pre-training scaling: The traditional scaling law, where AI models grow smarter by consuming more data. Multimodal learning and reasoning-based data are now enhancing this phase.

- Post-training scaling: The fastest-growing compute demand, where AI refines itself using reinforcement learning (both from human and AI feedback). Huang noted that post-training now requires even more compute than pre-training, as models generate vast amounts of synthetic training data.

- Inference & reasoning scaling: The biggest shift ahead, where AI performs “long thinking” through techniques like chain-of-thought reasoning and search. Huang emphasized that test-time compute (inference) already demands 100x more compute than early LLMs—and could eventually require millions of times more.

Huang positioned Blackwell as the first GPU designed specifically for this new AI paradigm. The architecture is built to handle pre-training, post-training, and inference in a unified, flexible data center environment. AI isn’t just getting bigger—it’s thinking deeper. Each phase now demands exponentially more compute, reinforcing why NVIDIA’s dominance in AI hardware could be here to stay.

3. Key quotes from the earnings call

CFO Colette Kress:

On Data Center:

“Q4 data center compute revenue jumped 18% sequentially and over 2 times year-on-year. Customers are racing to scale infrastructure to train the next generation of cutting edge models and unlock the next level of AI capabilities.”

Kress provided updates on the three major customer categories:

- Cloud Service Providers (CSPs): Contributed ~50% of Data Center revenue (unchanged sequentially), with hyperscalers like Amazon, Microsoft, Google, and Oracle racing to meet customer demand for AI. Data Center revenue from CSPs has nearly doubled year-over-year.

- Consumer Internet Companies: Meta is the elephant in the room here, with Llama models, the Meta AI assistant, and deep learning recommender engines to serve ads (Andromeda) and improve monetization and ROI. Management also called out xAI and its Grok 3 model. This category has surged 3x year-over-year.

- Enterprise: GenAI apps and co-pilots are flourishing across healthcare, education, and robotics. Kress called out the automotive vertical, which is expected to grow to $5 billion in FY26. This category will become the largest over time with physical AI and robotics.

On Blackwell:

“Blackwell sales exceeded our expectations. We delivered $11 billion of Blackwell revenue to meet strong demand. This is the fastest product ramp in our company’s history, unprecedented in its speed and scale. […] With Blackwell, it will be common for these clusters to start with 100,000 GPUs or more. Shipments have already started for multiple infrastructures of this size. Post-training and model customization are fueling demand for NVIDIA infrastructure and software as developers and enterprises leverage techniques such as fine tuning, reinforcement learning, and distillation to tailor models for domain-specific use cases.”

NVIDIA’s management wants to educate investors on the role played by its chips and software beyond training.

“Blackwell was architected for reasoning AI inference. Blackwell supercharges reasoning AI models with up to 25 times higher token throughput and 20 times lower cost versus Hopper 100. It is revolutionary. […] Many of the early GB200 deployments are earmarked for inference, a first for a new architecture.”

On export restrictions:

“As a percentage of total Data Center revenue, data center sales in China remained well below levels seen on the onset of export controls. Absent any change in regulations, we believe that China shipments will remain roughly at the current percentage. […] We are awaiting [the US government’s] plan—its timing, its where, and how much.”

NVIDIA’s China sales have already been cut in half, and new US tariffs and export restrictions could hit even harder. The Biden administration curbed AI chip sales to China, and Trump has suggested further tariffs on Taiwan-made semiconductors—potentially impacting NVIDIA’s supply chain. The risk? NVIDIA’s data center dominance is heavily reliant on global supply chains. Any disruption could slow growth and squeeze margins.

4. What to watch looking forward

Capital allocation

NVIDIA maintained its aggressive buyback pace in Q4:

- $9.5 billion in FY24.

- $33.7 billion in FY24.

- Q1: $7.7 billion.

- Q2: $7.2 billion.

- Q3: $11.0 billion.

- Q4: $7.8 billion.

While this signals management’s confidence in the company’s prospects, some investors might question whether the current cash influx would be better spent on R&D, M&A, or other growth initiatives to sustain long-term growth.

Valuation at a crossroads

Altimeter increased its NVDA allocation by 5% (now 19% of the fund), but the stock was mostly absent from other Q4’s top buys.

The trend? Funds aren’t buying NVIDIA as aggressively as before, but they’re not selling either—NVDA remains one of the most widely held stocks.

Here are the current forward PE ratios (via Ychartz):

- Apple 33.

- Microsoft 30.

- NVIDIA 30.

- AMD 22.

NVIDIA’s valuation reflects its rapid earnings growth. With $22 billion in net profit in Q4 (+80% Y/Y), this isn’t a dot-com-style bubble like Cisco in 2000—the profits are real, and fundamentals remain strong.

If you’re a regular reader, you already know the key risks, but let’s reiterate the most pressing concerns:

- Cyclicality and volatility: NVIDIA’s forward earnings rely on sustained AI demand. The semiconductor industry has historically been cyclical, and shortages often lead to oversupply. Could we see an AI chip glut?

- High customer concentration: NVIDIA’s biggest buyers are also building their own AI chips. A shift to internal solutions could impact long-term demand.

- Geopolitical uncertainty: Due to export restrictions, NVIDIA’s China sales have already been cut in half. US tariffs on Taiwan-made semiconductors could squeeze margins or disrupt supply chains.

Still early days

Jensen Huang laid out a three-layer AI transformation unfolding across industries:

- Agentic AI (Enterprise AI): AI copilots and automation tools that enhance employee productivity in industries like automotive, finance, and healthcare.

- Physical AI (AI for Machines): AI-powered training systems for physical objects, from robotic warehouses to autonomous vehicles.

- Robotic AI (AI-powered systems in the real world): AI that interacts with and navigates physical environments, such as self-driving cars and industrial robots.

Huang believes enterprise AI will eventually outgrow hyperscaler demand as AI transforms both digital and physical industries.

“No technology has ever had the opportunity to address a larger part of the world’s GDP than AI. No software tool ever has.”

Huang isn’t just talking about AI’s potential—he’s framing it as the biggest economic shift in history. Unlike past software revolutions, which digitized existing workflows, AI is creating entirely new industries while reshaping every sector, from manufacturing to healthcare.

For NVIDIA, this isn’t just about selling chips—it’s about powering the intelligence layer of the global economy.

Source: How They Make Money

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors

How Will Tesla Be Affected by 25% EU Tariffs?

Trump vows to slap 25% tariffs on EU and claims bloc was ‘formed to screw US’

Amazon Unveils Ocelot: A Game-Changer for Quantum Computing?

Covid and a Reminder about Long Term Investing

Understanding the Fed’s Rate Decisions: High or Low Interest Rates?

3 Value Stocks that are Backed by the World’s Largest Activist Hedge Fund

Is $MSTR “forced liquidation” possible and what happens if Bitcoin falls?