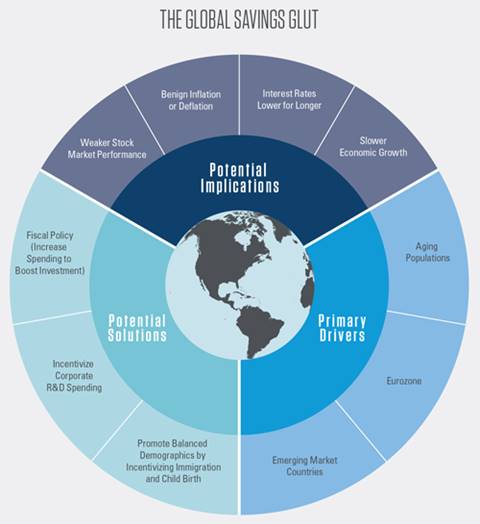

For decades, the global economy has been shaped by a powerful but often misunderstood force: the global savings glut — a condition where excess savings in some countries vastly exceed their domestic investment opportunities.

This imbalance has reshaped financial markets worldwide, pushing interest rates lower, encouraging risk-taking, inflating asset bubbles, and distorting the flow of capital across borders.

Understanding where we came from, how we got here, and what could come next is critical for every investor, policymaker, and business leader trying to navigate today’s complex environment.

Let’s break it down carefully.

What Is the Global Savings Glut?

The term “global savings glut” was popularized by former U.S. Federal Reserve Chair Ben Bernanke in a 2005 speech.

At its core, the concept refers to:

- Large current account surpluses in countries like China, Germany, and oil-exporting nations

- High household and corporate savings rates in these surplus economies

- Lack of equivalent domestic investment opportunities

In simple terms, countries with too much savings (more money coming in from exports than they spend domestically) send their surplus abroad, mainly into safe assets like U.S. Treasuries or European government bonds.

This massive inflow of foreign capital lowers global interest rates and floods developed markets with cheap credit.

The Origins and Drivers Behind the Savings Glut

Let’s look at the key players:

- China: Since joining the World Trade Organization in 2001, China’s manufacturing and export engine has generated trade surpluses year after year. Its household savings rate has remained over 40% of GDP — one of the highest in the world.

- Germany: As Europe’s industrial powerhouse, Germany has consistently run a current account surplus averaging around 7% of GDP for the past decade, thanks to its world-class export sector.

- Oil-exporting nations (Middle East, Russia, Norway): During commodity booms, oil-rich countries accumulated trillions in sovereign wealth funds, much of which flowed into global capital markets.

In short, these regions saved more than they could invest domestically, sending their excess capital abroad in search of stable returns.

Impact on Global Financial Markets

The global savings glut has had profound, lasting effects on financial markets over the past two decades. Here’s how:

- Interest Rates: Massive demand for safe assets, especially U.S. Treasuries, pushed yields to historic lows.

For example, the 10-year U.S. Treasury yield fell from over 6% in 2000 to under 1% by 2020. - Cheap Credit and Asset Bubbles: Low interest rates made borrowing cheap, fueling speculative booms.

Between 2012 and 2022, U.S. home prices surged over 60%, far outpacing wage growth.

Stock markets also soared, as investors searched for yield beyond government bonds. - Global Imbalances: While surplus countries exported capital, deficit countries like the U.S. became net borrowers.

By 2022, the U.S. net international investment position (NIIP) showed a deficit of $16 trillion.

These forces helped create the ultra-low-yield environment that defined global markets for much of the 2000s and 2010s.

What Might Change Moving Forward?

Many experts believe we’re entering a new phase — and the global savings glut may no longer dominate financial markets the way it once did. Here’s why:

Demographics: Countries like China and Germany are aging rapidly.

By 2030, 25% of China’s population will be over 60 years old. Older populations tend to save less and spend more, reducing surplus savings.

Increased Domestic Investment: China is now heavily investing in infrastructure, technology, and green energy — absorbing more of its own capital.

Shifts in Monetary Policy: After years of easy money, central banks are raising rates to fight inflation.

The era of near-zero yields may be ending, with the 10-year Treasury yield potentially stabilizing around 4-5%.

Geopolitical Realignments: As U.S.-China tensions grow and global supply chains shift, surplus countries may diversify away from U.S. Treasuries and look toward domestic or regional investments.

What Risks and Opportunities Should Investors Watch?

If the savings glut fades, the entire investing landscape could shift. Here’s what to watch:

Bonus Takeaway: Adaptability Is Essential

The global savings glut has shaped the world we know — but it may not define the next era.

For investors, businesses, and policymakers, staying informed, flexible, and forward-looking will be crucial to navigating the next chapter.

By recognizing the long-term structural shifts in savings, demographics, capital flows, and interest rates, we can position our portfolios and strategies for resilience and growth.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Decoding the Commodity Supercycles: Where We Stand and What Lies Ahead

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance