GameStop (NYSE: GME) is set to release its Q1 2025 earnings report after market close on June 10, 2025. This quarter is shaping up to be one of the most unpredictable earnings yet, due to evolving business strategies, Bitcoin investment, and meme-stock volatility.

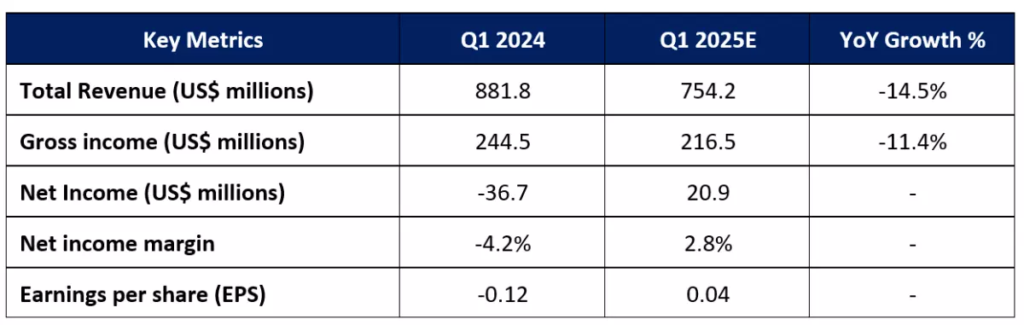

Upcoming Report Snapshot

- Q1 Date: Tuesday, June 10, 2025 (after market close)

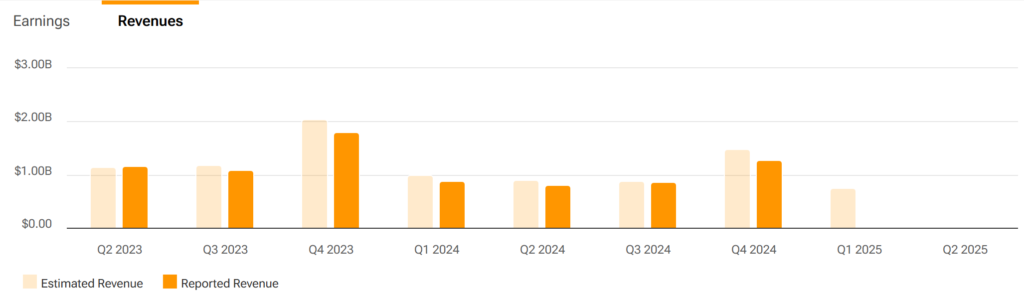

- Expected Revenue: ~$754 million

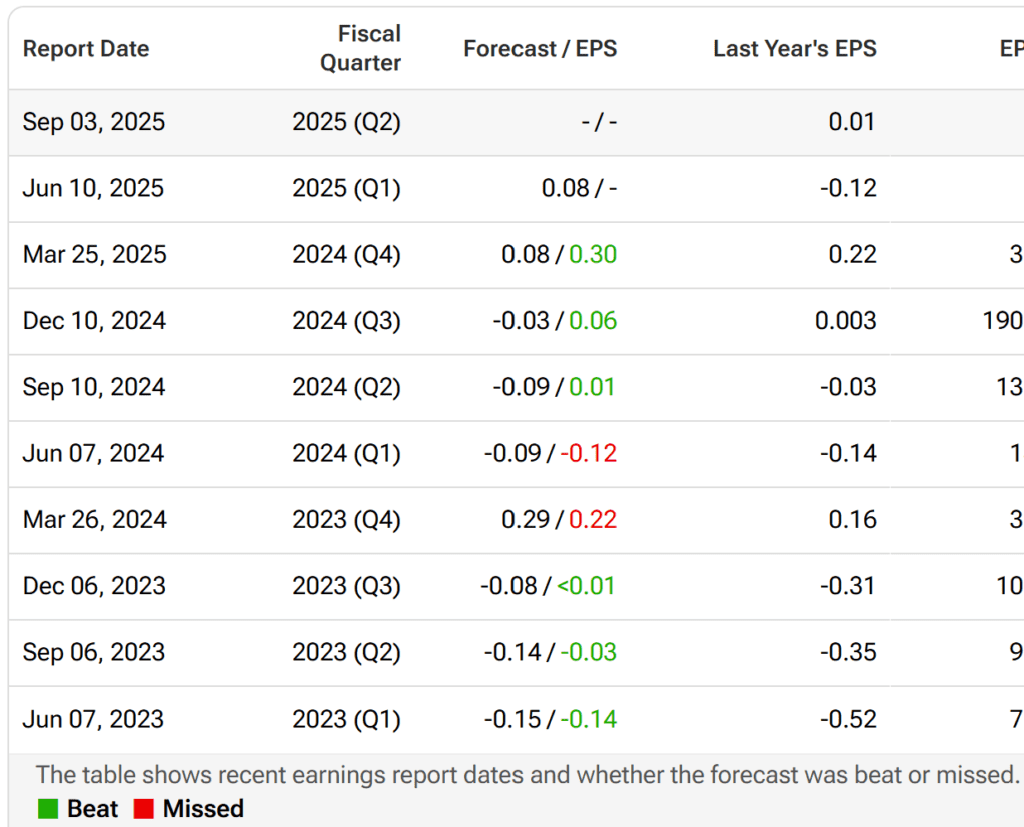

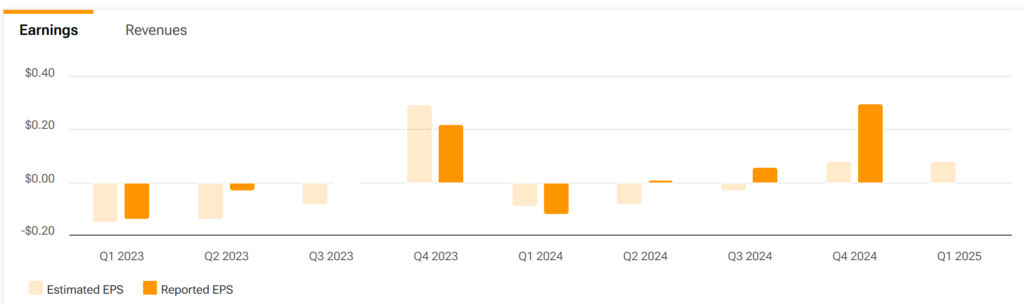

- Expected EPS: ~$0.04 (Vs. same quarter last year: -$0.12)

Analysts are forecasting a 133% YoY rise in EPS, even as revenue is seen down about 15% YoY .

What’s New This Quarter

- Heavy Bitcoin Investment

- In late May, GameStop purchased 4,710 BTC (~$515.7M) funded through a $1.3B convertible bond sale

- This move signals a pivot toward becoming a Bitcoin-backed treasury, similar to MicroStrategy’s strategy

- Insider Buying Wave

- CEO Ryan Cohen and other insiders bought shares—Ryan alone invested about $10.8M

- Strong insider buying often hints at well-informed optimism.

- Meme-Stock Unpredictability

- GME shares plunged ~15% from its 52-week high, then bounced ~26% in just three months

- The stock remains volatile, driven partly by retail momentum.

Drivers Behind the Data

- Core Business Pressure:

Revenue expected to fall ~14.5% YoY to ~$754M, reflecting struggling hardware and game retail sales - EPS Recovery from Losses:

Analysts estimate a swing to positive earnings (~$0.04 EPS vs. -$0.12 a year ago) - Bitcoin Exposure:

Huge treasury Bitcoin investment could heavily influence both revenues and headline earnings.

Segment & Strategy Outlook

| Business Segment | Q1 Drivers |

|---|---|

| Video Game Retail | Continued decline; focus on restructuring and retrenchment |

| Digital/Game Trading | Uncertain impact from core business challenges |

| Treasury Bitcoin Holdings | $515M “digital asset” stash brings upside & volatility |

Analyst and Trader Sentiment

- Analysts: Consensus EPS estimate of $0.08 is based on limited coverage (TipRanks shows just one Sell rating)

- Insider Confidence: Ryan Cohen’s share purchases indicate positive internal conviction

- Bitcoin as Hedge: Media coverage (Barron’s, AP) places this strategy alongside MicroStrategy’s well-known approach — though analysts remain cautionary

- Meme Volatility Factor: Despite fundamentals, GME remains a ‘volatility play,’ attracting both large short and long retail positions

- Valuation Signals: Inside trading mixed—some buying, some selling. Institutional holdings also fluctuating .

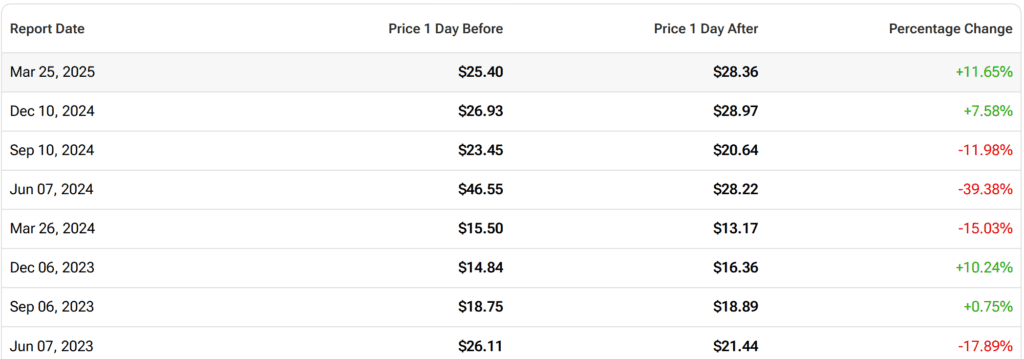

- Option Market: Implied volatility suggests a possible 11% price swing post-earnings

Bullish vs Bearish Cases

Bullish Factors:

- EPS turnaround, shifting from loss to profit.

- Significant insider buys, reinforcing belief in future upside.

- Bitcoin treasury strategy could boost returns during crypto rallies.

- Meme-driven momentum remains strong — retail traders could push the stock higher.

Bearish Risks:

- Declining core sales make sustained profitability doubtful.

- High revenue dependency on crypto markets adds risk exposure.

- One analyst rating the stock a “Strong Sell” with a $13.50 target – implying a 50% downside

- Retail volatility can swing prices unpredictably — both up and down.

What to Watch on June 10 Earnings Call

- Bitcoin on balance sheet

• How the $515M BTC investment statistics are reported — as asset or liability?

• Will they hint at future allocations or strategy? - Retail fundamentals

• Is physical/digital sales stabilization underway?

• Any signs of pivot to higher-margin services? - Guidance or Signals

• Will they couch Q2 with growth or retreat?

• Any mention of new business lines, NFTs, or e-commerce enhancements? - Insider Activity Post-Earnings: Following Cohen’s lead, will executives buy/sell once earnings are public?

Bottom Line for Investors & Traders

Long-Term Investors:

GameStop remains speculative. A promising EPS turn is positive, but survival hinges on diversifying beyond hardware. Bitcoin strategy is bold — but volatile.

Active Traders:

Anticipate sharp price swings around the release. Key triggers: Bitcoin reporting, retail revenue surprises, and insider moves. Expect 30–50% daily moves — this is a high-risk, high-reward environment.

Beginners:

If you hold GME, brace for volatility. Watch earnings reaction and stay nimble. Focus on whether revenue shrinkage continues or stabilizes — crypto tailwinds can be deceptive.

Conclusion

GameStop’s Q1 print combines two contrasting themes: struggling core business vs. aggressive crypto-led transformation. This duality creates unique opportunities — but also elevated unpredictability. The market reaction will pivot on Bitcoin exposure, insider sentiment, and forward signals about revenue stability.

After June 10, we’ll be closely tracking:

- How their treasury Bitcoin investment performs,

- Whether core retail revenue shows signs of stabilization,

- And where insiders position themselves post-report.

Expect fireworks — and a story well beyond traditional retail earnings.

After June 10, earnings could either reinforce this restructuring path — or highlight continuing instability. We will see.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift

Trump says relationship with Musk is over and threatens him

Elon Musk Empire Under Fire: What Trump’s Revenge Could Mean for Tesla and SpaceX

“You Mean Man Who Lost His Mind?” — Trump Slams Door on Musk

Timeline of Elon Musk and Donald Trump “Break Up”

Why Trump Can’t Just Quit Elon Musk — Even After Their Public Breakup