The global economy faces new risks from Europe, as investors shed French stocks and bonds, fearing a shift to far-right populism. French President Emmanuel Macron has called a snap parliamentary election, with polling suggesting the far-right National Rally party could gain significant power or even control the legislature. This raises concerns about wider fiscal deficits and new strains on European unity.

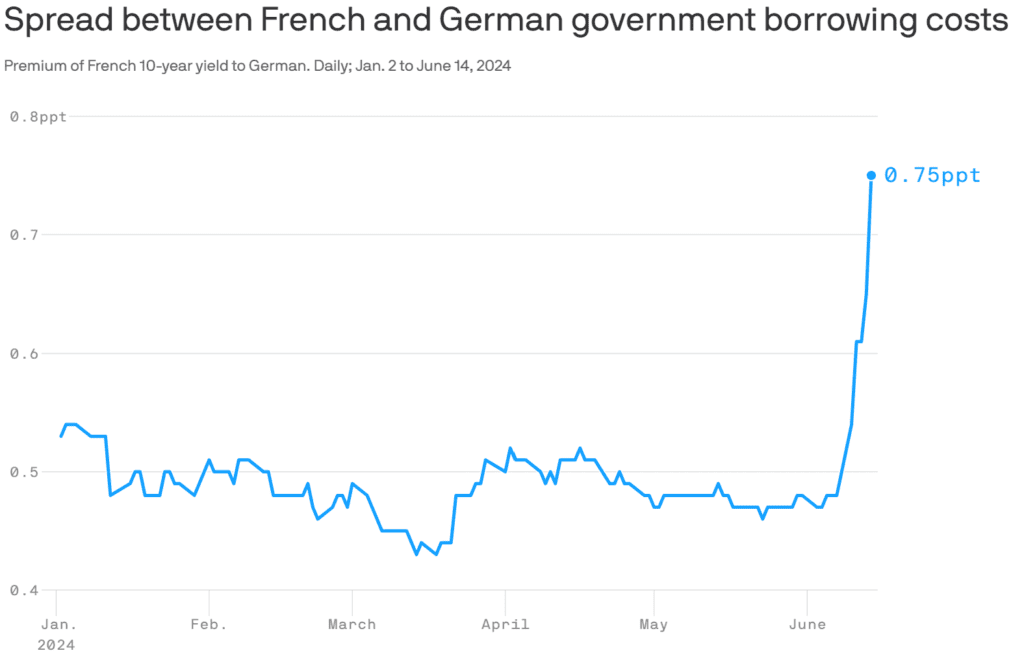

Finance Minister Bruno Le Maire warned of a potential French debt crisis if the National Rally enacts its agenda. French government borrowing costs have surged, with the gap between French and German borrowing costs reaching its widest since 2017. French stocks have dropped 8.5% over the past month, with financial stocks particularly hard hit.

Susannah Streeter of Hargreaves Lansdown noted concerns about the deficit impact of increased spending and potential windfall taxes under a populist government. The potential for a more populist government is significant, given France’s central role in the European Union.

While new tools exist to manage financial imbalances between eurozone nations, the extent to which a potential Le Pen administration would challenge or work within the EU framework remains unclear. French voters will cast their ballots on June 30 and July 7.