US stocks extended their slide on Wednesday, with the Nasdaq Composite down ~1% and the S&P 500 off 0.4%, marking the worst two-day stretch for tech since April. Investors rotated out of mega-cap growth names after weeks of AI-fueled gains.

- $PLTR slumped nearly 3%, extending a five-day drop of ~16% — its worst stretch since March.

- $NVDA and $AVGO fell ~2% each, while $AMD dropped more than 2% and $MU slid over 5%.

- The pressure spread to other Big Tech: $AAPL -1.8%, $META -0.9%, $GOOGL -0.6%.

Analysts flagged both profit-taking and bubble fears in AI stocks after comments from OpenAI’s Sam Altman and an MIT report suggesting many firms see little ROI from AI spending.

Meanwhile, defensives and value sectors held steadier, as investors rotated toward safer ground ahead of Fed Chair Powell’s Jackson Hole address on Friday.

Fed FOMC Minutes: Inflation Risks Take Center Stage

The minutes from the July 29–30 Federal Reserve meeting painted a picture of a central bank divided, but still tilting toward caution on inflation.

Inflation vs. Employment Risks

While policymakers acknowledged the labor market has weakened — with job creation slowing, unemployment ticking higher, and July’s historic downward revisions erasing more than 250,000 jobs from prior months — most officials still prioritized inflation. According to the minutes, “a majority of participants judged the upside risk to inflation as the greater of these two risks.”

Much of the concern stemmed from President Trump’s aggressive tariffs, which Fed officials described as carrying “considerable uncertainty” in both timing and magnitude. Several participants warned that tariffs could drive higher prices across the economy and that waiting for clarity before acting would be a mistake. Some went further, cautioning that inflation expectations risk becoming “unanchored” if companies continue passing costs directly to consumers.

Dissenters Break Ranks

Fed Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller dissented, advocating a quarter-point rate cut to cushion the labor market. Their dissent marked the first dual vote against the majority at the Fed’s Board of Governors since 1993. Yet they stood alone. Nearly all other policymakers viewed holding rates steady at 4.25%–4.50% as the right call, underscoring the committee’s reluctance to move aggressively despite softening labor data.

The Trump Factor

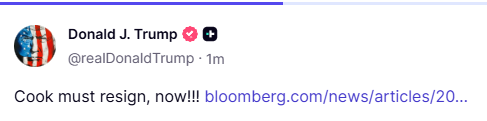

The political backdrop loomed large. Just days after the July meeting, weak jobs data rattled markets — and enraged President Trump, who went so far as to fire the head of the Bureau of Labor Statistics. Since then, the White House has ramped up pressure, with Trump publicly demanding that Fed Governor Lisa Cook resign, accusing her of misconduct, and openly vetting Powell’s potential replacements.

Market Expectations

Despite the hawkish tone of the minutes, traders remain convinced a cut is coming. The CME FedWatch tool now places an ~83–85% probability on a 25-basis-point reduction at the September meeting. Still, the minutes made clear that the pace and timing of cuts will depend on whether inflation proves temporary or entrenched — and on how sharply the labor market deteriorates in the months ahead.

The Road Ahead

The FOMC summed up its dilemma bluntly: if inflation persists while employment weakens, the Fed may face “difficult tradeoffs” that could force it to choose between its dual mandates. That sets the stage for Jerome Powell’s keynote at Jackson Hole on Friday, his final appearance at the symposium as Fed Chair — and potentially his most consequential.

Tariffs + Retail Earnings Add Pressure

Retail earnings this week underscored how tariffs are rippling through the consumer economy:

- $HD: Warned “modest price movement” could be coming despite prior pledges to hold the line; customers are shifting to smaller projects amid high borrowing costs.

- $TGT: Sales fell again, though not as steeply as Q1. Shares slid ~10% as new CEO Michael Fiddelke faces a tough tariff environment.

- $LOW: Beat earnings and sales expectations, and announced an acquisition of Foundation Building Materials.

- $WMT: Reports Thursday, expected to provide a crucial gauge of consumer resilience.

Foot traffic has fallen across big-box stores, but digital sales have been a bright spot (Home Depot up ~12% YoY).

Other Market Drivers

- Commodities: Oil eased ~0.8% on talk of a potential Russia-Ukraine ceasefire deal freeing supply; Gold steadied as investors hedge against inflation and geopolitical uncertainty.

- Crypto: Bitcoin dropped under $115K, extending this week’s slide as risk-off sentiment and profit-taking hit digital assets.

- Bonds: Treasury yields climbed for a fourth day, reflecting inflation concerns and pushing the 10Y yield back toward recent highs.

Outlook: Powell Front and Center

All eyes now turn to Jerome Powell’s Jackson Hole speech on Friday — his last as Fed Chair — where markets hope for clarity on whether the Fed prioritizes shielding the labor market or battling tariff-driven inflation.

As one strategist put it: “This is the August air pocket — too much AI hype, too much uncertainty on tariffs, and too little clarity from the Fed. Powell’s words could set the tone for the rest of the year.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Stock Market Today: Tech Tumbles, Retail Steadies, Fed Looms

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump

Zelenskyy–Trump Summit: Key takeaways from Diplomatic Optics to Defense Deals