Eli Lilly reports its highly anticipated first-quarter earnings on May 1, 2025, before the market opens. As one of the most closely watched healthcare stocks in the world, Lilly’s results will be critical not just for its investors but also for the broader biopharma sector, especially amid the red-hot competition in the weight-loss and diabetes markets.

Here’s a deep dive into what to expect, what’s driving results, where the risks lie, and what analysts are watching.

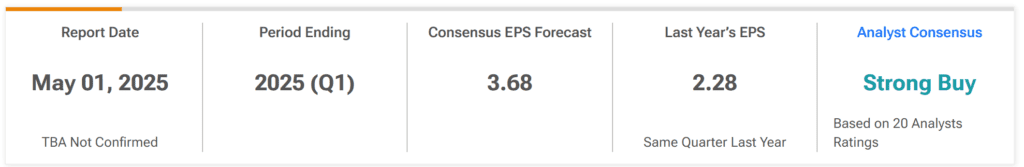

Expected Q1 2025 Results

What’s at stake:

Consensus numbers set the benchmark investors will judge Lilly against.

- Revenue: Zacks consensus estimate is $12.62 billion, reflecting solid growth from last year.

- EPS: Expected at $3.52 per share, up from $2.62 last year.

- 2025 EPS trend: Estimates have recently been cut from $23.53 to $22.43, signaling some caution in the analyst community.

Why it matters: Consensus is the “line in the sand” for earnings-day reactions. A beat can trigger rallies; a miss may hammer the stock — especially in a premium-valued name like Lilly.

Key Focus Areas

Let’s break down the product-level drivers shaping Q1 performance.

✅ Mounjaro (Diabetes) & Zepbound (Obesity)

These blockbuster GLP-1 drugs are Lilly’s crown jewels — the most crucial revenue drivers right now.

- Zacks consensus: Mounjaro: $3.75B; Zepbound: $2.27B

- Internal estimates: Mounjaro: $3.82B; Zepbound: $2.19B

What to watch:

Mounjaro and Zepbound underperformed in late 2024, but Lilly expects a rebound in 2025 as it ramps manufacturing, expands internationally, and benefits from new indications like obstructive sleep apnea. A big test will be early signs of recovery in Q1.

✅ China Expansion

Mounjaro was recently launched in China. While revenue contribution is likely small in Q1, management has guided for meaningful growth starting in H2 2025.

Why it matters:

China is a massive diabetes market — success here will cement Lilly’s global dominance.

✅ Other Key Growth Drugs

These drugs round out Lilly’s core portfolio:

| Drug | Zacks Estimate | Internal Estimate |

|---|---|---|

| Trulicity | $1.11B | $1.17B |

| Taltz | $663M | $659M |

| Verzenio | $1.25B | $1.23B |

| Jardiance | $675M | $775.8M |

| Olumiant | $228M | $240.3M |

| Emgality | $220M | $277.8M |

What to watch: While volume growth is strong, U.S. pricing pressures and patient switches (notably from Trulicity to Mounjaro) are hurting some segments.

✅ New Products

New launches like Ebglyss, Jaypirca, Omvoh, and the Alzheimer’s drug Kisunla (approved in China December 2024) are expected to contribute meaningful new revenue streams.

Why it matters:

These drugs are key to diversifying beyond GLP-1s and will be closely scrutinized for signs of momentum.

Challenges and Headwinds

What can go wrong? Here’s what investors are bracing for.

- Trulicity decline: Competitive pressure and Mounjaro cannibalization are eroding sales.

- U.S. pricing pressures: Medicare Part D reforms and lower realized prices could squeeze top-line growth.

- Foreign exchange impact: Unfavorable currency moves may chip away at revenue.

- Rising costs: Marketing and administrative spending for new launches could weigh on margins.

Bullish Drivers

Why some analysts and investors are still pounding the table on Lilly.

- GLP-1 pipeline strength: Lilly has several next-gen molecules in the works, including the oral GLP-1 orforglipron, which just showed positive Phase III data, rivalling Novo Nordisk’s Ozempic in weight and blood sugar reduction.

- International and label expansion: Acquisitions and collaborations with Morphic Therapeutics and OpenAI. Investments in manufacturing facilities totaling over $23 billion since 2020.

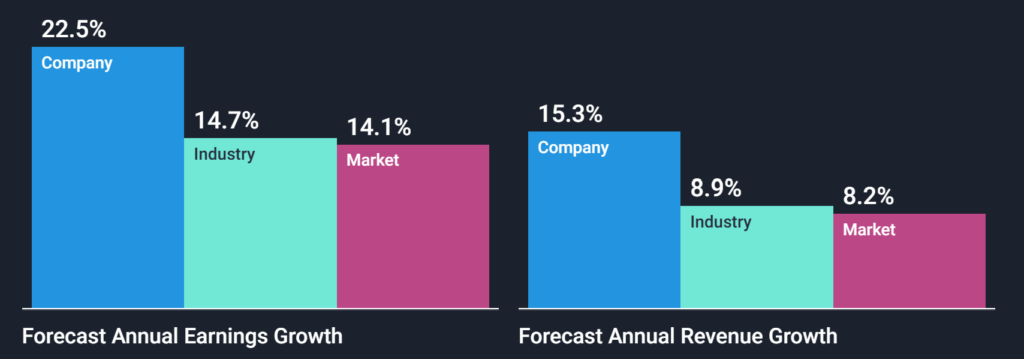

- Strong market position: Lilly and Novo Nordisk currently dominate the obesity market, a fast-growing $100B+ global opportunity.

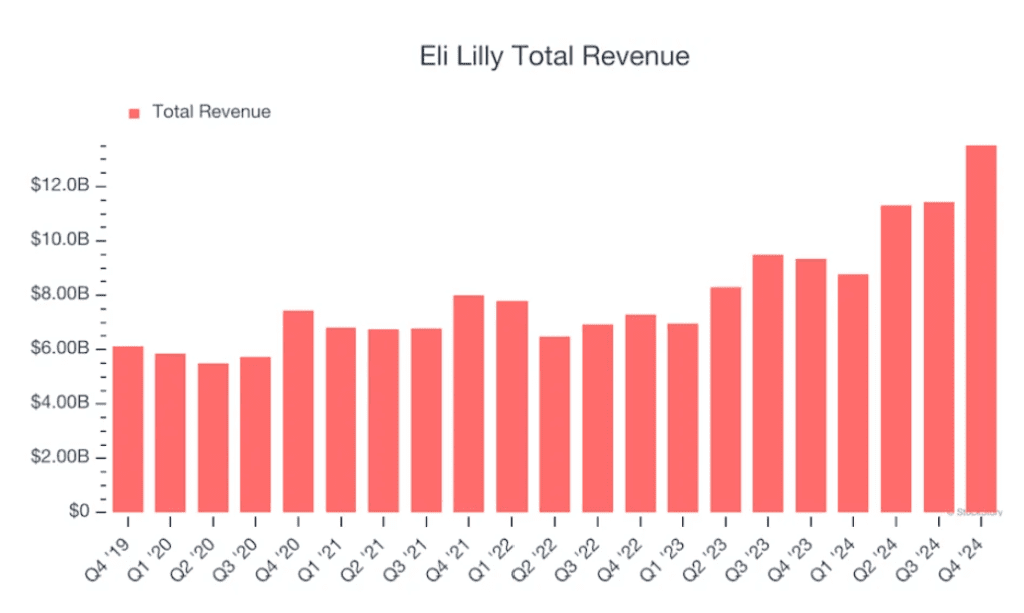

- Record-Breaking Revenue Growth: Full year revenue grew 32% compared to 2023, exceeding guidance by $4 billion. Revenue grew 45% in the most recent quarter.

- Strong Product Launches and Pipeline Advances: Successful launches of Mounjaro and Zepbound contribute significantly to revenue. Positive Phase III results for imlunestrant, insulin efsitora alfa, and several tirzepatide trials.

- Expansion and Innovation Initiatives: Acquisitions and collaborations with Morphic Therapeutics and OpenAI. Investments in manufacturing facilities totalling over $23 billion since 2020.

- New Product Approvals: Regulatory approvals for Kisunla, Ebglyss, and a new indication for Zepbound in obstructive sleep apnea.

- 2025 Financial Guidance: Expected revenue growth of approximately 32% compared to 2024, driven by continued incretin class growth and new market launches.

Bearish Risks

Why others are cautious.

- Intensifying competition: Rivals like Amgen, Viking Therapeutics, Roche, Merck, and AbbVie are racing to bring new obesity drugs to market, threatening Lilly’s future share.

- Execution risk:

Can Lilly smoothly scale up production and deliver on blockbuster expectations? - Pricing and Market Challenges: Realized prices decreased 5% in the U.S., and net prices are expected to decline by mid- to high single digits in percentage terms in 2025.

- Trulicity Revenue Decline: Worldwide Trulicity revenue declined by 25%, impacted by Mounjaro switches and lower realized prices.

- Supply Constraints: Limited initial sales of Mounjaro in China due to supply limitations, with more meaningful contributions expected in the second half of 2025.

- Investment and Expense Increases: R&D expenses increased 18% and marketing, selling, and administrative expenses increased 26% due to new product launches and promotional efforts.

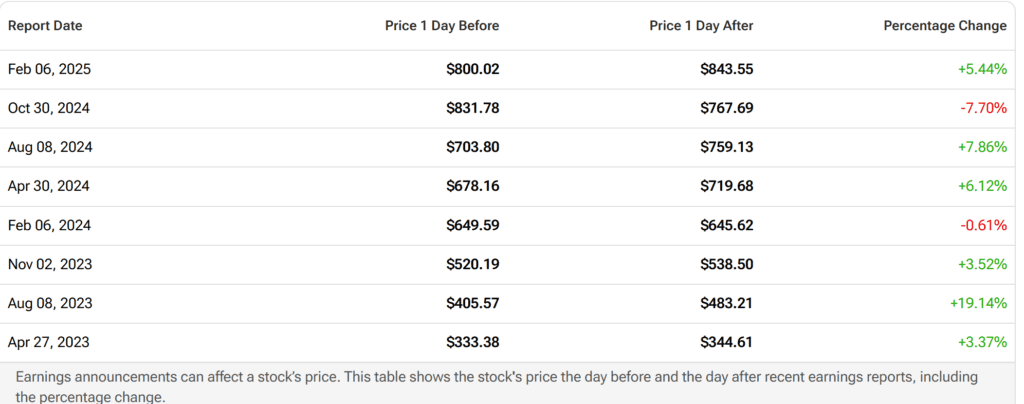

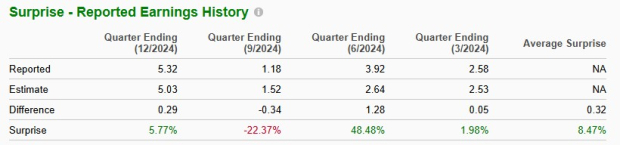

Surprise History

What history tells us about Lilly’s earnings-day moves.

- Beat EPS in 3 of last 4 quarters

- Average 4-quarter surprise: +8.47%

- Last quarter surprise: +5.77%

- Current Earnings ESP: -14.61%

- Zacks Rank: #3 (Hold)

Why it matters:

While Lilly has a solid beat record, the Earnings ESP suggests near-term caution.

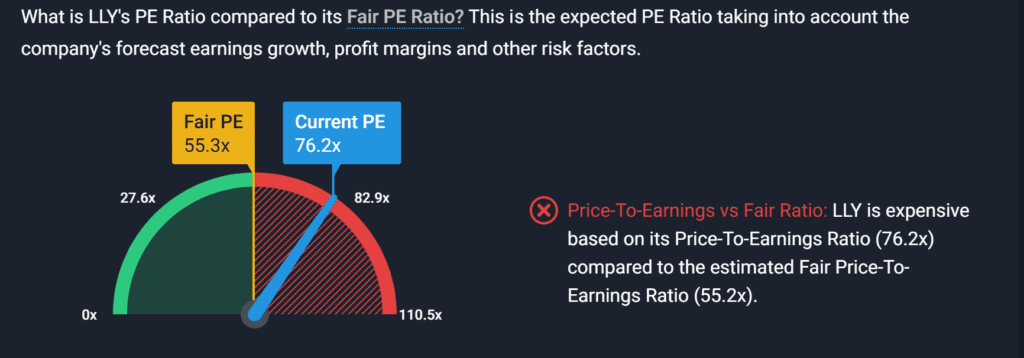

Stock and Valuation Snapshot

- YTD performance: +14.8% (vs. +1.5% healthcare sector)

- Valuation: Trading at a premium to peers

- Relative strength: Outperforming S&P 500 and healthcare sector

Why it matters: At premium valuations, Lilly needs to deliver near-flawless execution to justify its multiple.

Conclusion

Lilly’s Q1 report is a must-watch moment for healthcare investors.

The key questions:

- Can Mounjaro and Zepbound bounce back and reignite topline momentum?

- Will new launches like Kisunla, Jaypirca, and orforglipron accelerate diversification?

- Can Lilly maintain leadership in a fiercely competitive GLP-1 space?

Long-term, Lilly’s position as a leader in diabetes, obesity, and beyond remains strong — but the pressure to execute is enormous. Expect fireworks on earnings day.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion

Shein and Temu Hike Prices as Trump’s 120% Tariff Takes Effect Next Week