The US Department of Justice (DOJ) remains firm in its stance that Google should divest its Chrome browser, a move that could reshape the tech industry and redefine online competition. This development comes as part of the DOJ’s ongoing antitrust case against Google, targeting its alleged monopolistic control over internet search and digital advertising.

Why the DOJ Wants Chrome to Be Separated

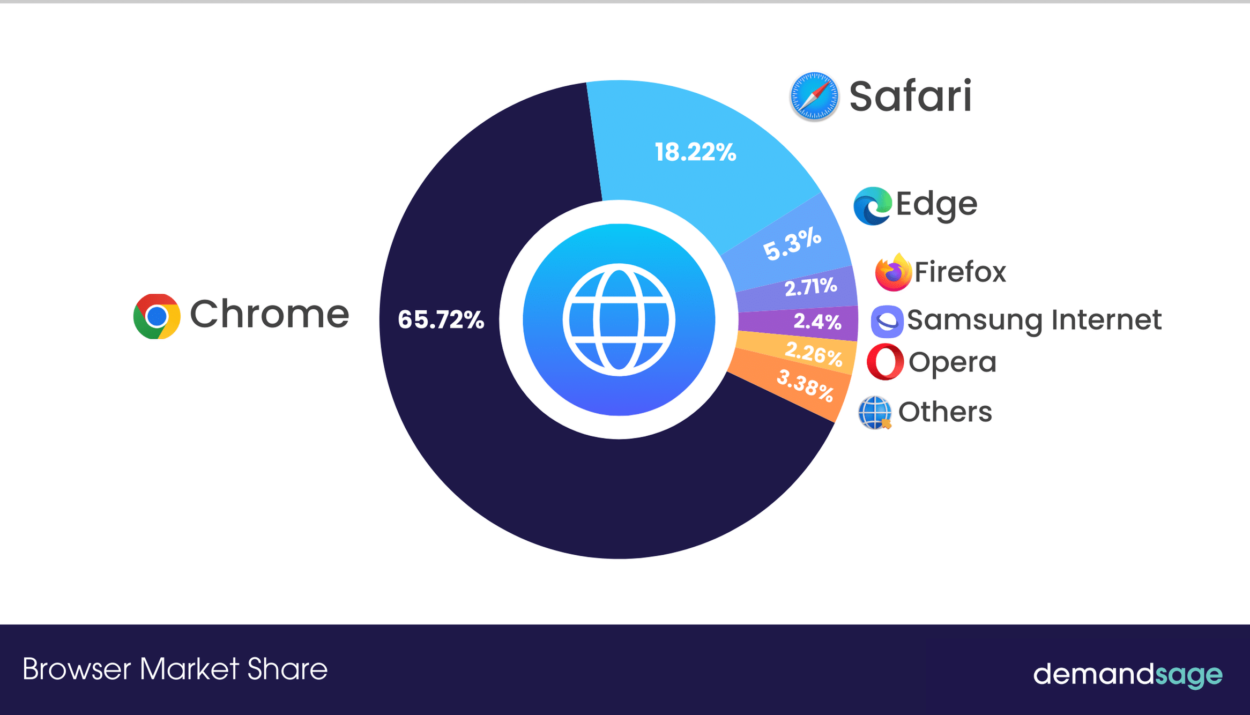

The DOJ argues that Google’s dominance in search, coupled with its ownership of Chrome, gives the company unfair leverage in the digital advertising market. Chrome, the world’s most widely used browser, provides Google with an extensive data pipeline that fuels its ad business. Regulators believe this integration stifles competition and allows Google to prioritize its own services over rivals’.

What This Means for Google

If forced to divest Chrome, Google would lose a major distribution channel for its search engine and advertising business. This could weaken its grip on the web ecosystem and create opportunities for competitors like Microsoft Edge, Apple Safari, and Mozilla Firefox. Google has long argued that its dominance is a result of product superiority rather than anti-competitive behavior.

Impact on Users and the Tech Industry

- More Browser Competition – A standalone Chrome could evolve into a more independent product, potentially integrating better with non-Google search engines.

- Privacy and Data Handling Changes – Google’s tight integration of search, ads, and browser data could be disrupted, leading to potential privacy improvements.

- Digital Advertising Shake-Up – Google’s ad business might face new challenges if it no longer has direct control over Chrome’s data and tracking capabilities.

What’s Next?

The antitrust case against Google is still unfolding, and while the DOJ continues to push for drastic measures, it remains to be seen whether courts will approve such a historic breakup. If successful, this could mark one of the biggest regulatory actions against Big Tech in recent history.

Related:

Next S&P 500 Inclusion Coming: Here are Potential Stock Additions

Congress Trading: A Spotlight on Ecolab (ECL)

Trump’s Bitcoin Reserve: A Game-Changer or a Market Shock?

TSMC and Intel Investments at Risk as Trump Targets $52B CHIPS Act

What Analysts Think of Broadcom Stock Ahead of Q1 Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

The 10 Stocks Hedge Funds Love—and Hate—the Most

Why Is the Stock Market Still Panicking after Nvidia Strong Earnings…?

After Trump announced the US Strategic Crypto Reserve, What’s coming next?

Market Debate: Economic Slowdown or Sector Rotation?