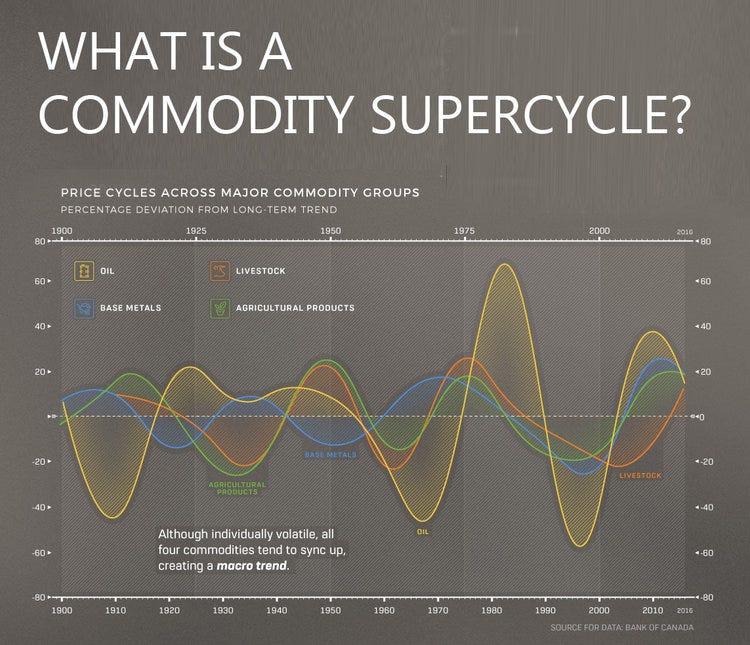

Commodity markets have long followed supercycles — extended periods of rising or falling prices that typically unfold over decades, shaped by massive macroeconomic forces. These supercycles often last 10 to 30 years and are driven by structural shifts such as global industrialization, technological revolutions, policy shifts, demographic transitions, and even geopolitical shocks.

For investors and traders today, understanding where we are in the current supercycle is essential. Not only does it help in spotting lucrative opportunities across sectors like mining, energy, and agriculture, but it also enables effective risk management as global supply chains tighten and inflationary pressures grow.

Let’s explore the drivers, historical patterns, and the outlook for the current commodity supercycle — and importantly, identify where you, as a trader or investor, can position yourself.

What Is a Commodity Supercycles?

A commodity supercycle is a long-term trend where commodity prices rise or fall sharply over an extended period, often in response to fundamental changes in global demand and supply. These trends are not short-term price swings; they are massive waves shaped by decades-long shifts.

For example:

- Rapid industrialization drives up demand for metals, oil, and agricultural commodities.

- Technological breakthroughs create demand for new raw materials (think: lithium for EV batteries).

- Geopolitical shifts like wars or trade sanctions choke or reroute supply chains, spiking prices.

- Monetary and fiscal policies, such as ultra-low interest rates or massive government infrastructure spending, create inflationary pressures that buoy commodity prices.

Today, the transition toward green energy and electric vehicles is creating immense demand for certain key materials, particularly battery metals like copper, lithium, nickel, and cobalt.

Historical Commodity Supercycles

Understanding past cycles helps us see patterns and anticipate future opportunities:

🔹 Post-WWII Boom (1945–1970):

This period saw the reconstruction of Europe and Japan, triggering huge demand for steel, oil, and food products. Copper prices doubled, while oil remained relatively stable. The rebuilding phase ignited global economic growth.

🔹 Oil Shock Era (1970s):

Driven by the 1973 oil embargo and the 1979 Iranian Revolution, oil surged from $3 per barrel to over $30. Gold and precious metals also boomed during this inflationary period.

🔹 China-Led Boom (2000s):

China’s WTO entry in 2001 kicked off massive infrastructure investment. Oil prices soared from $20 per barrel in 2001 to over $140 in 2008. Copper jumped from $0.60 per pound to over $4. This supercycle reshaped global commodity flows, with China as the key demand engine.

These cycles weren’t smooth. There were crashes, corrections, and political disruptions, but the underlying trend was clear: long-term opportunities for well-positioned investors.

Where Are We Now?

Many experts believe we are in the early innings of a new commodity supercycle, fueled by:

- The global energy transition: Electric vehicles, renewable energy projects, and battery technologies require enormous quantities of copper, lithium, cobalt, and rare earth elements. EVs alone use up to 10 times more copper than internal combustion vehicles.

- Massive infrastructure projects: The $1.2 trillion U.S. Infrastructure Investment and Jobs Act, China’s Belt and Road Initiative, and similar programs globally are boosting demand for steel, cement, and critical minerals.

- Geopolitical tensions: The Russia-Ukraine war has disrupted oil, gas, wheat, and fertilizer markets. Brent crude hit $120 per barrel in 2022. The Middle East and global trade routes face ongoing uncertainty.

- Persistent inflation and currency shifts: Commodities traditionally perform well in inflationary environments, offering a hedge when the dollar weakens.

Recent Analyst Quotes

Here’s what top analysts are saying:

- Goldman Sachs: “We expect the next structural bull market in commodities to be led by the green energy transition, creating multi-year demand surges in metals like copper and lithium.”

- JPMorgan: “Despite near-term headwinds, the commodity complex is positioned to benefit from supply constraints and rising capex, especially in mining and energy infrastructure.”

- BMO Capital Markets: “Mining stocks have lagged physical commodity prices, creating a compelling valuation gap for long-term investors.”

- Bloomberg Intelligence: “We project lithium demand to rise over 500% by 2030. Miners positioned to deliver reliable supply will be the biggest beneficiaries.”

Top ETFs and Stocks to Watch

If you want exposure to this megatrend, here are investable names and ETFs aligned with the commodity supercycle:

| Category | Name | Description |

|---|---|---|

| Mining & Metals ETFs | Global X Copper Miners ETF (COPX) | Pure-play copper miner exposure, critical for EV and renewable energy demand. |

| Amplify Lithium & Battery Tech ETF (BATT) | Focused on lithium producers and battery supply chains. | |

| SPDR S&P Metals & Mining ETF (XME) | Broader metals and mining exposure, including steel and aluminum. | |

| Energy & Clean Tech | Albemarle Corp (ALB) | Leading lithium producer for EV batteries. |

| Freeport-McMoRan (FCX) | Major global copper supplier. | |

| Glencore (GLNCY) | Diversified commodities giant with exposure to battery metals. | |

| SolarEdge Tech (SEDG) & Enphase Energy (ENPH) | Key clean energy technology providers benefiting indirectly from metals demand. | |

| Agriculture & Fertilizer | Nutrien (NTR) | One of the largest global fertilizer producers. |

| CF Industries (CF) | Major nitrogen fertilizer supplier. | |

| Archer Daniels Midland (ADM) | Global agricultural commodities leader. |

Potential Risks and Opportunities

While the supercycle presents major upside, investors should remain cautious of:

- Underinvestment in supply chains: Many new copper mines or lithium extraction sites take 10–15 years to reach production, creating supply gaps.

- Geopolitical disruptions: Sanctions, trade restrictions, or conflicts can create both price spikes and logistical bottlenecks.

- Regulatory shifts: Environmental and ESG considerations could slow project approvals or restrict production capacity.

However, long-term trends like electrification, urbanization, and climate change adaptation are structural forces that will likely continue fueling this supercycle.

Final Takeaway: How to Position

- Diversify exposure: Balance between physical commodities, producers, and emerging tech tied to resource demand.

- Monitor macro trends: Inflation, interest rates, and global policy decisions will shape price dynamics.

- Stay flexible: Supercycles are long, but they include sharp corrections — be ready to rebalance.

- Consider emerging markets: Nations rich in natural resources (South America, Africa, Southeast Asia) stand to benefit, offering unique equity and bond opportunities.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance