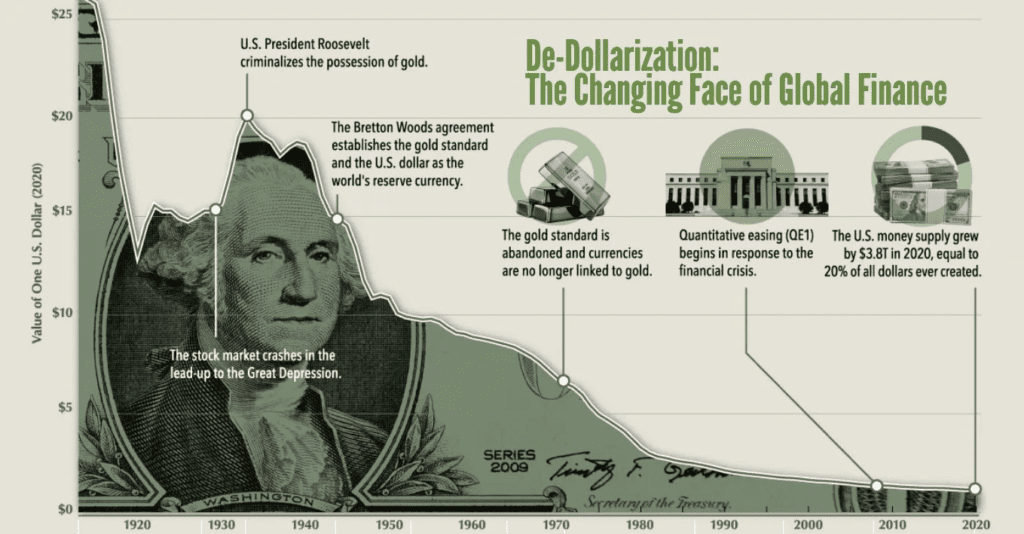

The U.S. dollar has reigned as the world’s most powerful currency for decades — dominating global trade, central bank reserves, and commodity markets. But a silent revolution is gaining speed. De-dollarization — the process of reducing reliance on the dollar in global financial systems — is no longer just a theory. It’s happening now, driven by geopolitics, technology, and economics.

In this new landscape, understanding the mechanics of de-dollarization is essential for investors, policymakers, and anyone with a stake in global markets.

What Is De-Dollarization?

De-dollarization refers to countries intentionally reducing their dependence on the U.S. dollar for trade, investment, and foreign currency reserves. This shift is not just about avoiding U.S. sanctions — it’s about building financial sovereignty and resilience in a world increasingly shaped by multipolar power dynamics.

Despite the dollar still accounting for:

- 60% of global central bank reserves

- 88% of international trade settlements

…its grip is slowly loosening.

Why Is It Happening Now?

1. Geopolitical Fragmentation

The weaponization of the dollar — such as using SWIFT bans and financial sanctions — has led countries like Russia, China, and Iran to seek alternatives.

Sanctions on Russia after the Ukraine invasion served as a wake-up call to many nations: reliance on the dollar can be a vulnerability.

2. Strategic Diversification

Central banks are diversifying their assets. The dollar’s share of global reserves fell to 58% in 2023, the lowest in 25 years, while gold reserves surged to a record 35,000 tons.

3. Technological Innovation

The rise of Central Bank Digital Currencies (CBDCs) and blockchain-based payment systems is enabling countries to settle cross-border payments without the dollar.

🔹 China’s digital yuan has already processed over $100 billion in pilot transactions.

🔹 Project mBridge — a cross-border CBDC project involving China, UAE, Hong Kong, and Thailand — is already live-testing real settlements.

Who Are the Key Players?

China

- As of 2023, 30% of China’s trade was settled in yuan, up from 15% in 2020.

- The Belt and Road Initiative (BRI) has helped China build trade agreements that promote the yuan.

- With over 140 countries participating in BRI, this gives China massive leverage to push de-dollarization globally.

Russia

- Post-sanctions, 80% of Russia-China trade is now conducted in local currencies, compared to just 10% a decade ago.

- Russia has also ramped up gold purchases to insulate its reserves.

BRICS Nations (Brazil, Russia, India, China, South Africa)

- Representing over 25% of global GDP, BRICS is exploring a joint currency for trade and reserves.

- BRICS+ (with new additions like Iran, Egypt, and Saudi Arabia) aims to challenge Western financial institutions by creating alternative systems.

India

- India and the UAE recently agreed to trade oil in Indian rupees, bypassing dollar pricing.

- India is also working on digital rupee infrastructure for future cross-border payments.

What Does De-Dollarisation Mean for Global Markets?

1. U.S. Treasuries Could Take a Hit

If global central banks reduce their demand for U.S. bonds:

- Yields will rise

- Borrowing costs for the U.S. government will increase

- The U.S. deficit could become harder to fund

In 2025 alone, interest payments on U.S. debt are projected to cross $1 trillion if yields remain elevated.

2. Volatility in Commodity Pricing

With more commodities priced in yuan, rupees, or euros, traditional pricing benchmarks may face disruption.

Oil, metals, and food could become more volatile due to currency risk and fragmented pricing models.

3. Gold’s Return as a Monetary Anchor

As fiat currencies wobble under rising debt and inflation, central banks are returning to gold.

Gold is:

- A neutral reserve asset

- Immune to sanctions

- A proven inflation hedge

In the 1970s, during the last great monetary reset, gold prices rose 1,600%. Today’s rising central bank purchases signal a similar long-term trend may be unfolding.

4. Empowerment of Emerging Markets

Countries like Indonesia, Brazil, Nigeria, and Turkey are using local currencies in trade agreements.

This reduces exposure to dollar volatility and gives them greater control over monetary policy and inflation management.

What the Future Looks Like

A Gradual Decline, Not a Collapse

The dollar won’t vanish overnight. But its share of reserves could fall from 58% to 50% or lower over the next decade.

CBDCs Will Reshape Settlement

Digital currencies will likely accelerate the move away from traditional SWIFT systems. This reduces costs, increases speed, and reduces dependency on dollar-based settlement infrastructure.

Multipolar Currency Order

In 2035, we could see a tripolar world:

- The dollar dominant in the Americas

- The euro and yuan leading in Europe and Asia

- Gold and digital assets rising as neutral global stores of value

The Investor’s Take

As the global currency order shifts, staying ahead means:

- Diversify away from USD-heavy assets

- Increase exposure to gold and commodities

- Monitor BRICS, CBDC developments, and sovereign gold purchases

- Watch the bond market and U.S. yield curve closely

The key lesson? Don’t anchor your portfolio to a fading system.

This is the era of strategic realignment — and those who adapt early will be best positioned to grow and protect wealth.

De-dollarization is not a conspiracy theory — it’s policy and it’s accelerating.

Whether you’re an investor, policymaker, or global citizen, the transition to a new monetary world order is no longer a question of if, but when.

The dollar may still dominate. But in the age of digital currencies, gold-backed diplomacy, and geopolitical flux — it no longer rules alone.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance