Palantir Technologies (NYSE: PLTR) has seen a significant stock surge, rising nearly 22% after its Q4 2024 earnings report exceeded expectations. The company reported $828 million in revenue, reflecting a 36% year-over-year increase, and adjusted EPS jumped 75% to $0.14. Its U.S. commercial revenue grew 64%, while U.S. government contracts increased 45%. With these strong numbers, Palantir projects 31% revenue growth in 2025, further fueling investor optimism.

As a result, Palantir’s stock has climbed to $107.82 as of February 6, 2025, reflecting a 6.37% increase from the previous close. The market’s excitement around Palantir’s AI capabilities and government contracts has been a driving force behind this rally.

Bearish Voices Raise Concerns Over Valuation

Despite the bullish momentum, some investors remain skeptical about Palantir’s long-term financial health. A post on StockTwits by user Nousernameo highlights these concerns, stating:

“Palantir’s current valuation is irrational. The company’s core business generates negative cash flow once you deduct stock-based compensation (which dilutes shareholders) and proceeds from stock option exercises (which are not a sustainable source of cash). The reported cash flow is heavily inflated by non-cash expenses and financing activities rather than genuine operational profitability.”

Breaking Down Palantir’s Cash Flow Situation

While Palantir has posted strong revenue and earnings growth, its cash flow situation is more complicated. The company is profitable on paper, but its reliance on non-cash expenses and financing activities raises concerns about long-term sustainability.

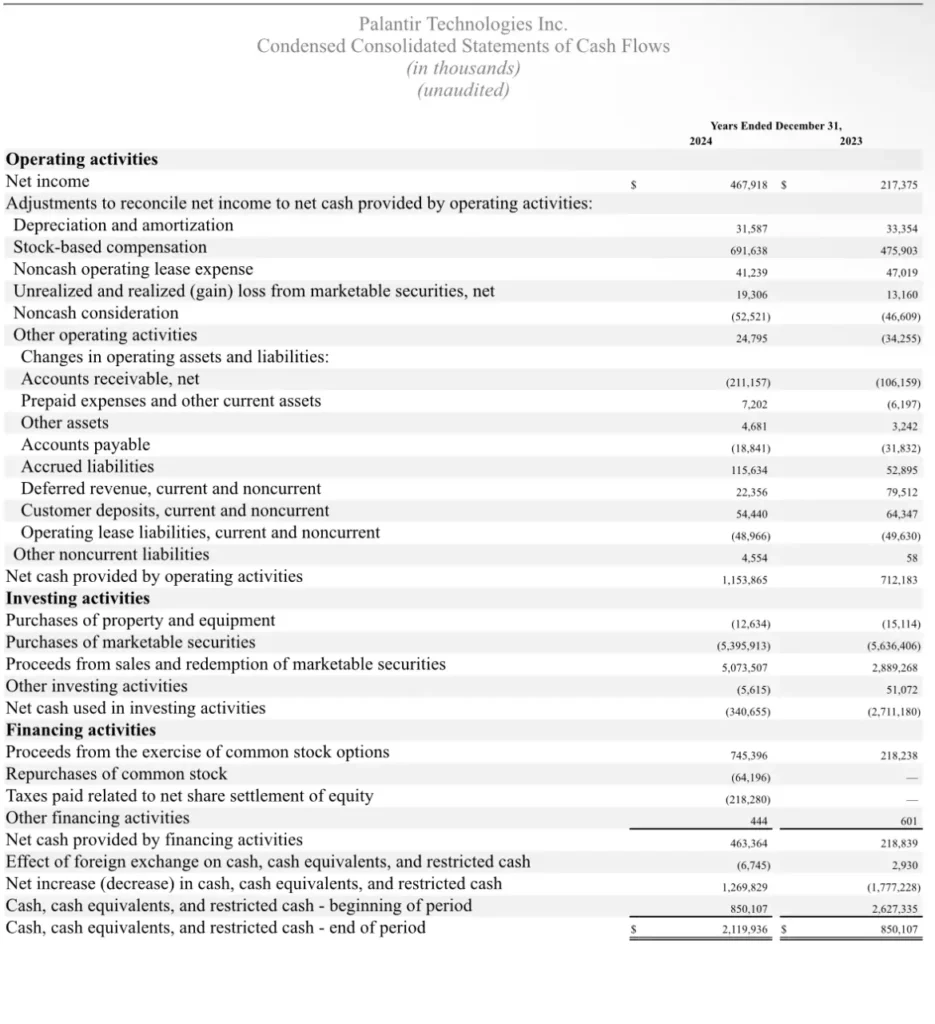

1. Stock-Based Compensation (SBC) is a Major Expense

- $691.6 million in stock-based compensation (SBC) in 2024, up from $475.9 million in 2023.

- SBC is a non-cash expense, but it dilutes shareholders over time.

- If you deduct SBC from net income, Palantir’s core operating profitability looks weaker.

2. Net Cash Flow from Operations is Strong, but Heavily Influenced by Non-Cash Adjustments

Palantir reported $1.15 billion in net cash from operating activities, which seems strong, but this includes:

- Depreciation & amortization: $31.6 million

- SBC: $691.6 million

- Unrealized gains/losses on marketable securities: $19.3 million

- Changes in working capital (e.g., accounts receivable: -$211.2 million)

Without these non-cash adjustments, actual cash generated from operations would be significantly lower.

Palantir is not generating strong cash flow purely from selling its services.

3. Financing Activities Contribute Significantly to Cash Flow

- $745.4 million from stock option exercises (which is not a long-term revenue source).

- -$64.2 million in stock buybacks.

- -$218.3 million in taxes paid for net share settlements.

- Net financing cash flow: $463.4 million.

Palantir is still relying on stock option exercises to fund operations, which is not sustainable long term.

If employees stop exercising stock options (or if the stock price declines), this cash flow could disappear.

4. Investing Activities Show Heavy Spending

- Purchases of marketable securities: $5.4 billion.

- Proceeds from marketable securities: $5.1 billion.

- The company is aggressively managing its cash reserves, but this is not core business cash flow.

5. Bottom Line: Is the Cash Flow Inflated?

✔ Yes, to some extent.

- A large portion of Palantir’s reported cash flow is from non-cash adjustments (SBC) and financing activities (stock option exercises).

- True free cash flow (excluding SBC and stock option proceeds) would be much lower.

- Palantir is not yet generating strong cash flow from its core business.

Does Palantir Have Enough Cash Flow?

✔ Yes, in the short term:

- $1.27 billion net cash increase in 2024, ending the year with $2.12 billion in cash.

- Strong 36% revenue growth and $467.9 million in net income.

- Expanding U.S. commercial and government contracts provide steady cash inflows.

❌ Long-term sustainability concerns:

- $691.6 million in stock-based compensation (SBC) inflates cash flow, diluting shareholders.

- $745.4 million from stock option exercises, which is not a sustainable cash source.

- Weaker free cash flow once SBC is deducted, raising concerns about organic profitability.

Conclusion: Bullish Momentum vs. Financial Reality

Palantir has strong short-term cash reserves and revenue growth, but its reliance on stock-based compensation and stock options raises concerns about long-term sustainability. If SBC expenses remain high and stock option proceeds decline, Palantir may struggle to maintain strong free cash flow without external financing or greater operational efficiency.

While investors are excited about Palantir’s AI and government deals, bearish analysts warn that its valuation might be inflated by non-cash expenses rather than true operational profitability. The question remains: Will Palantir sustain its growth, or will these concerns catch up with it?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of Amazon Stock Ahead of Earnings: Prediction

After quietly hit a record high, Gold is telling us something

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Trump’s Media Group Files for Bitcoin ETF: A Game-Changer for DJT?