The latest 13F filings for Q1 2025 are in, offering a fresh look at where some of the world’s most influential investors are placing their bets — and what they’re walking away from. With nearly $300 billion in combined portfolio value across firms like Berkshire Hathaway, Pershing Square, Appaloosa Management, Scion Asset Management, and NVIDIA’s disclosed holdings, these filings provide critical insight into the strategies shaping Wall Street’s future.

While Warren Buffett continues to lean into his core blue-chip favorites with a few high-conviction adds, Bill Ackman is betting big on Uber and trimming back tech and hospitality. Meanwhile, David Tepper took an aggressive stance on rebalancing, cutting large swaths of his tech exposure. Michael Burry, in a sharp pivot, dumped every position except one. And NVIDIA, fresh off its meteoric AI rise, kept its strategic holdings untouched.

Let’s break down each portfolio in full detail:

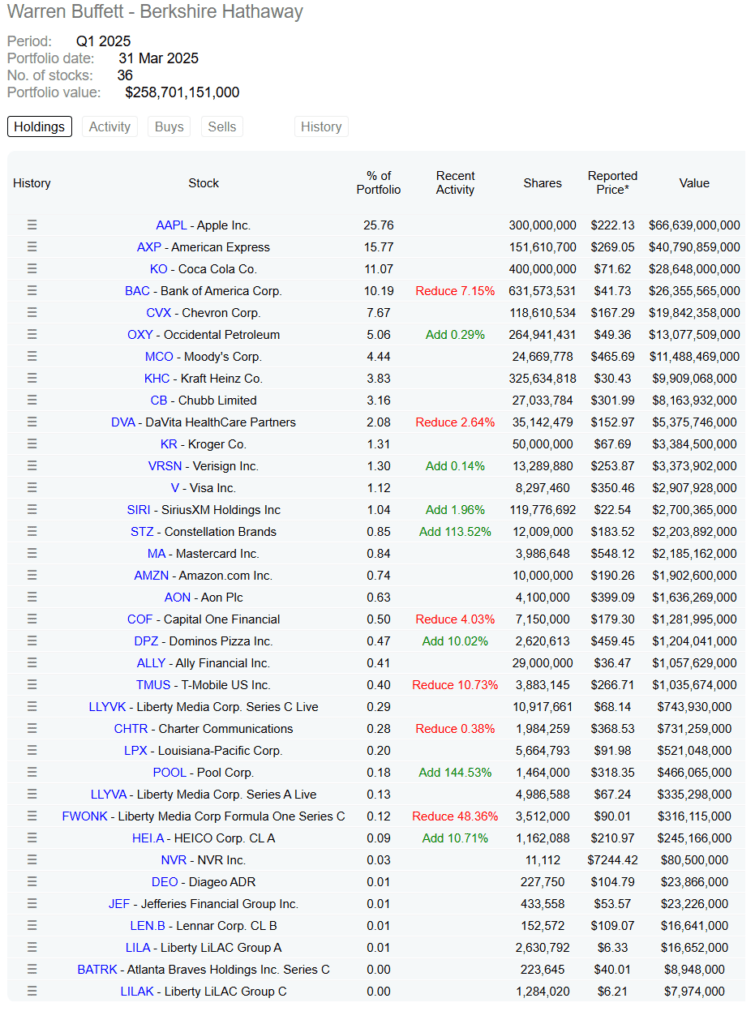

Warren Buffett – Berkshire Hathaway

Total Portfolio Value: $258.7 Billion

Number of Stocks: 36

Buffett’s Q1 moves reflect a mix of quiet conviction and bold bets. While he modestly trimmed positions in major banks and telecom, he aggressively added to names like Constellation Brands ($STZ) and Pool Corp ($POOL), increasing those stakes by more than 100%. The Oracle of Omaha also added to $OXY, $SIRI, and $VRSN. Notably, he exited $NU and $C entirely.

Bill Ackman – Pershing Square Capital Management

Total Portfolio Value: $11.93 Billion

Number of Stocks: 11

Ackman made waves this quarter by closing out his position in $NKE—only to clarify later that it had been replaced by over-the-counter call options of equal value. More notably, Pershing took a brand-new position in $UBER, now the firm’s largest holding. Ackman also doubled down on $BN (Brookfield), $HTZ (Hertz), and $GOOGL (Alphabet Class A), while trimming exposure to $GOOG (Class C), $CMG, $HLT, and $CP.

- New Buy:

- $UBER (30.3M shares, $2.21B)

- Exited:

- $NKE (replaced by OTC calls)

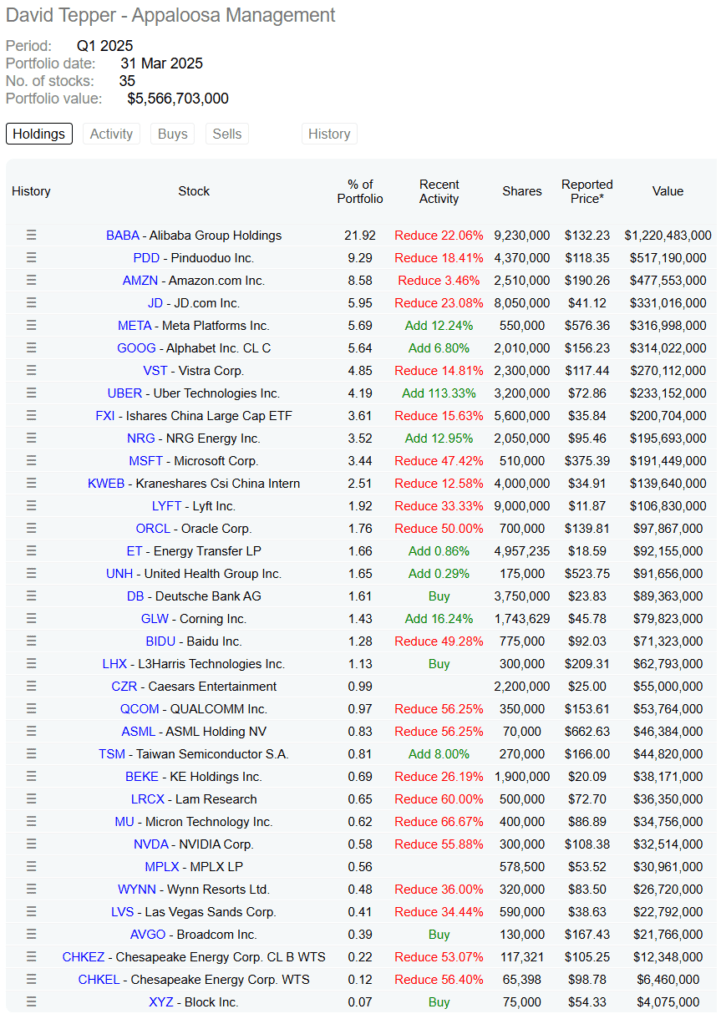

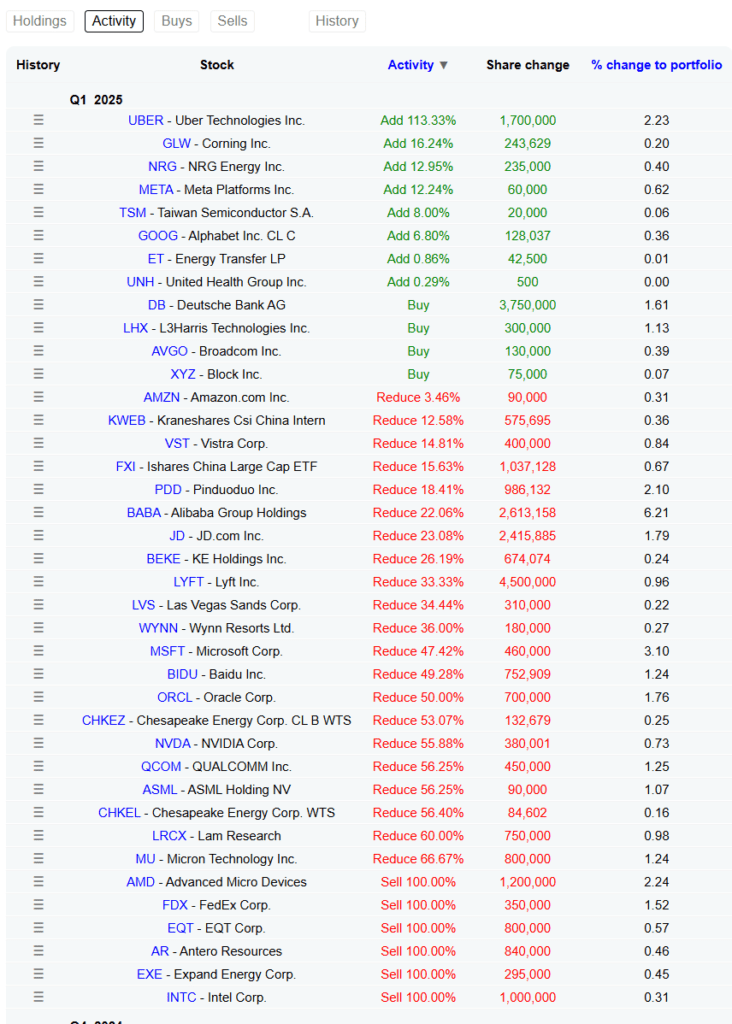

David Tepper – Appaloosa Management

Total Portfolio Value: $5.57 Billion

Number of Stocks: 35

Tepper made aggressive reallocations in Q1, selling off large portions of major names including $MSFT, $NVDA, $QCOM, and $MU. He exited entirely from six companies, including $AMD and $INTC, while adding multiple new positions. $UBER was one of his biggest buys, with shares increasing by 113%. He also opened new stakes in $DB, $AVGO, $LHX, and $XYZ.

- New Positions:

- $DB, $AVGO, $LHX, $XYZ

- Fully Exited:

- $AMD, $FDX, $EQT, $AR, $EXE, $INTC

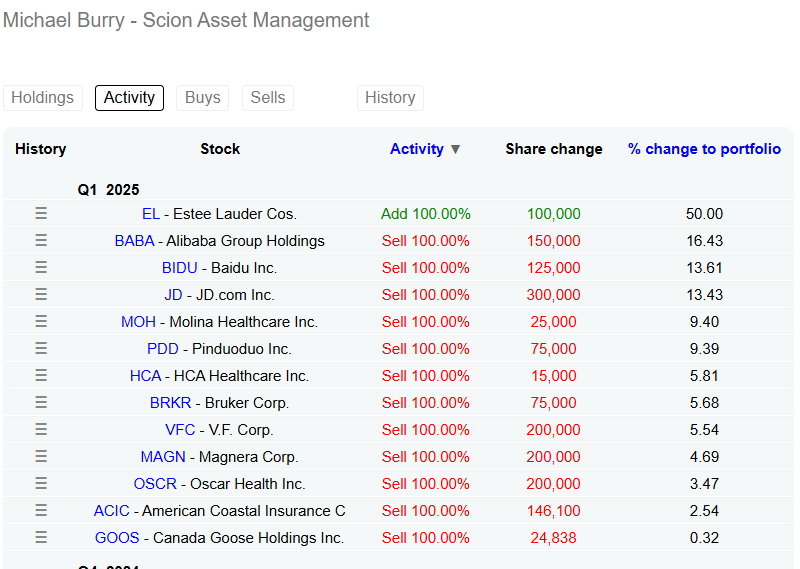

Michael Burry – Scion Asset Management

Portfolio Status: Now almost fully in cash

In a bold move reminiscent of 2022, Michael Burry liquidated every single holding from his portfolio—except for $EL (Estée Lauder), which now makes up 100% of Scion’s disclosed investments. He dumped all China exposure and exited $BABA, $JD, $BIDU, and $PDD entirely.

- New Holding:

- $EL (100K shares, 50% of previous portfolio value)

- Fully Sold:

- $BABA, $JD, $BIDU, $MOH, $PDD, $HCA, $BRKR, $VFC, $MAGN, $OSCR, $ACIC, $GOOS

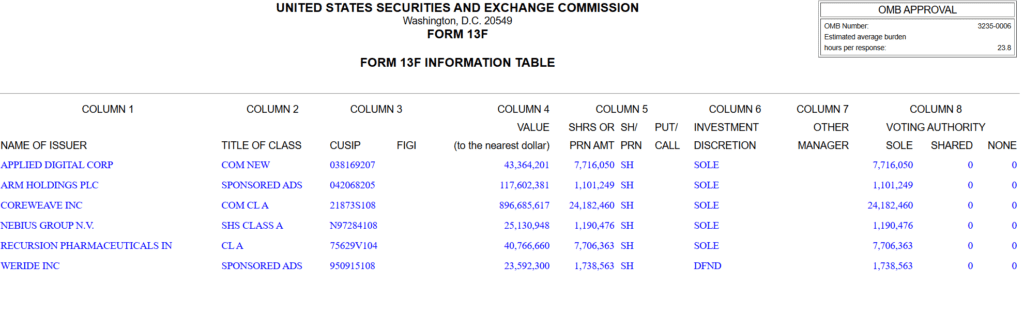

NVIDIA – 13F-HR Filing

Reported Position Status: No changes reported

NVIDIA’s latest 13F-HR filing showed no new buys or sales. The firm continues to hold high-tech and AI-related firms including: $ARM, $APLD, $CRWV, $NBIS, $RXRX, $WRD

Summary by Action

Most Bought Stocks:

- UBER: Ackman (new buy), Tepper (+113%)

- Brookfield (BN): Ackman +17.52%

- GOOGL: Ackman +11.33%, Tepper +6.8%

- Estee Lauder (EL): Burry +100%

- POOL & STZ: Buffett +144% and +113% respectively

- DB, AVGO, LHX, XYZ: Tepper new buys

Most Sold or Reduced Stocks:

- Nike (NKE): Ackman exited, replaced with options

- Alibaba (BABA): Tepper -22%, Burry sold 100%

- JD.com: Tepper -23%, Burry exited

- Microsoft (MSFT): Tepper -47.42%

- NVDA, QCOM, ASML, ORCL: Tepper large reductions (50%+)

- BAC (Bank of America): Buffett -7.15%

Stocks Still Held by Multiple Funds:

- GOOG/GOOGL: Held by both Ackman & Tepper

- Uber: Strongest shared buy this quarter (Ackman & Tepper)

- Amazon (AMZN): Held by Buffett & Tepper (both reduced)

What These Moves Signal

The Q1 2025 13F filings show a market in transition. Big tech saw notable selling pressure from hedge funds like Appaloosa and Scion, while Buffett and Ackman leaned into safer or high-upside opportunities like $POOL, $UBER, and $STZ. Across the board, we’re seeing a more selective, defensive posture, with a few bold bets.

While institutional portfolios are not always forward indicators, they do reveal where billionaires believe opportunities—or risks—are emerging. Whether it’s Buffett adding to legacy consumer names or Ackman shifting into ride-sharing, the signals are clear: selectivity, conviction, and hedging are the names of the game in 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump & US Executives Lock In Over $1 Trillion in Middle East Deals

Qatar Buys 160 Boeing Jets as Trump Accepts $400M Gift Jet

Elon Musk, Robotaxis, and Starlink: Inside Multi-Billion Dollar US–Saudi Tech Power Play

Nvidia’s Partnership With Saudi Arabia Opens a New Frontier in Global AI

Trump Secures $600 Billion Saudi Investment in US Tech, Energy, and AI

US Drug Price Revolution Begins: Trump Targets 30–80% Cuts

US and China announce deal to cut reciprocal tariffs for 90 days