- Investors seeking more diversification should look beyond the S&P 500.

- An equal-weight index fund will invest just as much in smaller companies as in the big names.

- Adding a small-cap fund will add exposure to a group of stocks that historically outperforms.

Investing in the Vanguard S&P 500 ETF (VOO 0.08%) is a popular strategy for guaranteed stock market returns, thanks to its low expense ratio and strong performance. Even Warren Buffett invests in it. However, with the index heavily concentrated in Microsoft, Nvidia, and Apple, which together account for over 20% of its value, investors might consider diversifying further.

Here are three ETFs that offer broader diversification:

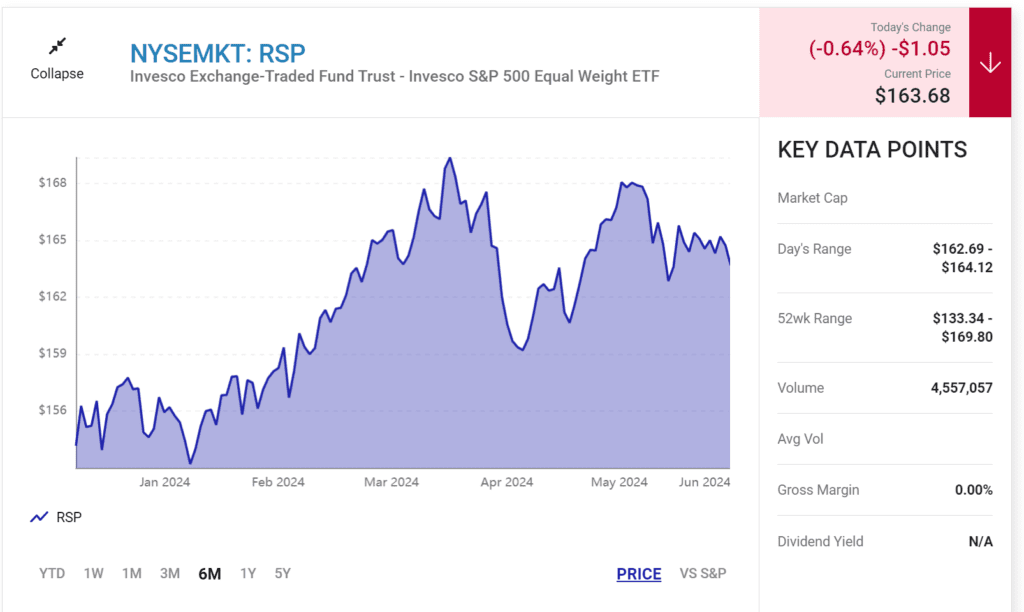

Invesco S&P 500 Equal Weight ETF (RSP -0.64%)

This ETF invests equally in all S&P 500 companies, rebalancing quarterly to maintain equal weightings. Historically, it has outperformed the cap-weighted index by spreading investment across a diverse range of companies. The expense ratio is 0.2%, higher than Vanguard’s, but it increases exposure beyond the top three tech giants.

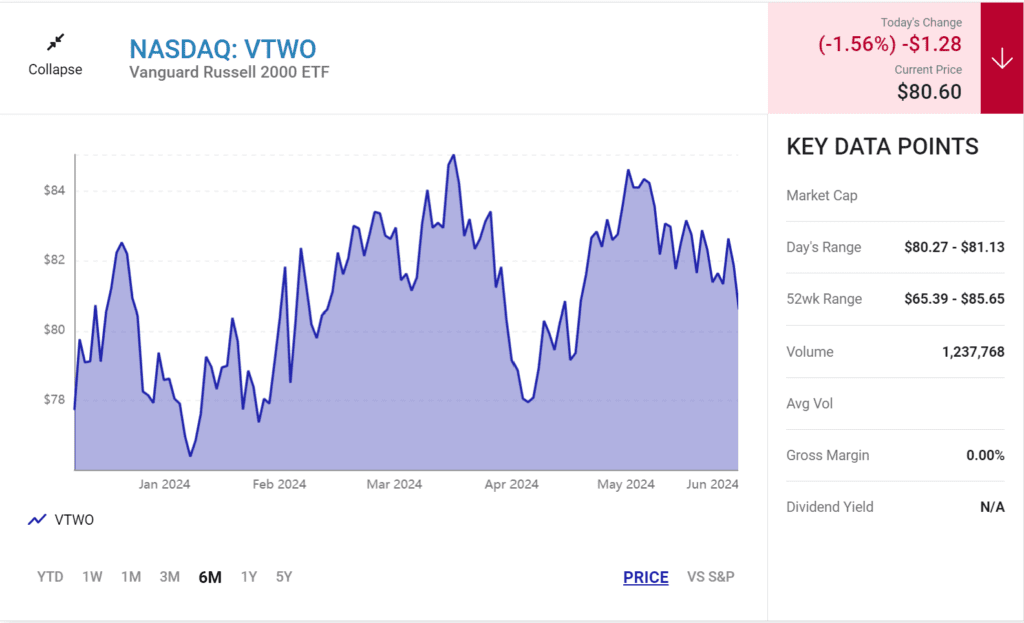

Vanguard Russell 2000 ETF (VTWO -1.56%)

Tracking the small-cap Russell 2000 index, this ETF provides exposure to over 2,000 smaller companies beyond the S&P 500. Small caps have historically outperformed large caps over the long run, though they have lagged since 2014. With an expense ratio of just 0.1%, it offers a low-cost way to invest in smaller companies that might be poised for a comeback.

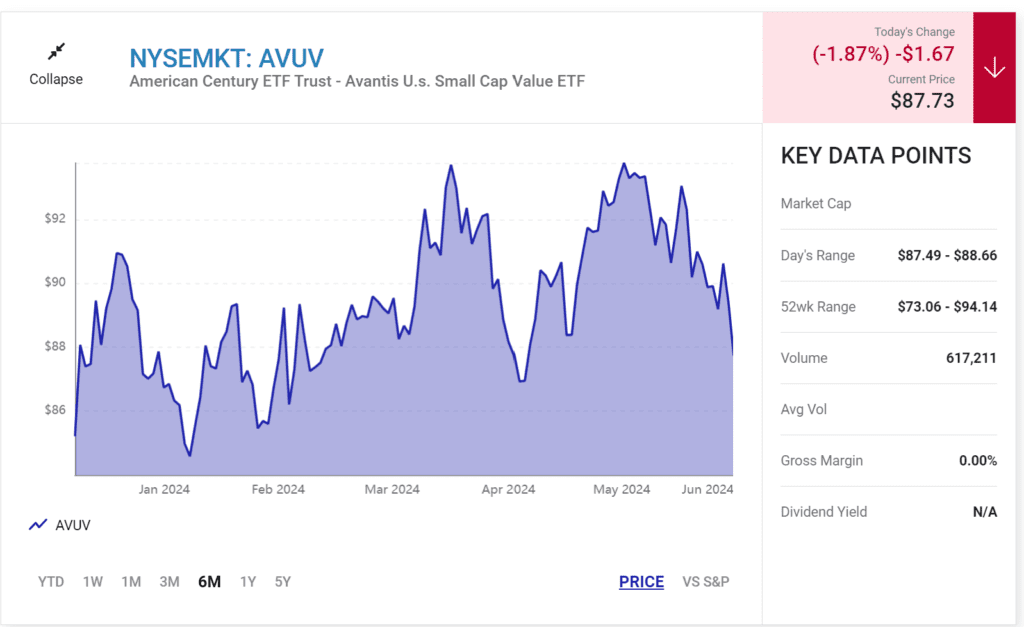

Avantis U.S. Small Cap Value ETF (AVUV -1.87%)

This ETF focuses on small-cap value stocks, which have historically outperformed larger companies. It selects and weights stocks based on profitability and valuation metrics, aiming to outperform the Russell 2000 value index.

Although it’s actively managed, it functions like a passive index fund with an expense ratio of 0.25%. The management team has a strong performance track record.

Investing in these ETFs can help achieve a more balanced and diversified portfolio, potentially enhancing long-term returns beyond the S&P 500.