A bear market is typically defined as a 20% drop or more from a recent peak in major indices like the S&P 500 or Nasdaq. But more than just numbers, it’s a psychological test for every investor.

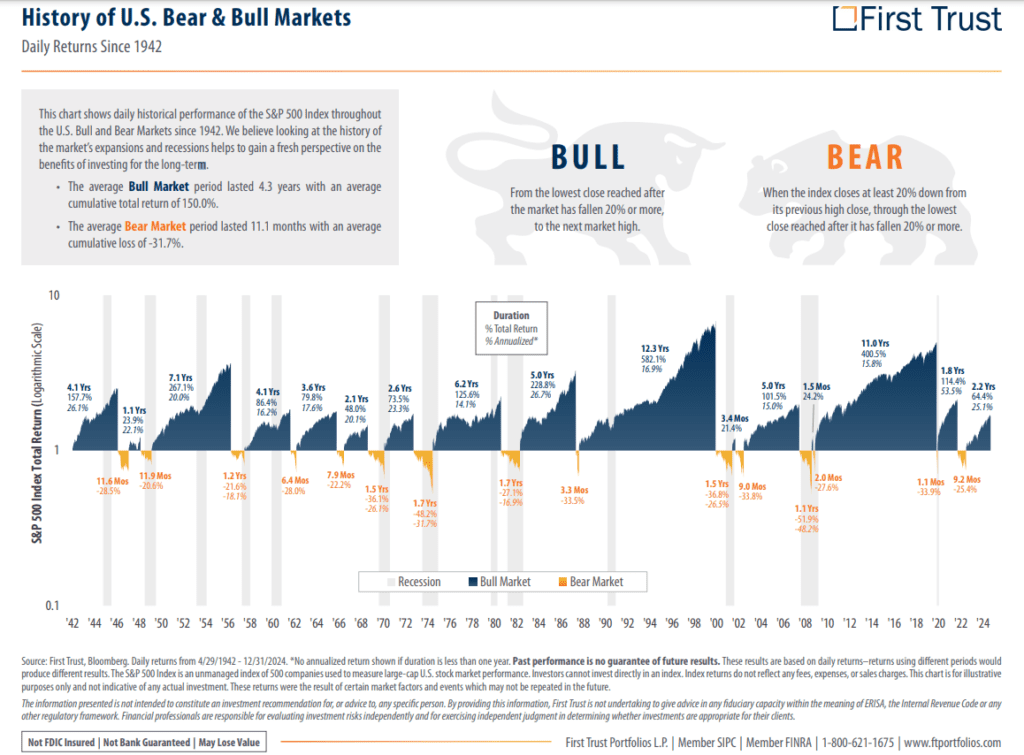

Since 1945, the S&P 500 has gone through 15 bear markets:

- Average decline: -32%

- Average time to bottom: 11 months

- Average time to recover: 1.7 years

If current trends follow the average, we may bottom out within the next year and recover by late 2026.

“You make most of your money in a bear market — you just don’t realize it at the time.” – Shelby Cullom Davis

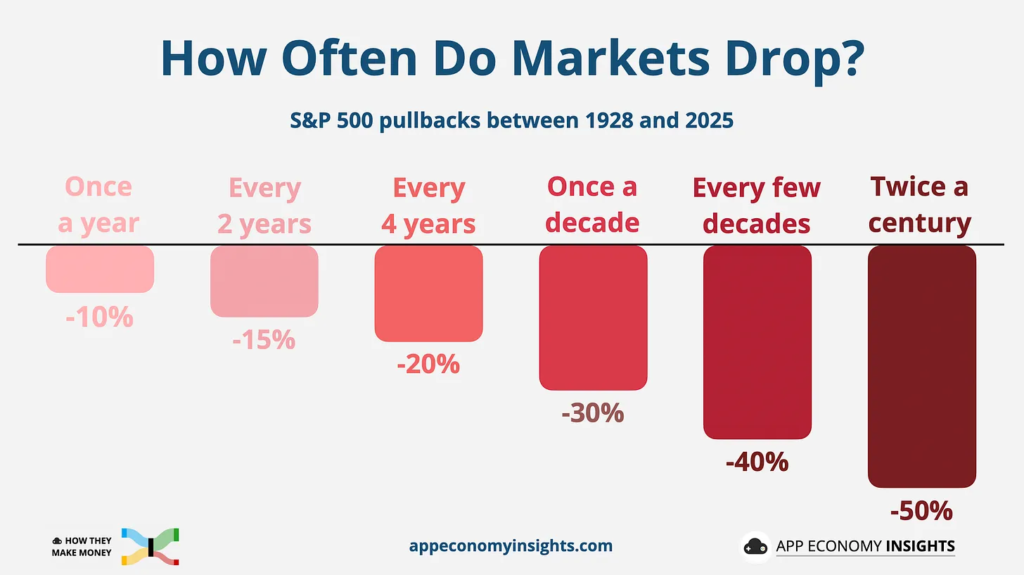

Bear markets are not anomalies — they’re built into the DNA of investing. The only real question is: how will you respond?

What History Tells Us

Bear markets feel endless when you’re in them. But history tells a different story:

- 12 of the last 15 bear markets saw full recoveries in under three years

- Only outliers like 1973-74, 2000, and 2008 took longer due to deep structural issues

Importantly, market rebounds often begin before the economy improves. If you wait for clarity, you may miss the strongest gains.

Peter Lynch: “Every recovery since WWII has been preceded by a market rally — and those rallies begin when conditions still look bleak.”

Why most investors underperform:

- Trying to time the bottom

- Waiting for headlines to turn positive

- Listening to “this time is different” narratives

Yes, every recession is different — but recovery always follows.

On average:

- Recessions last ~11 months

- Expansions last ~6 years

So why spend years preparing for downturns… when they’re short, often priced in, and inevitably followed by growth?

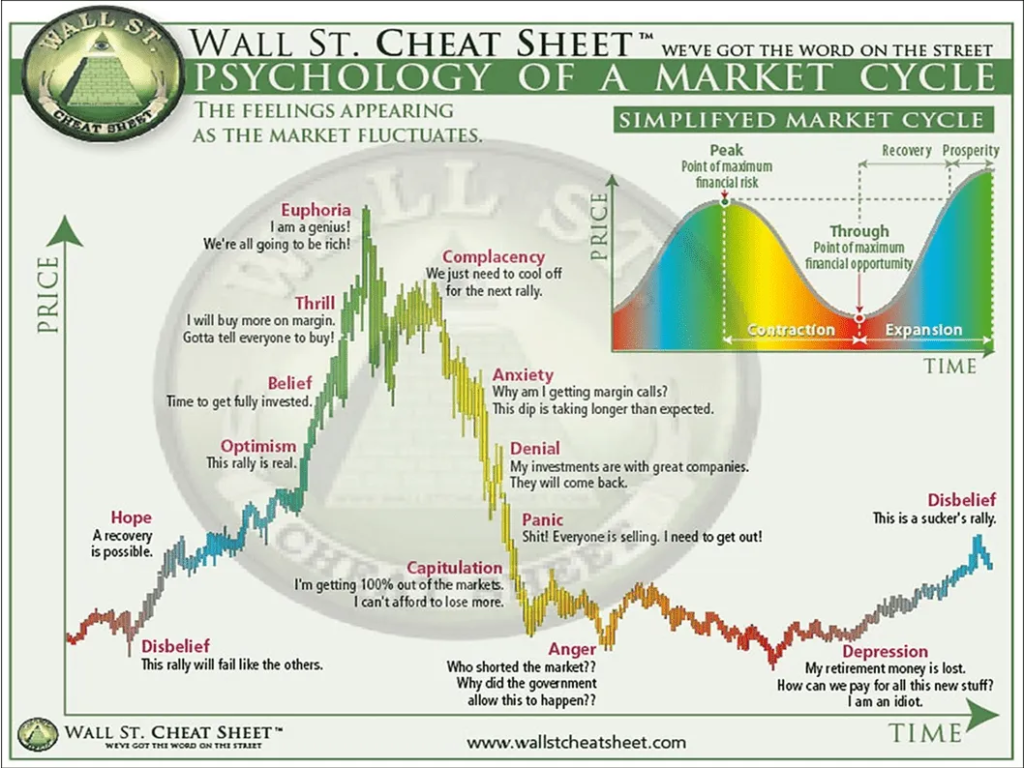

The Psychology of Downturns

The biggest threat in a bear market isn’t your portfolio — it’s your mindset. When prices drop:

- You feel like it’s only going to get worse

- Every small rebound feels like a trap

- Fear hijacks your long-term perspective

And here’s the catch:

Most portfolio damage doesn’t come from bad stocks — it comes from bad decisions made under stress.

Your job is not to forecast the bottom. It’s to avoid panic and stick to your process. Common emotional traps:

- Extrapolating losses (“20% down = 50% coming”)

- Freezing and hoarding cash

- Confusing volatility with permanent loss

In short, volatility is the price of admission for long-term returns.

How to Stay Invested (Even When It Hurts)

Discipline beats prediction. You don’t need to be brilliant — you need to be consistent. The secret weapon? A system. Here’s a simple 4-rule framework:

- Invest monthly — don’t try to time the market

- Avoid doubling down on losers

- Don’t panic-sell winners

- Invest with a 5+ year horizon

Why this works:

- Spreads risk

- Forces action when others freeze

- Removes emotion from the equation

- Gives compounding time to work

Want to go one level deeper? Start journaling your decisions:

- Why am I buying?

- What would break my thesis?

- How does this fit my long-term goals?

Writing down your reasoning builds clarity and helps fight emotional overreactions.

Adam Smith: “If you don’t know who you are, the market is an expensive place to find out.”

And before any major decision? Sleep on it. If it can’t wait 24 hours, it’s probably emotion-driven.

How to Find Opportunities

This is when the next generation of winners goes on sale. Bear markets are clearance racks for quality businesses. But only those who are prepared will recognize it. What to focus on:

- Companies with strong fundamentals

- Positive cash flow and low debt

- Durable competitive moats

- Ability to invest through downturns

Strategy: Use a rule-based approach for new positions — e.g., only invest when P/E < 20, or add in equal amounts over multiple months.

Revisit your watchlist: Those stocks that felt too expensive last year? They might be fairly priced or undervalued now.

Use regret-minimization: Would you regret not buying this stock if it doubles in 5 years?

Your Bear Market Checklist

Let’s wrap up with a simple, repeatable checklist to stay focused when the world looks shaky:

✅ Zoom Out

Bear markets are part of the cycle — and recoveries tend to last much longer than the downturns.

✅ Stay Calm

You don’t need perfect timing. You need to avoid panic and stick to the plan.

✅ Automate Your Strategy

Monthly contributions, pre-set buying rules, and journaling will help keep emotions in check.

✅ Focus on Resilience

Buy companies that can survive — and lead — in the next cycle.

✅ Buy Selectively

When prices fall, future returns rise. Use that to your advantage.

✅ Be Patient

Compounding doesn’t reward speed. It rewards time + consistency.

Charlie Munger: “If you’re not willing to react with equanimity to a 50% market decline… you’re not fit to be a common shareholder.”

Final Word

This isn’t just about surviving — it’s about positioning yourself to thrive. Bear markets don’t break great investors — they build them.

Volatility is uncomfortable. But so is missing the rebound. The next bull market always starts quietly, when few are looking.

Be the investor who’s ready.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

De-Dollarization: The Global Shift That Could Redefine the Future of Money

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance