Apple reports its Q2 2025 earnings on Thursday, May 2, after market close, and the stakes are high. As the world’s largest public company, Apple’s results will ripple through global markets, shape tech sentiment, and test the resilience of a trillion-dollar brand facing slowing hardware growth, rising tariffs, and the AI arms race.

Here’s a deep dive into what to expect, what’s driving results, where the risks lie, and how Wall Street is positioning.

Expected Q2 2025 Results

What’s at stake:

The Street will dissect every line item, from iPhone demand to Services margins.

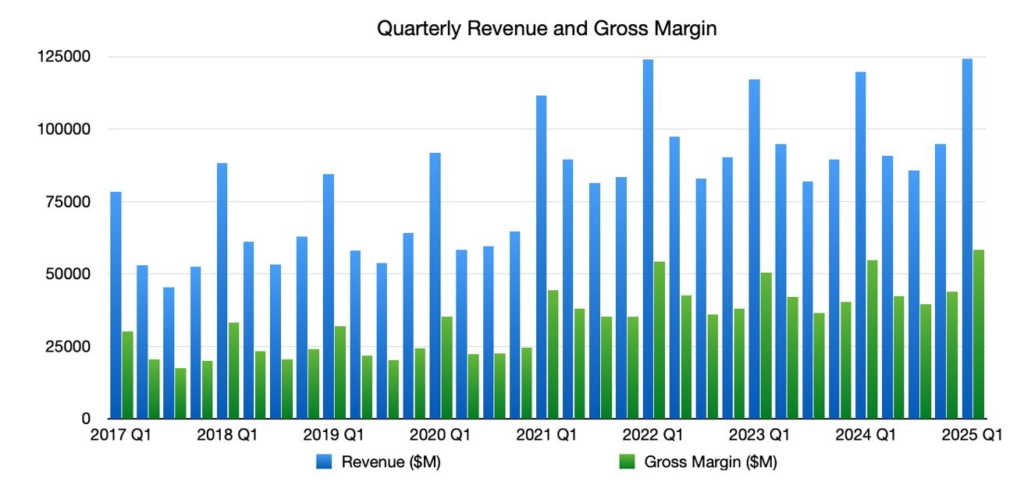

- Revenue: ~$95.1B (consensus; MarketBeat, Nasdaq)

- EPS: $1.51 per share (consensus; Yahoo Finance)

- Previous Year Revenue: $94.8B

- Previous Year EPS: $1.52

- 2025 EPS Trend: Recently trimmed on concerns over China and tariffs

Why it matters: This is a “show-me” moment for Apple. After underwhelming hardware growth last year, investors want reassurance that Services, Wearables, and AI can reignite topline momentum.

Key Focus Areas

Let’s break down the product-level and macro drivers shaping Apple’s quarter.

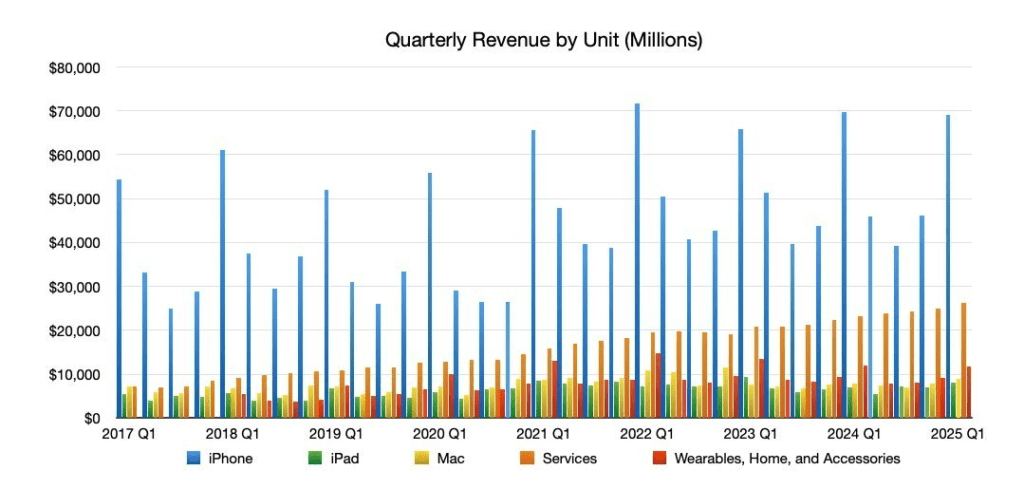

✅ iPhone Demand

iPhone is Apple’s profit engine, and its performance is critical.

- Market chatter points to steady iPhone 15 demand in the U.S. and Europe, but softness in China due to economic slowdown and Huawei’s resurgence.

- Supply chain checks suggest “OK but not great” volumes; expectations are low, so a slight beat could boost shares.

Why it matters:

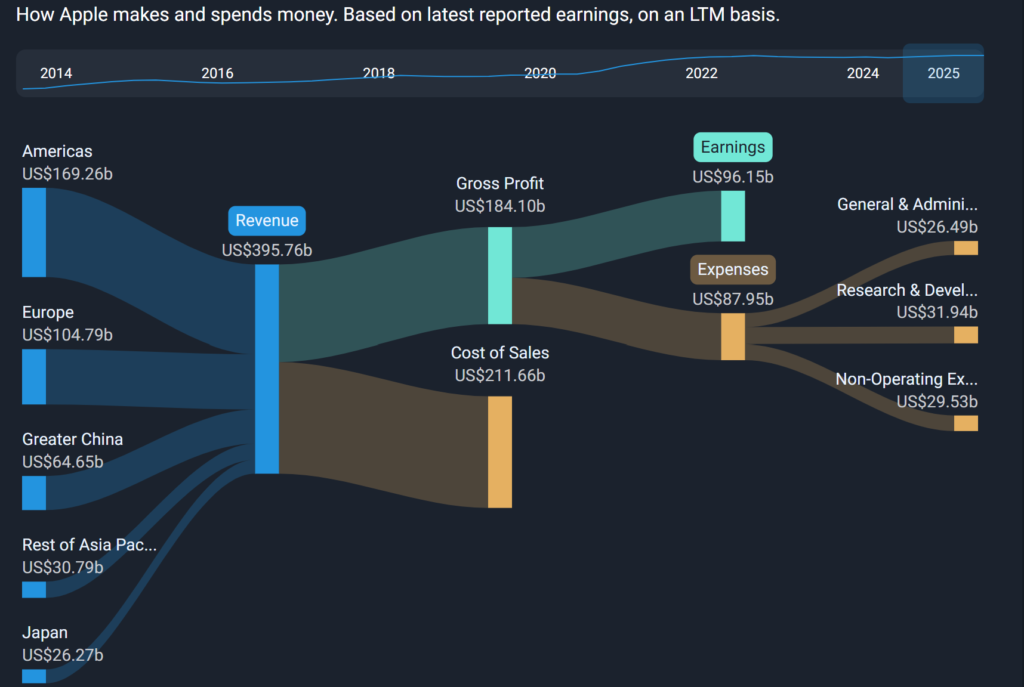

iPhone accounts for ~50% of revenue. Investors need proof it can still deliver amid fierce competition.

✅ Mac, iPad, and Wearables

- Mac and iPad sales are expected to decline YoY after pandemic-era strength.

- Wearables (especially Watch and AirPods) are a wildcard upside swing, with strength seen in international markets.

Estimates:

- Mac: ~$7B

- iPad: ~$6.7B

- Wearables/Home/Accessories: ~$8.7B

✅ Services Revenue

Services is Apple’s growth jewel — app store, iCloud, Apple TV+, Apple Pay.

- Expected to grow ~13% YoY to ~$24B

- Gross margins here are ~70%, far higher than hardware

Why it matters: Strong Services numbers can offset hardware sluggishness and support margins.

✅ China Sales and Tariffs

China accounted for ~19% of revenue last year.

- Tariff risks: Trump administration has floated new tariffs on Chinese electronics; Apple is highly exposed.

- Chinese consumers are showing preference for local brands (Huawei, Xiaomi).

- Analysts expect flat or slightly negative China revenue YoY.

Why it matters:

China is Apple’s biggest international market. Weakness here would spook investors.

✅ AI Strategy

Wall Street wants to hear a clearer AI story from Tim Cook.

- Apple has been quiet on generative AI while peers (MSFT, Google, Meta) surge ahead.

- Expectations are building for AI features in iOS 18 and the next iPhone.

Why it matters:

Apple can’t afford to miss the AI wave. Investors want a roadmap — or at least a teaser.

Challenges and Headwinds

- China macro + Huawei competition

- Tariffs and U.S. trade policy risks

- Hardware saturation + weak upgrade cycles

- Pressure to show AI innovation

Bullish Drivers

Why bulls are sticking with Apple.

- Installed base loyalty: 2B active devices create a powerful upgrade + ecosystem flywheel

- AI optionality: Low expectations mean any AI roadmap could spark a rally

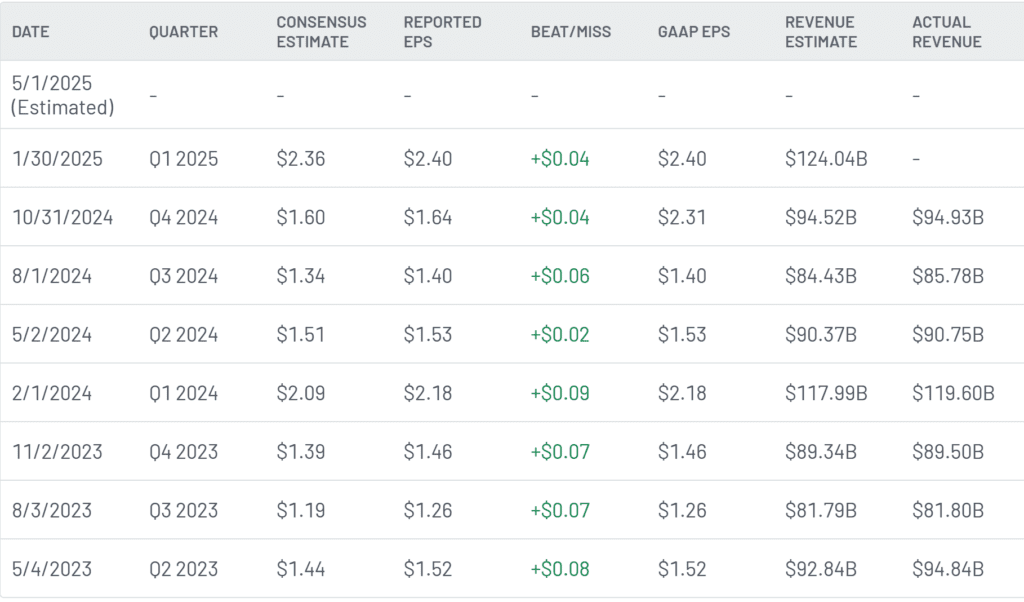

- Record-Breaking Revenue and Growth: Apple reported revenue of $124.3 billion for the December quarter, up 4% from a year ago, marking an all-time record. EPS also set an all-time record of $2.40, 10% higher year-over-year.

- Strong Performance in Emerging Markets: Apple achieved all-time revenue records in emerging markets such as Latin America, the Middle East, and South Asia. India set a December quarter record with the iPhone as the top-selling model.

- Services Revenue Surge: Services revenue reached an all-time record of $26.3 billion, up 14% year-over-year, with growth in every geographic segment and increased customer engagement.

- Mac and iPad Growth: Mac revenue was $9 billion, up 16% year-over-year, while iPad revenue was $8.1 billion, up 15% year-over-year, driven by new product launches and strong customer interest.

Bearish Risks

Why some analysts are cautious.

- Challenges in China: Greater China revenue decreased by 11% year-over-year, with over half of the decline driven by changes in channel inventory and competitive pressures.

- Wearables Revenue Decline: Wearables, home, and accessories revenue was $11.7 billion, down 2% year-over-year, partly due to difficult comparisons with the prior year’s launch of the Apple Watch Ultra 2.

- iPhone dependency: Too reliant on a maturing product line

- AI lag: Perception that Apple is falling behind rivals

- Gross margin pressure: Especially if hardware mix weakens

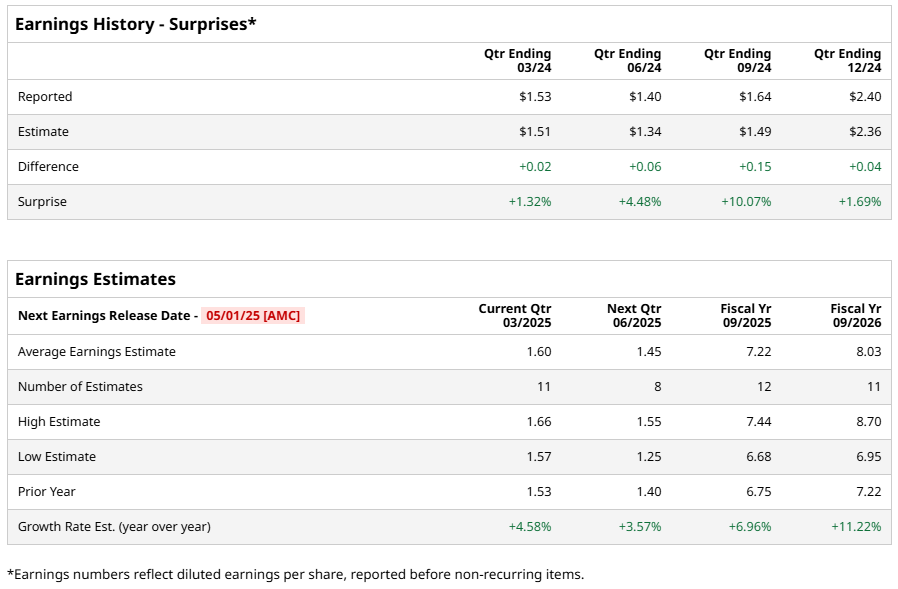

Earnings Surprise History

- Beat EPS in 15 of the last 16 quarters

- Average surprise: ~4%

- Recent caution as analysts trim forecasts slightly ahead of the print

Why it matters: Apple has a long track record of beating — but the bar on narrative and guidance is now higher.

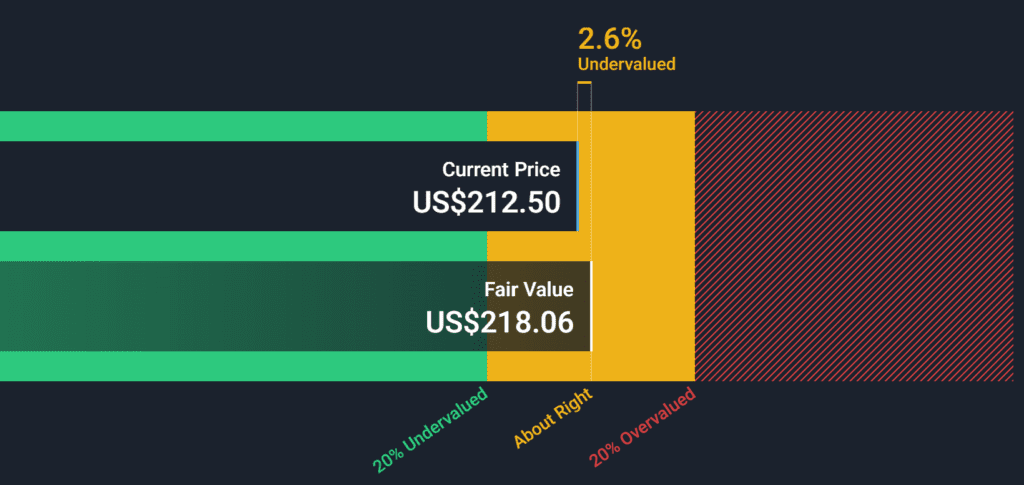

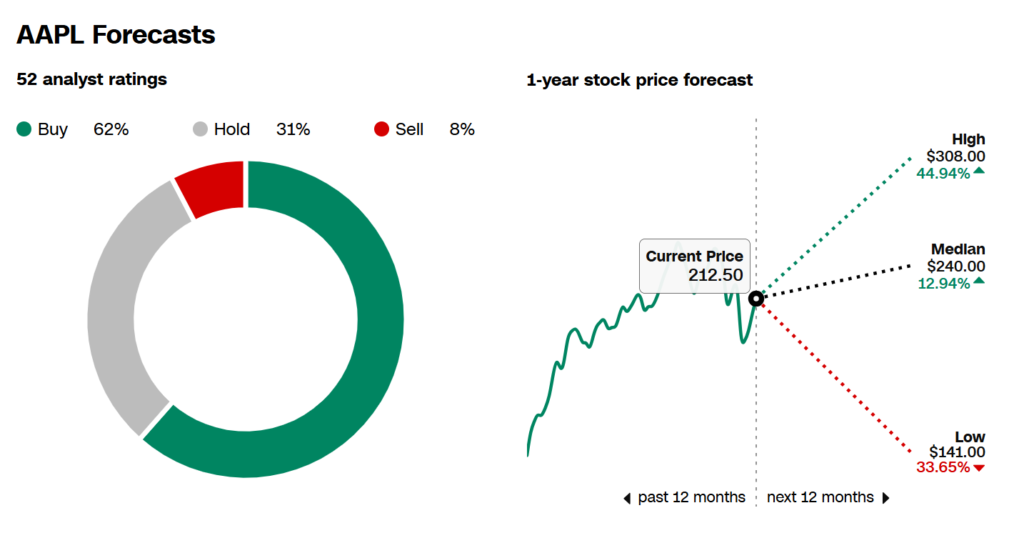

Stock and Valuation Snapshot

- YTD performance: ~+6% (lagging Nasdaq)

- Market cap: ~$2.7 trillion

- P/E ratio: ~27x forward earnings

- Wall Street sentiment: 27 Buy, 10 Hold, 5 Sell (MarketWatch, Morningstar)

- Average target price: ~$205 (upside ~10%)

Why it matters: Apple is seen as a “safe haven” in tech — but it needs to prove it still has a growth story to justify the premium.

Conclusion

Apple’s Q2 2025 earnings are shaping up as a pivotal moment.

The iPhone faces competitive and macro pressures, Mac and iPad are cooling, and China remains a thorn. But Services is booming, the install base is unmatched, and any AI announcement could flip the script.

For long-term investors, the big question isn’t just “Did Apple beat this quarter?” — it’s “Can Apple reaccelerate into the next era of growth?”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Eli Lilly Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion

Shein and Temu Hike Prices as Trump’s 120% Tariff Takes Effect Next Week