In a surprise Lunar New Year launch, Alibaba Cloud unveiled its Qwen 2.5-Max AI model, directly positioning it as a competitor to DeepSeek’s rapidly advancing AI systems. The timing of the release—when most businesses in China were closed for the holiday—underscored the intensifying AI race in China.

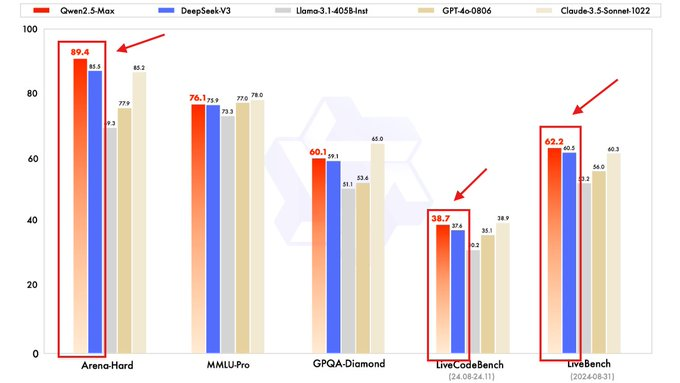

Alibaba boldly claimed that Qwen 2.5-Max outperforms OpenAI’s GPT-4o, DeepSeek-V3, and Meta’s Llama-3.1-405B on various industry benchmarks.

The announcement comes just weeks after DeepSeek stunned the AI industry with its highly efficient, low-cost AI models. Since January 10, DeepSeek’s V3 and R1 models have ignited a price war and a wave of skepticism over the necessity of massive AI infrastructure investments in the U.S.

DeepSeek’s Rise Disrupts AI Industry

DeepSeek’s ultra-efficient AI models have shaken both Silicon Valley and domestic Chinese tech giants. Its R1 model, released on January 20, claimed to rival OpenAI’s latest models, causing U.S. tech stocks to tumble and forcing AI companies to reassess their multi-billion-dollar investment strategies.

DeepSeek’s previous model, V2, had already triggered a price war in China when it launched last May. At just 1 yuan ($0.14) per 1 million tokens, it forced Alibaba, Baidu, and Tencent to slash prices by up to 97% to stay competitive.

ByteDance, the parent company of TikTok, rushed to upgrade its AI two days after DeepSeek-R1’s debut, claiming its updated model outperformed OpenAI’s o1 in benchmark tests.

DeepSeek vs. Chinese Tech Giants

Unlike Alibaba, DeepSeek operates as a lean AI research lab, primarily staffed by young graduates and doctorate students from top Chinese universities.

DeepSeek’s founder, Liang Wenfeng, has openly criticized China’s largest tech companies, arguing that their high-cost, top-down structures make them ill-suited to the future of AI.

“Large foundational models require continued innovation, and tech giants have their limits,” Liang said in a rare interview last July.

DeepSeek’s focus on achieving AGI (Artificial General Intelligence) rather than competing on price has positioned it as a formidable disruptor in China’s AI ecosystem.

Conclusion

Alibaba’s Qwen 2.5-Max release signals that China’s AI war is heating up, not just between China and the West but among domestic competitors as well. With DeepSeek continuing to push the boundaries of AI efficiency, major players like Alibaba, ByteDance, and Baidu are racing to keep up.

As the AI competition escalates globally, the winners and losers of this technological battle will be determined by who can develop the most powerful and cost-effective AI solutions.

Related articles:

What Is DeepSeek and Why Is It Crashing AI Stocks?

DeepSeek shows how Trump tariffs doomed to fail

DeepSeek Causes $1 Trillion Drop in Tech Stocks

Why market panic over China’s DeepSeek is ‘overblown,’ analysts say

DeepSeek ban coming soon? White House “looking into” national security implications of it