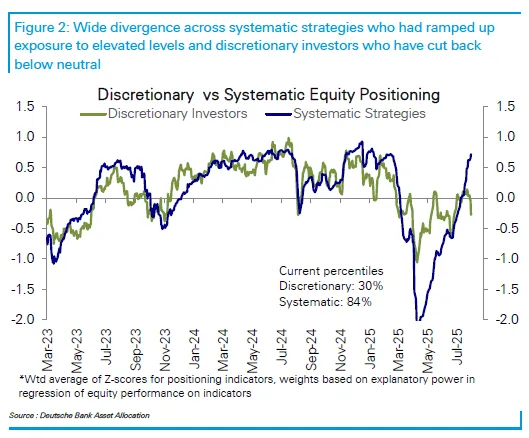

Wall Street is increasingly divided into two camps, and they’re seeing very different markets.

On one side are algorithmic traders and quantitative funds, whose models are flashing buy on US equities. Their positions in the S&P 500 and other major indexes have surged to pandemic-era highs, driven by pure momentum and volatility signals.

On the other side sit human, discretionary money managers, who rely on corporate fundamentals, macroeconomic data, and geopolitical assessments. They’ve recently cut equity exposure, citing Trump’s unpredictable trade agenda, the Federal Reserve’s unclear rate path, and concerns about overvaluation after a 30% rally from April lows.

This divergence has created a rare technical-versus-fundamental tug-of-war, with the S&P 500 hovering near record highs but struggling to break out decisively.

The Numbers Behind the Divide

- Systematic strategies: Long positions in US equities are now at their highest level since January 2020, according to Deutsche Bank’s Parag Thatte.

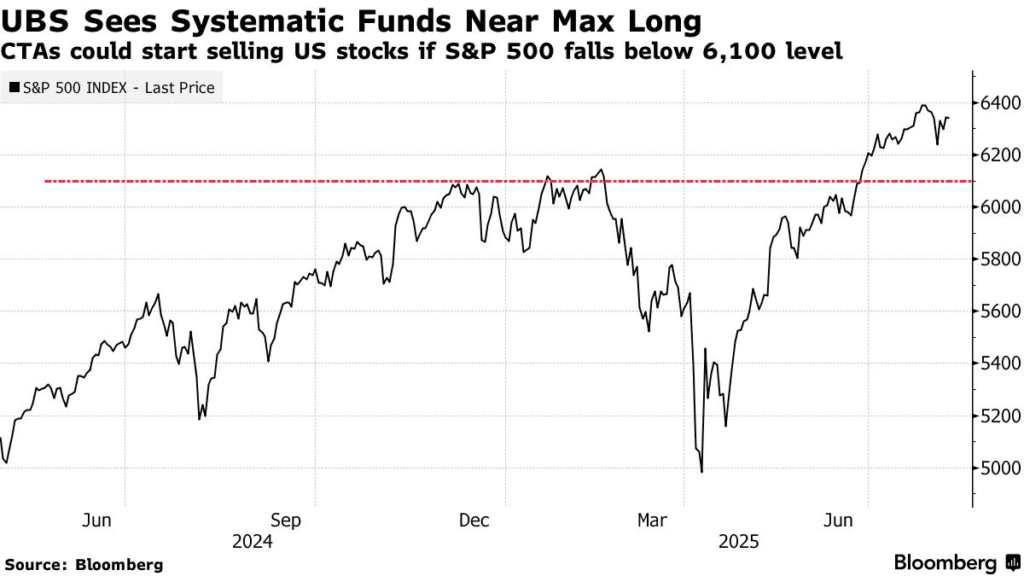

- Dollar exposure: Fast-money traders, including commodity trading advisors (CTAs), are long about $50 billion in US stocks — 92nd percentile historically, Goldman Sachs data shows.

- Trigger risk: Analysts estimate it would take about a 4.5% S&P 500 drop to unwind these positions, potentially causing a fast, self-reinforcing selloff.

That positioning build-up followed a spring period when quant funds were barely invested, leaving room for an aggressive re-entry as technical trends turned positive.

Why Humans Are Sitting Out the Party

Professional discretionary managers have shifted from neutral to modestly underweight equities. Their caution is rooted in several unresolved risks:

- Trade uncertainty: Trump’s recent wave of tariffs and shifting deal terms have made it harder to forecast corporate earnings.

- Fed policy unknowns: While rate cuts are increasingly expected, inflation data could flip the narrative quickly.

- Valuation concerns: The S&P 500’s rally has stretched multiples, with Nvidia now trading at the highest valuation multiple for a mega-cap since Microsoft in 1999.

“Thatte says they’re essentially waiting for something to give, either growth slows, inflation reaccelerates, or a geopolitical shock hits.”

The Crowded-Trade Risk

Trend-following quant models thrive in low-volatility, upward-trending markets. But that same behavior can become a problem when volatility spikes.

Colton Loder of Cohalo warns:

“The rubber band can only stretch so far before it snaps.”

This is not a theoretical risk — similar positioning unwinds happened in early 2023, after quant funds loaded up following the 2022 bear market, only to dump stocks in a sharp reversal when volatility jumped.

Potential Market Pathways

- If volatility stays low: Algorithms could keep buying, pushing the market higher despite human caution.

- If volatility spikes: Systematic funds may dump positions quickly, triggering a wave of selling.

- If a pullback occurs: Discretionary managers’ light positioning could fuel a buy-the-dip rally, limiting downside.

UBS strategist Maxwell Grinacoff says things are “starting to feel toppy” and sees limited near-term upside, though he does not yet view the situation as a crisis.

The market’s current strength is being driven disproportionately by machines chasing momentum. If conditions shift suddenly, the same forces that powered the rally could accelerate a selloff, potentially giving human traders the entry point they’ve been waiting for.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years