CNBC host and DealBook founder Andrew Ross Sorkin says today’s Wall Street frenzy mirrors the reckless speculation that preceded the 1929 crash—and warns that the next meltdown may already be in motion.

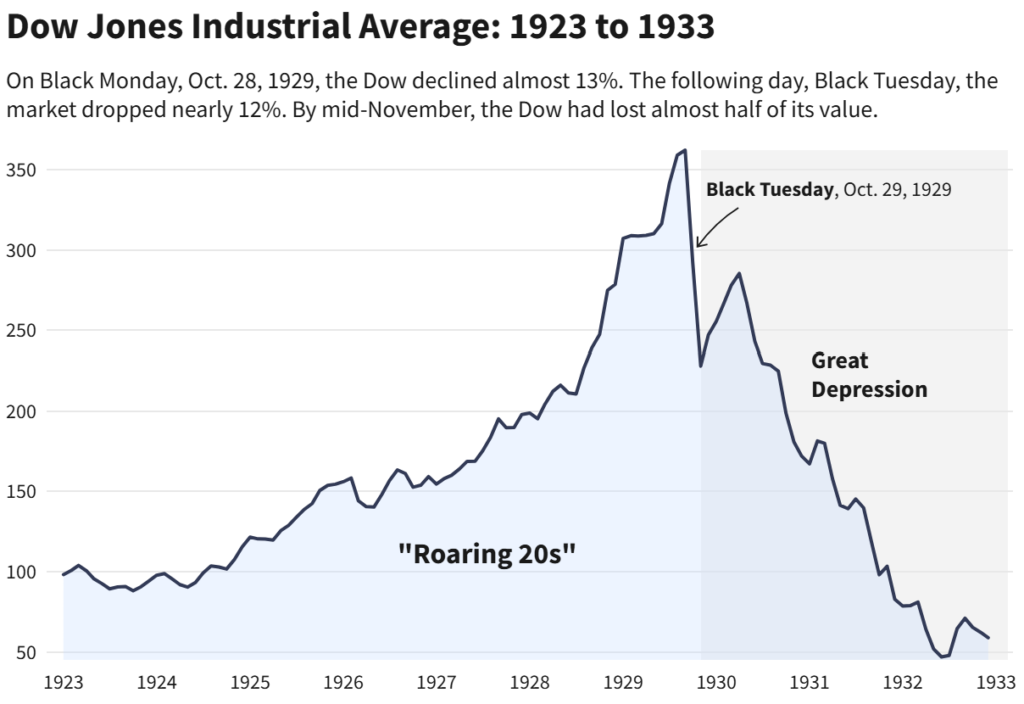

In his new book 1929: Inside the Greatest Crash in Wall Street History, Sorkin draws chilling parallels between the Roaring Twenties and today’s AI-fueled market mania. “A crash is coming,” he told CNBC. “I just can’t tell you when, and I can’t tell you how deep.”

According to Sorkin, the modern market’s obsession with artificial intelligence stocks, speculative crypto investments, and leveraged retirement funds echoes the margin-trading bubble that devastated ordinary Americans nearly a century ago. “It’s the same psychology,” he says. “In the 1920s it was cars and radios. Today it’s AI, meme stocks, and private equity access for everyone.”

Andrew Ross Sorkin on Stock Market Crash:

— Wall St Engine (@wallstengine) October 15, 2025

“We will have a crash, I just can't tell you when, and I can't tell you how deep. But I can assure you, unfortunately, I wish I wasn't saying this, we will have a crash” pic.twitter.com/VAtlgyQK3C

Sorkin argues that “guardrails designed to protect investors are being dismantled,” pointing to the push to let 401(k) savers invest in private funds and digital assets under the banner of “democratizing finance.” He warns that such moves risk exposing millions of middle-class investors to massive losses if markets reverse.

While the market sits at record highs, Sorkin says that reality beneath the surface looks more fragile—marked by soaring debt, excessive speculation, and geopolitical uncertainty. “I’m anxious that we are at prices that may not feel sustainable,” he said, citing AI valuations and weakening fundamentals.

Not everyone agrees. BlackRock CEO Larry Fink argues that greater access to private markets could strengthen retirement portfolios and says crypto now plays a “legitimate role” in modern investing. Yet Sorkin maintains that these arguments downplay the danger of deregulation at a time when “the same excesses that broke the system before are being invited back in.”

Sorkin’s warning is less about timing and more about trajectory. From AI exuberance to relaxed financial safeguards, he believes Wall Street is once again “dancing on the edge of a bubble.” As he puts it: “History doesn’t repeat—but right now, it’s rhyming loudly.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.