Recent wildfires driven by Santa Ana winds have burned 30,000 acres in Los Angeles, destroying over 1,000 structures and causing an estimated $50–60 billion in financial damage, largely due to the high-value properties affected. Private insurers are expected to cover $10 billion, with additional support from reinsurance and California’s FAIR Plan, which holds $25 billion in exposure for these areas. However, insurers have been scaling back coverage in high-risk zones after historical losses, leaving many homeowners with limited options. We explore the financial impact and related insurance industry.

The Fire

Fires have swept through on the breath of angry winds, burning out parts of LA and its landscape to the ground. At up to 40 miles per hour, the Santa Ana winds descended from the mountains and pushed through to dry land, carrying bright embers that would scorch up nearly 30,000 acres of Los Angeles. The wrath of nature is unforgiving, its sovereignty unmoved by our desire for life.

For those of you in the affected areas, I hope you are safe.

The Financial Scale

We write about this to learn the financial story. This is a fintech, not insurance, newsletter, so we remain novice in our approach. Perhaps you will learn along with us.

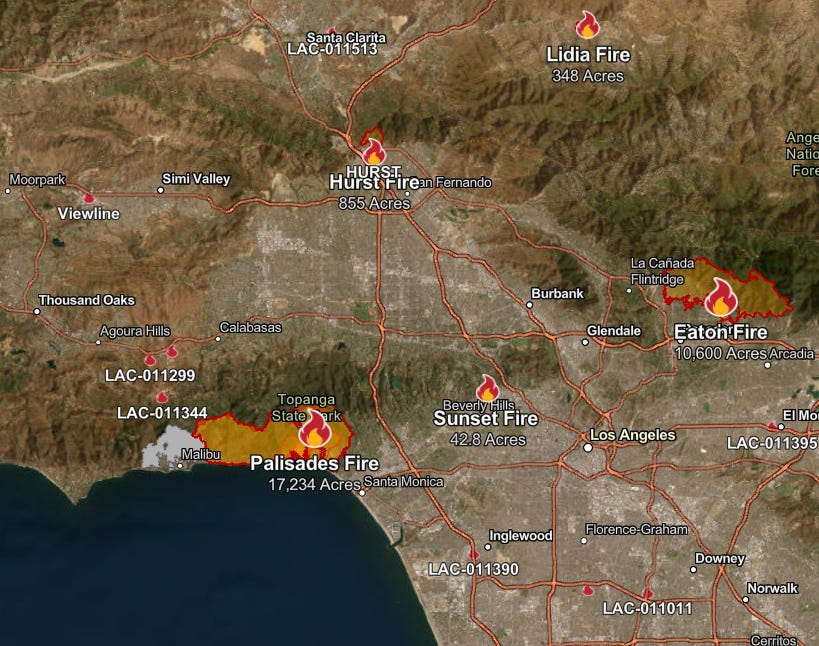

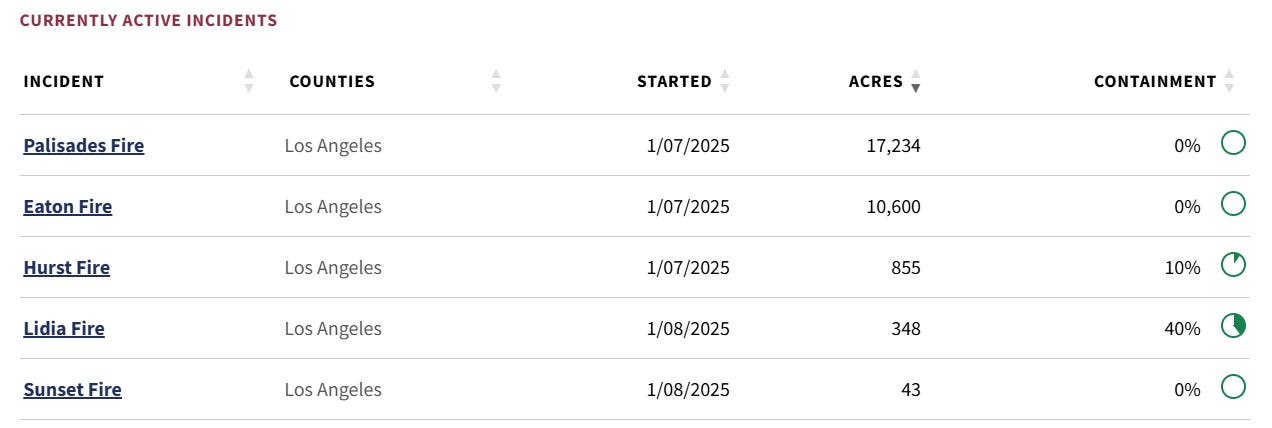

Here is the current size of the damage — 30,000 acres in total. Little is “contained”, so probably there is a lot more to come.

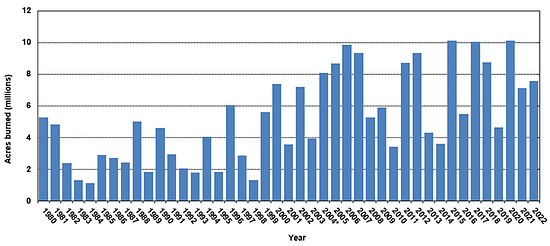

Historically, the total number of acres burned per year is about 7 million across the United States. That number has increased from under 2 million in the 1980s, though the trend appears to have some sort of cyclicality upwards.

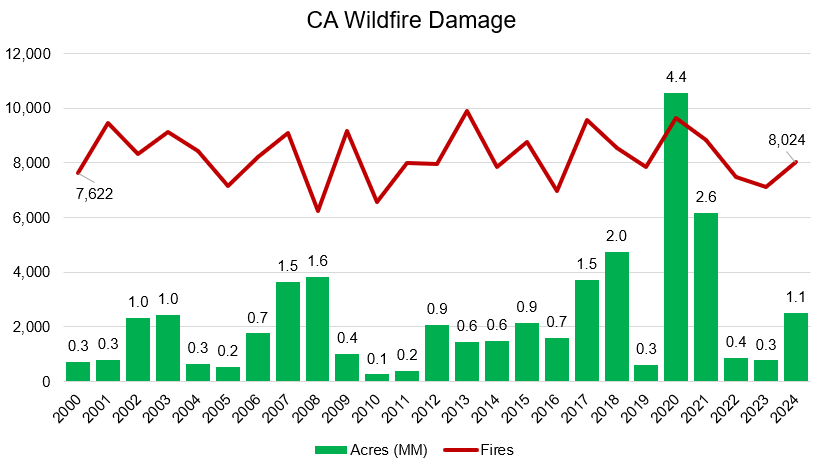

In 2022, California had about 8,000 fires, which destroyed over 300,000 acres of land. Below is the chart for CA-only wildfires.

We can see that the number of fires has stayed relatively flat for the last 25 years, but the spread of those fires has increased meaningfully. The worst year on record is 2020, with 4.4 million acres of land burned down. Even though 2025 is going to generate comparable financial distress, it pails in comparison to the scale of that event.

Wikipedia tells us that since 1850, around 4.5 million acres burned annually on a regular basis, with up to 12 million acres at its worst. Note that people lived in houses made of wood and lit fires in their homes for light and cooking at the time.

So we learn that the current tragedy is not an exceptional event by statistical standards. Rather, it is an exception because of *what* is being destroyed — not the beautiful forests or small towns inland, but some of the most iconic and desired areas in one of America’s greatest cities at the heart of its media and cultural empire.

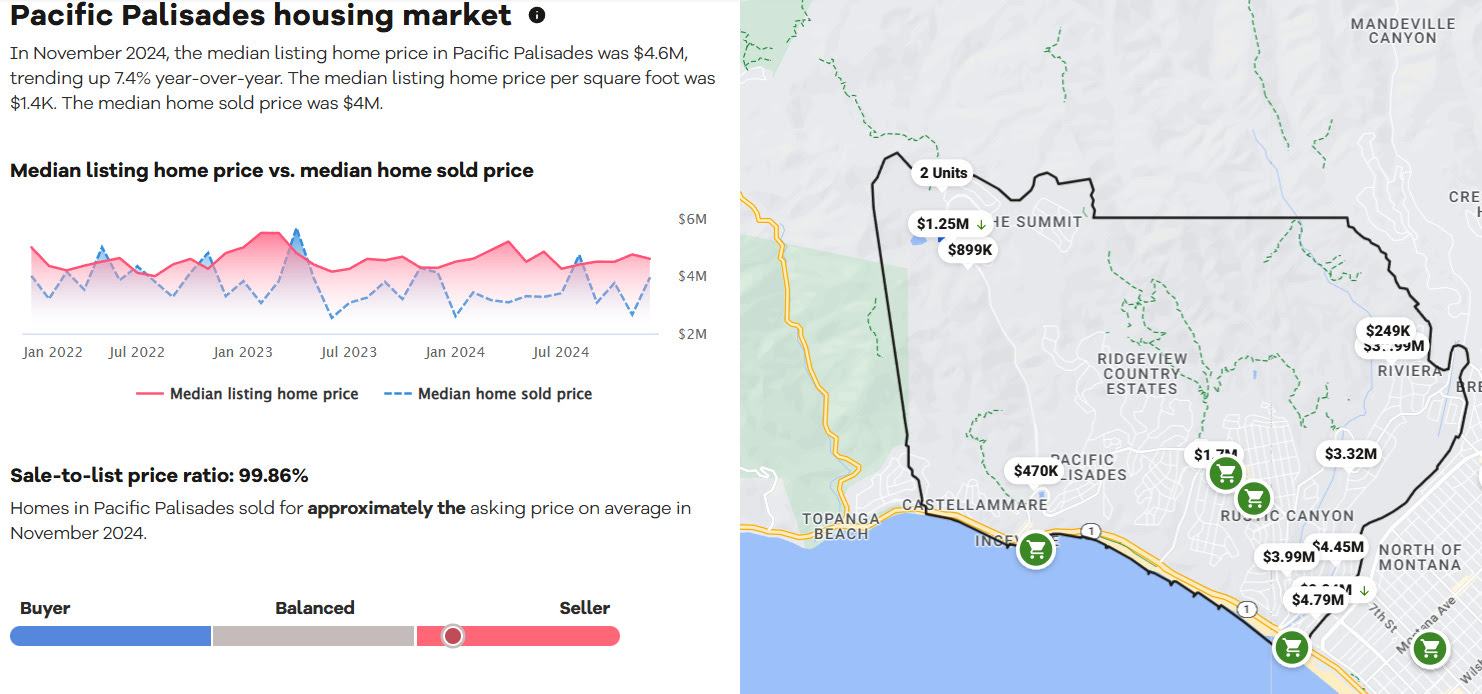

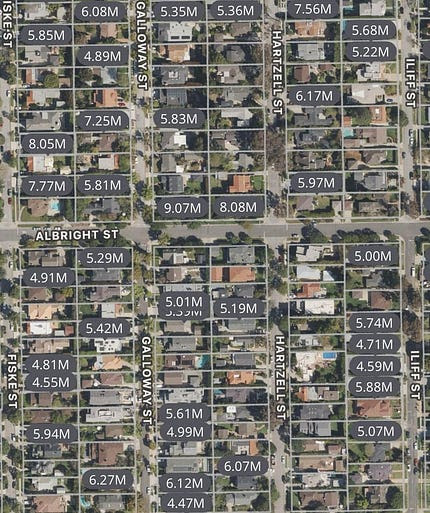

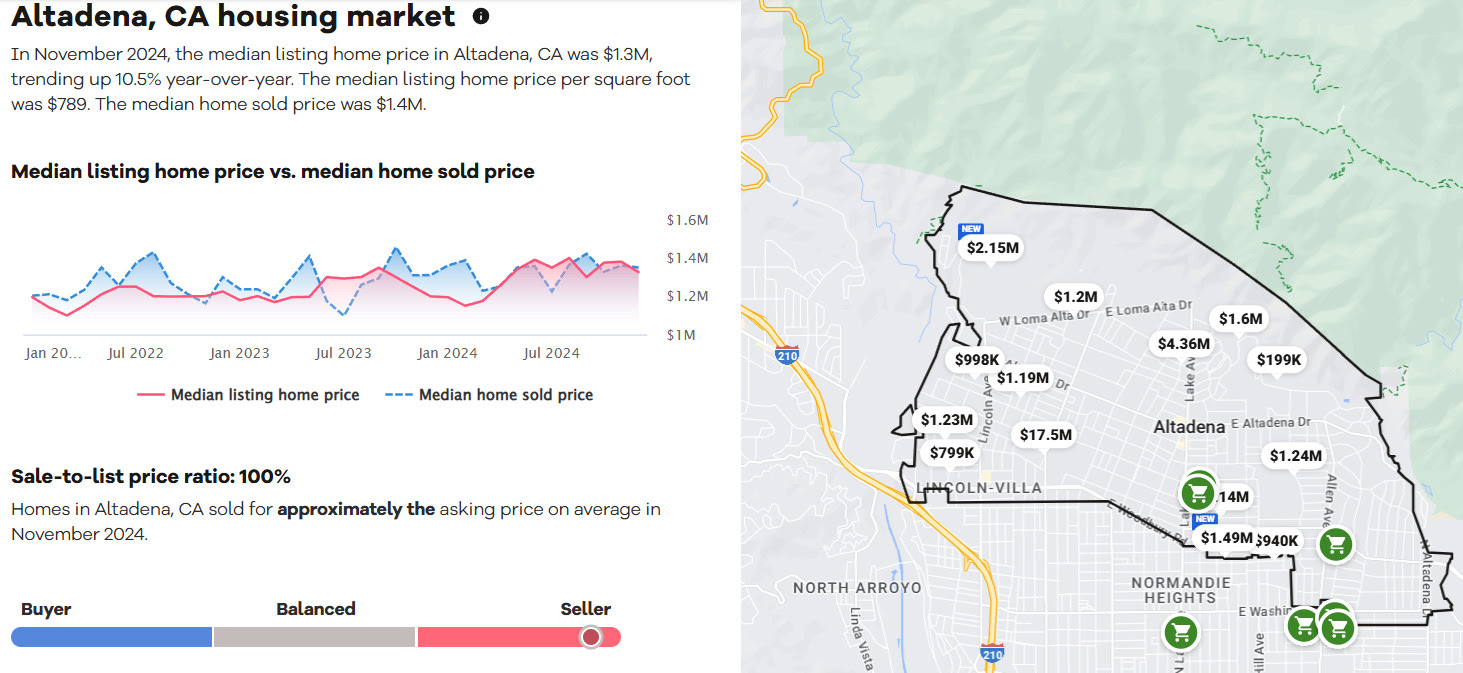

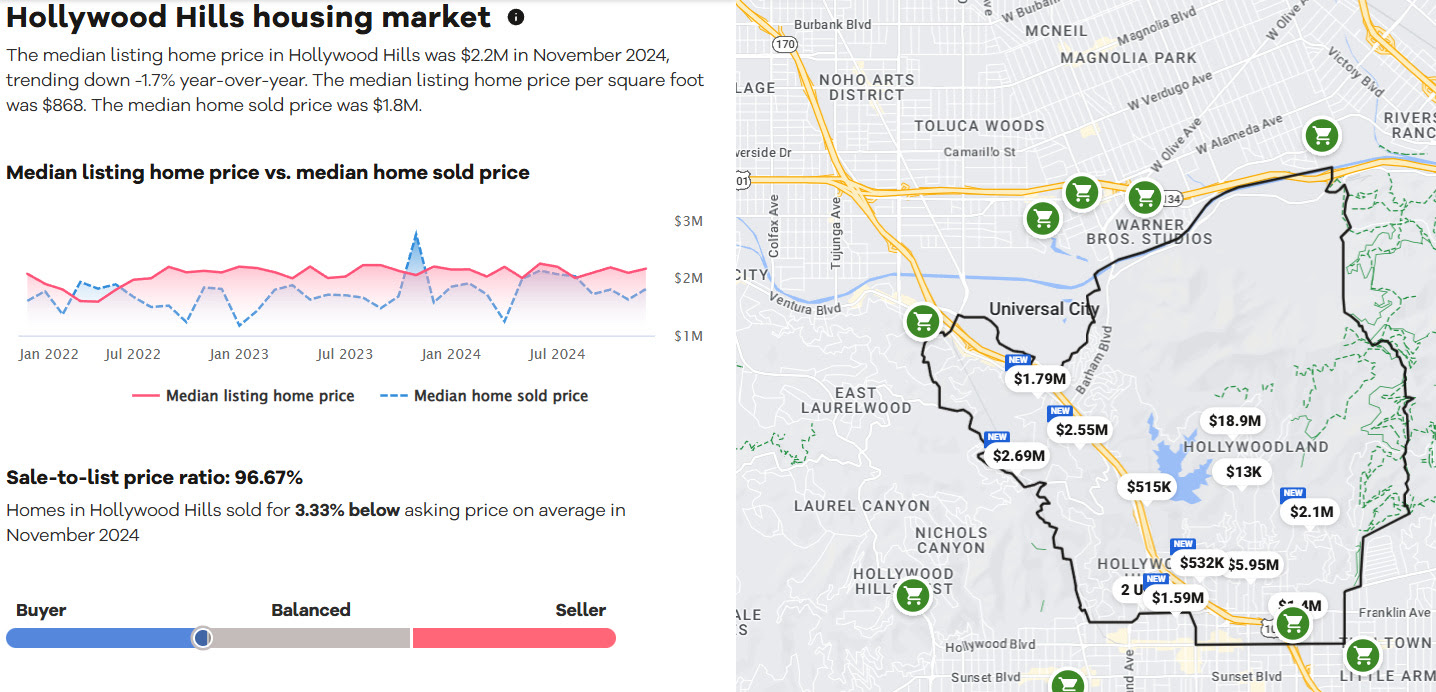

Here are the property values for the affected areas.

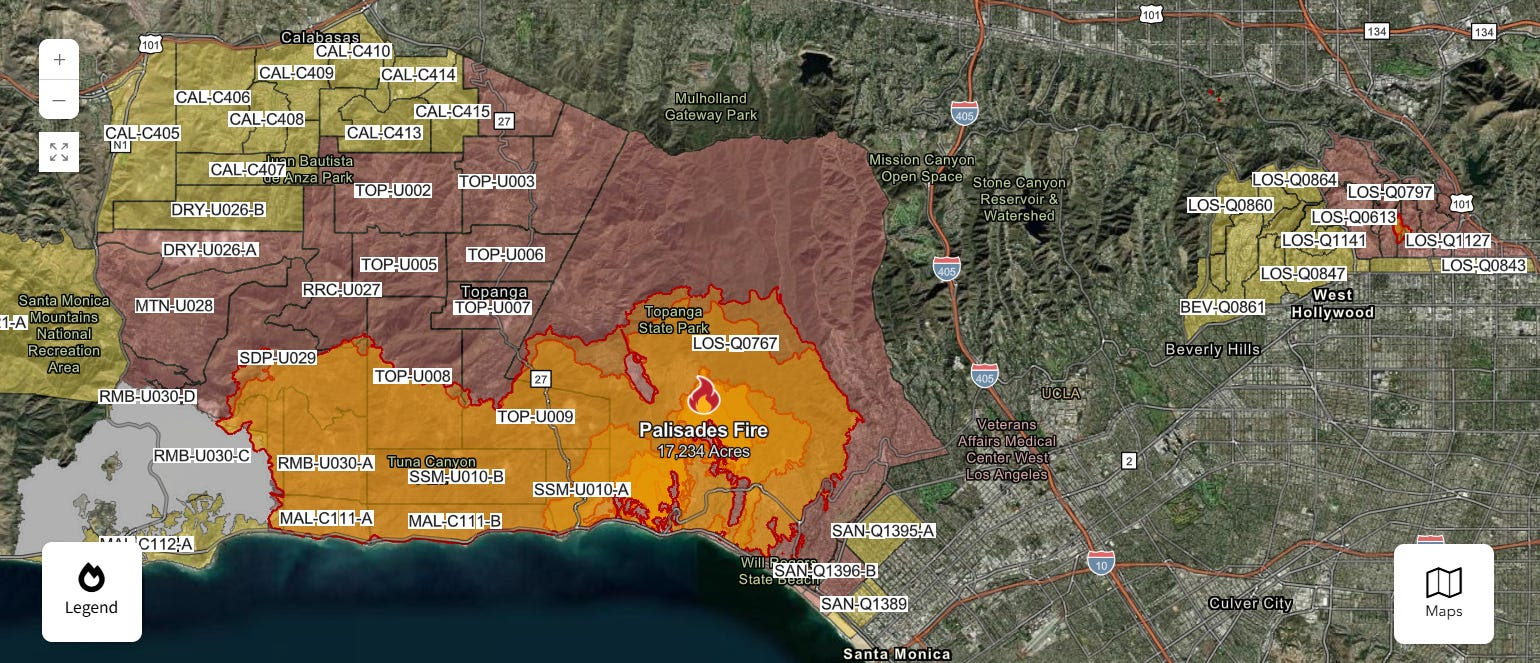

The median sold price in the Palisades is $4MM. In the Hollywood Hills, it is $1.8MM, and about $1.4MM in the Eaton fire. The fire may not be the largest physically, but certainly hits the homes of the people with a large concentration of financial resources and attention from other people.

Over 1,000 structures have been destroyed so far, which would imply $2-5B in direct property damage. However, estimates from AccuWeather are floating around that the financial impact is going to be closer to $50-60B in this case. Home values are an imperfect proxy, as they combine the value of land with the cost of building the house, all floating in the negotiations of capital markets. Far more goes into the public infrastructure underneath the houses themselves than we can see on a Zillow map.

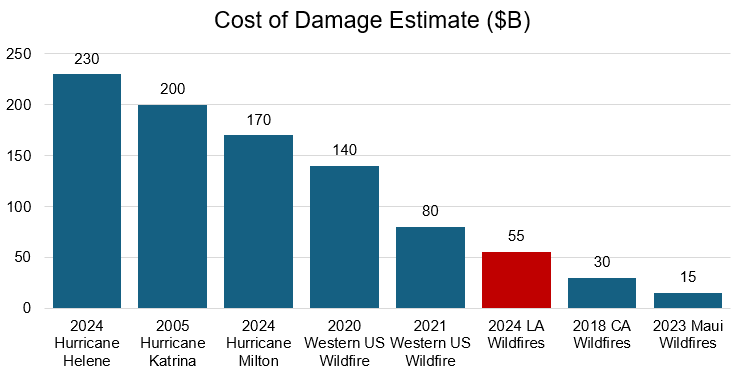

Let’s zoom out and look at other estimates for US catastrophes.

Hurricane Katrina was responsible for destroying 200,000+ structures, about 200x more than the current fires and estimated at $200B of damage. To that end, we can see how much more *expensive*, in a literal sense, the wildfires have been. As other estimates come online, we are curious to see if the numbers end up trending any lower.

This brings us to the next leg of the questioning.

Who pays?

The Insurers

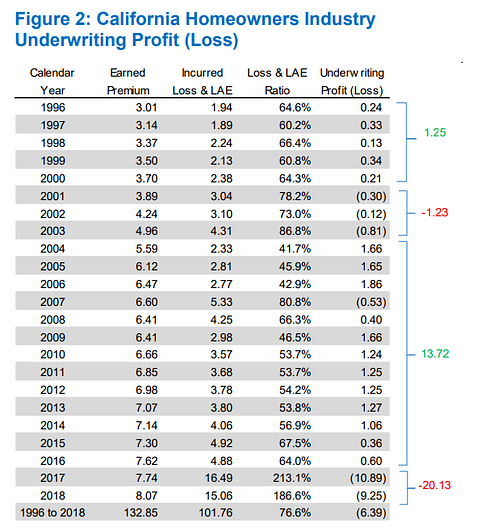

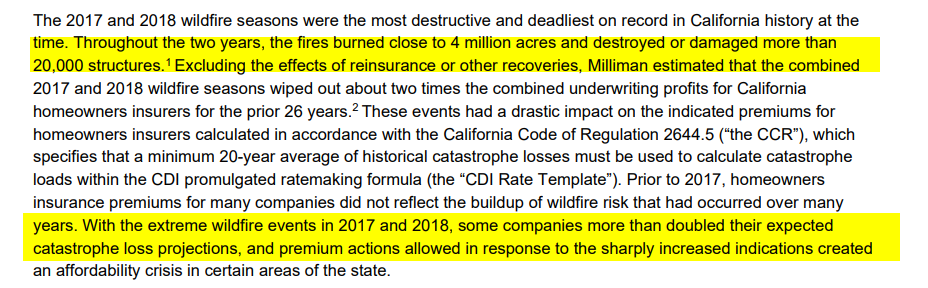

The 2017 and 2018 wildfires in California were a historically bad event for insurers in the state. We quote below a report from Milliman, a specialist research firm, that was published at the time. It suggests that the damages wiped out 2x the combined underwriting profits for CA homeowners insurers over the last 26 years.

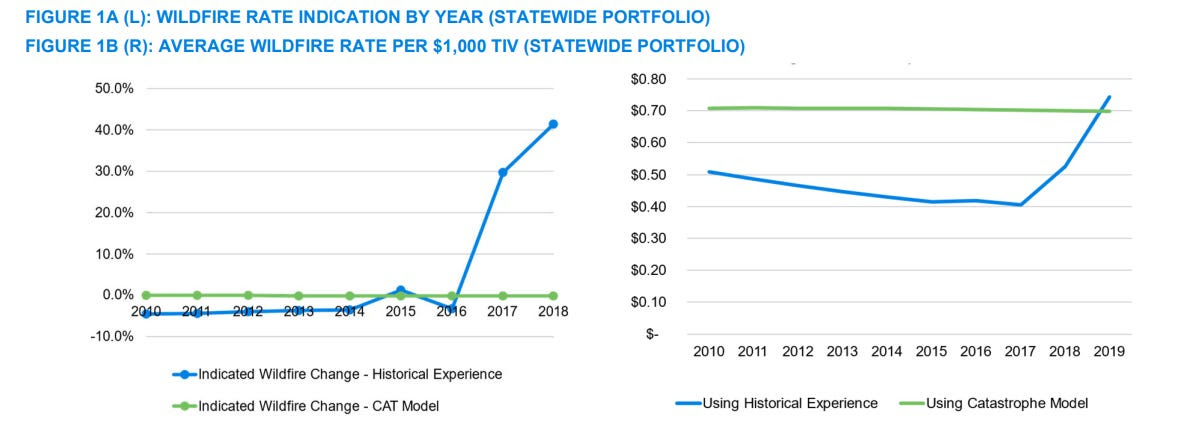

Here is how incorrect the underwriting models were in predicting those events.

The green line in the chart below is a projection based on historical data to cover the risk, and the blue line is the actual experience. That uptick in the graph means bankruptcy for the insurer.

Insurers are math machines, not creatures of emotion or politics.

If they want to leave a state uninsured, it is because the math no longer works. You cannot spread the risk or sell it off to a reinsurer. There is no profound attachment to long-term clients or geographies — either the statistics make sense, or they do not. By 2020, the insured losses from wildfires added up to $13 billion, even though homeowners in LA were paying them $3,000 per month. Where wildfires were more likely insurers either raised rates or tried to exit the business. State Farm began to pull out of CA and said it would not renew over 70,000 home and apartment policies — in the Palisades, it canceled 70% of its coverage.

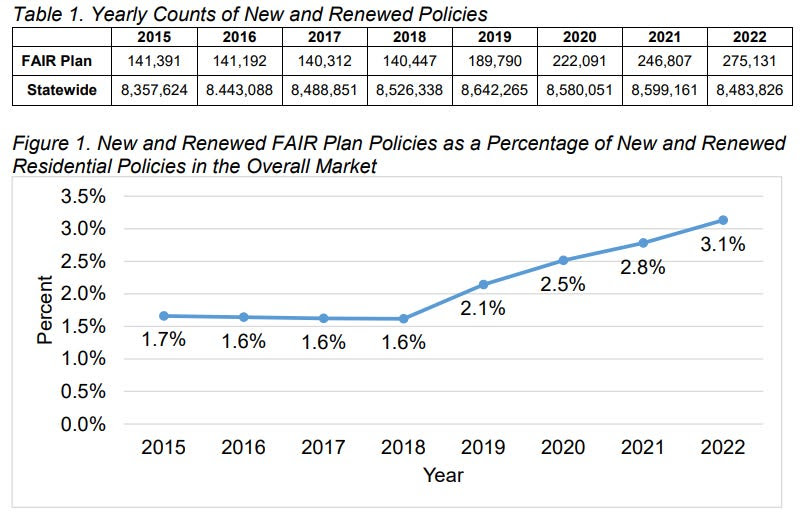

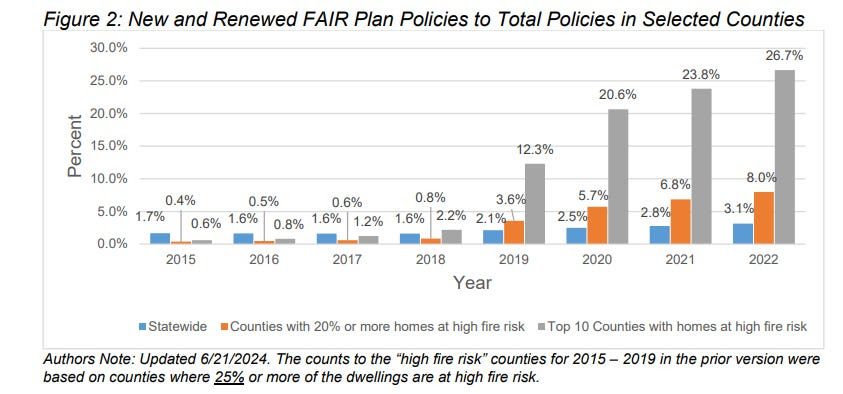

The State of California tried to block insurers from leaving, which doesn’t work well for market-driven actors. It also set up a program called the California FAIR Plan Association, which works as an insurer of last resort when somebody cannot find a private option. It had limited adoption in the overall market, but a high adoption level in those areas where insurance companies decided to exit due to high fire risk.

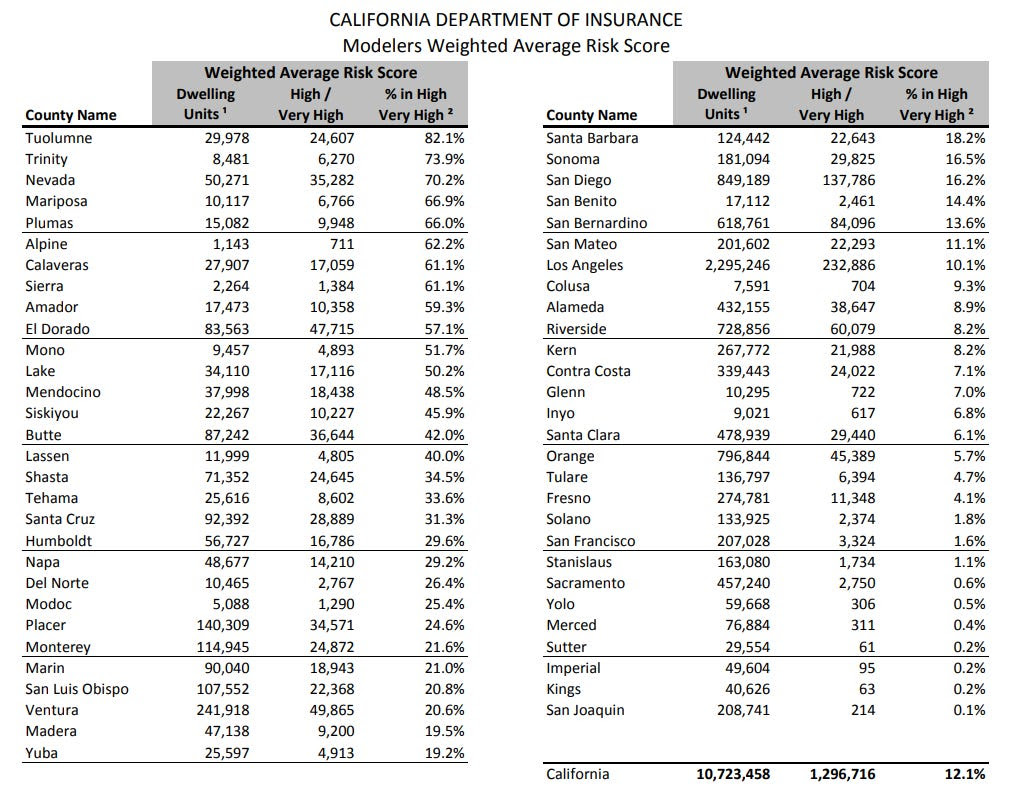

You can see the 2022 figures showing nearly 30% adoption of FAIR in the top 10 counties with homes at high fire risk. For the Palisades, the percentage of residential units insured by Fair was only 8% and for Altadena it was 6% — far below the average of other areas that were seen as high risk. Below is the full list of the most risky counties.

Los Angeles doesn’t even make the top half of the sheet, which is bad news for the rest of California.

In regards to the current fires, the FAIR Plan has $25B in exposure in the impacted neighborhoods, a little bit less than 10% of its overall exposure of $300-400B. There is $385 million on hand to pay out claims. There is another $2.5B or so in reinsurance that can be tapped to cover the damages. As a reminder, reinsurance is insurance that insurance companies buy from other insurance companies to cover risks for which they do not have sufficient balance sheet. So this stuff can have systemic and high-correlation impacts.

It’s not quite clear how the insurance world in California will get to $50B, if that is the number on the other side of this disaster.

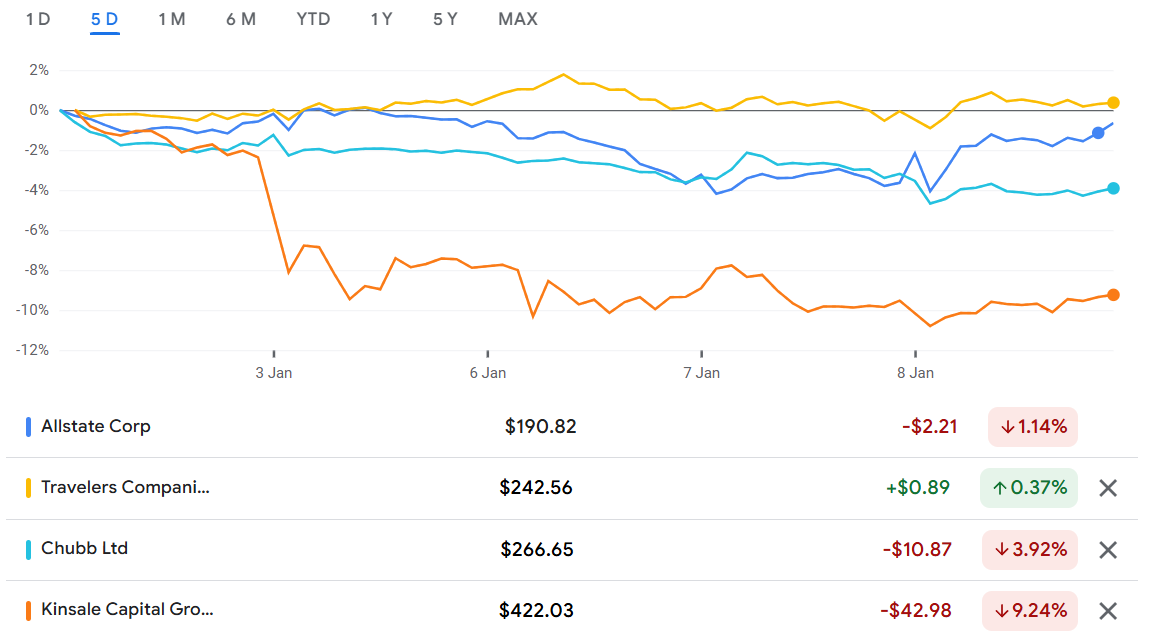

JP Morgan estimates that private insurance will cover about $10B of the losses. The most impacted companies are likely Allstate ($50B marketcap), Travelers ($55B), Chubb ($110B), and Kinsale Capital ($10B) on the insurance side, and Arch Capital ($35B) and RenaissanceRe ($13B) on the reinsurance side.

Source: Fintech Blueprint