Global markets were shaken again this week as President Donald Trump’s renewed tariff threats and his push to take control of Greenland revived fears of a new trade war and long-lasting market turbulence.

Stocks, US Treasuries, and the dollar all sold off on Tuesday after Trump warned he could impose fresh tariffs on European allies, reopening geopolitical tensions that many investors thought were fading. (Trump Threatens Tariffs on 8 EU Countries Over Greenland Dispute)

The S&P 500 fell 2.1 percent, its biggest one-day drop in more than three months. Long-dated US bond yields jumped, and the dollar weakened, a rare combination that signaled investors were pulling money out of US assets.

Investors Fear This Time Could Be Different

Market strategists said the selloff was worrying because it hit several asset classes at once.

“This is not the usual dip-buying environment,” said Jack Ablin of Cresset Capital. “Global investors are taking these threats seriously.”

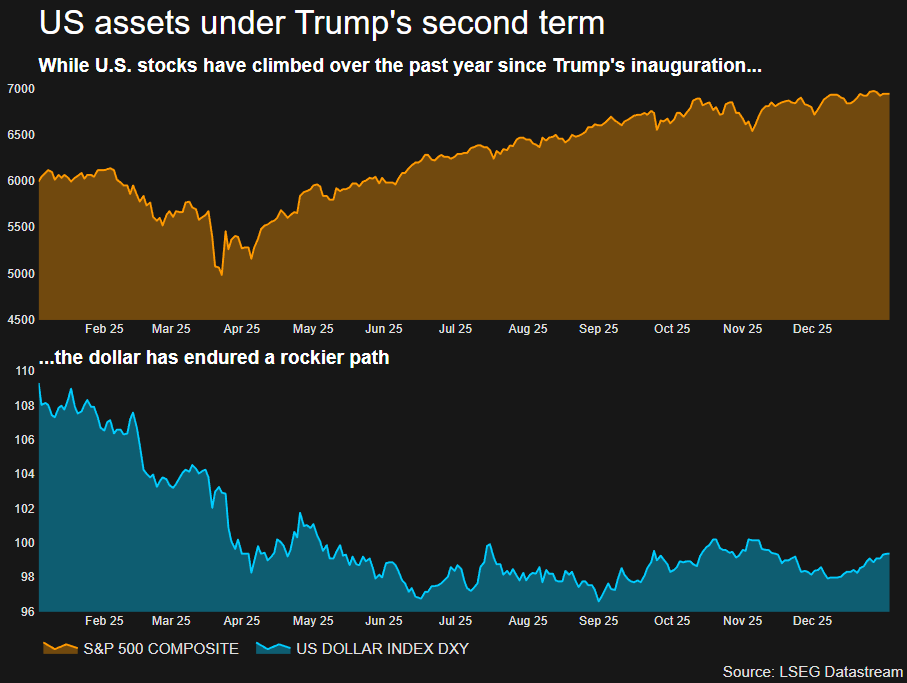

The move brought back memories of last year’s “Sell America” trade after Trump’s surprise tariff announcement on “Liberation Day,” when markets slid sharply before later recovering.

Some investors fear the current tensions over Greenland could last longer and damage the political and military ties between the US and Europe.

Waiting to See if Trump Backs Down

Many traders are still holding back from panic, betting Trump may soften his stance as he has in the past.

On Wall Street, this idea is known as “TACO,” short for “Trump Always Chickens Out,” referring to his habit of making aggressive threats before later stepping back.

“If this does continue to devolve, then all of a sudden you’ve got yourself an issue,” said Alex Morris of F/m Investments. “But we’re not there yet.”

Trump is expected to address world leaders at the World Economic Forum in Davos, where investors will watch closely for signs of de-escalation.

Stocks Look Vulnerable

After three years of strong gains, stock valuations are high, leaving markets sensitive to bad news. With earnings season beginning, analysts still expect strong profit growth in 2026, which is helping keep many investors in US stocks.

Still, some fund managers warned that foreign investors could reduce exposure to US markets if tensions worsen, which could weigh on returns.

For now, most investors are waiting, watching Davos closely, and hoping the latest tariff scare fades before turning into a full-blown trade crisis.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.