Nvidia is set to report third-quarter results for its fiscal year 2026 after markets close on November 19. With investors closely watching every signal from the company at the centre of the artificial intelligence boom, this earnings report carries weight well beyond just one stock. Nvidia’s chips and platforms power the majority of today’s large language models, sovereign AI infrastructure, and enterprise AI workloads.

Shares have climbed over 35 percent this year, driven by a surge in data centre demand and massive expectations for its new Blackwell platform. But with market sentiment fragile and geopolitical tension rising, the question is whether Nvidia can keep outperforming without triggering concerns about overvaluation or slowing momentum.

Street Forecast: Revenue Near $55 Billion, EPS Topping $1.25

Wall Street is expecting another blowout quarter. The consensus forecast calls for revenue in the range of 54.8 to 55.2 billion dollars, which would mark growth of more than 50 per cent from a year ago. Adjusted earnings per share are projected to be around 1.25 to 1.28 dollars. Gross margins are expected to hold steady in the mid-70 per cent range, supported by a continued mix shift toward high-margin data centre products.

| Metric | Q3 FY26 Consensus | Year-on-Year Change |

|---|---|---|

| Revenue | 54.8 to 55.2 billion | +50 to +56 percent |

| Adjusted EPS | 1.25 to 1.28 dollars | +55 to +60 percent |

| Gross Margin (non-GAAP) | 73 to 74 percent | Flat to slightly higher |

| Data Center Revenue | 48 to 49 billion | +50 to +55 percent |

Prediction: Nvidia likely beats consensus slightly on both revenue and earnings, with stable gross margin. Investor focus will shift to guidance and commentary around Blackwell demand heading into 2026.

Data Center: Blackwell Ramp Driving the Engine

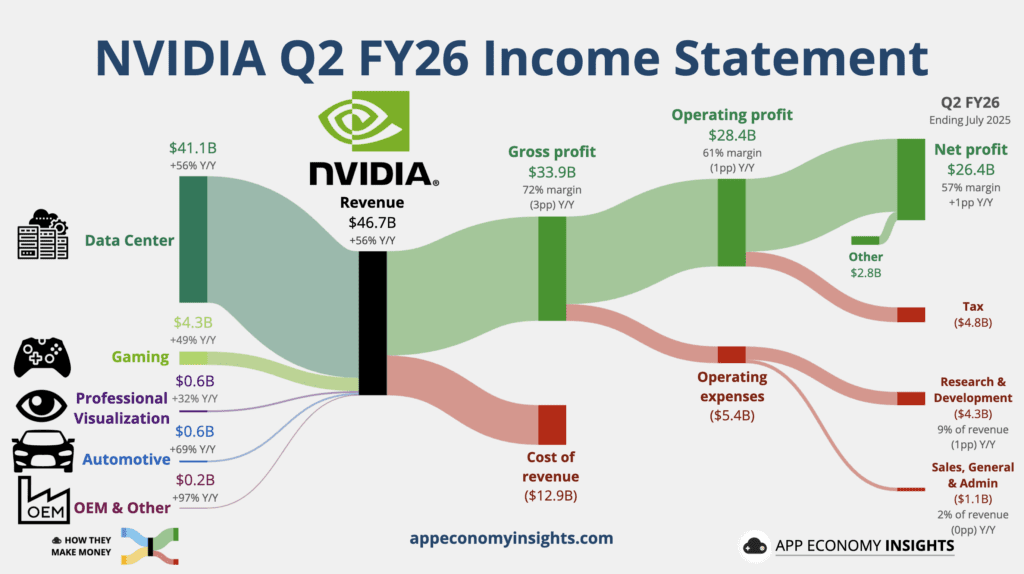

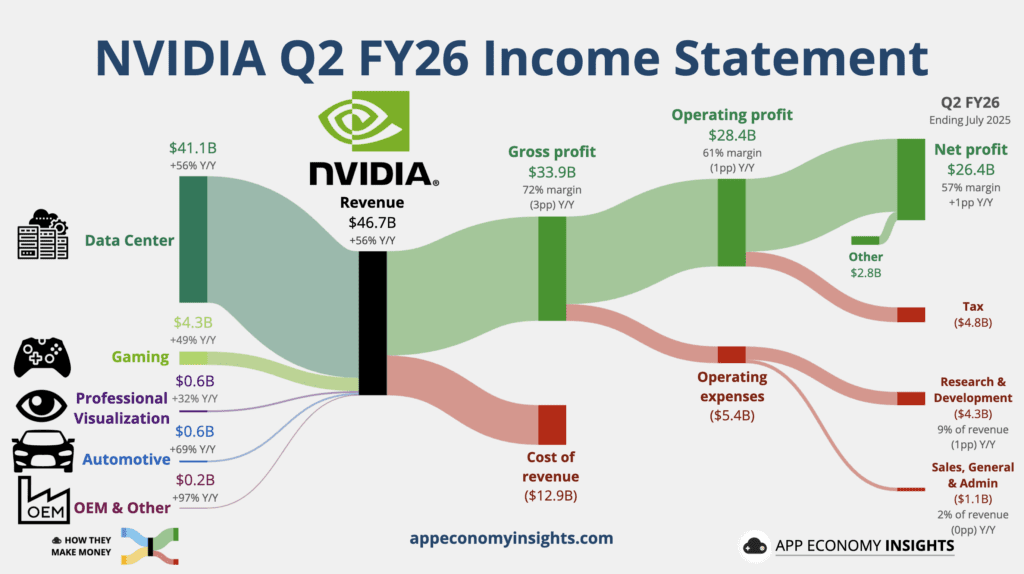

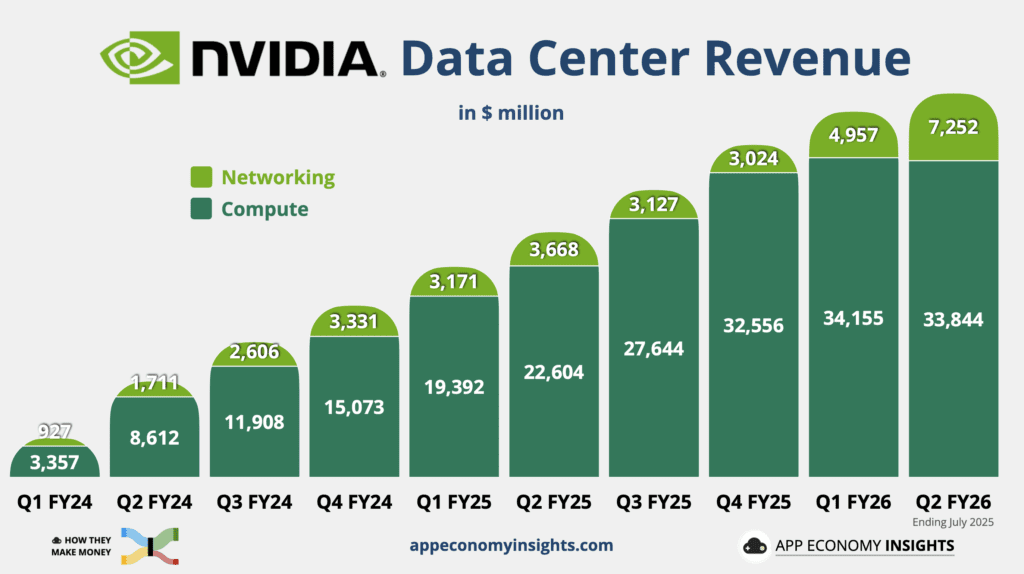

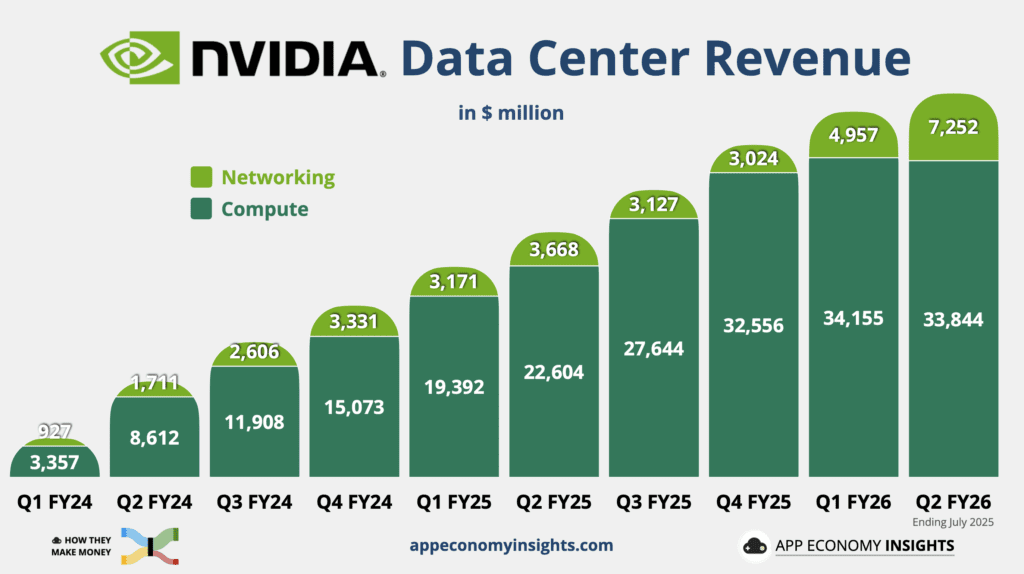

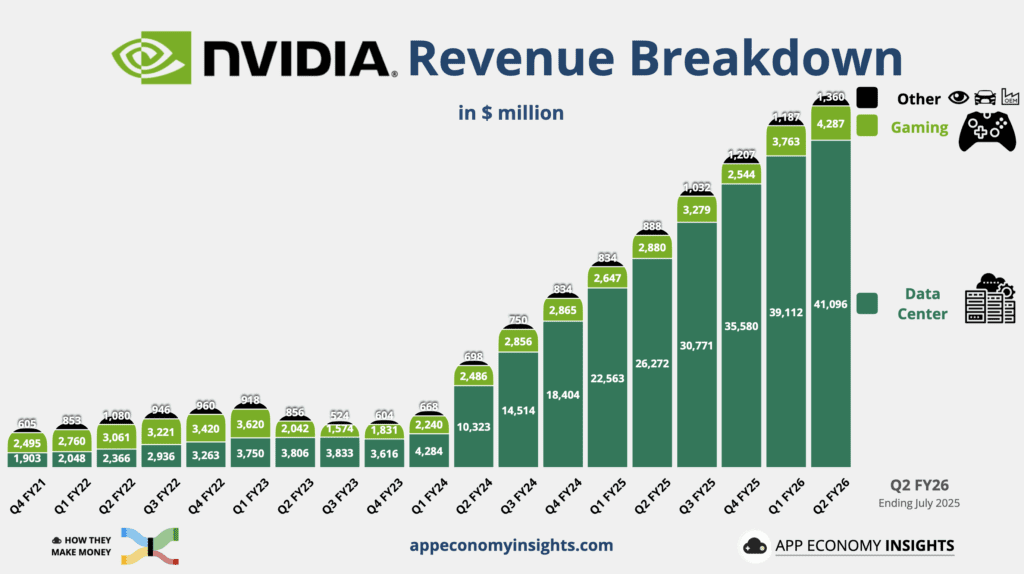

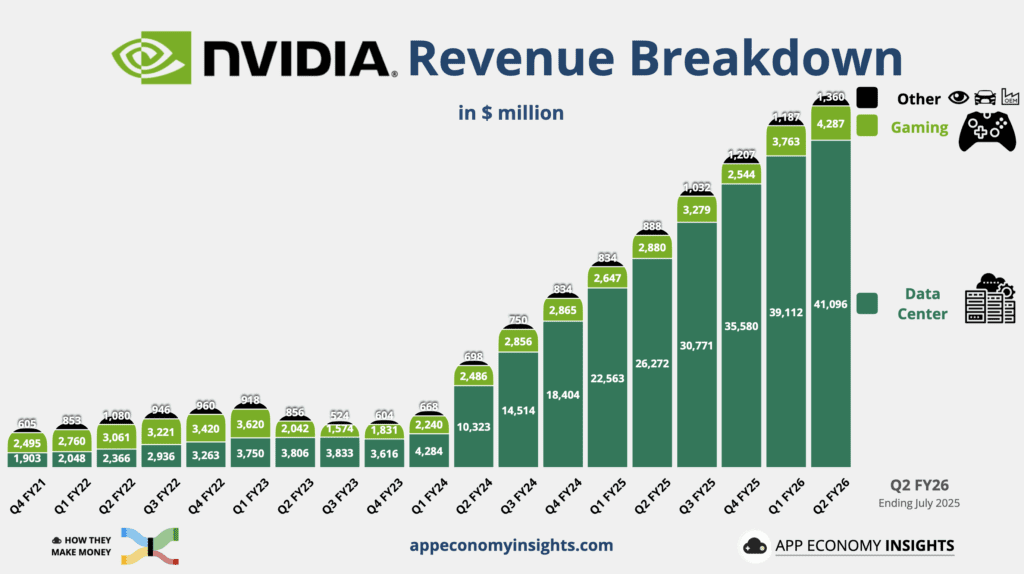

Data center remains the growth engine for Nvidia, now accounting for roughly 90 percent of total revenue. Last quarter, data center sales reached 41.1 billion dollars, up 56 percent year over year. In the third quarter, Wall Street sees that number jumping to nearly 49 billion.

This growth is largely driven by strong demand for Nvidia’s new Blackwell platform, which is ramping across hyperscalers and sovereign infrastructure projects. Analysts estimate that between 8 and 12 billion dollars of third-quarter revenue could come from Blackwell shipments, up from about 5 to 7 billion last quarter.

Nvidia is also benefiting from long-term agreements and reserved capacity purchases. Major customers like Microsoft, Meta, Oracle, and others have made multi-billion-dollar commitments to Nvidia’s AI chips for infrastructure scaling. The company disclosed over 500 billion dollars in cumulative demand across Blackwell and the upcoming Rubin platform.

Prediction: Data center revenue lands near the top of expectations. Nvidia emphasizes long-term visibility and accelerating deployment of Blackwell-powered systems.

Gaming, Visualization, and Auto: Steady but Secondary

Other business segments contribute only a small share of total sales but remain relevant to Nvidia’s overall financial story.

- Gaming is expected to come in around 4.4 billion dollars, up from 4.29 billion in the second quarter. Demand for high-end GPUs remains steady, with some seasonal boost heading into the holiday period.

- Professional Visualization was around 600 million dollars last quarter and may grow slightly. This segment serves enterprise workstations and AI simulation platforms.

- Automotive revenue stood near 586 million last quarter. Nvidia’s Drive platform continues to gain design wins, but automotive remains a long-term opportunity, not a major near-term contributor.

Prediction: Modest growth across these segments. No major surprises expected, and the focus remains squarely on data center.

Margins, Buybacks, and Capital Allocation

Nvidia remains one of the most profitable large-cap tech companies. In the second quarter, non-GAAP gross margin reached 72.7 percent. Third-quarter margins are expected to hold steady or tick higher, thanks to premium pricing on Blackwell chips and strong software attach.

Operating margin and free cash flow continue to impress. Nvidia returned 24.3 billion dollars to shareholders during the first half of the fiscal year and authorized a 60 billion dollar share repurchase plan. The dividend remains symbolic at one cent per share, but capital returns are clearly a priority.

Prediction: Gross margin comes in slightly above forecast. The buyback pace continues aggressively, reinforcing Nvidia’s strong cash position and confidence in long-term growth.

China Risk and the Geopolitical Overhang

Geopolitics remains one of the largest question marks for Nvidia. The company’s advanced chips remain restricted from sale to China under current U.S. export controls. While a downgraded H20 chip was approved for sale, demand in China has been weak due to competitive pressure from local alternatives and regulatory disincentives.

President Trump’s administration recently introduced a 15 percent tariff on AI chip sales into China. At the same time, there is speculation that Nvidia may eventually be allowed to sell a slower version of Blackwell into China, though nothing is finalized.

CEO Jensen Huang has acknowledged that Nvidia expects little or no contribution from China in the near term. For now, most of Nvidia’s growth is coming from customers in the United States, Europe, and the Middle East.

Prediction: Nvidia maintains a conservative stance on China. Any update suggesting a policy shift or renewed shipments could provide upside optionality.

AI Cycle and Infrastructure Spending: Is There More Room to Run?

Nvidia’s story is built on the accelerating buildout of global AI infrastructure. From sovereign AI clouds to foundation model training to enterprise deployment, demand for GPU compute remains overwhelming.

Key drivers:

- Ongoing capex expansion from hyperscalers

- Broad adoption of Nvidia’s software and networking stack

- Early signs of demand for the next-gen Rubin platform, due in late 2026

Some concerns have emerged about the sustainability of AI infrastructure spending. Critics point to circular vendor-financing and rising investor fatigue. But for now, the order book appears solid, and Blackwell demand has yet to show any signs of slowing.

Prediction: Nvidia reiterates that AI spending remains robust and global. Management points to 2026 as a year of continued growth, supported by backlog and new product ramps.

Sentiment and Market Implications

The options market is pricing a move of roughly 7 to 8 percent following earnings. With Nvidia trading near all-time highs, sentiment is cautiously bullish.

Analyst ratings are overwhelmingly positive, and price targets continue to trend higher. Yet some high-profile funds, including Thiel Macro and SoftBank, have exited their Nvidia stakes, while others have placed short bets.

This report could be a market mover beyond just Nvidia. A strong print could lift the entire AI and chip sector. A miss or soft guidance, on the other hand, could lead to broad weakness across tech.

Prediction: Unless Nvidia’s outlook disappoints or margins fall short, the stock is likely to move higher post-earnings. But the bar is high, and even small stumbles may trigger outsized reactions.

Is the AI Cycle Still Just Getting Started?

Nvidia’s third-quarter report will not just reflect its own execution. It will help answer whether the AI cycle has more legs or is starting to mature. With Blackwell ramping, sovereign cloud investment growing, and hyperscalers committed to AI infrastructure, Nvidia appears well positioned.

But with valuations stretched and geopolitical risk lurking, management will need to deliver a clean quarter and a compelling outlook to keep investors fully on board.

Our call: Nvidia beats on headline metrics, reiterates strong demand for Blackwell, and leans optimistic on 2026 visibility. Unless Q4 guidance is weak or China commentary turns negative, shares are likely to move higher post-earnings, solidifying Nvidia’s place as the epicentre of enterprise AI.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.

Related: Morgan Stanley Lifts Nvidia Price Target Ahead of Critical Q3 Report

Nvidia Jensen Huang: No Plans to Ship Blackwell Chips to China

Nvidia Becomes First $5 Trillion Company: Here is how

Jensen Huang Says Nvidia Went From 95% Market Share to 0% in China