Wall Street got exactly what it wanted from Friday’s PCE report, the Fed’s preferred inflation gauge: no surprises. The numbers landed in line with forecasts, calming fears of a sudden flare-up in prices.

- Headline PCE: +0.3% m/m in August, +2.7% y/y (up slightly from July’s 2.6%).

- Core PCE (ex food & energy): +0.2% m/m, +2.9% y/y, unchanged from July.

This is the highest pace since February, but critically, it wasn’t hotter than expected. For investors, that’s a win.

The Fed prefers PCE over CPI because it better tracks how people shift their spending — for example, swapping national brands for cheaper store brands. Policymakers cut rates for the first time this year last week, lowering the Fed funds rate to 4.00%-4.25%, but they’ve warned they’re cautious about going further until the inflation picture is clearer.

Consumer spending stays strong

Americans didn’t close their wallets. Personal spending jumped 0.6% in August, the third month in a row of solid gains. High-income households — boosted by a record $176.3 trillion in household wealth thanks to rising stocks and home values — are doing most of the heavy lifting.

Lower-income families are showing more strain from tariffs and higher food costs, with further pressure expected when cuts to food stamp benefits kick in later this year. Economists warn this imbalance could slow spending into year-end, even though Q2 GDP surged at a 3.8% annualized rate and Q3 is tracking closer to 2.5%.

Market reaction

The relief was immediate:

- Dow futures +200 points,

- S&P 500 futures +0.3%,

- Nasdaq futures +0.2%.

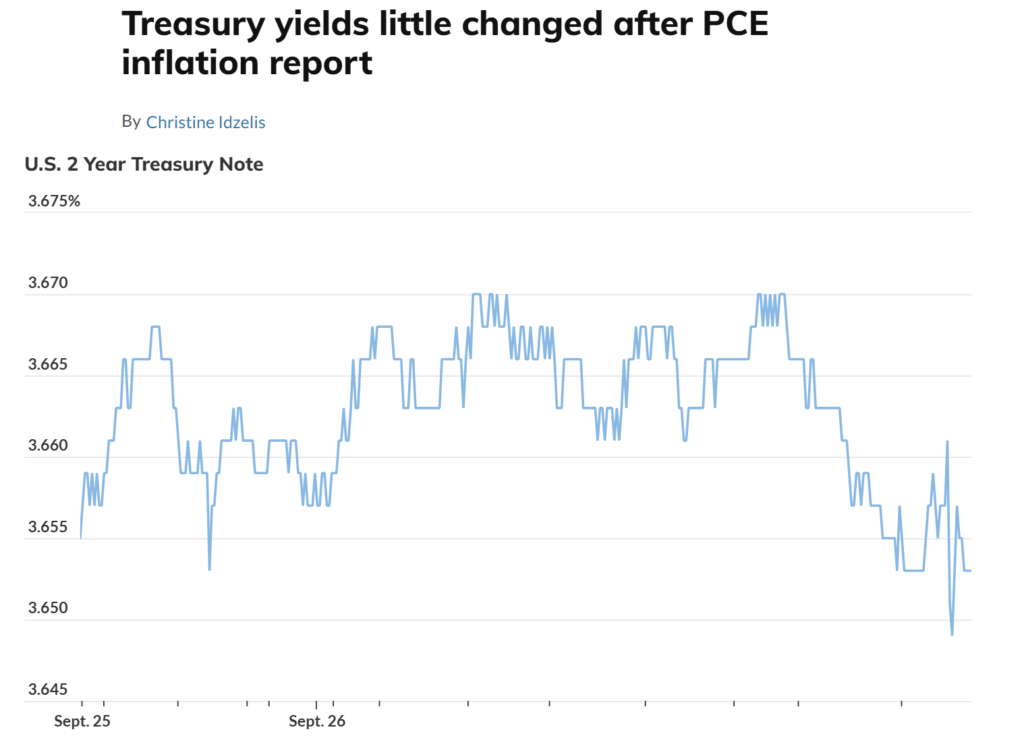

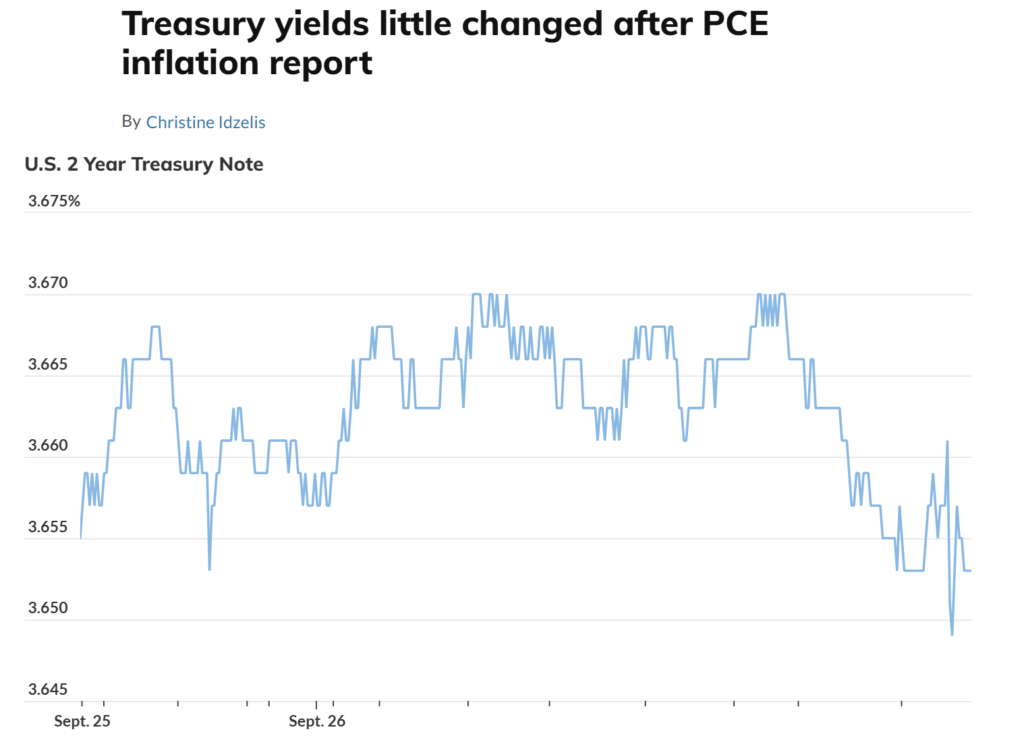

- Treasuries rallied, pushing the 2-yr yield down to 3.65% and the 10-yr to 4.16%.

Investors also re-priced Fed expectations: markets now see an 87.7% chance of a quarter-point cut in October and 61.9% odds of another in December.

The Fed’s balancing act

The backdrop is tricky. Inflation hasn’t fully cooled, tariffs on everything from pharmaceuticals to trucks are still filtering through prices, but the job market has clearly softened. That’s why the Fed cut rates for the first time this year just last week, lowering its benchmark to 4.00%-4.25%.

Chair Jerome Powell has been cautious, noting risks are tilted: inflation on one side, weaker jobs on the other. Trump, meanwhile, continues to blast the Fed for not cutting faster, even trying (unsuccessfully, for now) to fire Fed governor Lisa Cook.

Stocks in focus

Despite the better mood, the week has been tough for equities:

- S&P 500 is down nearly 0.9%,

- Nasdaq Composite off 1.1%,

- Dow lower by 0.8%.

In corporate news:

- Costco slipped 1% premarket, with same-store sales decelerating for a second straight quarter, though Q4 earnings beat expectations.

- AI-linked names like Oracle, Meta and Tesla fell earlier in the week, showing how fragile sentiment is around the AI trade. Oracle alone is down 5.6% this week.

Price-to-sales ratio hits new record high — but there’s a catch: Bespoke

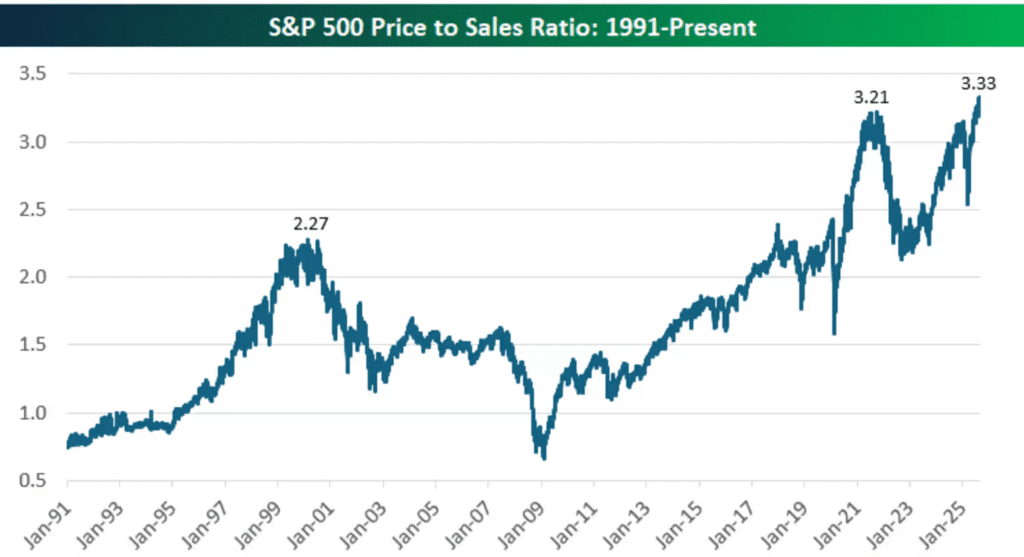

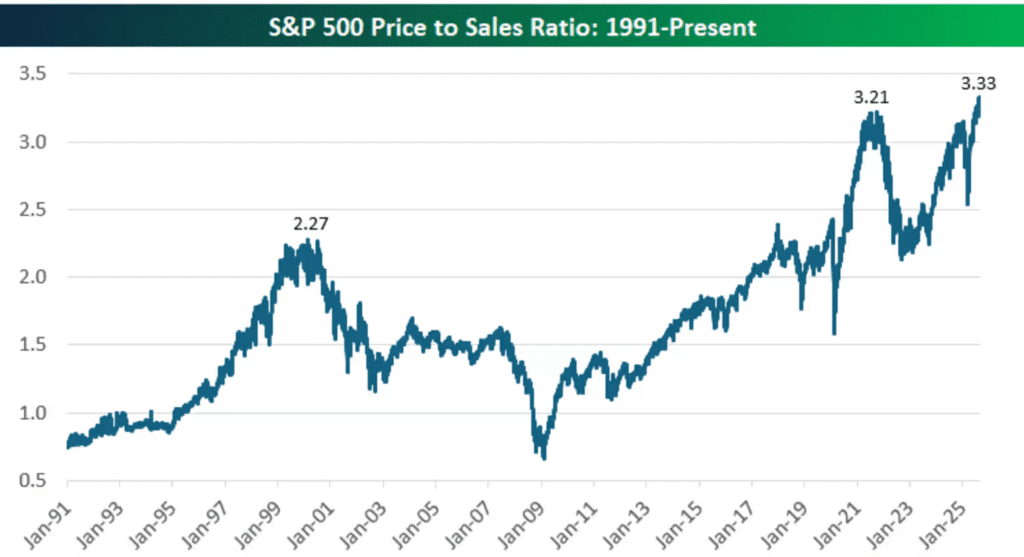

The price-to-sales ratio for the S&P 500, which compares the price of the index with analysts’ expectations for members’ revenues over the coming year, recently hit a new high of 3.3. That surpassed levels seen during the peak of the dot-com bubble, a team of analysts at Bespoke pointed out.

Before investors get too concerned, there is an important caveat to keep in mind. The price-to-sales ratio on the equal-weighted version of the S&P 500 is currently sitting at 1.66, well below its 2021 peak of 2.18.

“While valuation excesses are concentrated in the largest companies, much of the broader market is trading at far more reasonable levels,” the Bespoke team said.

The Trump factor

Even with calm inflation, trade policy keeps markets guessing. Trump announced a 100% tariff on all branded pharmaceuticals unless companies build U.S. plants, plus a 25% tariff on imported heavy trucks effective Oct. 1. Shares of truckmaker Paccar jumped 6% on the news, while pharma stocks watched nervously. (More about: Trump Imposes Sweeping New Tariffs on Drugs, Furniture & Heavy Trucks)

The August PCE report gave markets the “steady” outcome they needed: inflation is sticky but not spiralling, consumers are still spending, and the Fed has cover to keep cutting rates slowly. But between tariffs, a cooling labour market, and uneven household finances, the story isn’t finished, and the Fed’s balancing act will only get trickier into year-end.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Trump Turns Washington Into America’s Biggest Activist Investor With Intel Deal

Trump’s 10% Stake in Intel: A “Great Deal” or Political Gamble?

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump