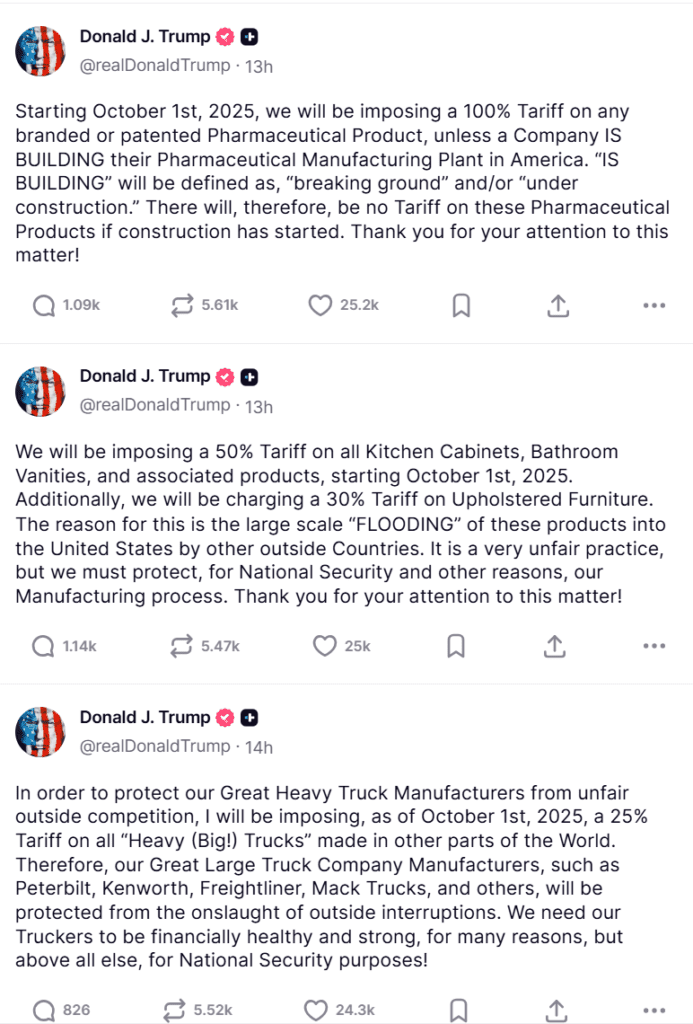

President Donald Trump announced a bold new round of import duties on Thursday — including a 100% tariff on branded pharmaceuticals, along with steep levies on trucks, furniture, and kitchen cabinets — set to take effect October 1.

– Trucks will face a 25% tariff.

– Kitchen cabinets and bathroom vanities hit with 50% tariffs.

– Upholstered furniture will carry a 30% tariff.

– The 100% duty on patented drugs applies only if the manufacturer has not broken ground on a U.S. facility.

– Some sectors, like aircraft and generic drugs with U.S. manufacturing plans, may be exempt.

Markets React, Pharma Under Pressure

Asian pharmaceutical stocks slid following the announcement, while European equities held steadier ground. Indian pharma names were hit hard: their stocks dropped ~2%, hurt by anxiety over U.S. demand and export risk.

Still, not all eyes are on the downside: some major drugmakers like Roche and Novartis say they expect exemptions because they’re building or funding U.S. manufacturing sites.

What It Means for Investors & Policy

Inflation risk: Tariffs on consumer goods (furniture, cabinets) and pharma could push prices higher, complicating the Fed’s inflation fight.

Legal risk: The administration’s sweeping use of tariff authority is already facing court scrutiny.

Supply chain shakeups: Companies may accelerate relocation, import substitution, or “U.S. content” requirements.

Winners & losers: U.S.-based manufacturing, especially in pharma, may benefit; importers, retailers, and foreign exporters may struggle.

What to Watch Next

What to watch now is how the pharma industry reacts; major firms like Pfizer, Roche, Novartis, AstraZeneca, and Merck will need to show if they qualify for exemptions under Trump’s manufacturing requirement. At the same time, markets will be watching how these companies’ stock prices move in response to the new tariffs. Another key test will be whether the duties filter into core U.S. inflation measures such as CPI and PCE, which could complicate the Fed’s path on rate cuts. Legal challenges could also derail or delay the tariff rollout, with the Supreme Court set to weigh in. Finally, the response from key trade partners, particularly the EU, UK, and Japan, will be critical, since the new tariffs could clash with existing trade agreements and potentially spark retaliation.

The tariff expansion is more than just a policy move; it’s a market event with ripple effects across pharma, consumer goods, and global trade. Investors should expect volatility as companies, courts, and foreign governments decide how to respond.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Trump Turns Washington Into America’s Biggest Activist Investor With Intel Deal

Trump’s 10% Stake in Intel: A “Great Deal” or Political Gamble?

Intel Secures $2 Billion Lifeline From SoftBank, Shares Jump