Jerome Powell was speaking today, and yes, he dropped several lines that make you stop and think. Let’s unpack what he said, in his own words, and what it means for markets and your money.

1. Tariffs & Inflation — A Bump, Not a Trend (So Far)

Powell admitted goods prices are rising due to tariffs:

“We have begun to see goods prices showing through into higher inflation … the increase in goods prices accounts for most of the increase in inflation … This year.”

But he was also clear:

“Inflation will move up this year because of the effects on goods prices from higher tariffs, and that will be a one-time effect.”

“We will make sure that this one-time increase in prices does not become an ongoing inflation problem.”

What that means: tariffs are pushing prices now — but Powell’s betting they won’t fuel permanent inflation, at least under baseline expectations.

2. Labor Market Isn’t Looking So “Solid” Anymore

Powell was straightforward: the labor market is cooling.

“We have seen … a very different picture of the risks to the labor market.”

“Downside risks to employment have shifted balance of risks, prompting last week’s rate cut.”

And he framed the rate cut as a response to that cooling:

“You could think of this … as a risk-management cut … now we see the revisions and we see the new numbers … the labor market is really cooling off.”

So: he’s watching job gains, unemployment, softness in hiring, markets are vulnerable if these go further down.

3. No Preset Route — Every Move Is Data-Driven

One of the strongest messages: Powell pushed back on the idea that the Fed has a fixed path.

“Two-sided risks mean there is no risk-free path.”

“This policy stance, which I see as still modestly restrictive, leaves us well positioned to respond to potential economic developments.”

Translation: don’t expect the Fed to promise a series of cuts. Powell wants flexibility.

4. Valuations Are “Fairly Highly Valued,” But No Panic Yet

Powell flagged that stock and asset prices are up there:

“Stock prices appear ‘fairly highly valued,’ but I do not see elevated financial stability risks at this time.”

That said, he doesn’t think it’s the Fed’s job to tame asset valuations directly. He’s more concerned about inflation, employment, and the balance between them.

Gen Z, Skills & the ‘Low-Hire, Low-Fire’ Economy

For years, Powell said jobs were “strong.” Not today. He warned: “You can’t really say the labour market is solid anymore.”

And the weakness is hitting young people hardest. Powell said if Gen Z grads don’t have tech skills, “you’re increasingly left with less attractive employment options.” He described today’s climate as a “low-hire, low-fire economy”, firms aren’t cutting staff, but they’ve slowed down hiring while waiting on tariff and policy clarity.

He tied the challenge to education: “I’m struck by how U.S. educational attainment kind of plateaued.” In his view, schools aren’t keeping up with the AI economy. The Fed can’t fix that, Powell admitted bluntly: “We can’t fix the education system. That’s for legislators and the private sector.”

In other words, if you’re coming into the workforce without AI or tech skills, you’re getting crushed.

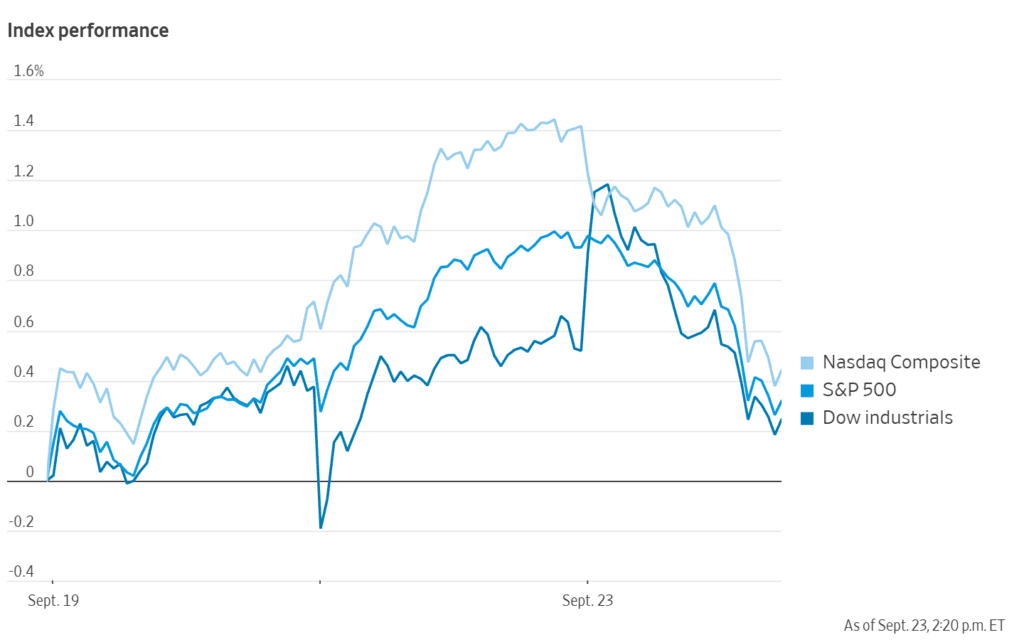

Market Reaction Right Now

Stocks cooled a bit after hits to tech; Nasdaq slipped, Dow held up better. Investors seem to be digesting the risk that Powell may slow down the pace of cuts.

Treasury yields eased slightly, as bond markets adjust to uncertainty about how many cuts (if any) are realistic this year.

Gold continued to shine as a hedge, likely benefiting from the cautious tone and “no risk-free path” warning.

What to Watch Next

The upcoming PCE inflation report — if core inflation sticks above/remains elevated, Powell could jack up caution.

Labor data: slowdown in job creation, unemployment, wage growth. If softening accelerates, the odds of more cuts rise.

Tariff developments: which ones stick, which ones expire, and how much companies end up passing them down.

Financial conditions: any sign that markets or asset valuations are overleveraged will get more attention.

Powell is signalling an in-between moment. The rate cut is done, but no rush now. Inflation is messy, jobs are weakening, and every decision will be data-dependent. Markets are up at the highs — but with a clear caution flag waving.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Powell Frames Cut as “Risk Management” Amid Weakening Jobs, Tariff Risks