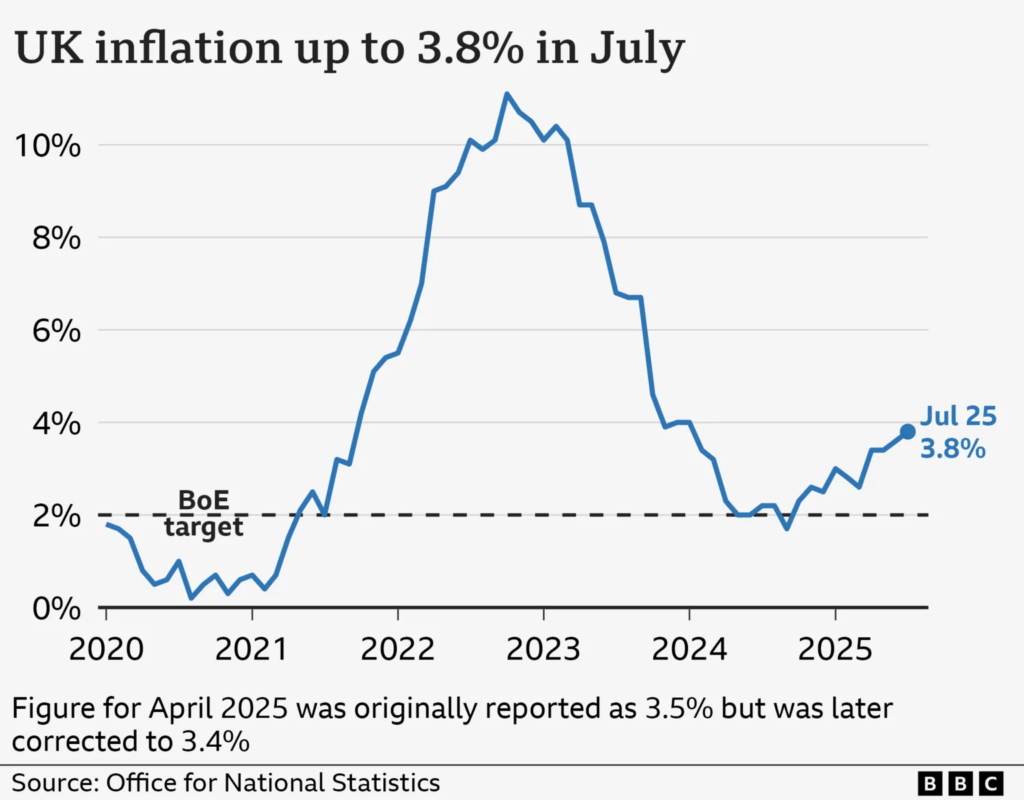

Britain’s cost of living edged higher again in July, with annual inflation rising to 3.8%, surprising economists and putting fresh pressure on the Bank of England as it weighs the timing of future rate cuts.

The Office for National Statistics (ONS) said July’s inflation rate was the highest since January 2024, and above consensus forecasts of 3.7%. The increase follows June’s 3.6% reading and leaves UK inflation the highest among major advanced economies — roughly one percentage point above the U.S. and eurozone.

What’s Driving the Rise

The ONS pointed to a 30.2% surge in air fares, the steepest July jump since records began in 2001, as families traveled at the start of school holidays. This single category added significant upward pressure to the index.

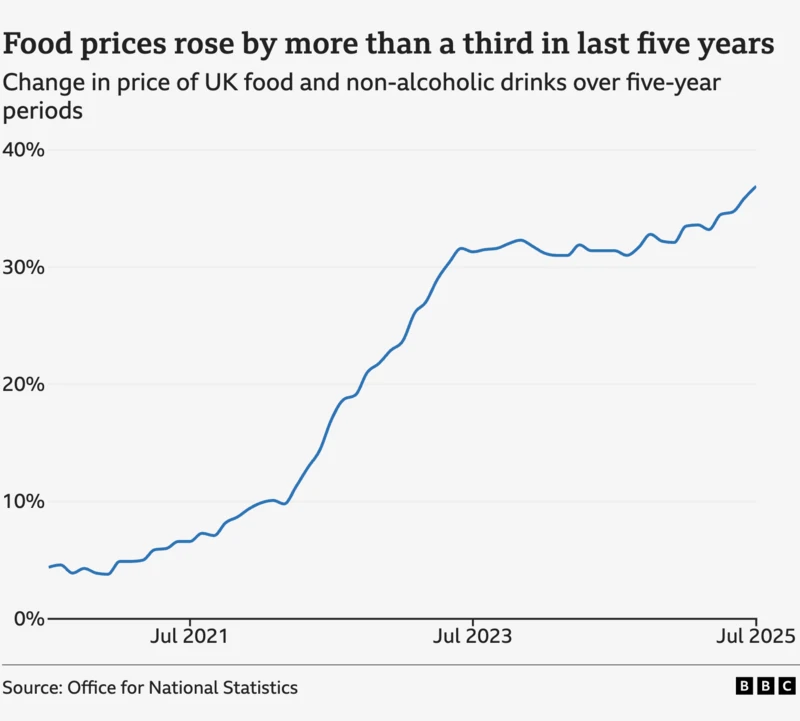

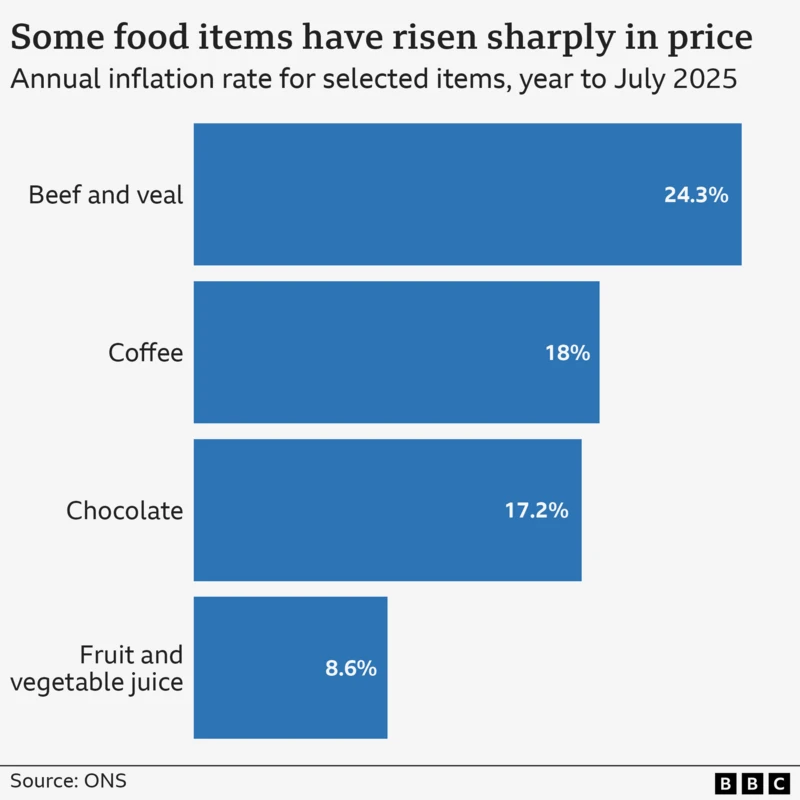

Food prices also continued their relentless climb, with the food and non-alcoholic drinks index rising 4.9% year-on-year, the fourth straight monthly increase. Items such as beef, chocolate, instant coffee, and fresh orange juice were among the biggest contributors.

Petrol and diesel costs also moved higher compared to the same period last year, reversing previous declines.

Reactions from Policymakers

ONS chief economist Grant Fitzner described the July print as “hefty,” while Chancellor Rachel Reeves acknowledged that “there is more to do to ease the cost of living,” citing measures such as higher minimum wages and extended free school meals.

The opposition, however, called the data “deeply worrying for families.” Shadow Chancellor Mel Stride accused the government of fueling inflation through higher taxes and borrowing, while Liberal Democrat treasury spokesperson Daisy Cooper called the figures “grim news” for households and businesses still grappling with the cost-of-living crisis.

Impact on the Bank of England

The reading complicates the Bank of England’s easing cycle. Earlier this month, the Monetary Policy Committee voted narrowly (5–4) to cut rates from 4.25% to 4%, the second trim this year. The Bank had projected inflation to peak at around 4% in September before easing into 2026, but sticky services inflation and persistent food prices could delay further moves.

Some economists now warn that the chance of a November rate cut is diminishing. Handelsbanken’s UK chief economist James Sproule said: “I’m annoyed about services inflation — it’s sticky. If the MPC is looking at that as well, the chance of a November cut is vanishingly small.”

Others, including Deutsche Bank, still expect inflation to soften toward 3.5% by year-end, but acknowledge the road back to the Bank’s 2% target is narrowing.

Consumer and Business Impact

Households continue to feel the pinch. Food costs have risen 37% over the past five years, according to ONS data. Restaurateurs and shop owners interviewed by the BBC say margins are squeezed and there is “nothing left to cut.” Families are also reporting a marked increase in grocery bills, with one consumer telling the BBC her weekly shop has jumped from £100 to £150 in just two years.

Market Reaction

The British pound was little changed at $1.3489 following the release, suggesting markets were braced for the slightly hotter print. Traders, however, pared back expectations for aggressive rate cuts in the near term.

The July inflation surprise reinforces the Bank of England’s dilemma: inflation is still proving sticky, particularly in services and food, even as the labor market cools. For households and businesses, the higher cost of living remains a daily reality — and for markets, the prospect of easier policy looks a little further away.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Markets Brace for Jackson Hole as Fed Faces Trump Pressure and Policy Uncertainty

Morning Bid: Jackson Hole Opens Under Trump’s Shadow