Markets are starting Friday in a cautious but upbeat mood, with the Fear & Greed Index firmly in Greed territory, even after this week’s hot inflation surprise tempered expectations for aggressive Fed cuts.

Wednesday Recap: US markets wobbled midweek after the PPI — wholesale inflation — jumped nearly 1% MoM, the biggest surge in three years. The blowout reading prompted traders to price out the possibility of a jumbo 50 bps cut in September, but odds for a smaller 25 bps trim remain high at around 92% (CME FedWatch). Mortgage rates, however, slipped to 6.58%, their lowest in a year.

Stocks regained momentum late in the session after Bloomberg reported the Trump administration is considering taking a stake in Intel to support its Ohio mega-fab project — a move that sent $INTC shares surging nearly 7%. (Trump Administration in Talks to Invest in Intel)

Market Resilience: As Reuters noted, even a “measly” blowout PPI print wasn’t enough to knock the mighty US stock market off course. S&P 500 futures held a 0.2% gain in Asian trading, while Nasdaq futures slipped for a third day. The 10-year Treasury yield dipped 2 bps to 4.27%, while the 2-year yield eased to 3.71%.

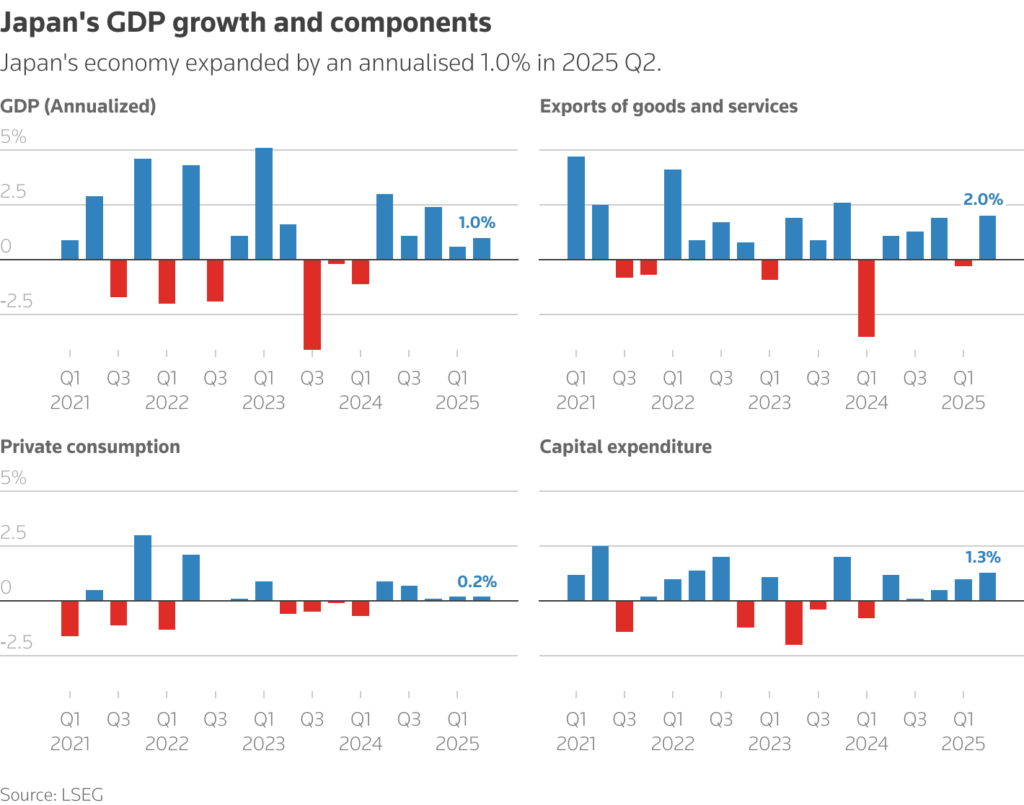

Asia & Macro Data: Japan’s GDP grew at an annualized 1.0% in Q2, beating expectations as businesses raced to stock up ahead of Trump’s tariff deadline. The Nikkei jumped 1.2% after Thursday’s sharp selloff. In China, weak July retail sales and industrial output data reinforced speculation about more policy stimulus, helping the CSI 300 rise 0.5%. Hong Kong’s Hang Seng dropped 1.2%. Markets in India and South Korea were closed for holidays.

Geopolitics: All eyes are on today’s Trump–Putin meeting in Alaska. The first round is widely expected to be a scene-setter for more substantive talks later. Lucerne Asset Management’s Marc Velan said, “If a ceasefire is reached, expect a positive reaction in the euro and a weaker dollar; the opposite if a ceasefire fails.”

Trump’s Economic Pitch: President Trump added to market optimism, declaring, “Inflation is now down to the perfect number. We’ve ended Biden’s inflation nightmare. There’s hardly any inflation at all.” He also highlighted soaring 401(k) balances and record stock market levels as proof of economic strength.

This Morning

Investor sentiment remains surprisingly resilient heading into the weekend. Even after yesterday’s hotter-than-expected PPI, market participants appear willing to look through the data, focusing instead on corporate headlines, potential diplomatic progress, and signs of underlying economic strength. President Trump added fuel to the optimism, declaring, “Inflation is now down to the perfect number. We’ve ended Biden’s inflation nightmare. There’s hardly any inflation at all.” He also pointed to soaring 401(k) balances and record-high stock indexes as proof of policy success.

- Bonds: Treasuries are edging higher, with 2-year yields at 3.71%.

- Futures: S&P 500 +0.2%, Nasdaq slightly softer, Europe +0.5%.

- Currencies: Dollar weaker; yen leads G10 gains at 147.64/USD.

- Asia: Nikkei +1.2%, CSI 300 +0.5%, Hang Seng -1.2%.

- Commodities: Brent crude steady at $66.79, just above two-month lows.

Key events to watch today: Eurozone July reserve assets, UK government debt auctions (1-, 3-, and 6-month maturities).

Pre-Market Earnings: SharpLink Gaming ($SBET), Tuniu ($TOUR), Flowers Foods ($FLO).

Markets are brushing off the week’s hot PPI print, with sentiment still in Greed mode. Traders remain confident in a September Fed cut, Intel’s surge on White House backing lifted tech optimism, and attention now shifts to the Trump–Putin meeting in Alaska, where even small diplomatic signals could sway currencies and commodities into next week.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?