Tariff collections have surged to historic highs, adding tens of billions to US revenue, but the numbers show it’s still a drop in the bucket compared to federal debt and spending.

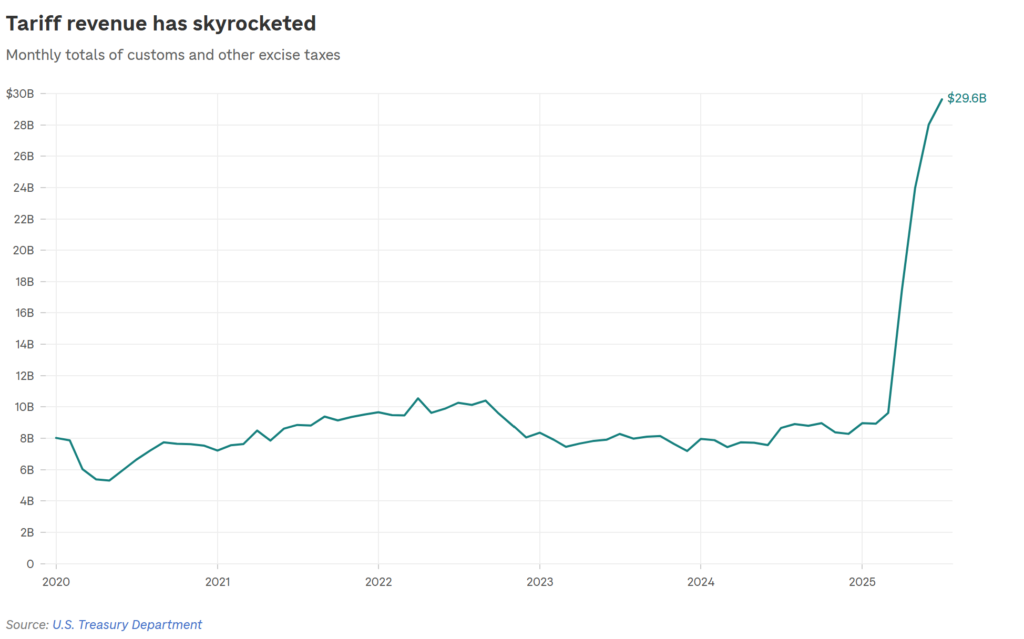

$29 Billion in a Month

President Donald Trump’s sweeping tariff strategy is delivering a surge in federal cash. In July, the US Treasury collected over $29 billion in “customs and excise taxes” — a category dominated by tariff revenue.

That’s nearly one-third of all tariff revenue collected in 2024 ($98 billion) in just a single month. At this pace, 2025 could more than double last year’s total, hitting levels not seen in the modern era.

The April Tariff Wave

The spike follows Trump’s April 2 executive order imposing wide-ranging tariffs on dozens of US trading partners. After initial delays, most of those measures are now in effect, with new sector-specific tariffs under consideration for semiconductors, pharmaceuticals, and commercial airplanes.

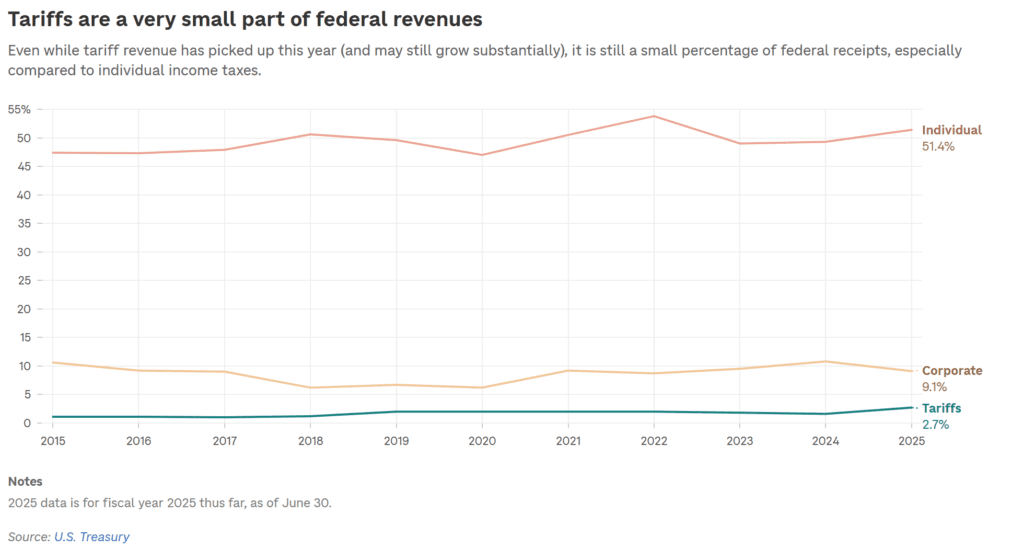

Trump has pitched tariffs as a way to replace or reduce income taxes, even floating the idea of using them to “pay down debt” and “make a dividend to the people.”

The Scale Problem

While $29 billion in a month is a huge jump historically, it’s tiny next to the federal government’s main income stream — income taxes.

So far in FY2025, tariffs make up 2.7% of federal revenue. If all current and planned tariffs remain in place, experts estimate that share could rise to 5% — the highest in modern history, but still nowhere near enough to replace or even substantially reduce income taxes.

With the national debt hovering near $37 trillion, even $300 billion in annual tariff revenue would barely dent the total.

Tariffs vs. New Spending

The timing is also key: Republicans’ recently passed domestic policy megabill, signed by Trump last month, will cost an estimated $3.4 trillion over the next decade. Independent estimates peg tariff revenue at $2–3 trillion over the same period — meaning it won’t fully offset the new spending.

The Economic Trade-Off

While tariffs bring in revenue, they also act as a tax on Americans. Importers pay tariffs directly, often passing costs on to consumers via higher prices. That drag on the economy can reduce revenue from income, payroll, and corporate taxes, offsetting some of the gains from tariffs.

As Jessica Riedl of the Manhattan Institute put it:

“That must be offset against the lower revenue we’re bringing in… as a result of the economy growing at only half the rate it was forecast before the year started.”

Manufacturing Shift Could Shrink Tariff Base

Trump’s own manufacturing push could also reduce tariff revenue. If companies move production onshore to avoid tariffs, imports fall — and with them, tariff collections.

Example: If Apple successfully sources and assembles all iPhones in the US, those sales generate zero tariff revenue.

Legal Cloud Over Country-by-Country Tariffs

A federal court ruled in May that Trump lacked authority to impose certain country-specific tariffs, including those recently applied to India and Japan. The White House appealed, keeping the tariffs in place for now.

If Trump loses, many tariffs could be struck down, potentially forcing the government to refund collected revenue — a logistical and political nightmare that would undermine his strategy.

Market & Policy Takeaways

- Record Highs: Tariffs are now producing revenue at more than double historic averages.

- Limited Debt Impact: Even at 5% of federal revenue, tariffs can’t cover the debt or replace income taxes.

- Growth Risk: Higher prices from tariffs risk slowing the economy, hurting other revenue streams.

- Legal Uncertainty: Court rulings could dismantle parts of Trump’s tariff regime.

For now, tariff revenue is a clear win for Trump’s short-term fiscal optics — but the long-term math doesn’t add up to his debt-reduction promises.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?