President Donald Trump has confirmed an unprecedented arrangement: Nvidia and AMD can resume sales of certain AI chips to China — but only if they give the US government 15% of that revenue.

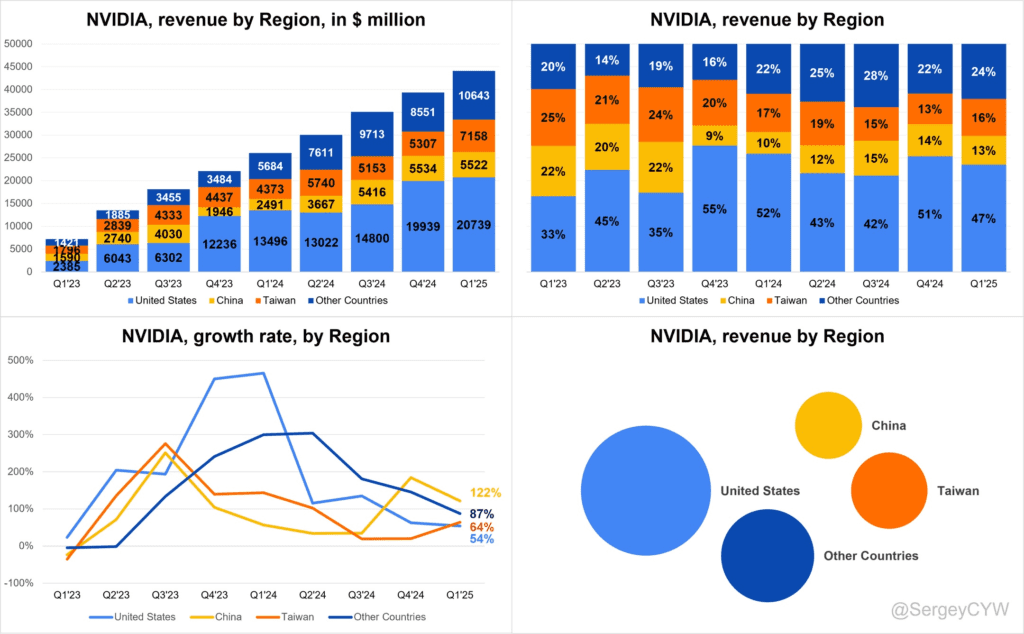

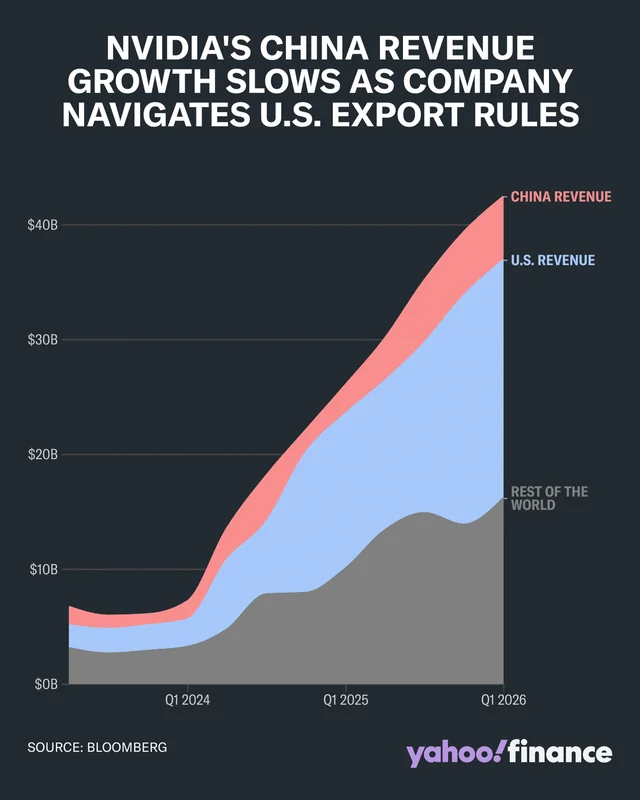

For Nvidia, that’s up to $3 billion this fiscal year based on Wall Street estimates. The company is set to recoup around $15 billion in lost sales after Trump reversed an April ban on its H20 chips. China accounted for 13% of Nvidia’s revenue last year, making the market too big to walk away from.

Trump called it “a little deal” , also “This is for the US, not for myself,” told reporters, and described Nvidia CEO Jensen Huang as “a brilliant guy” who bargained the cut down from the 20% Trump first demanded. AMD secured a similar deal for its MI308 chips.

“This is for the US, not for myself,” Trump told reporters, saying Nvidia CEO Jensen Huang bargained him down from an initial 20% demand.

And just to keep the pressure high, Trump isn’t touching Nvidia’s next-gen Blackwell GPU… yet. “I wouldn’t make a deal with that,” he warned, unless it’s “heavily downgraded.” Huang flies in this week to try to change his mind.

Why It’s So Unusual

This isn’t a tariff at the border — it’s a direct levy on revenue before the product even leaves the US. Trade policy experts are calling it everything from “extortion” to an “indirect tariff at source”, warning it may violate the Constitution’s ban on export taxes.

But investors aren’t rattled. Nvidia’s stock rose modestly Monday, AMD gained over 2%. As Quilter Cheviot’s Ben Barringer put it:

“85% of the revenue is better than zero.”

Blackwell Ban Still on the Table

Trump says the deal applies only to Nvidia’s H20 — a prior-gen Hopper-based chip designed for export compliance. He called it “obsolete” and made clear he’s not yet approving exports of Nvidia’s newest Blackwell GPU unless it’s “heavily downgraded.”

Jensen Huang is expected at the White House this week to negotiate.

Beijing’s Backdoor Accusations

China’s reaction? Suspicion.

State-linked media claims the H20 could have a “hardware backdoor” enabling remote shutdown and dismissed the chip as “unsafe, outdated, and not environmentally friendly.”

Regulators have summoned Nvidia for security talks, demanding proof there’s no hidden access. Nvidia has flatly denied any backdoors, insisting the chip does not enhance military capabilities and that all transactions are visible to the US government.

What This Means for the World

The deal sends three clear signals:

- Washington is willing to monetize tech access rather than block it outright — at least under Trump.

- The “pay-to-play” model is now in the AI chip market — but analysts doubt it will spread to other sectors like Apple’s iPhones or Meta’s apps.

- China’s AI ambitions remain tied to US hardware, even as it accelerates domestic development via Huawei.

For China, the deal is a dilemma: pay more (and fund Washington) for critical chips, or accelerate self-sufficiency and risk lagging in AI performance.

The Longer-Term Risk

Analysts warn that the arrangement might backfire, pushing China to avoid US chips entirely. DA Davidson’s Gil Luria says it could “encourage China to move away from buying its chips from American companies.”

The Chip Security Act now under debate in Congress could add another twist, requiring geolocation tracking on chips to prevent smuggling — a move that would make China’s security services even more nervous.

Market Takeaways

- Nvidia ($NVDA): Regains access to China but hands over up to $3B in FY26 revenue.

- AMD ($AMD): Similar deal on MI308 chips; gains short-term China sales certainty.

- Blackwell GPU: Still in limbo — downgrade or ban possible.

- Huawei: Could benefit long-term if Chinese buyers shift away from US hardware.

- Investors: For now, 85% of China revenue beats 0% — but the precedent is a wild card.

What Trump’s Nvidia and AMD China deal means for the world: It’s part geopolitical chess, part business hustle. Washington gets billions without lifting a tariff, Beijing gets the chips it needs (but at a political cost), and Nvidia and AMD get to fight another day in the world’s most important AI market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years