Microsoft steps into the earnings spotlight this afternoon with expectations pinned on Azure’s AI-fueled momentum, the trajectory of Copilot monetization, and how much capex management plans to pour into data centers over the next year. With the shares up ~20%+ year‑to‑date and hovering near record highs, the bar is high and the reaction will hinge on Azure growth, AI commentary, and capital‑spending guidance.

Street consensus: solid double‑digit growth, Azure in focus

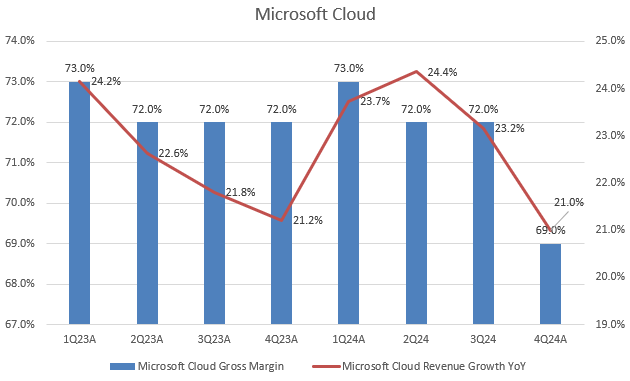

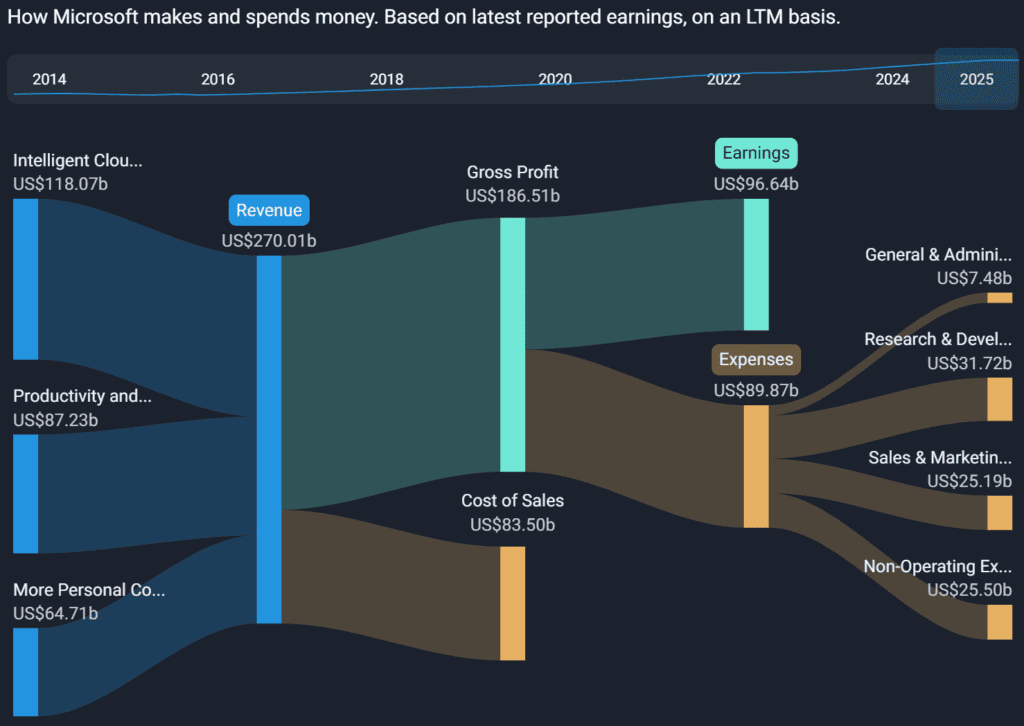

Analysts (FactSet/consensus) look for revenue around $73.8B and EPS near $3.38, up from $64.7B and $2.95 a year ago. The focal point is Azure, where Wall Street is braced for ~35% YoY growth (constant‑currency), an uptick from ~33% last quarter. Segment‑level expectations imply Intelligent Cloud revenue near the high‑$20Bs to ~$29B.

- Why it matters: Azure’s print and commentary typically drive the stock’s first move; investors are also laser‑focused on AI’s contribution to Azure growth versus last year and on pipeline/backlog signals.

Three things to watch on the call

Azure + AI demand vs. supply

Beyond the headline growth rate, look for clues on AI‑workload demand, capacity constraints, and how many points AI adds to Azure growth relative to last year. Analysts expect the AI uplift to be larger than in 2024, and several previews highlight capacity tightness as a sign of robust demand. Any color on NPU/GPU availability and regional capacity adds will be key.

Copilot adoption and monetization

Investors will want KPIs around Copilot attach rates across Microsoft 365, GitHub, Dynamics, and Windows—plus evidence that AI seats are translating into revenue per user lifts (and not just trials). Even without hard numbers, management’s tone on renewals, usage, and upsell can help the Street gauge durability of AI‑driven software demand into FY26. (Previews flag this as a core debate tonight.)

Capex run‑rate and FY26 cadence

Capex is the fulcrum: how much AI data‑center spend in FY25/FY26, and does management still expect slower capex growth in FY26 after a step‑function in FY25? Some outlets note record‑scale AI investments this year (press reports cite on the order of ~$70B) and say capex guidance is a primary market focus. The stock could swing on any shift to that trajectory.

Setup: sentiment & positioning into the print

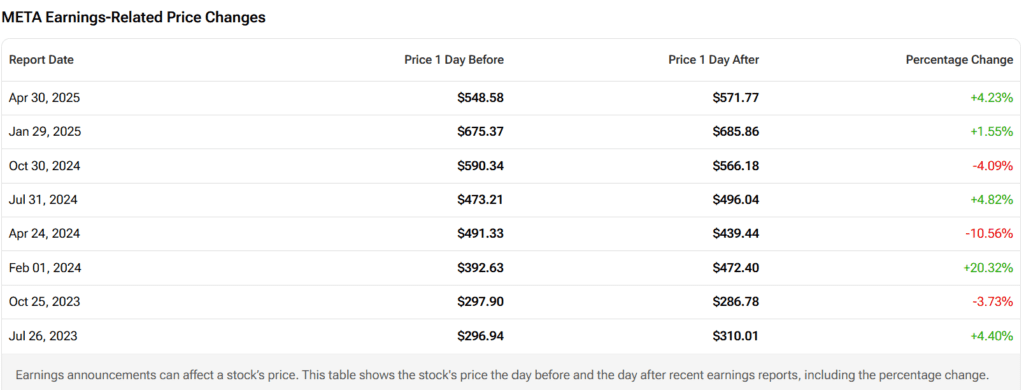

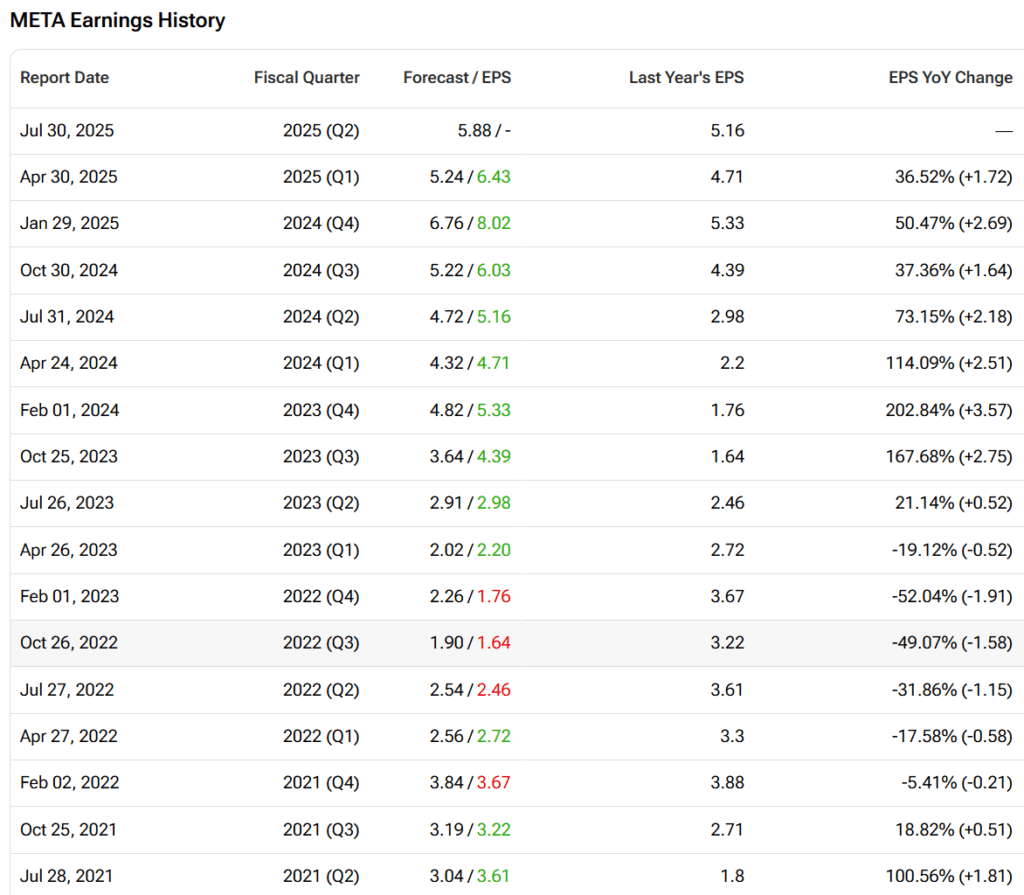

Microsoft’s stock has rallied into earnings, and several previews stress that expectations are elevated; good numbers may need to be better‑than‑good to extend the move. Options and trader write‑ups point to a typical ~5% average post‑earnings move over the last four quarters, underscoring risk for active traders around the release.

Bullish case heading into tonight (with facts)

- Azure acceleration + backlog: Street modeling ~35% Azure growth reflects expanding AI workloads; commentary also highlights a large backlog supporting multi‑quarter visibility and capacity tightness as a demand signal.

- Earnings & revenue reacceleration: Consensus implies ~14–19% YoY growth on both EPS and revenue—a notable acceleration vs. last year’s run‑rate—driven by Intelligent Cloud and Microsoft 365.

- AI monetization optionality: Previews argue Copilot’s cross‑suite attach and pricing levers can sustain premium growth beyond “one‑time” AI lifts to Azure consumption. (Watch for seat/usage anecdotes.)

- Street support: Most analysts keep Buy/Overweight ratings; some targets push into the mid‑$500s on the view that AI and Cloud remain multi‑year drivers.

Bearish case & risks to monitor (with facts)

- Capex burden / ROI timing: Press and prior disclosures underscore very high AI capex in FY25; if FY26 spend or depreciation ramps faster than revenue, margin pressure could follow. A visible slowdown in capex growth (as some expect) would ease this, but any upshift could spook a market already focused on cash returns.

- High expectations, limited upside surprise: With shares near highs, some previews warn that even strong Azure might not be enough for a breakout if guide or capex cadence disappoint.

- Macro IT budgets: Several commentaries flag lingering concerns about enterprise budget digestion; softer software demand or a slower Copilot ramp would challenge the bull narrative.

Trading lens: what the options crowd is eyeing

Short‑term traders note Microsoft’s average ~5% next‑day move over the last four reports; tonight’s setup will hinge on Azure’s print, capex guidance, and any FY26 margin color. A beat without a convincing capex/margin framework could see relief but limited follow‑through; conversely, clean beats plus a disciplined spend cadence could set up a new‑highs scenario.

The three swing factors tonight are Azure, Copilot, and capex. If Microsoft delivers ~35% Azure with confident AI demand commentary and sketches a measured FY26 capex path, the setup favors a constructive reaction despite lofty expectations. If Azure underwhelms or capex tilts higher for longer, the bar for upside narrows. Either way, this print is likely to reset FY26 expectations across AI infrastructure and software—and, by extension, the broader mega‑cap tech trade.

Sources:

Barron’s; Omni Ekonomi; Reuters; Yahoo Finance – Preview; Yahoo Finance – Azure/Backlog; MarketWatch; Investopedia; TipRanks – Earnings Page; TipRanks – Preview Note; GeekWire – Preview; GeekWire – Stock/Mkt Cap; Nasdaq – Earnings Page; Investing.com – Preview; Microsoft Investor Relations.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Trade War Reshaped: US–EU Deal Finalized, China Truce Extension Likely

Global Markets Kick Off Tuesday With Cautious Optimism: Market Wrap

Market Is Euphoric Again — and Everyone Knows It

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion